Panama Immigration for Cryptocurrency Investors: A Comprehensive Guide

Panama: A Comprehensive Analysis for Cryptocurrency Investors Considering Emigration

1. Executive Summary: Panama – An Emerging Hub for Cryptocurrency Investors?

Panama is increasingly recognized as a country with significant appeal for international investors and individuals seeking a new place to reside. Its strategic geographical location, coupled with a distinctive tax system, positions it as a potentially attractive destination, particularly for those involved in the dynamic world of cryptocurrency. This report delves into the multifaceted aspects of emigrating to Panama for a cryptocurrency investor, exploring the key factors that make this Central American nation a compelling option.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

The analysis will cover Panama’s tax policies, with a specific focus on the treatment of cryptocurrency, the various visa and residency options available to foreign investors, the nation’s economic and political stability, insights into the local cryptocurrency community, the stance of the Panamanian banking system on digital assets, a comparative analysis of the cost of living, and the relevant legal and regulatory frameworks that could impact a cryptocurrency investor’s decision. The information presented aims to provide a holistic understanding of Panama’s landscape for this specific investor profile.

2. The Allure of Panama: Key Advantages for Investors

Panama presents a unique combination of factors that can be particularly attractive to international investors. Among these, its tax regime stands out as a primary draw. Panama operates under a territorial tax system, a fundamental aspect that distinguishes it from many Western countries that impose global taxation. This means that individuals and corporations are only taxed on income earned within the geographical boundaries of Panama. Income generated from sources outside of Panama is generally exempt from Panamanian income tax. This policy extends to capital gains tax, with foreign investments typically not subject to this tax in Panama. Furthermore, Panama does not levy inheritance or estate taxes, which can be a significant advantage for individuals looking to preserve and transfer their wealth. This tax framework can be particularly beneficial for cryptocurrency investors who often derive their income from international transactions and holdings.

Beyond its favorable tax structure, Panama fosters a pro-business environment characterized by fewer regulations compared to many developed nations. The government actively encourages foreign investment by offering straightforward processes for starting businesses. Additionally, tax incentives are available in specific sectors identified as key to Panama’s economic growth, such as free trade zones, tourism, and logistics. A significant advantage for foreign investors is the ability to have 100% foreign ownership of businesses and real estate, providing greater control and flexibility. This less regulated environment can be especially appealing to cryptocurrency entrepreneurs seeking to establish and operate their ventures with greater ease.

Panama’s strategic geographic location plays a crucial role in its appeal as a global center for international banking and trade. The country serves as a vital link between the Atlantic and Pacific Oceans through the Panama Canal, facilitating significant seaborne trade and offering investors access to global commercial goods markets. Tocumen International Airport stands as a major travel hub with direct flights connecting North America, Europe, and Latin America, making international travel convenient. Panama’s proximity to the U.S. simplifies maintaining connections with family and business interests in North America. Moreover, its location provides easy access to the Central, South, and North American markets, creating opportunities for business expansion and networking.

The cost of living in Panama is generally considered to be relatively low compared to North America, Canada, and most of Western Europe, particularly outside of the bustling Panama City. Despite its affordability, Panama offers first-world amenities and modern infrastructure, including high-speed internet, luxury shopping centers, and international schools, catering to the needs of expatriates. Furthermore, the country boasts affordable healthcare options, with private hospitals providing high-quality medical care at costs significantly lower than those in North America. This combination of affordability and quality of life enhances Panama’s attractiveness for international investors.

Panama also presents a stable economic and political landscape, which is a critical factor for investors seeking a secure environment for their assets. The country’s economy is recognized as one of the strongest and most consistently growing in Latin America, supported by the stability of the U.S. dollar, which serves as its official currency. The robust dollar-based economy and the substantial government revenue generated by the Panama Canal contribute significantly to the nation’s financial strength. This economic and political stability provides a solid foundation for investment and long-term planning.

