Monaco: Your Crypto Wealth’s Safe Harbor and Luxurious Playground

1. Monaco: A Mediterranean Haven for the Crypto Investor

Nestled along the glamorous French Riviera, the Principality of Monaco has long held an esteemed position as a premier destination for the world’s wealthiest individuals. While its reputation was initially built upon traditional industries and inherited fortunes, Monaco is increasingly attracting a new generation of affluent individuals, particularly those who have found success in the burgeoning digital asset space. This tiny nation offers a unique combination of opulent living, unparalleled security, and significant financial advantages, making it a compelling location for high-net-worth individuals seeking an optimal environment for their assets. For cryptocurrency investors, in particular, Monaco’s specific characteristics present a potentially ideal scenario for establishing a stable and tax-efficient base for their digital wealth.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

2. The Allure of Monaco: Key Advantages for High-Net-Worth Individuals

Monaco stands out as one of the safest places on the globe, boasting remarkably low crime rates. This security is reinforced by a highly visible and effective police presence, with a notable ratio of law enforcement officers to residents, ensuring a secure environment for both personal safety and financial interests. Furthermore, the principality enjoys a high degree of political and economic stability, providing a secure foundation for residents and their assets, which is particularly attractive in the often-volatile world of cryptocurrency investments.

Beyond security, Monaco offers an exceptional quality of life, characterized by a pleasant Mediterranean climate with abundant sunshine. Residents benefit from a high standard of living, with access to world-class healthcare facilities, top-tier educational institutions, and a wide array of luxurious amenities. The principality is also renowned for its upscale shopping experiences, fine dining establishments, and exclusive entertainment options, catering to the discerning tastes of affluent individuals.

Monaco’s strategic location on the French Riviera provides excellent connectivity to major European cities. Its proximity to the Nice Côte d’Azur International Airport ensures convenient global travel , and efficient rail and road networks link it to France and Italy. Moreover, residents of Monaco enjoy the significant benefit of visa-free travel within Europe’s Schengen area.

The principality boasts a vibrant cultural scene, hosting numerous world-class events, concerts, and performances. Monaco is also home to prestigious international events such as the Formula 1 Monaco Grand Prix and the Monaco Yacht Show, attracting global elites. These gatherings, along with exclusive yacht parties and elite social events, provide ample opportunities for networking and establishing valuable connections with influential individuals across various industries.

3. Navigating the Legal Landscape: Monaco’s Regulatory Framework for Cryptocurrencies

Monaco has demonstrated a forward-thinking approach to financial technology innovations and is widely regarded as a crypto-friendly jurisdiction. Currently, there is no specific legislation in Monaco that directly addresses cryptocurrencies; instead, they are generally treated as regular financial instruments under existing laws. Since 2019, the government has permitted Initial Coin Offerings (ICOs) on a case-by-case basis, subject to official approval. Furthermore, Monaco has explored the potential introduction of a central bank digital currency (CBDC) and other solutions based on blockchain technology.

The legal landscape for digital assets in Monaco is evolving. Law 1.528, enacted on July 7, 2022, introduced a more detailed framework for both digital assets and crypto-assets. This legislation provides definitions for key terms and sets forth conditions for service providers operating in this space, as well as for the conduct of ICOs. Depending on the specific crypto-asset service being offered, providers may need to obtain prior approval from either the State Minister or the Commission de Contrôle des Activités Financières (CCAF). Notably, the CCAF has issued warnings to the public regarding the risks associated with investing in unregulated crypto-assets and ICOs.

For cryptocurrency investors, the tax implications in Monaco are particularly attractive. The principality enforces no personal income tax and no capital gains tax, and this extends to profits derived from cryptocurrency activities for residents. This means that profits from trading and investing in cryptocurrencies are generally tax-free for individuals who are tax residents of Monaco. The tax treatment of cryptocurrency mining and staking is less explicitly defined but could potentially be considered business income, which might be subject to Monaco’s corporate tax rules if the activities meet certain thresholds. Gifts and inheritance of cryptocurrencies are treated similarly to other assets in Monaco, with no inheritance tax levied on direct heirs for assets located within the principality. It is important to note that companies generating more than 25% of their revenue from outside of Monaco are subject to a corporate tax.

