Emigrating to Hong Kong: A Strategic Analysis for Cryptocurrency Investors

1. Executive Summary

Hong Kong is rapidly emerging as a significant global hub for digital assets, actively seeking to attract cryptocurrency investors and businesses. The city’s strategic ambition is supported by a developing regulatory environment and burgeoning opportunities within the fintech sector. For cryptocurrency investors considering relocation, Hong Kong presents a unique proposition, blending its established financial infrastructure with a forward-looking approach to digital currencies.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

However, a thorough evaluation of various factors is crucial. Understanding the specific immigration pathways available, the notably high cost of living, and the nuances of the quality of life in Hong Kong are essential considerations. Furthermore, potential emigrants must be aware of the risks and challenges associated with both relocating to a new jurisdiction and investing in the dynamic cryptocurrency market within Hong Kong’s specific regulatory context. This report aims to provide a comprehensive analysis of these critical aspects, offering cryptocurrency investors the necessary insights to make well-informed decisions regarding a potential move to Hong Kong.

2. Hong Kong as a Rising Digital Asset Hub

Hong Kong is strategically positioning itself to become a leading center for financial innovation, with a particular focus on establishing itself as a key player in the global cryptocurrency market, especially within the Asia-Pacific region. The government has openly declared its commitment to fostering an open and vibrant cryptocurrency market, signaling a potentially welcoming environment for investors in this sector. This proactive stance is particularly significant considering mainland China’s restrictive policies on cryptocurrency activities, presenting a strategic opportunity for Hong Kong, operating under the “One Country, Two Systems” framework, to attract cryptocurrency investors and businesses by establishing a clear and appealing regulatory environment.

Hong Kong has taken proactive steps to establish a legal framework governing cryptocurrencies, which includes regulations for the deposit and withdrawal of digital assets. This framework is constructed from a combination of existing laws and new regulations specifically tailored to address the unique characteristics of digital assets. The primary regulatory bodies overseeing this evolving landscape are the Hong Kong Monetary Authority (HKMA), which focuses on maintaining the stability of the financial system, and the Securities and Futures Commission (SFC), which regulates activities related to securities and futures involving cryptocurrencies. Mandatory compliance with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations is a cornerstone for all cryptocurrency exchanges operating within Hong Kong. The regulatory guidance provided by these bodies is continuously updated to reflect the dynamic nature of the cryptocurrency market.

Businesses engaged in digital asset activities in Hong Kong, including exchanges, brokers, and wallet providers, are required to obtain licenses to operate legally. The SFC has implemented a licensing regime for Virtual Asset Service Providers (VASPs) to ensure they adhere to stringent operational standards and risk management practices. These licensed entities must demonstrate their capability to comply with AML and CTF regulations. As of February 2025, nine entities have been granted a Hong Kong Virtual Asset Service Provider (VASP) license. The SFC has also introduced enhancements to its licensing regime for Virtual Asset Trading Platforms (VATPs), including extending a swift licensing process to all new applicants after December 2024. Licensed platforms are mandated to implement stringent cybersecurity measures, encompassing network segmentation, robust governance frameworks for privileged accounts, and the utilization of up-to-date encryption technologies. Regulations also govern the handling of clients’ virtual assets, emphasizing limited access rights for employees, the avoidance of commingling client and platform assets, and specific cold and hot wallet storage ratios, with at least 98% required to be held in cold storage. Furthermore, licensed VATPs are obligated to have insurance policies in place to cover potential compensation amounts for clients in case of asset loss.

Currently, only a limited number of cryptocurrencies are legally available for trading in Hong Kong, including Bitcoin, Ether, Avalanche, and Chainlink. However, the landscape is evolving, with digital banks such as ZA Bank recently launching services to allow retail users to buy and sell Ethereum and Bitcoin. Hong Kong has also introduced crypto spot ETFs that provide investors with exposure to Bitcoin and Ethereum. The SFC pre-approves high-liquidity tokens for listing on licensed VATPs.