3. Decoding Panama’s Tax Policies for Cryptocurrency

Panama’s territorial tax system forms the cornerstone of its tax policy, and this principle extends to the realm of cryptocurrency. To reiterate, only income that originates or is generated within Panamanian territory is subject to taxation. This means that if a resident of Panama earns income from sources located outside of the country, that income is generally not taxed by the Panamanian government.

This territorial approach has significant implications for the taxation of foreign income and capital gains, particularly concerning cryptocurrency. Panama does not tax foreign-sourced income, a policy that is highly relevant for cryptocurrency investors who often engage in trading, mining, or other activities on international platforms. Importantly, Panama also does not levy capital gains tax on foreign investments, which includes profits generated from the buying and selling of cryptocurrencies on exchanges located outside of Panama. Furthermore, Panama generally does not impose wealth tax or inheritance tax, adding to its attractiveness as a jurisdiction for managing and preserving digital assets.

The current landscape of cryptocurrency taxation in Panama is characterized by a lack of specific regulations directly addressing digital assets. In the absence of tailored legislation, the tax treatment of cryptocurrency income largely falls under the umbrella of the existing territorial tax system. As mentioned, profits from cryptocurrency transactions carried out on international exchanges are typically considered foreign-sourced income and are therefore not subject to local taxation. However, it is important to note that income derived from cryptocurrency-related activities that occur within Panama itself, such as operating a cryptocurrency exchange based in Panama or providing services to Panamanian residents, would likely be classified as Panama-source income and could be subject to the standard income tax rates applicable in the country.

The potential for future regulatory changes in Panama’s approach to cryptocurrency taxation is an important consideration for investors. Panama has been actively exploring the regulation of digital assets, as evidenced by the introduction of Bill No. 697. This bill, aimed at establishing a legal framework for the use of cryptocurrencies and blockchain technology, was approved by the National Assembly in April 2022. The proposed legislation sought to recognize cryptocurrencies as valid payment methods and to regulate virtual asset service providers (VASPs). Notably, the bill also intended to treat crypto assets as foreign-source income for tax purposes, which aligns with Panama’s existing territorial taxation system. However, in June 2022, the bill faced a partial veto by the President of the Republic due to concerns regarding anti-money laundering (AML) regulations. As of late 2024 and early 2025, the bill’s status remains uncertain, and it may be returned to the National Assembly for further discussion and potential amendments. While the future of specific cryptocurrency tax regulations in Panama is not yet fully defined, the ongoing legislative efforts indicate a potential evolution in this area.

4. Gaining Entry: Visa and Residency Options for Investors

Panama offers several visa and residency options that may be of interest to cryptocurrency investors. One of the most prominent is the Qualified Investor Visa (VIP), established in October 2020, which provides a fast-track route to permanent residency for individuals making a significant investment in the country. To qualify for this visa, applicants must make a minimum investment of USD $300,000 in Panamanian real estate, USD $500,000 in the Panamanian stock market, or make a fixed-term bank deposit of USD $750,000 in an approved Panamanian bank for a minimum period of five years. Notably, the processing time for this visa is remarkably short, often taking around 30 days to obtain permanent residency. A significant advantage is that the application process can be initiated remotely, and the investor is not required to reside in Panama immediately after approval. Funds for the investment must originate from a foreign source. This visa grants permanent residency, allowing the investor to live, work, and study in Panama, and it opens a pathway to apply for Panamanian citizenship after five years. Maintaining this permanent residency requires visiting Panama at least once every two years.

Another popular option is the Friendly Nations Visa, introduced in 2012, which is available to citizens of approximately 50 countries that Panama considers to have friendly professional, economic, and investment ties. Eligible countries include the United States, Canada, most European nations, Japan, South Korea, Australia, and New Zealand. To qualify, applicants must demonstrate professional or economic links to Panama through one of three main avenues: obtaining employment with a Panamanian company, purchasing real estate in Panama with a minimum value of USD $200,000, or making a fixed-term bank deposit of USD $200,000 in a Panamanian bank for a minimum of three years. Funds for investment or deposit must come from abroad. This visa initially grants a two-year provisional residency, after which the applicant can apply for permanent residency. A key benefit of this visa is the possibility of obtaining a work permit in Panama. After holding permanent residency for five consecutive years under the Friendly Nations Visa, individuals can apply for Panamanian citizenship through naturalization, which involves demonstrating basic Spanish language proficiency and renouncing their previous nationality.

