Portugal for Crypto Investors & Holders: A Comprehensive Relocation Guide for 2025

Portugal continues to capture the attention of expatriates worldwide, offering a blend of appealing lifestyle factors, relative affordability within Western Europe, and an evolving, though historically favourable, environment for digital asset holders. Its sunny climate, rich culture, high safety levels, and accessible residency pathways contribute to its allure.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

This report provides a comprehensive, structured analysis tailored specifically for cryptocurrency investors and holders, particularly non-EU nationals, considering a move to Portugal in 2025. It examines the critical factors influencing such a decision – from securing residency and navigating the current crypto tax landscape to understanding living costs, healthcare access, the property market, daily life practicalities, and the local crypto ecosystem. The aim is to equip potential movers with the necessary information for informed decision-making in a landscape marked by recent regulatory changes.

1. Securing Your Stay: Key Visa Pathways for Crypto Nomads & Investors

For nationals from outside the European Union (EU), European Economic Area (EEA), or Switzerland, residing in Portugal for longer than 90 days necessitates obtaining an appropriate visa and, subsequently, a residence permit. While citizens of countries like the US, Canada, UK, and Australia can enter visa-free for short stays (up to 90 days), longer-term relocation requires navigating Portugal’s visa system.

1.1. Portugal’s Visa Landscape: An Overview for Non-EU Nationals

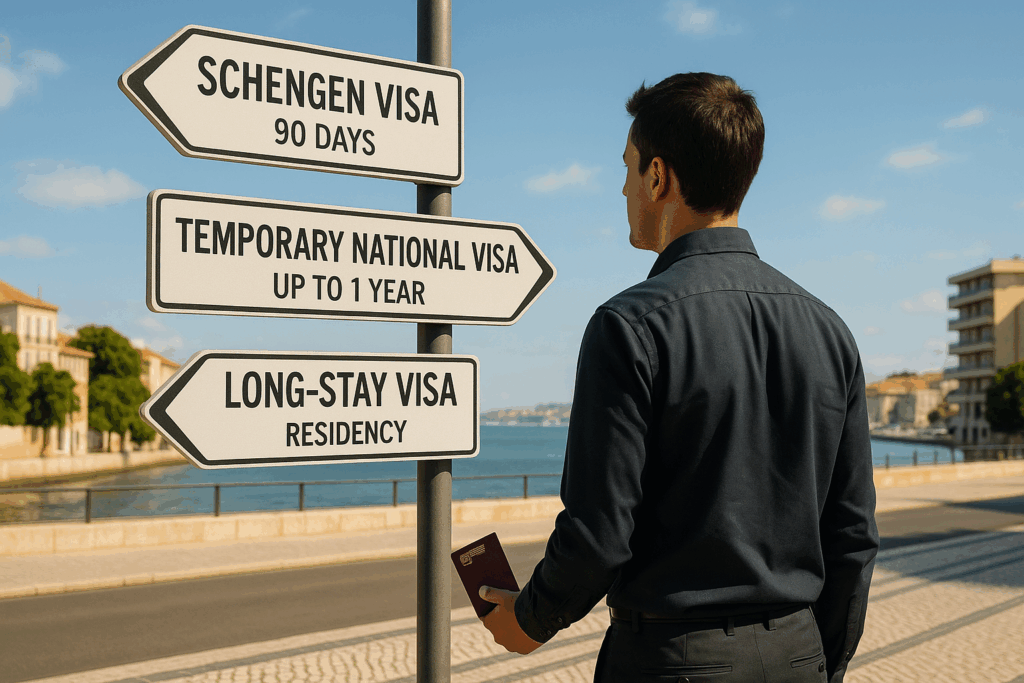

Portugal offers several visa categories, broadly divided into:

- Short-stay Schengen Visas (Type C): For tourism, business, or family visits up to 90 days within any 180-day period.

- Temporary Stay National Visas: For specific purposes lasting up to one year (e.g., temporary work, study).

- Long-Stay National Visas (Type D / Residence Visas): For stays exceeding one year, intended for those seeking to establish residency. These visas are the initial step towards obtaining a Portuguese residence permit.

For crypto investors and holders planning a longer-term move, the most relevant long-stay options are typically the D7 Passive Income Visa, the D8 Digital Nomad Visa, and the Golden Visa through specific investment routes.

1.2. The D7 Visa: Leveraging Passive Income for Residency

The D7 Visa, often termed the ‘Passive Income Visa’, is tailored for individuals who can demonstrate a stable, regular passive income stream originating from outside Portugal. This makes it suitable for retirees, investors receiving dividends or interest, individuals with rental property income, or those earning royalties.

Eligibility & Income: The core requirement is proof of consistent passive income meeting at least the Portuguese national minimum wage. For 2025, this minimum is €870 per month (€10,440 annually) for a single applicant. This threshold increases for dependents: an additional 50% for a spouse/partner or dependent parent (€435/month) and an additional 30% for each dependent child (€261/month).

Eligible passive income sources include:

- Pensions

- Rental income (from property)

- Dividends (from stocks/company shares)

- Royalties (from intellectual property like books, patents, music)

- Interest from savings or investments (bonds, fixed deposits)

- Income from trust funds or annuities.

It is crucial that this income is stable, reliable, and well-documented through bank statements, tax returns, pension letters, rental contracts, or investment statements.

Savings Requirement: Applicants must also demonstrate sufficient savings to support themselves and their family for at least the first year. The minimum required savings mirror the annual income threshold: €10,440 for a single applicant in 2025, plus 50% for a spouse (€5,220) and 30% for each child (€3,132). Holding these funds in a Portuguese bank account prior to application is strongly recommended.

Table 1: D7 Minimum Passive Income & Savings Requirements 2025

| Applicant Type | Minimum Monthly Passive Income (€) | Minimum Annual Passive Income (€) | Minimum Required Savings (€) |

|---|---|---|---|

| Single Applicant | 870 | 10,440 | 10,440 |

| Married Couple | 1,305 (870 + 435) | 15,660 | 15,660 |

| Couple + 1 Child | 1,566 (1,305 + 261) | 18,792 | 18,792 |

| Couple + 1 Adult Dep. | 1,740 (1,305 + 435) | 20,880 | 20,880 |

Note: Figures based on 2025 minimum wage of €870/month. Adult dependent assumes same requirement as spouse.

Accommodation: Proof of suitable accommodation in Portugal is mandatory. This typically means providing a 12-month rental agreement (lease) or proof of property ownership.

Application Process: The D7 involves a two-stage process :

- Visa Application (Abroad): Apply for the D7 national visa at the Portuguese consulate or embassy in your country of citizenship or legal residence. This requires prior steps like obtaining a Portuguese Tax Identification Number (NIF), opening a Portuguese bank account, and securing accommodation. The visa, if granted, is typically valid for 4 months and allows two entries into Portugal.

- Residence Permit Application (In Portugal): After arriving in Portugal with the D7 visa, you must attend a scheduled appointment with the Agency for Integration, Migration and Asylum (AIMA) to apply for your residence permit. The initial permit is usually granted for two years, renewable for a subsequent three years.

Minimum Stay: To maintain and renew the D7 residence permit, holders must spend a minimum of 6 consecutive months or 8 non-consecutive months in Portugal per year.

1.3. The D8 Digital Nomad Visa: Options for Remote Workers

Introduced to cater specifically to the growing trend of remote work, the D8 Digital Nomad Visa targets freelancers or individuals employed by companies based outside Portugal, earning active income from their remote work.

The D8 visa offers two distinct pathways :

- Temporary Stay Visa:

- Valid for up to one year, allowing multiple entries.

- Suitable for shorter-term stays or those exploring Portugal.

- Requires proof of accommodation for at least the duration of the visa (minimum 4 months often cited).

- Generally does not lead to permanent residency or citizenship.

- Family reunification is typically not permitted under this specific temporary stay option.

- Residency Visa (leading to Residence Permit):

- Starts with an initial 4-month national visa (allowing two entries).