3. Navigating Immigration Pathways for Investors

Hong Kong offers several immigration pathways that may be relevant for a cryptocurrency investor, including the New Capital Investment Entrant Scheme (New CIES), the Top Talent Pass Scheme (TTPS), the Quality Migrant Admission Scheme (QMAS), and the Investment as Entrepreneurs pathway under the General Employment Policy (GEP). The government has also recently revived a retired investment visa scheme, further expanding the options for high-net-worth individuals.

The New CIES requires applicants to be 18 years or older, meet specific nationality criteria, demonstrate net assets of at least HKD 30 million for the six months preceding the application, and commit to investing at least HKD 30 million in permissible investment assets in Hong Kong. These assets include equities, debt securities, certificates of deposit, subordinated debt, eligible collective investment schemes, limited partnership funds, a capped investment in real estate (up to HKD 10 million), and a mandatory contribution of HKD 3 million to a CIES Investment Portfolio managed by the Hong Kong Investment Corporation Limited.

The TTPS caters to individuals with an annual income of HK$2.5 million or above in the year immediately preceding the application, or graduates from eligible top universities with at least three years of work experience over the past five years. It also includes a quota-based category for recent graduates from these universities with less than three years of work experience.

The QMAS employs a points-based system assessing factors like age, academic qualifications, language proficiency, work experience, financial ability, and business ownership, and is designed for highly skilled or talented persons who do not yet have a job offer in Hong Kong. The Investment as Entrepreneurs pathway requires applicants to have a detailed business plan, register a Hong Kong company, make a substantial capital investment in a business that actively employs local residents, and demonstrate business ties with Hong Kong or engage in real business operations. Generally, all applicants need to have a clean immigration record and demonstrate the ability to support themselves and any dependents without relying on public assistance.

The processing time for the New CIES has been reported as approximately 6 months, with the first batch of visa applications approved in less than three months. The TTPS offers a fast authorization process, with approvals potentially granted within four weeks. The QMAS application process typically takes between 9 to 12 months. The Investment as Entrepreneurs pathway has a processing time of around 6 to 8 months. Overall, Hong Kong has a relatively high visa approval rate, reported at around 85%. However, the success rate for investment visas, while generally favorable, is contingent on meeting all the specific eligibility and investment requirements of the chosen scheme.