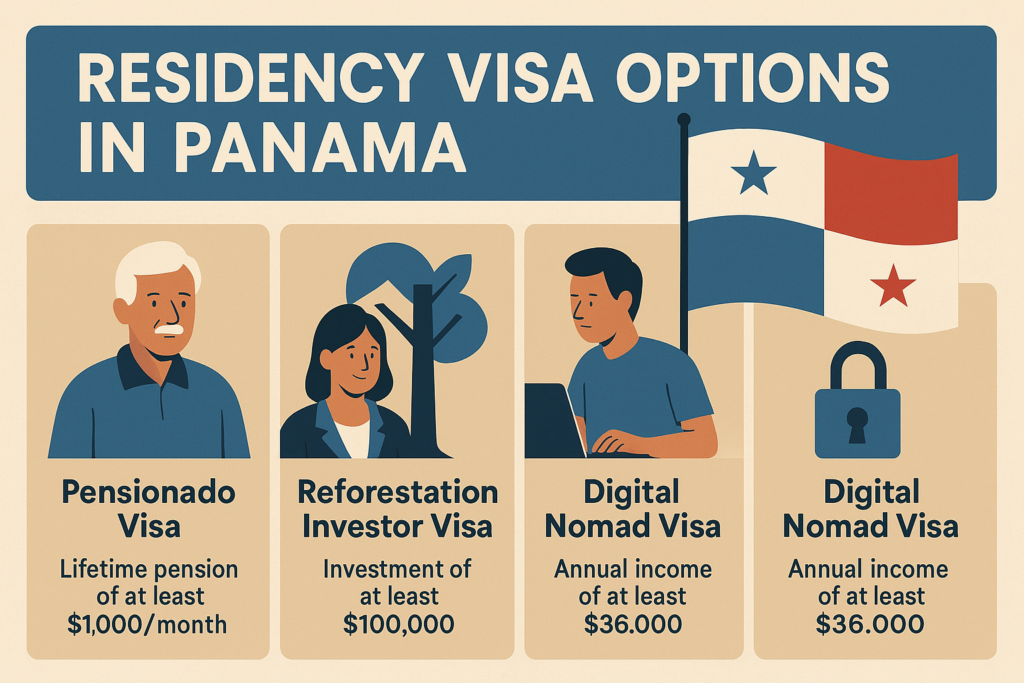

Beyond these primary options, other visa categories may be relevant depending on an investor’s specific circumstances. The Pensionado Visa (Retiree Visa) is available to individuals aged 18 and over who receive a guaranteed lifetime pension of at least USD $1,000 per month (or USD $750 per month if they purchase property in Panama worth at least USD $100,000). This visa grants immediate permanent residency and offers various discounts and benefits for retirees. The Reforestation Investor Visa provides a path to residency for those investing in government-certified reforestation projects, with investment thresholds of USD $100,000 for temporary residency or USD $350,000 for immediate permanent residency. Finally, the Digital Nomad Visa caters to individuals who earn income remotely from sources outside of Panama, requiring proof of annual earnings of at least USD $36,000 and medical insurance covering Panama.

Regardless of the chosen visa path, several key requirements and application considerations are generally applicable. These typically include a valid passport, a clean criminal record certificate from the applicant’s country of origin (often requiring an apostille or authentication by a Panamanian consulate), a certificate of good health obtained from a Panamanian doctor, passport-sized photographs, and proof of economic solvency relevant to the specific visa category. It is crucial to ensure that all foreign-issued documents are properly apostilled or authenticated to be legally recognized in Panama. Given the complexities of immigration laws and procedures, it is highly recommended to engage a reputable local Panamanian immigration lawyer to guide applicants through the process, ensure all requirements are met, and facilitate a smooth application.