- Requires the holder to apply for a residence permit with AIMA upon arrival in Portugal.

- The residence permit is initially granted for two years, renewable for a further three years (totaling five years).

- This pathway can lead to permanent residency and citizenship after five years of legal residency, subject to meeting requirements (including basic Portuguese language proficiency).

- Requires proof of accommodation for at least 12 months (e.g., a one-year lease agreement).

- Allows for family reunification (spouse/partner, dependent children, potentially dependent parents).

Income Threshold: Both D8 pathways require proof of average monthly income from remote work (over the last 3-6 months) equal to at least four times the Portuguese minimum wage. Based on the 2025 minimum wage of €870, this equates to €3,480 per month. Some sources mention €3,280, possibly based on the previous year’s wage; using the higher figure (€3,480) is prudent for planning. This income must originate from outside Portugal.

Savings Requirement: Applicants, particularly for the residency route, generally need to show savings equivalent to at least 12 times the Portuguese minimum wage (€10,440 in 2025) in a bank account (preferably Portuguese). If applying for the residency visa with family members, additional savings are required.

Proof Requirements: Crucially, applicants must provide robust evidence of their remote working status (employment contract specifying remote work, freelance contracts with clients, proof of business ownership operating remotely outside Portugal) and consistent income meeting the threshold (bank statements, payslips, tax returns).

Application Process (Residency Visa): Similar to the D7, the D8 residency visa follows a two-stage process :

- Visa Application (Abroad): Apply at the Portuguese consulate/embassy in your home country/country of residence after obtaining NIF, opening a bank account, securing 12-month accommodation, and gathering all documents (including proof of remote work/income and health insurance).

- Residence Permit Application (In Portugal): Upon arrival with the 4-month D8 visa, attend a pre-scheduled or self-scheduled appointment with AIMA to apply for the 2-year residence permit. Processing times for the initial visa are around 60 days, but AIMA appointments and permit issuance can take several additional months.

Table 2: D8 Visa Key Differences (Temporary Stay vs. Residency)

| Feature | Temporary Stay Visa | Residency Visa (leading to Permit) |

|---|---|---|

| Initial Visa Type | Temporary Stay National Visa | Long-Stay National Visa (Type D) |

| Initial Validity | Up to 1 year | 4 months |

| Renewability | Generally not renewable | Yes (2-year permit, then 3-year permit) |

| Path to PR/Citizenship | No | Yes (after 5 years of legal residency) |

| Min. Accommodation Proof | Typically 4+ months | 12 months |

| Min. Monthly Income | €3,480 | €3,480 |

| Min. Savings Req. | Proof of subsistence | €10,440 (+ increments for dependents) |

| Family Reunification | No | Yes |

1.4. The Golden Visa in 2025: Investment Routes Beyond Real Estate

The Portugal Golden Visa program provides a residency-by-investment pathway for non-EU nationals. However, it underwent significant changes in October 2023.

Status Update: Crucially, the previously popular options of purchasing real estate (direct or indirect) and investing in real estate-related funds are no longer qualifying investments for the Golden Visa. The option for a large capital transfer (€1.5 million) to a Portuguese bank account was also eliminated. It is important to note that existing Golden Visa holders under the old rules are not affected and can renew their permits and apply for family reunification as before.

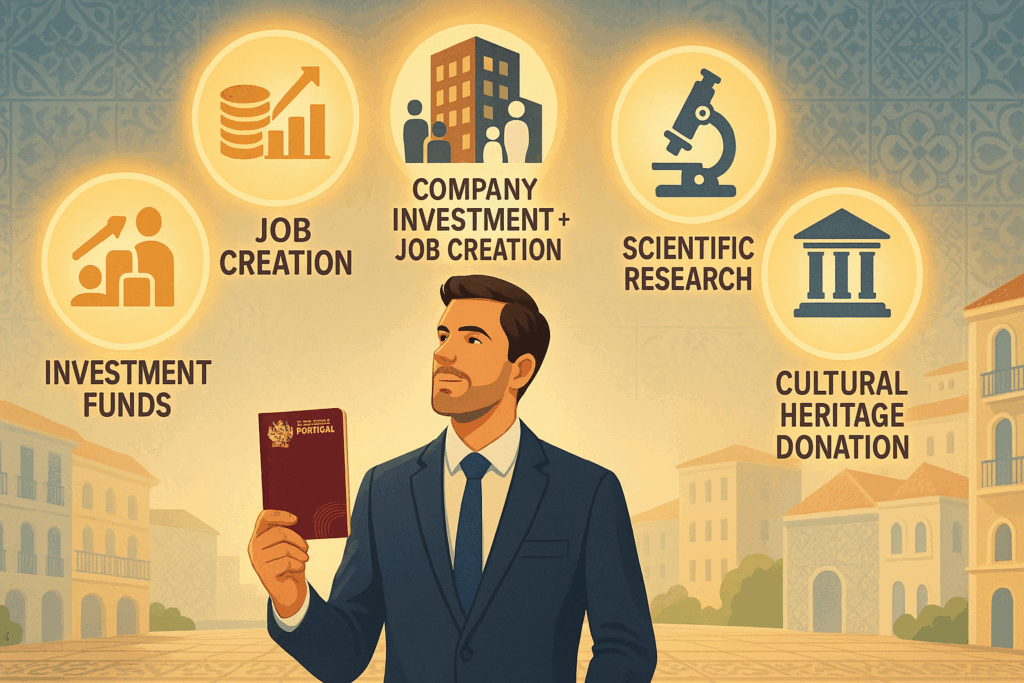

Current Qualifying Investments (as of 2025): The available routes now focus on contributions to the Portuguese economy and culture :

- Investment Funds: A minimum investment of €500,000 in qualifying Portuguese Venture Capital or Private Equity funds. These funds cannot be directly or indirectly linked to real estate and must invest at least 60% of their capital in Portuguese-registered companies. This has become the predominant route, chosen by over 95% of new investors. Funds vary in risk profile, from capital preservation focus to higher-risk venture capital.

- Job Creation: Creation and maintenance of at least 10 full-time jobs in Portugal.

- Company Investment + Job Creation: Investment of €500,000 in the share capital of a new or existing Portuguese-registered company, combined with the creation and maintenance of at least 5 permanent jobs for a minimum of three years.

- Scientific Research Contribution: A capital transfer of at least €500,000 to support research activities conducted by public or private scientific research institutions integrated into the national scientific and technological system.

- Cultural Heritage or Arts Donation: A capital transfer (donation) of at least €250,000 to support artistic production or the recovery/maintenance of national cultural heritage through specified public or private entities. (The threshold may be reduced to €200,000 if the investment is in a designated low-density area ). However, sourcing eligible projects for this route can be challenging, and success rates have been reported as lower.

Table 3: Golden Visa Investment Options & Thresholds 2025

| Investment Type | Minimum Investment / Requirement | Key Conditions |

|---|---|---|

| Investment Fund (PE/VC) | €500,000 | Non-real estate related; Min. 60% investment in PT companies |

| Job Creation | 10 full-time jobs | Maintain jobs |

| Company Investment + Jobs | €500,000 + 5 permanent jobs | Maintain jobs for min. 3 years |

| Scientific Research | €500,000 | Contribution to eligible PT research institutions |

| Cultural/Arts Donation | €250,000 (potentially €200k low-density) | Donation to approved cultural/heritage projects |

Key Benefits: The primary allure of the Golden Visa lies in its flexibility and long-term potential:

- Minimal Stay Requirement: Only an average of 7 days per year (or 14 days over each two-year permit period) needs to be spent in Portugal to maintain residency status.

- Path to Citizenship: Provides a clear route to apply for permanent residency and Portuguese citizenship after 5 years of holding the permit, subject to meeting requirements (e.g., basic language test, clean criminal record). A recent change means the 5-year clock now starts from the date of the initial residency application submission, potentially shortening the overall timeline due to processing delays.

- Schengen Area Travel: Visa-free travel throughout the 29 countries of the Schengen Zone.