4. Decoding the Cost of Living in Hong Kong

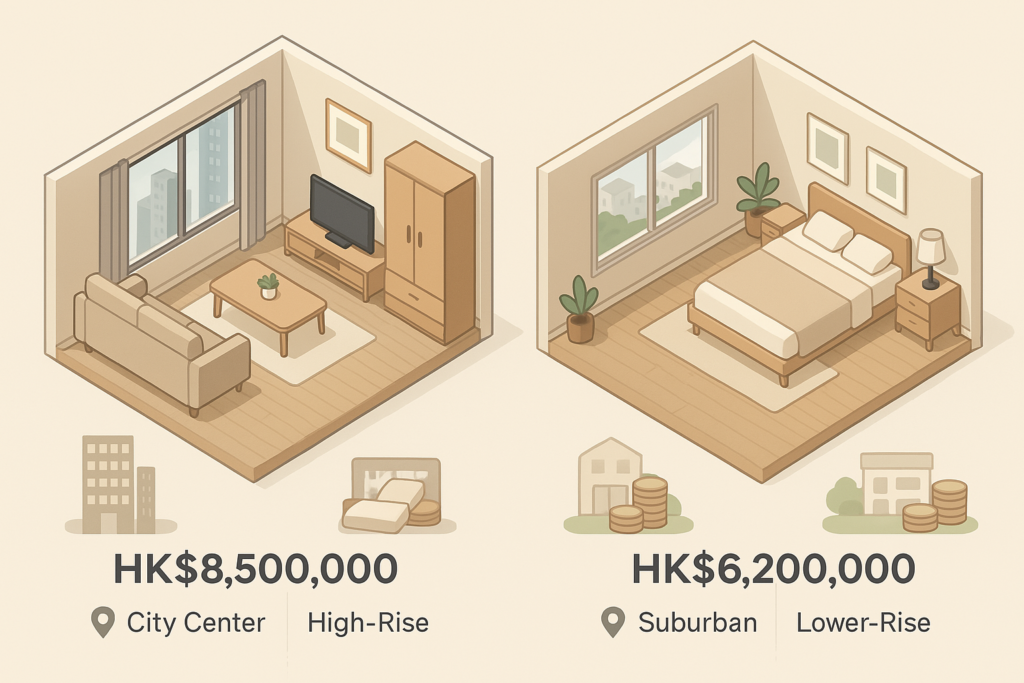

Housing in Hong Kong is notably expensive, with average property prices per square foot reaching approximately USD $1,987. In the third quarter of 2024, the average home price was around HK$13,755 per square foot. For those looking to rent, the average monthly cost for a one-bedroom apartment in the city center is approximately HK$18,522.73, with a range from HK$13,000 to HK$30,000. Outside the city center, the average monthly rent for a similar apartment is around HK$13,066.67, ranging from HK$9,000 to HK$18,000. Larger accommodations, such as a three-bedroom apartment in the city center, can cost an average of HK$38,576.92 per month, with a range of HK$25,000 to HK$60,000. Purchasing property also comes at a premium, with the average price per square foot to buy an apartment in the city center being around HK$21,251.27.

Transportation costs in Hong Kong are relatively moderate compared to housing. A monthly pass for public transport costs around HK$500, with a range of HK$445 to HK$700. A one-way ticket for local transport averages around HK$12, with a range of HK$10 to HK$20. The monthly transportation expenses for an average commute are estimated to be between HK$450 and HK$480. The government also provides a public transport subsidy scheme, where the threshold for eligibility was recently increased to HK$500 in monthly expenses. Utilizing the Octopus card is a convenient and often more economical way to pay for public transport.

Average monthly utility expenses for a 915 sq ft apartment, including electricity, heating, cooling, water, and garbage, are around HK$2,151.68, with a range from HK$1,200 to HK$3,400. A mobile phone monthly plan with calls and 10GB+ data costs around HK$147.27, with a range of HK$60 to HK$250. Internet service (60 Mbps or more with unlimited data) averages around HK$180.95 per month, with a range of HK$100 to HK$300. For a two-person household in a two-bedroom apartment, total utility costs are estimated to be around HKD $1,700 per month.

Food and grocery costs can vary significantly. A meal at an inexpensive restaurant costs around HK$65, with a range of HK$45 to HK$100. A meal for two at a mid-range restaurant averages around HK$500, with a range of HK$300 to HK$800. Monthly grocery costs for a single person are estimated to be between HK$1,300 and HK$2,000, while for a family, these costs can range from HK$4,000 to HK$5,300.

Healthcare in the public system is subsidized and affordable for residents with a Hong Kong ID card, but expatriates may need private health insurance, which can be expensive, with annual costs potentially ranging from HKD 2,000 to 25,000 for an adult around 30 years old. For education, international school fees are high, with yearly costs ranging from HKD 120,000 to HKD 210,000.

Considering these factors, the overall cost of living in Hong Kong is high. The average monthly net salary (after tax) is around HK$32,142.65. Estimated monthly living costs for a single nomad are around $2,872 USD (approximately HK$22,400), while for an expat, the estimate is around $2,540 USD (approximately HK$19,800). A monthly budget for a single person in Hong Kong could range from HK$37,700 to HK$87,100, and for a family, it could range from HK$92,000 to HK$145,000.

5. The Business and Investment Ecosystem for Fintech and Crypto

Hong Kong offers a stable political environment and a pro-business culture, underpinned by a strong legal system and world-class infrastructure. The incorporation requirements are straightforward, and there is a strong emphasis on the protection of Intellectual Property rights. Strategically located with close proximity to mainland China, Hong Kong operates under the “One Country, Two Systems” principle, allowing it to function as a global business hub with direct access to the Mainland market. Recognized as one of the world’s most competitive and freest economies, Hong Kong boasts a low and simple tax system with profit tax deductible expenses, and there are no restrictions on foreign ownership. Capital gains are not taxed, nor are there withholding taxes on dividends and royalties, and profits can be freely converted and remitted.