5. Panama’s Economic and Political Stability: A Foundation for Investment

Panama boasts a strong and consistently growing economy that stands out as one of the most robust in Latin America. This economic strength is significantly underpinned by the official use of the U.S. dollar as its currency, which provides a high degree of stability and eliminates the risks associated with currency exchange rate fluctuations. The Panamanian economy is diversified, with key sectors including a thriving tourism industry, substantial international trade facilitated by the Panama Canal, a well-established commerce sector, and a prominent international banking hub. The Panama Canal itself is a critical component of the global supply chain and a major source of revenue for the country, contributing significantly to its economic resilience. Furthermore, Panama is witnessing the growth of a dynamic tech industry, attracting foreign investment and leveraging its strategic location and skilled workforce.

The political climate in Panama is characterized by stability and a commitment to democratic principles. This stable political environment fosters a sense of security and predictability for both residents and investors. Additionally, Panama benefits from a relatively low risk of experiencing extreme weather events such as hurricanes, which can significantly impact other regions. This combination of political stability and a generally safe environment from major natural disasters makes Panama an attractive long-term destination for investment and residence.

The role of the U.S. dollar in Panama’s economy cannot be overstated. The official use of the dollar for over a century has created a highly stable monetary environment. For individuals and businesses that primarily deal in USD, this dollarized economy simplifies financial transactions, eliminates currency conversion costs, and provides a significant level of financial convenience and security. This is particularly advantageous for cryptocurrency investors whose assets are often denominated in or traded against USD.

6. Connecting with the Crypto Community in Panama

While the provided research material does not offer extensive details about the size and organization of the cryptocurrency investor network within Panama, there are indications of a growing interest and activity in the digital asset space. One snippet mentions the presence of online entrepreneurs residing in Panama, a demographic often associated with early adoption and involvement in cryptocurrency. This suggests that a community of individuals engaged in the crypto and digital asset sector is likely emerging within the country.

Specific information regarding readily available resources, regular events, or established groups catering to cryptocurrency enthusiasts in Panama is limited within the provided snippets. However, Panama’s proactive stance in attempting to regulate and attract cryptocurrency startups, coupled with its favorable tax policies for foreign-sourced income, suggests that the infrastructure and community for crypto enthusiasts are likely in the process of development. Individuals interested in connecting with the local crypto community may need to explore online platforms, social media groups, or local business and technology networks to identify existing communities or potentially take a proactive role in fostering such connections.

Despite the current lack of comprehensive information on a well-established crypto community, Panama’s underlying strategic advantages, including its tax system, geographic location, and developing regulatory environment, point towards a strong potential for the country to evolve into a more significant hub for cryptocurrency investors and businesses in the future. As Panama continues to navigate the regulatory landscape for digital assets and attract more crypto-related ventures, the local community of investors and enthusiasts is also expected to expand and become more organized.

7. Navigating the Panamanian Banking System with Cryptocurrency

Panama has a long-standing reputation as a global center for international banking, boasting a well-established and robust banking system with a significant presence of international financial institutions. A key characteristic of the Panamanian financial system is its strong emphasis on banking privacy and confidentiality, which can be an important consideration for some investors.

However, the current stance of banks in Panama on cryptocurrency and digital assets is generally cautious. Licensed banking entities are typically not permitted to custody or provide analogous banking services related to cryptocurrency or other digital assets. The Superintendence of Banks (SBP) has previously indicated that cryptocurrencies fall outside its direct regulatory competence, and Panamanian financial institutions have not generally sought authorization to engage with these instruments. Reports suggest that some Panamanian banks have been hesitant to open accounts for companies whose primary activities involve cryptocurrencies, citing perceived risks and regulatory uncertainties. Nevertheless, there are emerging indications of a potential shift, with at least one banking entity reportedly promoting a “crypto-friendly” account.