- Family Reunification: Allows inclusion of spouse/partner, dependent children (under 18, or up to 25 if unmarried, studying full-time, and financially dependent), and dependent parents.

Process & Costs: Applicants need a NIF, a Portuguese bank account (to show investment funds transferred from abroad), proof of the qualifying investment, a clean criminal record, and proof of health insurance. The investment must be maintained for the entire 5-year period until permanent residency or citizenship is obtained. Associated costs include government application and renewal fees, plus significant legal fees (estimated around €5,000+ for the main applicant plus additions for family members). Processing times have faced considerable delays, particularly with the transition from SEF to AIMA, although AIMA has stated intentions to clear backlogs. Expect the entire process from application to potential passport to take around six years currently.

1.5. Navigating the Application: General Documents & The AIMA Process

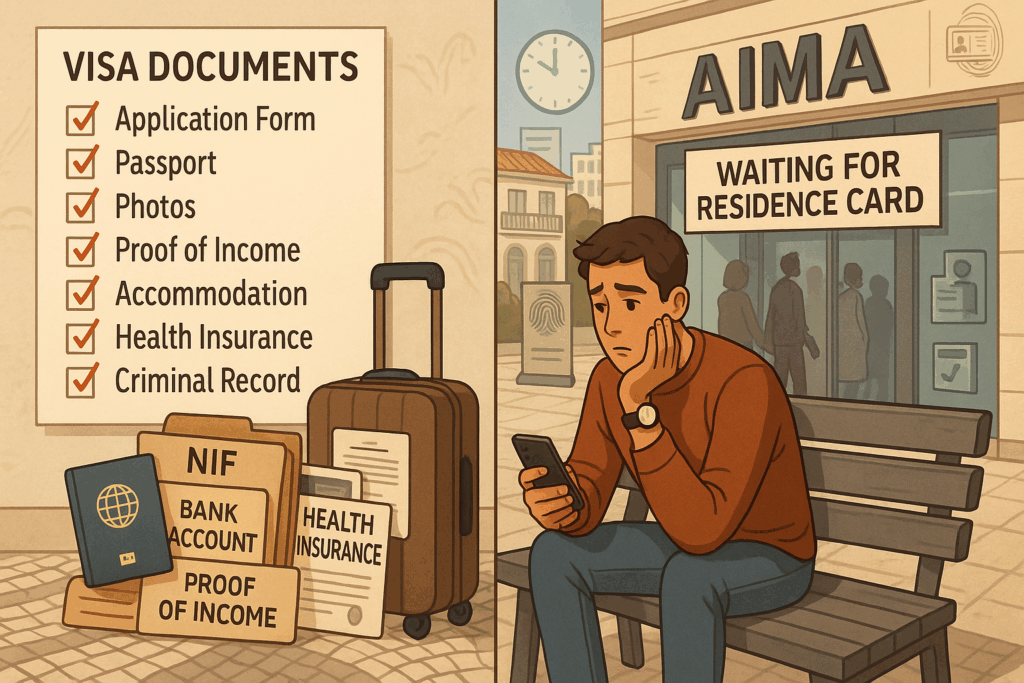

Regardless of the specific long-stay visa (D7, D8 Residency, Golden Visa pathway initiation), applicants will generally need a core set of documents for the initial visa application submitted abroad and/or the subsequent residence permit application in Portugal. These commonly include:

- Completed visa application form

- Valid passport (with sufficient validity remaining)

- Recent passport-sized photographs

- Proof of sufficient financial means (income statements, bank statements showing required savings)

- Proof of accommodation in Portugal (rental contract, property deed, or sometimes a letter of invitation)

- Valid travel/health insurance covering medical expenses in Portugal

- Criminal record certificate from country of origin and any country resided in for over a year (often requires translation and Apostille/legalization)

- Proof of NIF (Portuguese Tax ID number)

- Details of a Portuguese bank account

- Specific documents related to the visa type (e.g., proof of passive income for D7, proof of remote work for D8, proof of investment for Golden Visa).

The Role of AIMA: The Agency for Integration, Migration and Asylum (AIMA) is the governmental body responsible for processing residence permit applications after an individual has arrived in Portugal with their initial long-stay national visa. This involves attending a scheduled appointment to submit documents, provide biometric data (fingerprints, photo), and pay the permit fee.

A significant practical challenge reported by many applicants across different visa types has been the processing times and appointment availability with AIMA, particularly following its establishment replacing the former SEF agency. While efforts are underway to improve efficiency and digitize processes, applicants should anticipate that securing an AIMA appointment and receiving the final residence card can take several months after arriving in Portugal. This bureaucratic element is often cited as a drawback of the Portuguese immigration process. Patience and proactive follow-up are often necessary.

2. Portugal’s Crypto Tax Rules: What Investors Need to Know in 2025

Portugal garnered significant attention as a “crypto tax haven” for several years due to the absence of specific legislation taxing cryptocurrency gains for individuals. However, this landscape changed dramatically with the introduction of a new crypto tax regime effective from January 1, 2023. Understanding these rules is paramount for any crypto investor or holder considering relocation.

2.1. The New Reality: Understanding Portugal’s Crypto Tax Framework (Post-2023)

The 2023 State Budget brought crypto-assets explicitly under the Portuguese Personal Income Tax (PIT) Code (Código do IRS). Income and gains related to crypto are now generally classified into one of three categories :

- Category G (Capital Gains): Primarily relevant for gains from the sale/disposal of crypto assets.

- Category E (Investment Income): Applies to passive income generated from crypto assets, such as staking or lending rewards.

- Category B (Self-Employment/Business Income): Covers income from professional crypto trading activities or crypto mining.

It’s noteworthy that Non-Fungible Tokens (NFTs) are expressly excluded from this specific crypto taxation framework, meaning gains from NFT sales are generally not taxed under these rules.

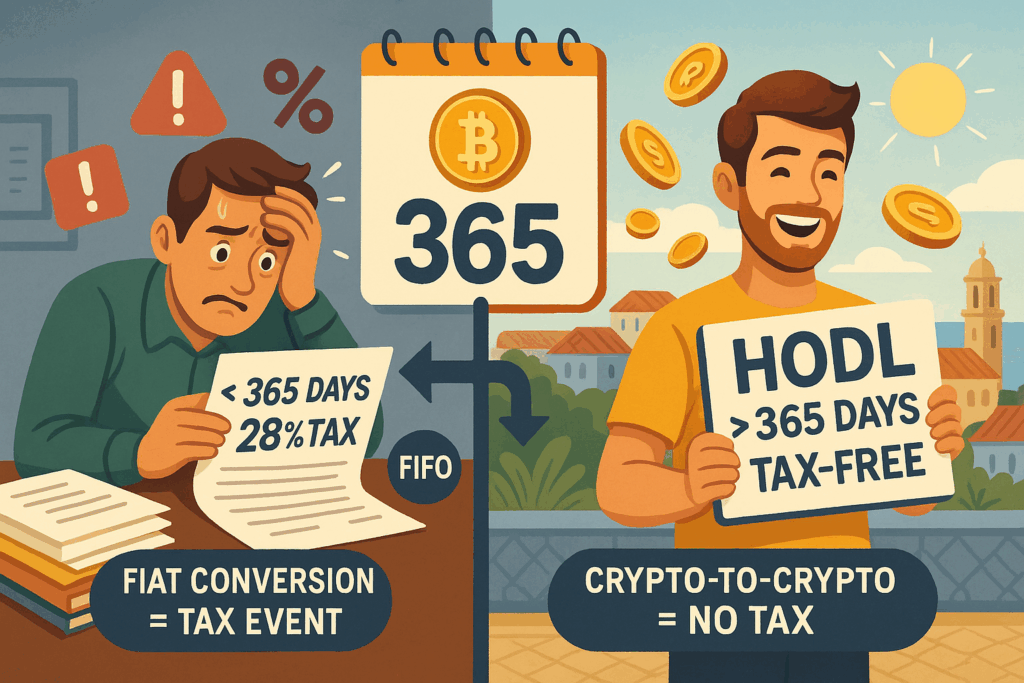

2.2. Capital Gains Tax (Category G): The Crucial 365-Day Holding Period

The tax treatment of capital gains from selling cryptocurrencies hinges entirely on the holding period:

- Short-Term Gains (< 365 days): If you sell or dispose of crypto assets (for fiat currency) that you have held for less than 365 days, the resulting capital gain is subject to tax. It falls under Category G and is taxed at a flat rate of 28%. Taxpayers can optionally choose to aggregate this income with their other earnings and be taxed at progressive rates (up to 48% + solidarity surcharge), which might be beneficial if their overall income is low. One source suggests a nuance where residents might only aggregate 50% of the short-term gain if choosing progressive rates, while non-residents are taxed at 28% on the full gain; clarification from a tax advisor is recommended on this point.