The fintech and cryptocurrency sectors in Hong Kong are particularly vibrant, hosting around 1,100 fintech companies. The top sub-sectors include digital assets, cryptocurrency and blockchain application, WealthTech, and payment and remittance, with digital assets, cryptocurrency, blockchain, green fintech, and fintech cybersecurity being the fastest growing. Hong Kong is home to over 10 fintech unicorn companies and ranks highly in global startup ecosystem reports. The government actively supports virtual asset development and Web3 initiatives, and there is increasing adoption of fintech in banking, along with a growing fintech-savvy workforce. Prospects are strong in areas like digital payments, securities settlement, electronic KYC, data analytics, blockchain, wealthtech, insurtech, and regtech. Numerous job opportunities exist within the fintech sector. Recent developments include the launch of wealth management platforms for crypto assets and the acceptance of crypto assets as proof of wealth for immigration schemes.

Despite the promising environment, investors face challenges such as an evolving regulatory framework leading to uncertainty, limited banking services for crypto businesses, lengthy approval processes, frequent policy changes, and inconsistent enforcement. Obtaining crypto licenses can be difficult, and persistent regulatory uncertainty exists due to global standards and geopolitical factors. Market competition is intensifying, and strict regulations may deter some international crypto banks. Low public trust after incidents like the JPEX scandal also pose a hurdle. Obtaining a VASP license requires robust internal controls, capital reserves, and compliance expertise. Cybersecurity and data privacy are significant concerns, along with market competition from established financial institutions.

While Hong Kong offers a stable political environment, tight political control exists, and the economy is vulnerable to external shocks and sensitive to developments in mainland China and US-China relations. The PRC’s imposition of the National Security Law (NSL) and the Safeguarding National Security Ordinance have introduced heightened uncertainty. Rule of law risks have also increased.

6. Evaluating the Quality of Life for Expatriates

Hong Kong boasts a high-quality healthcare system with both public and private sectors. Public healthcare is affordable for residents with a Hong Kong ID card, thanks to substantial government subsidies. While the quality of care is generally high in both sectors, the public system often experiences long wait times, especially for non-emergency procedures. Private healthcare offers faster access and more personalized care but comes at a higher cost. Consequently, expatriates often rely on private medical insurance, which can be expensive.

Expatriate families have several education options. Public schools offer free education from primary to senior secondary levels, but the curriculum is mainly taught in Cantonese and can be academically competitive. Private international schools are a popular choice for expats, offering a more Westernized curriculum in English; however, tuition fees are high, ranging from HKD 100,000 to HKD 200,000 or more annually. The English Schools Foundation (ESF) runs partially subsidized international schools with the IB curriculum, offering a more affordable option compared to non-ESF international schools. Due to high demand, applying to international schools early is crucial.

Hong Kong generally enjoys a low crime rate, making it a safe city for residents. Violent crime is rare. However, it is advisable to exercise caution with personal belongings, especially in crowded areas and on public transport. In light of recent political developments, increased caution is advised regarding the potential for arbitrary enforcement of local laws, including those related to national security.

Culturally, Hong Kong presents a unique blend of traditional Cantonese and British/Western influences. Both English and Cantonese are official languages, with a significant portion of the population speaking English. Hong Kongers are generally polite and circumspect in public. The concept of “face,” emphasizing reputation and dignity, is important in social and business interactions. The business culture values long-term relationships and may involve protracted negotiations. The presence of a large expatriate community facilitates settling in and finding social connections. However, the work culture can be demanding, often involving long working hours.

7. Comparative Analysis of Cryptocurrency Regulatory Frameworks

Compared to Singapore, Hong Kong has seen Singapore overtake it as a leading digital-assets hub in 2024, with Singapore issuing more than double the number of crypto licenses granted in 2023. Hong Kong’s regulatory regime for exchanges is perceived as more restrictive in areas such as custody of customer assets and token listing policies. While Singapore’s framework encourages interaction between new entrants and established institutions, Hong Kong’s focus on established financial institutions may limit the scope of innovation. Singapore’s approach to cryptocurrency regulation is generally seen as more embracing. In terms of taxation, Singapore does not impose capital gains tax on crypto (though income tax may apply), similar to Hong Kong, which also does not have capital gains tax (but profits tax may apply for regular trading).