Several laws and authorities are relevant to the cryptocurrency landscape in Monaco. Law 1.528 is central to regulating digital asset service providers and investment services related to crypto assets. The Autorité Monégasque de Sécurité Financière (AMSF) plays a crucial role in overseeing compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations for businesses operating with cryptocurrencies. The Commission de Contrôle des Activités Financières (CCAF) is the financial regulatory authority that issues warnings about crypto risks and may be involved in licensing certain crypto-related financial activities. Additionally, Law 1.362, as amended, addresses anti-money laundering obligations for crypto asset service providers , and Law 1.383, as amended, defines various types of crypto assets.

While Monaco is not a member of the European Union and therefore not directly bound by EU directives such as the Markets in Crypto-Assets Regulation (MiCA) , the principality often aligns its legislation with European standards. Law 1.528, for instance, reflects recent trends in European digital finance regulation. Given Monaco’s close ties to France and its desire to remain a competitive international financial center, it is likely that developments in EU cryptocurrency regulations will continue to inform Monaco’s own approach in the future.

4. Gaining Access: Requirements and Procedures for Monaco Residency

To become a resident of Monaco, individuals must meet specific eligibility criteria. Applicants must be at least 16 years of age and provide a police certificate demonstrating a clear criminal record. A crucial requirement is to provide proof of sufficient financial means to live in Monaco, which can be demonstrated through a bank attestation letter, an employment contract in Monaco, income from self-employment, a pension, or evidence of support from a close relative already residing in Monaco. Additionally, applicants must provide proof of having accommodation in Monaco, which can be in the form of a lease agreement for at least 12 months or evidence of property ownership. Non-EU/EEA nationals are required to obtain a long-stay (type D) visa from a French embassy or consulate before they can apply for residency in Monaco. Finally, Monegasque authorities may require a personal interview as part of the application process.

Demonstrating sufficient financial capacity often involves providing a bank attestation letter from a local Monegasque bank confirming substantial savings, which may range from €500,000 to €1,000,000 in liquid assets. While a significant bank deposit is a common pathway, individuals can also demonstrate their financial capacity through a job offer in Monaco or proof of ongoing self-employment income. Another option is to provide justification that a spouse or close relative residing in Monaco will provide financial support. Securing suitable accommodation, either by purchasing or renting a property of adequate size, is also a fundamental requirement for obtaining residency. While investing in real estate does not automatically grant residency, it can certainly strengthen an application.

The application process requires submitting various documents, including a valid passport, birth certificate, and, if applicable, marriage or divorce certificates and proof of health insurance. Specific documentation related to financial status (such as a bank reference letter or proof of income) and accommodation (like a lease agreement or property deed) must also be provided. Applications are typically submitted to the Ministry of State or the Residency Section of the Police Department in Monaco. As mentioned, non-EEA citizens must first apply for a long-stay visa through the French Consulate in their country of residence. The entire process can take several months to complete.

Monaco issues different types of residency permits with varying validity periods. The initial permit is typically a carte de séjour temporaire, which is valid for one year and can be renewed annually for up to three years. After this period, residents may be eligible for a carte de séjour ordinaire, which is valid for three years and can be renewed twice, extending the residency for a total of nine years. Long-term residents may eventually qualify for a carte de privilège, a privileged residence card valid for ten years and renewable indefinitely, typically after 12 years of continuous residence. To maintain any of these residency permits, a minimum stay in Monaco of at least three months per year is generally required, although the carte de privilège may necessitate a longer stay of 183 days.

5. The Tax Advantage: A Financial Paradise for Investors

Perhaps the most compelling reason for high-net-worth individuals, including cryptocurrency investors, to consider Monaco is its highly favorable tax regime. The principality does not levy personal income tax on its residents, with the notable exception of French nationals who are subject to a specific tax treaty with France. This absence of personal income tax, a policy in place since 1869, applies to various forms of income, including salaries, dividends, interest, capital gains, and director’s fees.

Crucially for cryptocurrency investors, Monaco also does not impose taxes on capital gains, wealth, or net worth. This exemption from capital gains tax is particularly advantageous for those who trade or invest in digital assets, as any profits realized from these activities are not subject to taxation in Monaco. Similarly, the absence of wealth tax further reduces the overall tax burden for individuals with substantial assets, including cryptocurrency holdings.