- Long-Term Gains (> 365 days): This remains the most significant advantage of Portugal’s crypto tax regime. If you sell or dispose of crypto assets held for more than 365 days, the capital gain is generally tax-exempt. This “hodler-friendly” rule makes Portugal attractive for long-term crypto investors.

Exceptions to Long-Term Exemption: The tax exemption for long-term gains does not apply in specific cases: * If the crypto assets are legally classified as ‘securities’ (e.g., security tokens). The determination of whether a token qualifies as a security is typically made on a case-by-case basis, considering the rights and economic interests it represents. The specific criteria under Portuguese law can be complex , and clear guidance on which specific tokens fall into this category is limited. * Potentially, if the assets are held in or sourced from jurisdictions considered tax havens or outside the European Economic Area (EEA), though the specifics require careful verification.

Calculation Method: Capital gains and losses are calculated using the First-In, First-Out (FIFO) method. This means the crypto assets acquired first are considered the ones sold first when calculating the holding period and cost basis.

Crypto-to-Crypto Swaps: A key planning advantage in Portugal is that exchanging one cryptocurrency for another is generally not considered a taxable event. Taxation is typically triggered only upon the conversion of cryptocurrency into fiat currency (like Euros or US Dollars). This allows investors to rebalance portfolios, move between different crypto assets, or convert volatile assets into stablecoins without incurring an immediate tax liability, effectively deferring taxation until a cash-out event occurs. This differs significantly from tax regimes in countries like the US, where crypto-to-crypto trades are often taxable.

2.3. Taxing Crypto Income: Staking, Lending, Mining & Professional Trading

Income generated from crypto activities other than simple buying and selling is taxed differently:

- Passive Income (Staking/Lending): Income received from activities like staking crypto assets or lending them out to earn interest is generally classified as Investment Income (Category E). This income is typically taxed at a flat rate of 28%. If the income (e.g., staking rewards) is received in the form of crypto assets, the taxable event occurs only when these assets are subsequently converted into fiat currency.

- Mining & Professional Trading: Income derived from crypto mining operations or from frequent, systematic crypto trading that is deemed a professional or business activity falls under Self-Employment Income (Category B). This income is subject to Portugal’s progressive income tax rates, which range from 14.5% to 48%. Additionally, high earners face an additional solidarity surcharge of 2.5% (on income €80k-€250k) or 5% (on income above €250k), potentially bringing the top marginal rate to 53%.

- Determining ‘Professional Trader’: Whether an individual’s trading activity constitutes a professional business activity depends on several factors, including whether crypto trading is the main source of income, the frequency and volume of trades, the average holding period of assets, and the number of trading platforms used. Due to the significant difference in tax treatment (28% flat vs. up to 53% progressive), individuals engaging in frequent trading should seek professional tax advice to determine their classification.

- Simplified vs. Organized Accounting (Category B): For Category B income (mining/professional trading), if annual gross income does not exceed €200,000, taxpayers can typically use a simplified regime. Under this regime, tax is applied not to the net profit but to a predetermined coefficient of the gross income. For crypto asset operations (excluding mining), this coefficient is 15% (0.15), meaning only 15% of the gross income is subject to progressive tax rates. For crypto mining income, the coefficient is 95% (0.95). Alternatively, taxpayers can opt for organized accounting, where actual business expenses can be deducted to determine the taxable profit. Professional traders using organized accounts may be able to deduct relevant expenses like electricity or equipment costs.

- Crypto as Salary: If cryptocurrency is received as payment for employment (salary), it is taxed as regular Employment Income (Category A) at the standard progressive rates (14.5% to 48% + surcharge).

Table 4: Portugal Crypto Taxation Summary 2025

| Activity Type | Tax Category | Tax Rate / Treatment | Notes |

|---|---|---|---|

| Selling Crypto (< 365 days holding) | G | 28% flat rate (or progressive if aggregated) | Gain = Sale Value – Acquisition Cost (FIFO) |

| Selling Crypto (> 365 days holding) | Exempt | 0% | Does not apply if asset is a ‘security’ or potentially from tax haven |

| Staking / Lending Income | E | 28% flat rate | Taxed when converted to fiat if received in crypto |

| Mining / Professional Trading Income | B | Progressive rates (14.5% – 53%) | Simplified regime (tax on coefficient) or organized accounts possible |

| Crypto-to-Crypto Swap | N/A | Not Taxable | Tax triggered upon conversion to fiat |

| Receiving Crypto as Salary | A | Progressive rates (14.5% – 48% + surcharge) | Treated as regular employment income |

| Selling NFTs (Non-Fungible Tokens) | Exempt | Not Taxable (under current crypto rules) | Explicitly excluded from the 2023 crypto tax regime |

2.4. NHR Regime Phase-Out: Impact and Potential Alternatives (IFICI)

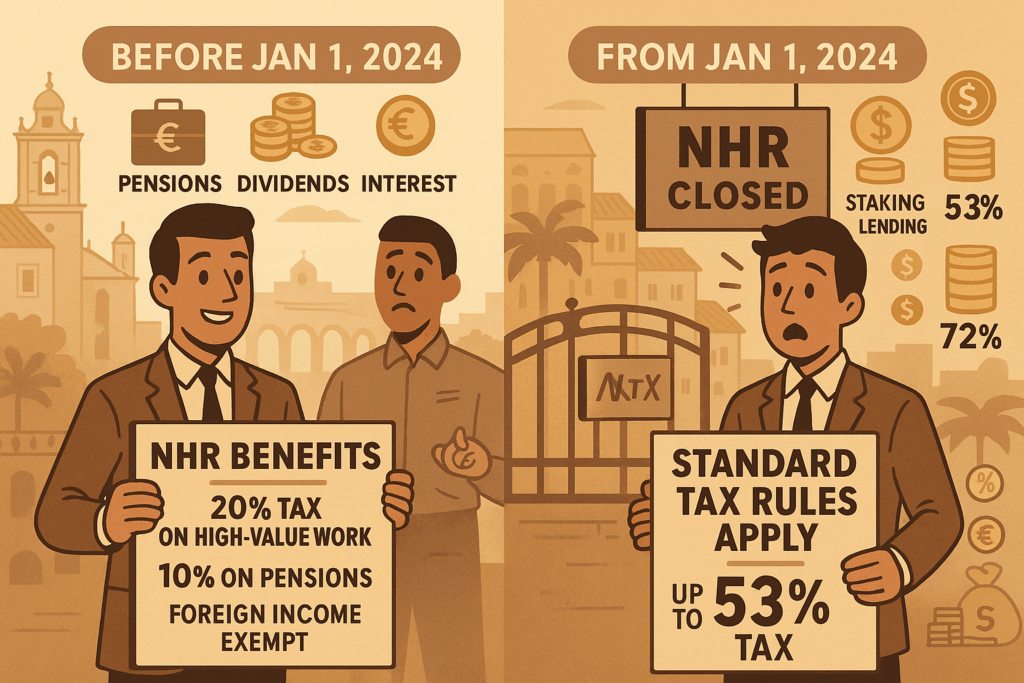

A significant factor for many expats considering Portugal in recent years was the Non-Habitual Resident (NHR) tax regime. This program offered substantial benefits for 10 years, including a 20% flat tax rate on income from specific high-value-added activities performed in Portugal and, crucially, tax exemptions on most types of foreign-sourced income (like dividends, interest, royalties, and sometimes employment or self-employment income if taxed abroad). Foreign pensions were taxed at a favourable 10% rate.