Dubai in the UAE is another rapidly growing cryptocurrency market with favorable regulations. Dubai has established the Virtual Assets Regulatory Authority (VARA) with a comprehensive regulatory framework for VASPs. Collaboration on virtual asset regulation is a priority for both Hong Kong and the UAE. Dubai’s regulatory approach is considered potentially more open to crypto businesses than that of Hong Kong, with a higher-risk, higher-reward economic strategy aimed at encouraging industry growth. Notably, the UAE imposes no income or capital gains tax on crypto.

Switzerland treats cryptocurrencies as assets, providing tax clarity and has been an early adopter in the crypto space. Hong Kong and Switzerland have signed an MoU to enhance collaboration between their fintech ecosystems, with a particular focus on stablecoin regulation. Hong Kong is unique in encouraging the exploration of non-HKD fiat currencies for stablecoins. Switzerland offers stable economies and clear rules for crypto ventures.

Table 1: Comparison of Cryptocurrency Regulations

| Feature | Hong Kong | Singapore | Dubai (UAE) | Switzerland |

| Key Regulator(s) | HKMA, SFC | MAS | DFSA (DIFC), VARA (Onshore Dubai) | FINMA |

| Exchange Licensing | Mandatory, stringent requirements | Mandatory, proactive approach | Mandatory for VASPs | Guidelines for ICOs and crypto businesses |

| Stablecoin Approach | Regulatory sandbox, Stablecoin Bill in progress, exploring non-HKD pegs | “MAS regulated stablecoins” framework, regulated as digital payment tokens | Part of VARA’s comprehensive regulations | Guidance for stablecoin issuers, often rely on bank guarantees |

| Crypto Tax (General) | No capital gains tax, profits tax may apply for regular trading | No capital gains tax, income tax may apply | No income or capital gains tax | Treated as assets, tax clarity provided |

| Overall Stance | Developing, cautious yet progressive | Embracing, forward-thinking | Encouraging growth, higher-risk/higher-reward strategy | Pioneering, clear rules, favorable tax policies |

8. Identifying Potential Risks and Challenges

Emigrating to Hong Kong presents several risks and challenges. The increased uncertainty due to the National Security Law and Safeguarding National Security Ordinance, along with the potential for arbitrary enforcement of local laws, including exit bans, are significant considerations. Concerns about the erosion of autonomy and freedoms, as well as rule of law risks, have also been raised. Potential emigrants should be aware of the possibility of increased scrutiny from PRC state security and Hong Kong law enforcement. The high cost of living, particularly for housing, and the demanding work culture are also major challenges. Air pollution can be a concern, and cultural and political differences with mainland China may be a factor for some. Some immigrants may also face discrimination and social isolation.

Investing in cryptocurrencies in Hong Kong involves inherent risks such as market volatility and the potential for significant financial loss. Security concerns, including hacking, fraud, and theft of digital assets, are ever-present. The regulatory framework is still evolving, leading to uncertainty. The number of approved trading platforms and cryptocurrencies is currently limited. Operational inefficiencies in deposit and withdrawal processes, the lack of insurance for crypto assets, and the risk of market manipulation are also factors to consider. Investors must conduct thorough due diligence on digital asset service providers and be aware of the tax implications. The potential for scams and fraud, especially involving unregulated entities, remains a risk.

Obtaining and maintaining a Hong Kong VASP license requires meeting specific criteria. Eligible entities include Hong Kong incorporated companies or registered overseas companies with a permanent business presence in Hong Kong. Applicants must appoint at least two responsible officers (ROs) who meet the SFC’s “fit and proper” test and maintain minimum paid-up share capital and liquid capital. Engaging an external assessor to evaluate policies, procedures, systems, and controls is mandatory. Strict KYC and AML/CTF procedures must be implemented, along with robust risk management frameworks, including cybersecurity measures. Compliance with regulations on the admission of virtual assets for trading and measures to prevent market abuse and manipulation are also required. Licensed entities face ongoing regulatory obligations, including regular audits and financial disclosures, and must comply with the Travel Rule for virtual asset transfers. The entire process demands significant cost and effort.