For cryptocurrency investors considering Panama, practical considerations for opening accounts and managing crypto assets are important. It is advisable to conduct thorough research to identify specific banks or financial institutions that may be more receptive to clients involved in the digital asset space. Exploring the potential of utilizing international banks with operations in Panama could also be beneficial, as these institutions might have more established policies and experience with cryptocurrency in other jurisdictions. Additionally, investors may need to consider alternative financial solutions for managing their cryptocurrency assets, such as regulated cryptocurrency custodians or established international cryptocurrency exchanges that comply with relevant AML and KYC regulations. Navigating the Panamanian banking system with cryptocurrency holdings may require a strategic approach and a willingness to explore various options to effectively manage both traditional and digital financial assets.

8. The Cost of Living in Panama: A Comparative Analysis

The cost of living in Panama is generally lower than in many developed countries, particularly when compared to the United States. For instance, data suggests that the cost of living in the US is approximately 84% more expensive than in Panama. This difference is evident across several key areas, including housing, groceries, and healthcare. Rent for a one-bedroom apartment in Panama City can range from USD $800 to $2,000 per month, while similar accommodations in smaller towns or rural areas may cost between USD $350 and $750 per month. In contrast, the average rent for a one-bedroom apartment in the US can be significantly higher, averaging around USD $1,800.

Grocery costs also tend to be lower in Panama. Monthly grocery expenses for one person can range from USD $200 to $400, depending on location and dietary preferences. Essential food items such as bread, fruit, rice, eggs, and meat are reported to be over 50% more expensive in the US compared to Panama.

Healthcare expenses present another area where Panama offers potential savings. Routine dental checkups can cost between USD $50 and $100, and private health insurance plans may range from USD $50 to $200 per month. These costs are generally lower than those in the US, where monthly health insurance premiums can be considerably higher.

Transportation costs in Panama can vary. Public transportation within Panama City is relatively inexpensive, with monthly passes potentially costing around USD $50. However, transportation costs in more rural areas might be higher, potentially reflecting the need for personal vehicles. Utility costs for a medium-sized apartment in Panama typically range from USD $120 to $200 per month, including water, electricity, and garbage collection. Internet service can cost around USD $50 per month.

Compared to other popular expat destinations, the cost of living in Panama is generally slightly more economical than in Costa Rica, particularly for everyday items. However, Panama might be more expensive than some other Latin American countries like Guatemala. When compared to South Africa, the cost of living in Panama is notably higher, especially regarding rental costs.

The lower cost of living in Panama can translate to significant potential for cost savings for cryptocurrency investors who relocate. This can lead to a higher disposable income, allowing for more financial flexibility and an enhanced lifestyle. Additionally, Panama offers a warm tropical climate, diverse natural beauty, and a welcoming culture, further contributing to the quality of life for expatriates. The availability of affordable domestic help, such as house cleaners and gardeners, can also contribute to a more comfortable and less burdensome lifestyle.

Comparative Cost of Living Analysis (Estimates)

| Expense | Panama City (USD/Month) | Rural Panama (USD/Month) | United States (USD/Month) | Costa Rica (USD/Month) |

|---|---|---|---|---|

| Rent (1-bedroom apartment) | 800 – 2000 | 350 – 750 | 1800+ | 600 – 1500 |

| Groceries (single person) | 300 – 400 | 200 – 350 | 400+ | 350 – 500 |

| Utilities (water, electricity, internet) | 170 – 250 | 150 – 230 | 365+ | 200 – 300 |

| Transportation | 50 – 100 | 20 – 80 | 100+ | 75 – 150 |

| Healthcare (routine visit) | 20 – 50 | 20 – 50 | 100+ | 30 – 60 |

| Meal for two (mid-range restaurant) | 60 – 100 | 40 – 80 | 130+ | 50 – 80 |

Exporter vers Sheets

Note: These are estimated ranges and can vary based on lifestyle, location, and individual choices.