However, the NHR regime was officially terminated for new applicants effective January 1, 2024. Individuals who were already registered as NHRs before this date continue under the old rules for the remainder of their 10-year period. Transitional rules allowed individuals who became tax residents in 2023 and met certain conditions (e.g., initiated visa process) to apply until March 31, 2024. For newcomers in 2025, the original NHR regime is no longer an option.

The termination of NHR significantly alters the tax landscape for many potential expats, including those in the crypto space. While the specific rule exempting long-term crypto capital gains remains in place, the broader benefits of NHR that could have applied to other crypto-related income (like foreign-source staking/lending income potentially being exempt, or professional trading income potentially taxed at 20% if qualifying as a high-value activity) are gone for new residents. Without NHR, these other income streams are now generally subject to standard Portuguese tax rates (28% flat for Category E, progressive up to 53% for Category B). This makes the overall tax proposition potentially less attractive than previously, especially for individuals with diverse income sources beyond just long-term crypto gains.

The IFICI Alternative: Portugal introduced a replacement scheme, the Tax Incentive Scheme for Scientific Research and Innovation (IFICI), sometimes dubbed ‘NHR 2.0’, effective from 2024. IFICI also offers benefits for 10 years, including:

- A 20% flat tax rate on Portuguese-sourced employment (Category A) or self-employment (Category B) income.

- A tax exemption on most foreign-sourced income (employment, self-employment, dividends, interest, capital gains on non-Portuguese real estate, rental income).

However, IFICI is much narrower in scope than the old NHR regime. Eligibility is restricted to individuals performing specific “high value-added activities” linked to scientific research, innovation, technology, and startups. This includes roles such as higher education teaching and research, qualified positions within companies benefiting from contractual tax incentives for productive investment, R&D personnel, jobs in certified startups, or roles in entities certified as technology and innovation centers.

For the typical crypto investor or trader, it is unlikely that their activities would automatically qualify them for IFICI, unless they are specifically employed in a qualifying research or tech role within the blockchain sector in Portugal. Standard crypto trading or passive holding and staking activities do not fall under the defined eligible categories. Therefore, IFICI is not a direct substitute for the broad applicability of the former NHR regime for the average crypto-focused individual. Foreign pensions are also taxed at progressive rates under IFICI, unlike the 10% NHR rate, and income from blacklisted jurisdictions remains taxed at 35%.

2.5. Compliance Essentials: Reporting, Deadlines, and Other Considerations

Navigating the Portuguese tax system requires adherence to specific compliance rules:

- Reporting: All crypto-related income and transactions, including tax-exempt long-term capital gains, must be reported on the annual Portuguese personal income tax return (Declaração Modelo 3 de IRS). Free transfers (gifts/inheritance) of crypto may also need reporting, even if exempt from Stamp Duty.

- Deadlines: The tax filing period in Portugal runs from April 1st to June 30th each year, covering income from the previous calendar year. Any tax due must typically be paid by August 31st.

- Penalties: Failure to file or report accurately can lead to penalties ranging from €200 to €2,500. Late payment of taxes can incur fines up to 100% of the tax owed.

- VAT (Value Added Tax): Portugal aligns with general EU principles, treating cryptocurrencies similarly to fiat currency for VAT purposes. Therefore, the buying and selling of cryptocurrencies are exempt from VAT.

- Stamp Duty (Imposto do Selo): Free transfers of crypto assets, such as gifts or inheritances, may be subject to Stamp Duty at a rate of 10% on the value transferred. However, transfers between close relatives (spouses, partners, parents, children, grandparents, grandchildren) are exempt from this tax. Donations below €500 are also exempt. Reporting may still be required even for exempt transfers.

- Exit Tax: Portugal imposes an exit tax on unrealized capital gains, which includes crypto assets, when an individual ceases to be a Portuguese tax resident. This means that a portion of the appreciation in value of crypto assets accrued during the period of residency in Portugal could become taxable upon departure, even if the assets haven’t been sold. This is a critical factor for long-term financial planning, especially for those who may not intend to remain in Portugal permanently.

- Corporate Tax: Businesses involved in cryptocurrency activities (e.g., exchanges, trading firms, mining operations) are subject to Portuguese Corporate Income Tax (IRC) on their profits. Standard rates apply, which are progressive, typically starting around 15-17% for smaller profits and rising to 21% (plus potential surcharges). Specific rules apply to mining companies, which are often taxed on 95% of their gross income under the simplified regime.

Given the complexities and recent changes, seeking advice from a qualified tax professional familiar with both Portuguese tax law and cryptocurrency specifics is highly recommended before making any decisions.

3. The Cost of Living: Budgeting Your Portuguese Lifestyle

Portugal is frequently cited as one of the most affordable countries in Western Europe, offering a high quality of life at a lower price point than many of its neighbours. However, costs can vary significantly depending on location and lifestyle.

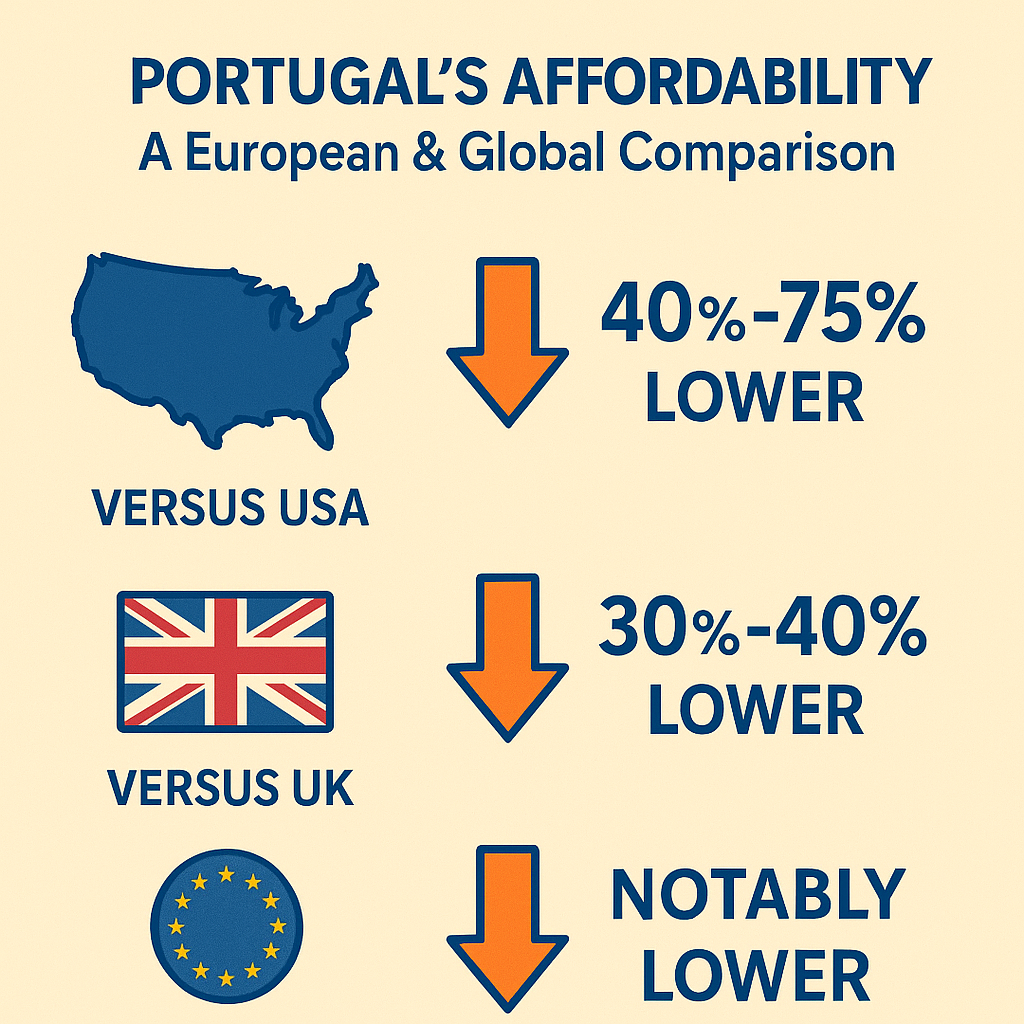

3.1. Portugal’s Affordability: A European & Global Comparison

Compared to major Anglophone countries and other Western European nations, Portugal generally offers significant cost savings:

- Versus USA: The overall cost of living, including rent, is estimated to be 40% to 75% lower in Portugal than in the US. Rent prices can be over 100% lower, groceries around 95-105% lower, and restaurant prices roughly 80% lower.