9. Recent Trends and Future Outlook

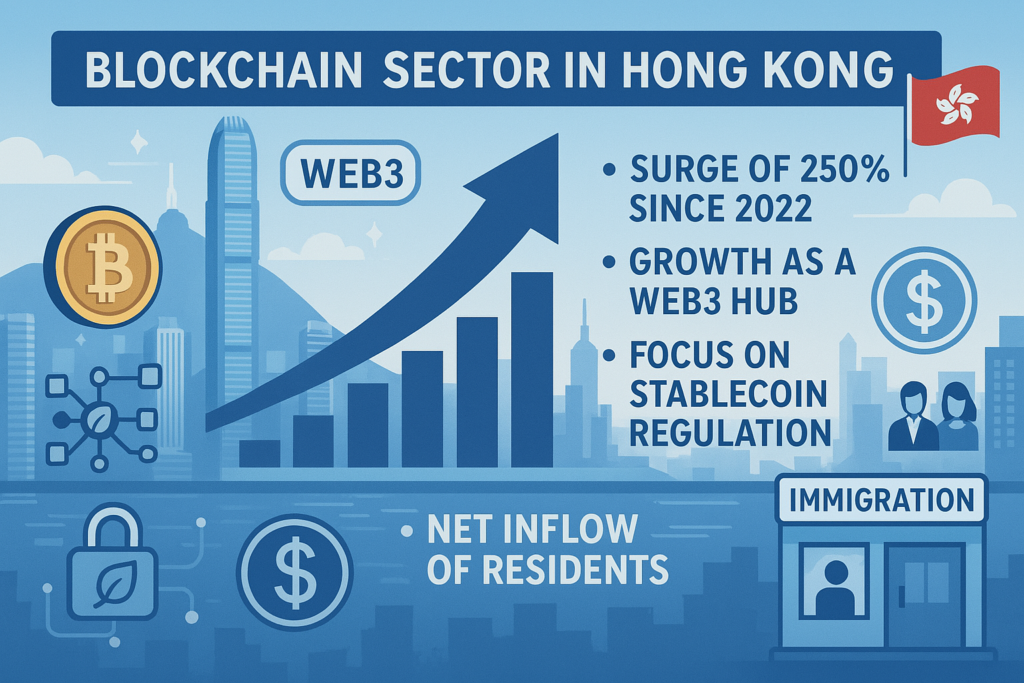

The Hong Kong blockchain sector has experienced a significant surge, growing by 250% since 2022. Hong Kong is actively positioning itself as a premier global hub for Web3, with the Financial Secretary reaffirming the city’s pro-digital asset policy. There is increasing investment in Web3 infrastructure and human resources, and the Cyberport Web3 network is expanding rapidly. Tax relief on crypto profits for hedge funds and private equity funds has been introduced. Institutional adoption of digital assets is on the rise. The focus is also on stablecoin regulation, with draft legislation expected, and the advancement of CBDC adoption through the e-HKD pilot program. The SFC is working to streamline the VATP license approval process. Notably, Hong Kong is now accepting crypto assets as proof of wealth for its immigration scheme. OSL has launched a wealth management platform specifically for crypto assets.

Recent immigration trends show a net inflow of residents for the third consecutive year in 2024, with 21,000 more people entering than leaving. This growth is attributed to individuals arriving with one-way permits and through talent attraction and labor importation measures such as the TTPS. Since late 2022, around 175,000 people have arrived in Hong Kong under various talent admission schemes, contributing to a population increase of 0.1% to over 7.53 million in 2024.

The future outlook for the cryptocurrency market in Hong Kong is promising. The global cryptocurrency market is projected to reach US$5 trillion by 2030. Hong Kong aims to establish the “most comprehensive Web3 regulatory framework globally within the next 12 to 18 months”. Substantial growth is expected in Hong Kong’s spot crypto ETF market in 2025. The SFC is expected to further streamline the VATP license approval process, and there will be a continued focus on stablecoin regulation, with a related bill introduced in the Legislative Council. Further development of regulatory frameworks for the virtual asset market is anticipated, potentially allowing professional investors to trade virtual asset derivatives and access new token listings. The government also plans to adopt the Crypto-Asset Reporting Framework to enhance transparency.