While Monaco’s tax system is highly favorable for individuals, it does have provisions for corporate taxation. Companies are subject to corporate tax only if they generate more than 25% of their turnover outside the Principality, with the standard rate set at 25%. New businesses may benefit from an initial period of lower tax rates or even full exemptions. Notably, profits derived from business activities conducted within Monaco are generally tax-exempt. The corporate tax rate for profits generated outside Monaco can range from 0 to 33.33% depending on specific circumstances.

5.1. Inheritance and Gift Tax

Inheritance and gift tax considerations in Monaco are also noteworthy. The principality has a relatively low inheritance tax, with a 0% rate applicable to spouses and direct children if the inherited assets are located in Monaco. For other beneficiaries, inheritance tax rates vary. For instance, siblings may be subject to an 8% tax. Gift tax applies to assets situated in Monaco and is levied at the same rates as inheritance tax.

5.2. Summary of Monaco’s Cryptocurrency Tax Policies

| Activity | Tax Treatment in Monaco |

|---|---|

| Holding Cryptocurrency | No personal income tax, no capital gains tax, no wealth tax. Therefore, holding cryptocurrency as an investment or store of value is not taxed for residents. |

| Trading Cryptocurrency | No personal income tax, no capital gains tax. Profits from trading cryptocurrencies are tax-free for residents. |

| Cryptocurrency Mining | Not explicitly taxed at the individual level. May be considered business income and subject to corporate tax if the mining operation generates more than 25% of its revenue outside Monaco. |

| Cryptocurrency Staking | Not explicitly taxed at the individual level. Similar to mining, may be considered business income and subject to corporate tax under certain conditions. |

| Cryptocurrency as Payment | Transactions using cryptocurrency for personal use are not subject to capital gains tax. Businesses accepting crypto as payment may be subject to corporate tax if over 25% of revenue is from outside Monaco and must comply with AML/KYC. |

| Gifts of Cryptocurrency | Treated as other assets; no gift tax for direct heirs on assets located in Monaco. |

| Inheritance of Cryptocurrency | Treated as other assets; no inheritance tax for direct heirs on assets located in Monaco. |

6. Life in Monaco: Community, Lifestyle, and Networking Opportunities

Monaco is a truly cosmopolitan environment, with a diverse population representing numerous nationalities and cultures. The principality is home to a significant number of affluent expatriates, including prominent figures from the business world, celebrities, and leaders in various industries. While French is the official language, English and Italian are widely spoken, facilitating communication for international residents.

For investors and entrepreneurs, Monaco offers a vibrant ecosystem with numerous networking opportunities. As a global financial and business center, it attracts successful individuals from around the world. Various events and organizations provide platforms for making valuable connections with influential people across different sectors. The Monaco International Investment Forum (MIIF) is a key event that brings together global entrepreneurs and investors. Organizations such as the Monaco Economic Board (MEB) play a vital role in fostering business networking and promoting the principality’s economy. Additionally, private business networking clubs like Club Vivanova and potentially The Monaco Business Circle , along with financial industry events like Fund Forum Monaco and IMPower FundForum , offer further avenues for professional engagement.

The financial technology sector is experiencing significant growth in Monaco, with a progressive stance from the government and an increasing number of fintech companies establishing a presence. Initiatives like the Extended Monaco program aim to further digitize public services and attract blockchain and fintech enterprises. MonacoTech serves as a startup hub, providing support for new ventures in the technology space. The fintech sector in Monaco is active in areas such as decentralized finance (DeFi), artificial intelligence (AI), and blockchain technology, with companies focusing on portfolio management, digital finance solutions, and payment systems.

While Monaco offers an exceptional standard of living with high-quality infrastructure and services , it is important to acknowledge that it is also one of the most expensive cities in the world. Housing costs, in particular, are very high, with real estate prices among the highest globally , and rental prices are also significantly elevated.

7. Healthcare in Monaco

Monaco boasts a high standard of healthcare with state-of-the-art medical facilities. The principality is known for having the highest life expectancy in the world, with an average of over 85 years. Residents have access to world-class healthcare facilities and medical services. The Princess Grace Hospital is a prominent institution offering excellent care. All residents are required to have health insurance coverage, either through the state scheme or private providers. Monaco’s healthcare system is considered excellent and contributes to the overall high quality of life in the principality.