- Versus UK: Portugal is estimated to be 30% to 40% cheaper overall than the UK. Rent averages around 40% lower.

- Versus Other EU: Portugal is notably more affordable than countries like Germany, France, and the Netherlands. It is slightly cheaper than Spain overall.

Table 5: Cost of Living Index Comparison (Portugal = 100)

| Index | Portugal (Baseline) | USA | UK | Spain | France | Germany | Netherlands |

|---|---|---|---|---|---|---|---|

| Overall Cost of Living | 100 | 138.1 | 139.1 | 105 | 125 | 120 | 130 |

| Rent Index | 100 | 155.8 | 132.2 | 105 | 120 | 115 | 125 |

| Groceries Index | 100 | 189.0 | 142.5 | 102 | 115 | 110 | 118 |

| Restaurant Prices Index | 100 | 191.0 | 145.0 | 103 | 120 | 118 | 125 |

Source: Adapted from Numbeo comparison data referenced in. Indices provide a relative comparison.

While generally affordable, it’s worth noting that Portugal’s average disposable income is also lower than the EU average. However, a lower risk of poverty suggests the cost of living aligns reasonably well with local earning potential for many. Inflation is projected to be relatively contained in 2025 (around 1.9-2.1%), potentially below the EU average.

3.2. City vs. Coast vs. Countryside: Regional Cost Variations

Living costs are not uniform across Portugal. Major cities and popular coastal areas are significantly more expensive than inland regions and smaller towns.

- Lisbon: Consistently the most expensive city. Rent is a major driver, being significantly higher than elsewhere. The overall cost of living including rent is roughly 17% higher than in Porto.

- Porto: Portugal’s second city offers a more affordable alternative to the capital, while still providing urban amenities. Rent prices are estimated to be around 31% lower than Lisbon’s.

- The Algarve: As a major tourist destination and expat hub, costs can be relatively high, particularly in prime locations like Loulé, Faro, Lagos, or Albufeira, and during peak season. However, overall costs might still be lower than Lisbon.

- Other Regions: The lowest costs are generally found in the interior Central region, the Alentejo region, and parts of the North region (excluding Porto). Cities like Braga, Coimbra, Aveiro, Viseu, Castelo Branco, Evora, and Santarém are often cited as offering good value for money. Rent in these areas can be substantially lower than in Lisbon or Porto.

Table 6: Estimated Monthly Costs by Location – Single Person (2025)

| Expense Category | Lisbon (€) | Porto (€) | Faro (Algarve) (€) | Braga (€) |

|---|---|---|---|---|

| Rent (1-bed apt city center) | 1,200 – 1,500+ | 900 – 1,200 | 1,000 – 1,500 | 650 – 900 |

| Utilities (Basic, 85m²) | 120 – 150 | 100 – 130 | 100 – 140 | 90 – 120 |

| Groceries | 250 – 350 | 200 – 300 | 200 – 300 | 200 – 300 |

| Public Transport Pass | 40 | 40 | ~40 | ~40 |

| Est. Total (incl. Rent) | 1,610 – 2,040+ | 1,240 – 1,670+ | 1,340 – 1,980+ | 980 – 1,360+ |

Note: Ranges are estimates based on data from various sources. Actual costs vary based on specific location, consumption, and lifestyle.

3.3. Everyday Expenses: Housing, Utilities, Groceries, Transport, Leisure

- Housing (Rent): Average monthly rents vary widely. In Lisbon city center, a 1-bedroom apartment might range from €1,200-€1,500+, while outside the center it could be €900-€1,100+. A 3-bedroom in the center could exceed €2,500. In Porto, expect around €900-€1,200 for a central 1-bedroom. In smaller cities like Coimbra or Braga, central 1-bedrooms might start around €500-€650. Rental demand is high, although supply reportedly increased towards the end of 2024.

- Housing (Purchase): Average prices per square meter also show large regional differences. Lisbon Metropolitan Area averages near €5,000/m², Porto around €4,000/m², Algarve around €4,400/m², while Central and Northern regions can be closer to €2,000/m² or less.

- Utilities: Basic utilities (electricity, heating/cooling, water, garbage) for an 85-90m² apartment average around €110-€130 per month nationally, but can range from €80 to €200 depending on usage and location. Internet (60Mbps+) typically costs €35-€40/month. A mobile phone plan with data costs around €20-€25/month.

- Groceries: Considered affordable, especially local produce, fish, and wine. Expect to budget around €200-€350 per month for a single person, and €500-€700 for a family of four. Sample prices: 1L milk ~€0.90, loaf of bread ~€1.20-€1.40, dozen eggs ~€2.70, 1kg chicken fillets ~€6.80, mid-range bottle of wine ~€4-€5.

- Transportation: A monthly public transport pass for unlimited travel within a city typically costs €40. Single tickets are around €1.50-€2.00. Taxis start around €3.50, with a typical 5km trip costing €7-€11. Gasoline prices hover around €1.70-€1.90 per litre. Intercity trains are reasonably priced (e.g., Lisbon-Porto €25-€35).

- Leisure & Dining Out: Eating out is relatively inexpensive. A meal at an inexpensive restaurant costs around €10-€13. A three-course meal for two at a mid-range restaurant is typically €40-€50. A domestic beer (0.5L draught) costs €2.00-€3.00, and a cappuccino around €1.60-€1.80. A cinema ticket is about €7.50-€8.00. A monthly gym membership averages €35-€40.

Overall Budget: A single person might live comfortably (excluding rent) on €700-€800 per month in many areas. A family of four might need €2,400-€2,600 per month excluding rent and schooling. Including rent, estimates vary significantly by location: a single person might need €1,200-€1,500 in cheaper areas up to €2,000+ in Lisbon; a couple/family might range from €2,000-€2,500 in smaller towns up to €4,000-€6,000+ in Lisbon depending on lifestyle and housing choices.

4. Healthcare in Portugal: Accessing Services as an Expat

Portugal boasts a well-regarded healthcare system that combines public and private provision, generally offering good quality care that is accessible to legal residents.

4.1. Understanding the System: Public (SNS) and Private Options

The Portuguese healthcare landscape consists of two main pillars:

- Serviço Nacional de Saúde (SNS): This is the public healthcare system, funded primarily through taxation and social security contributions. It aims to provide universal healthcare coverage to all legal residents of Portugal. The SNS operates a network of public health centers (Centros de Saúde) for primary care and public hospitals for secondary and tertiary care. Registration with a local health center and assignment to a family doctor (médico de família) is the standard way to access primary care and referrals within the SNS.

- Private Healthcare Sector: Alongside the SNS, there is a robust private healthcare sector comprising private hospitals, clinics, and practitioners. This sector often offers faster access to specialists, shorter waiting times, more choice of doctors, potentially more modern facilities in some cases, and services not fully covered by the SNS (like comprehensive dental care). Many residents use private health insurance to access these services or supplement their SNS coverage.