10. Strategic Conclusion and Recommendations

Emigrating to Hong Kong as a cryptocurrency investor presents a compelling mix of opportunities and challenges that necessitate careful consideration. The city’s ambition to become a leading digital asset hub, coupled with various immigration pathways for investors and a generally favorable business environment, offers significant potential. The quality of life for expatriates is generally high, albeit with a substantial cost of living.

However, critical considerations include the notably high cost of living, particularly housing, and the evolving and sometimes restrictive cryptocurrency regulations. Potential political and social uncertainties, along with a demanding work culture, also warrant attention.

For a cryptocurrency investor contemplating a move, thorough due diligence on licensed cryptocurrency exchanges and other service providers in Hong Kong is paramount. It is crucial to carefully evaluate the eligibility criteria and requirements for different immigration pathways, especially the New CIES and TTPS, and to develop a detailed budget that accounts for the high cost of living. Seeking professional legal and financial advice to navigate the regulatory and immigration processes is highly recommended. Staying updated on the latest developments in Hong Kong’s cryptocurrency market and regulatory landscape is also essential. Visiting Hong Kong to experience the city and its culture firsthand before making a final decision could provide valuable insights. For cryptocurrency businesses, a careful assessment of the requirements and complexities of obtaining a VASP license is necessary. Finally, weighing the advantages and disadvantages of Hong Kong compared to other potential locations like Singapore and Dubai based on individual needs and priorities as a cryptocurrency investor is a critical step in the decision-making process.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

Table 2: Cost of Living Breakdown in Hong Kong (Monthly Estimates)

| Expense Category | Estimated Cost for Single Person (HKD) | Estimated Cost for Family (HKD) | Notes/Range |

| Housing (Rent) | 13,000 – 30,000 | 25,000 – 60,000 | City center vs. outside; apartment size |

| Transportation | 450 – 900 | 1,500 – 2,000 | Public transport pass around 500; varies with usage |

| Utilities | 1,000 – 2,600 | 2,175 – 3,400 | Includes electricity, water, internet, mobile; varies with usage and size |

| Food/Groceries | 1,300 – 4,000 | 4,000 – 10,000 | Depends on dining habits (eating out vs. cooking) |

| Healthcare (Insurance) | 167 – 2,083 (annual range divided by 12) | 500 – 6,250 (example for family) | Private insurance recommended for expats; varies with plan and individual needs |

| Education (Intl. School) | N/A | 10,000 – 17,500 (monthly) | For one child; annual fee divided by 12 |

| General/Miscellaneous | 2,000 – 5,000 | 3,000 – 10,000 | Entertainment, personal care, shopping, etc. |

Table 3: Comparison of Immigration Pathways for Investors

| Scheme Name | Target Audience | Minimum Investment/Net Assets Requirement | Key Eligibility Criteria | Processing Time | Initial Visa Duration | Path to Permanent Residency |

| New Capital Investment Entrant Scheme | High-net-worth individuals | HKD 30 million investment, HKD 30 million net assets | Age 18+, specific nationalities, clean record, financial independence | ~6 months | Up to 24 months | After 7 years of residence |

| Top Talent Pass Scheme | High-income earners, top university graduates | HKD 2.5 million annual income (Category A) | Category B: Top university degree + 3 years work experience; Category C: Recent top university degree (quota-based) | ~1 month | 24-36 months | After 7 years of residence |

| Quality Migrant Admission Scheme | Highly skilled/talented individuals (no job offer required) | Financial ability to support self | Points-based system (age, education, experience, etc.), good character | 9-12 months | 3 years | After 7 years of residence |

| Investment as Entrepreneurs (GEP) | Individuals establishing or joining a business in Hong Kong | Substantial capital investment | Detailed business plan, registered HK company, active employment of locals, business ties to HK | 6-8 months | 2 years | After 7 years of residence |