8. Cost of Life in Monaco

Monaco is renowned for its high cost of living, ranking among the most expensive cities globally . Housing costs are particularly high, with property prices among the highest in the world. In 2024, the average price of newly built properties soared to €36.4 million, while resales averaged around €6 million. Studio apartments can start at approximately €1 million. Rental prices are also significantly elevated, with a one-bedroom apartment averaging around €3,500 per month, and larger units reaching into the tens of thousands of euros. The limited availability of housing further exacerbates these high costs. As a rough estimate, an individual would typically need significant wealth to afford a comfortable lifestyle in Monaco.

| Expense Category | Estimated Cost (Monthly) | Notes |

|---|---|---|

| One-Bedroom Apartment | €3,500+ | Average cost; larger units can be significantly more expensive. |

| Transportation | €22 (Monthly Pass) | For the public bus system. |

| Health Insurance | Varies | Required for all residents; cost depends on provider, coverage, and personal circumstances. |

| Overall Cost of Living | Significant Wealth | Monaco is known for its high-end services, fine dining, and exclusive events, all contributing to a higher cost of living compared to other cities. A substantial annual income or savings are essential for a comfortable lifestyle. |

9. Security in Monaco

Monaco is widely recognized as one of the safest places in the world, with remarkably low crime rates. The principality has a strong police presence, with a high ratio of law enforcement officers to residents, approximately one police officer for every 70 to 100 residents [21, 5, 9, 13, 18, 26, 44, 13, 11, 15]. This, combined with 24-hour video surveillance throughout Monaco , ensures a secure environment for both personal safety and financial interests. The crime level is low, and many buildings have 24/7 concierge services. Monaco’s commitment to security is a significant factor contributing to its appeal for high-net-worth individuals.