4.2. Getting Access: SNS Eligibility and Registration for Residents

Access to the public SNS system is primarily determined by legal residency status:

- Eligibility: All legal residents of Portugal, including expatriates holding valid residence permits (obtained through visas like D7, D8, or Golden Visa), are entitled to register for and use the SNS. EU citizens residing in Portugal can also register, often using an S1 form if they are pensioners or receive benefits from their home country. EU citizens visiting temporarily can use their European Health Insurance Card (EHIC) for necessary care.

- Non-Residents: Tourists and short-term visitors (typically those staying less than 90 days or without legal residency) generally do not have access to free non-emergency care through the SNS. They are usually required to have private travel or health insurance. Policy changes enacted in late 2024 further clarified these restrictions, limiting non-emergency SNS access for non-residents and irregular migrants, primarily citing financial sustainability concerns. This underscores the critical importance of obtaining legal residency status to ensure access to the public healthcare system.

- Registration Process: To access the SNS as a resident, you typically need to:

- Obtain a Portuguese Social Security Number (Número de Identificação da Segurança Social – NISS), if you are working or contributing to the system.

- Visit your local health center (Centro de Saúde) with your residence permit/certificate, proof of address (e.g., rental contract, utility bill), and your NISS (if applicable).

- Complete the registration process to receive your SNS user number (Número de Utente de Saúde). This unique number identifies you within the public healthcare system.

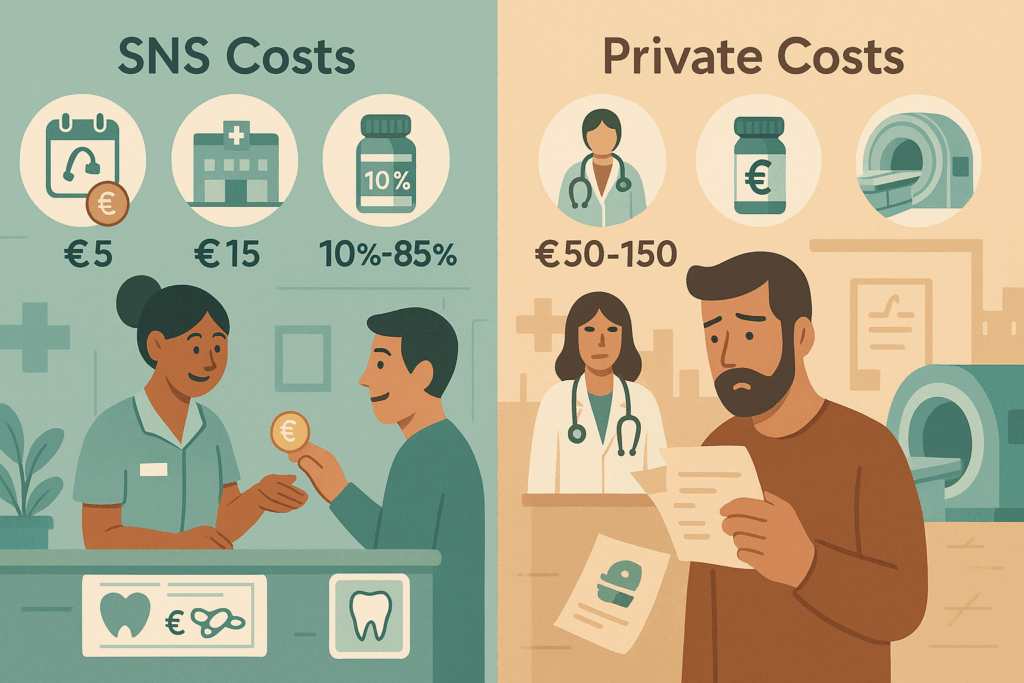

4.3. Healthcare Costs Explained: SNS Fees vs. Private Sector Pricing

- SNS Costs: While the SNS provides care that is free at the point of use for many services, it is not entirely free. Small user fees, known as ‘taxas moderadoras’, are charged for certain services, although these have been reduced or eliminated for many primary care interactions. Where applicable, fees are typically nominal: around €5 for a GP visit at a health center (though often waived now), €15-€20 for an emergency room visit (if not admitted or referred by SNS 24 health line), and varying amounts for specialist consultations or diagnostic tests (capped around €40 per exam). Numerous exemptions from these fees exist for specific groups, including children under 18, pregnant women, registered unemployed individuals, low-income households, and blood donors. Prescription medications obtained through the SNS are subsidized, with patients paying a co-payment ranging from 10% to 85% of the cost, depending on the medication’s classification. Dental care is generally not covered by the SNS for the general population, only for specific vulnerable groups (children, elderly, pregnant, disabled) via programs like ‘cheque dentista’.

- Private Costs: Costs in the private sector are significantly higher and vary widely. A consultation with a private GP or specialist typically ranges from €50 to €150 or more. Costs for tests, procedures, and hospital stays depend on the provider and the specifics of the treatment.

4.4. Private Health Insurance: Necessity, Options, and Costs

Given the potential waiting times in the SNS for non-urgent procedures and the limited coverage for services like dental care, many expats opt for private health insurance.

- Necessity: Private health insurance is often a mandatory requirement for obtaining certain visas (like temporary stay visas) and may be needed during the initial stages of residency before SNS registration is complete. It is highly recommended for non-residents and those who desire faster access to specialists, greater choice of providers, English-speaking doctors, or coverage for services like comprehensive dental care.

- Options: Numerous international and local insurance companies offer plans in Portugal. Well-known providers include Allianz Care, Cigna Global, Bupa Global, AXA PPP Healthcare, Médis, Multicare, Fidelidade, and AdvanceCare. Plans vary greatly in coverage levels, networks, and exclusions.

- Costs: Private health insurance in Portugal is generally considered more affordable than in many other Western countries, particularly the US. Monthly premiums typically range from €30-€50 for basic plans to €100-€150 or more for comprehensive plans. Costs are highly dependent on the insured person’s age, pre-existing health conditions, and the desired level of coverage. Annual costs can therefore range from approximately €400 to over €1,000 per person.

Table 7: Healthcare Cost Comparison (Estimates)

| Service | SNS Cost (€) | Private Sector Cost (€) |

|---|---|---|

| GP Visit (Primary Care) | ~0 – 5 (often waived) | 50 – 100+ |

| Emergency Room Visit (non-admitted) | ~15 – 20 | 100 – 200+ |

| Specialist Consultation | ~7 – 15 (if fee applies) | 80 – 150+ |

| Basic Private Insurance (Monthly) | N/A | 30 – 60 |

| Comprehensive Private Ins. (Monthly) | N/A | 100 – 150+ |

Note: SNS fees (‘taxas moderadoras’) have exemptions and may vary. Private costs are indicative ranges.

5. Housing Market Insights: Renting and Buying Property

Securing accommodation is a fundamental step in relocating. Portugal’s real estate market has seen significant activity and price appreciation in recent years, driven partly by foreign demand, though affordability remains a key concern.

5.1. Market Snapshot: Trends and Forecasts for 2025

The Portuguese real estate market demonstrated resilience in 2024, showing positive growth trends despite slowdowns observed in other parts of Europe. Forecasts for 2025 generally remain optimistic:

- Investment Growth: Commercial real estate investment volume is projected to increase by approximately 8% year-on-year, potentially reaching €2.5 billion, with retail and hospitality sectors expected to lead.

- Price Appreciation: Overall residential property market value is forecast to grow by around 5.8% in 2025, continuing to outperform the broader EU market average. Lisbon’s prime residential market is also expected to see positive price growth (around 4.5%).

- Demand Drivers: Continued demand is fueled by Portugal’s attractiveness for international investment, affluent expatriates relocating for lifestyle and safety, and the residual effects or indirect impact of residency programs like the Golden Visa (even with the exclusion of direct real estate investment). Economic growth projections for Portugal in 2025 are also stronger than the Eurozone average.

- Market Dynamics: While demand remains strong, particularly in desirable locations like Lisbon, Porto, and the Algarve, housing supply shortages continue to exert upward pressure on prices, impacting affordability. However, construction costs show signs of stabilizing. An increase in the supply of rental properties was noted towards the end of 2024, potentially easing some pressure in that segment. Yields saw some stabilization in 2024, with potential for further compression in 2025 depending on interest rate movements.