9. Legal and Regulatory Considerations for Crypto Investors in Panama

Panama generally has a welcoming stance towards foreign investment and business regulations. Foreigners have the right to own businesses and real estate outright, without the necessity of local partners. The process for starting a business in Panama is relatively straightforward, and the government offers various tax incentives to attract investment in key sectors of the economy. Additionally, minimal reporting requirements for businesses can reduce administrative burdens. The existence of free trade zones, such as the Panama-Pacific Special Economic Area, provides further tax exemptions for specific types of business activities.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

The current legal status of cryptocurrency and digital assets in Panama is somewhat unique. While cryptocurrency is legal to own and use, it is not recognized as legal tender. As of the current time, there is no specific, comprehensive regulatory framework in place that directly governs cryptocurrencies, mining, trading, or custody. The Superintendence of Banks (SBP) and the Superintendence of the Securities Market (SMV) have issued non-binding opinions indicating that cryptocurrencies fall outside their direct regulatory purview and are not classified as currencies or securities under existing Panamanian law. Consequently, there is currently no specific licensing regime required for engaging in cryptocurrency-related activities within Panama. However, it is important to recall the ongoing legislative efforts with Bill No. 697, which aimed to establish a more defined legal framework but has faced setbacks.

Regarding Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, Panama does have general AML laws in place that could potentially apply to cryptocurrency businesses, particularly those involved in exchange services or wallet provision, as they might be considered “Obligated Financial Subjects”. Bill No. 697, in its proposed form, included provisions for enforcing AML and KYC regulations in line with international standards, which would have required Virtual Asset Service Providers (VASPs) to register with Panama’s Financial Analysis Unit (UAF). Even in the absence of specific cryptocurrency regulations, it is advisable for cryptocurrency businesses operating in Panama to adopt and implement AML/KYC best practices to mitigate risks and align with international norms.

Given the evolving nature of cryptocurrency regulations globally and the current state of legal ambiguity in Panama, it is of paramount importance for cryptocurrency investors and businesses considering Panama to seek comprehensive legal counsel from experienced Panamanian attorneys specializing in financial regulations and emerging technologies. Legal advice is crucial for understanding the current legal landscape, navigating the uncertainties, staying informed about potential future regulatory changes, and ensuring full compliance with all applicable Panamanian laws and international standards.

10. Conclusion: Evaluating Panama as a Destination for Cryptocurrency Investors

In conclusion, Panama presents a compelling mix of advantages for cryptocurrency investors considering emigration. Its favorable territorial tax regime, which generally exempts foreign-sourced income and capital gains, is a significant draw for individuals whose primary cryptocurrency activities occur outside of Panama. The country’s relatively lower cost of living compared to many developed nations, coupled with a stable and dollarized economy, further enhances its appeal. Panama’s strategic geographic location and growing interest in the digital economy also position it as a potentially emerging hub for cryptocurrency-related activities.

However, potential challenges and considerations exist. The regulatory landscape for cryptocurrency in Panama is currently evolving and lacks specific comprehensive guidelines, which could create a degree of uncertainty. The traditional banking sector in Panama has generally adopted a cautious stance towards direct engagement with digital assets, which might present challenges for investors seeking seamless integration with traditional financial services. Additionally, while there are indications of a growing interest in cryptocurrency, the local community and established resources for crypto enthusiasts may still be in the early stages of development.

Ultimately, whether Panama is the right destination for a cryptocurrency investor depends on their individual circumstances, risk tolerance, and investment strategies. The country offers significant financial benefits and a desirable lifestyle, but navigating the evolving regulatory environment and the banking system requires careful consideration. It is strongly recommended that cryptocurrency investors conduct thorough due diligence, seek personalized legal and financial advice from professionals with expertise in Panamanian law and cryptocurrency, and carefully evaluate their own specific needs and priorities before making a final decision regarding emigration to Panama.