10. Potential Challenges and Considerations for Crypto Investors

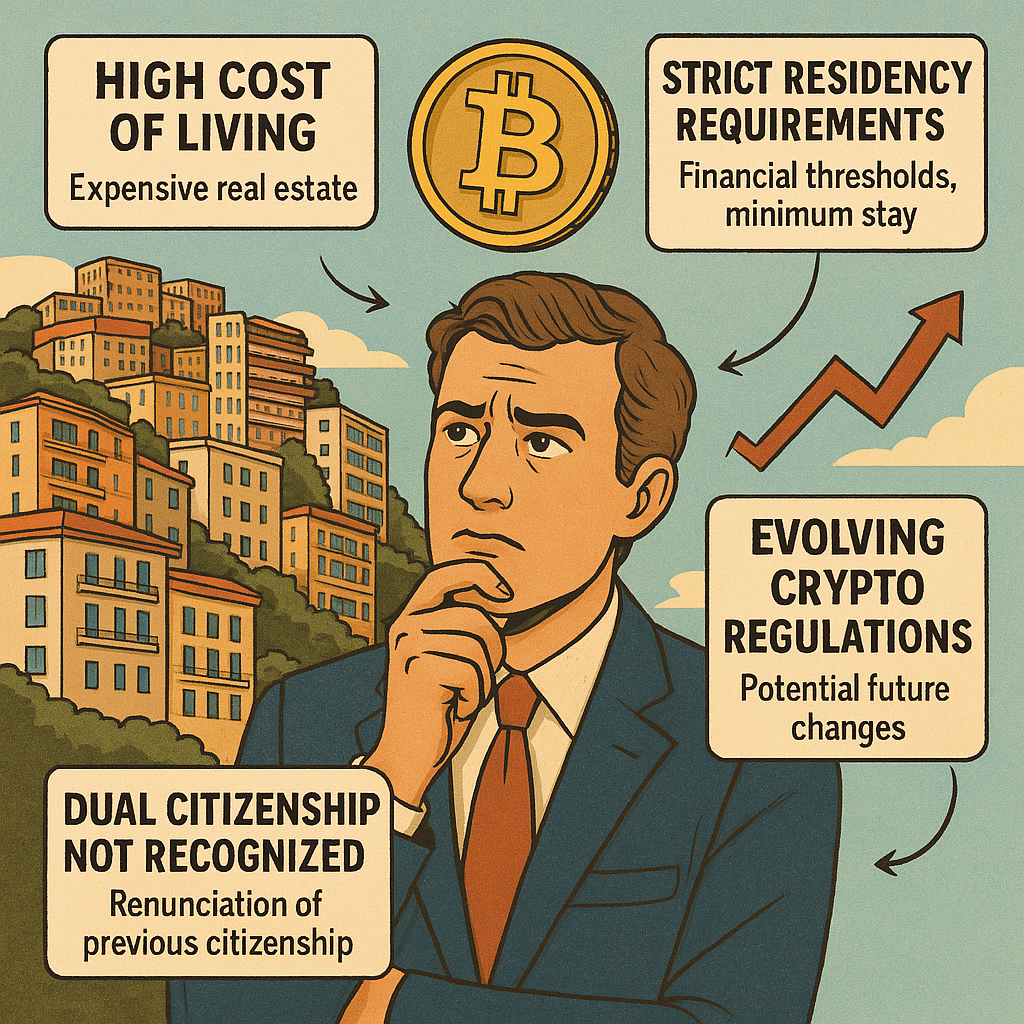

Despite the numerous advantages, cryptocurrency investors considering a move to Monaco should be aware of potential challenges. The high cost of living, particularly concerning real estate, can be a significant factor. Both property prices and rental costs are exceptionally high , and the limited availability of housing can further exacerbate this issue. Furthermore, purchasing property in Monaco involves additional expenses beyond the purchase price, such as registration and notary fees, real estate agent commissions, and deposits.

The residency requirements in Monaco are strict, with significant financial thresholds that applicants must meet, along with providing proof of suitable accommodation and demonstrating good character. Additionally, there are minimum stay requirements that residents must adhere to in order to maintain their residency status.

Another important consideration is Monaco’s stance on dual citizenship. The principality does not recognize dual nationality, meaning that individuals applying for Monegasque citizenship are required to renounce their previous citizenship.

Finally, the global regulatory landscape for cryptocurrencies is constantly evolving. With increasing international cooperation and the development of global standards , future changes in regulations worldwide could potentially influence Monaco’s current approach to cryptocurrency taxation and regulation.

11. Expert Opinions and Reports: Monaco as a Crypto Destination

Expert opinions and reports generally highlight Monaco as an attractive destination for cryptocurrency investors and businesses, primarily due to its favorable tax policies and progressive approach to fintech. A recent Crypto Wealth Report awarded Monaco a high score of 9 out of 10 for its tax-friendliness towards crypto-related activities. Global investment expert Jeff D. Opdyke has identified Monaco among countries with a 0% tax rate on crypto. The increasing number of fintech and crypto professionals relocating to Monaco suggests a growing recognition of its appeal. Monaco has also established a dedicated legal framework for Security Token Offerings (STOs), positioning itself as a forward-thinking “Funding nation” in the digital asset space. Crypto industry figure Brock Pierce has even suggested that Monaco should consider making Bitcoin legal tender to further boost its economy. Altana Wealth, an asset management firm with a presence in both London and Monaco, launched a Digital Assets Fund, indicating the principality’s relevance in the cryptocurrency market. Savills has also noted the recent influx of fintech and crypto personalities into Monaco, bringing a new dynamic to the principality , and recognizes the government’s focus on digital transformation and investment in digital infrastructure.

12. Conclusion: Is Monaco the Right Move for Your Crypto Investments?

Monaco presents a compelling proposition for high-net-worth cryptocurrency investors seeking significant tax advantages and a luxurious lifestyle within a secure and stable environment. The absence of personal income tax and capital gains tax on cryptocurrencies makes it a particularly attractive jurisdiction for those looking to optimize their financial situation. Furthermore, its exceptional quality of life, strategic location, and growing fintech sector offer a range of benefits beyond just taxation.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

However, potential residents must carefully consider the significant drawbacks, primarily the extremely high cost of living and real estate, which necessitate substantial financial resources. The strict residency requirements and the need to maintain a minimum stay in the principality also require a genuine commitment to living in Monaco. Additionally, the fact that Monaco does not permit dual citizenship for those seeking Monegasque nationality is a crucial factor for individuals who wish to retain their original citizenship. Finally, it is essential to remain aware of the evolving global regulatory landscape for cryptocurrencies, which could potentially impact Monaco’s current favorable stance.

In conclusion, while Monaco offers a unique and advantageous environment for cryptocurrency investors with substantial wealth, a thorough evaluation of the financial implications, residency requirements, lifestyle considerations, and potential future regulatory changes is crucial for making an informed decision about relocation.