The removal of the real estate option from the Golden Visa program represents a significant shift in direct investment incentives. However, the underlying appeal of Portugal for foreign residents and investors appears strong enough to sustain market momentum, particularly in the mid-to-high end segments. Affordability for average buyers and renters remains a challenge.

5.2. Renting Guide: Average Prices and Finding a Home

Renting is often the first step for newcomers. Average rental prices vary significantly across the country:

- Lisbon: Remains the most expensive rental market. A central 1-bedroom apartment averages €1,400-€1,500+ per month, while a 3-bedroom can easily exceed €2,600. Outside the center, 1-bedrooms might be found for €1,000-€1,100.

- Porto: More affordable than Lisbon. A central 1-bedroom averages €1,000-€1,200, and a 3-bedroom around €1,800-€1,900. Outside the center, 1-bedrooms are around €800-€850.

- Algarve: Prices fluctuate depending on location and season. Tourist hotspots like Cascais (€2,141 avg), Loulé (€2,166 avg), and Faro (€1,986 avg) report very high average rents. However, more modest 1- or 2-bedroom apartments in towns like Lagos or Tavira might be found in the €1,100-€1,300 range, potentially lower outside prime areas or complexes. Luxury villas can reach €2,000+.

- Smaller Cities/Towns: Offer significant savings. In cities like Coimbra, Aveiro, or Braga, central 1-bedroom apartments can start around €500-€650 per month, though expats might typically rent around the €1,000 mark depending on quality and size. Municipalities on the outskirts of Lisbon (e.g., Moita, Barreiro) are increasingly sought after due to lower rents (around €900-€1,100 average) compared to the capital.

While rental price growth reportedly slowed in early 2025 , overall demand remains high relative to supply, particularly for affordable properties. Popular online portals like Idealista and Imovirtual are commonly used to search for rental properties.

5.3. Buying Guide: Process for Foreigners, Costs, and Legal Steps

Portugal places no restrictions on foreigners buying property, and the process is relatively straightforward, though professional guidance is highly recommended.

The Buying Process: The typical steps involved in purchasing property are :

- Financial Preparation: Secure financing (if needed) by obtaining mortgage pre-approval. Define your budget, considering purchase price and associated costs.

- Property Search: Use online portals (Idealista, Imovirtual, etc.) and/or engage real estate agents. Consider using a buyer’s agent who represents your interests.

- Due Diligence & Documentation Check: Crucially, verify the property’s legal status. Although a recent law change means the Licença de Utilização (Habitation License) and Ficha Técnica da Habitação (Property Technical File) are no longer mandatory at the signing of the promissory contract, buyers should insist on seeing these documents to ensure the property is legal, habitable, and matches official records. This places a greater emphasis on buyer due diligence. Engaging a lawyer is vital for checking property registration, verifying ownership, searching for liens or debts, and confirming building permissions.

- Property Survey: While not legally mandatory like in some countries, obtaining an independent structural survey is highly recommended before making an offer to identify potential issues.

- Make an Offer & Negotiate: Submit a formal offer, usually through the agent or lawyer. Negotiation on price is common.

- Promissory Contract (Contrato Promessa de Compra e Venda – CPCV): Once the price is agreed, a legally binding promissory contract is signed by both buyer and seller, outlining the terms of the sale.

- Pay Deposit: Upon signing the CPCV, the buyer typically pays a deposit, usually 10% of the purchase price. If the buyer defaults, they lose the deposit. If the seller defaults, they usually must repay double the deposit.

- Final Deed (Escritura de Compra e Venda): The final stage is signing the official deed of sale before a public Notary. All parties (or their legal representatives with power of attorney) must be present. If you don’t speak Portuguese fluently, a translator may be required.

- Payment & Registration: Pay the remaining balance of the purchase price, along with all applicable taxes and fees. The Notary then registers the property transfer with the Land Registry (Conservatória do Registo Predial).

Essential Requirements for Foreign Buyers:

- NIF (Número de Identificação Fiscal): A Portuguese tax identification number is mandatory for buying property. Non-residents usually need to appoint a fiscal representative in Portugal to obtain and manage their NIF.

- Portuguese Bank Account: While not strictly mandatory for the purchase itself (funds can be transferred internationally), it is highly recommended and practically necessary for paying taxes, utilities, and other ongoing property-related expenses.

- Valid Identification: Passport or valid ID card.

Mortgages for Foreigners: Mortgages are available to non-residents from Portuguese banks. However, terms may be less favourable than for residents:

- Loan-to-Value (LTV) ratios are typically lower, often 60-80% of the property valuation or purchase price (whichever is lower), requiring a larger down payment.

- Loan terms may be shorter, often capped at 30 years for non-residents versus potentially longer for residents.

- Banks will assess the applicant’s financial situation (income, debts, credit history) and conduct an independent valuation of the property. Proof of income (payslips, tax returns, rental income statements, etc.) is required.

- Home (building) insurance and often life insurance are mandatory requirements when taking out a mortgage in Portugal.

Associated Purchase Costs: Buyers must budget for significant costs beyond the property price :

- Property Transfer Tax (IMT – Imposto Municipal sobre as Transmissões Onerosas de Imóveis): This is the largest transaction tax. The rate varies based on the property value, type (urban/rural), location (mainland/islands), and intended use (main residence vs. second home/rental). Rates are progressive, potentially reaching up to 8% for higher-value residential properties. Non-residents buying in designated tax havens may face a higher flat rate (e.g., 10%).

- Stamp Duty (IS – Imposto do Selo): Charged at 0.8% of the property’s declared value or registered value (whichever is higher). An additional Stamp Duty (usually 0.5% or 0.6%) is levied on the mortgage amount if financing is used.

- Notary and Land Registry Fees: Fees for the notary’s services in witnessing the deed and for registering the property. Combined costs typically range from €750 to €1,250 or potentially 0.2% to 1.2% of the property value, depending on complexity.

- Legal Fees: Fees for hiring a lawyer to handle due diligence, contract review, and representation. Typically range from €2,000 to €5,000+, depending on the property value and complexity of the transaction.

Table 8: Estimated Property Purchase Costs (Excluding Purchase Price)

| Cost Item | Typical Rate / Range (%) | Estimated Cost (€) Example (€300k Property) | Notes |

|---|---|---|---|

| IMT (Main Residence) | Progressive (0% – 8%) | ~€12,500 – €15,000 | Rate depends heavily on value & use. Use online simulator. |

| Stamp Duty (Purchase) | 0.8% | €2,400 | On purchase value / registered value. |

| Stamp Duty (Mortgage) | 0.5% – 0.6% | €1,200 – €1,440 (assuming €240k mortgage) | Only if obtaining a mortgage. On mortgage amount. |

| Notary & Registry Fees | Variable | €750 – €1,250+ | Combined fee for deed execution & registration. |

| Legal Fees | Variable | €2,000 – €5,000+ | Depends on lawyer and transaction complexity. |

| Total Estimated Costs | ~5% – 10%+ | ~€18,850 – €25,090+ | Excludes mortgage arrangement fees. Budget conservatively. |

Note: IMT calculation is complex; use an online simulator for accurate estimates based on specific property value and type. Example assumes mainland Portugal.

5.4. Property Prices Across Portugal: Key Regions Compared

Average purchase prices per square meter (€/m²) show significant regional disparity:

- Lisbon Metropolitan Area: Highest prices, averaging around €4,900 – €5,300/m² , with central Lisbon potentially exceeding €6,000/m².

- Algarve: Also high, averaging around €4,300 – €4,400/m² , though some sources quote lower regional averages around €2,000/m². Prices vary greatly within the region.

- Porto Metropolitan Area: More affordable than Lisbon, averaging around €3,900 – €4,000/m² , though central Porto is higher.

- Madeira: Averages around €1,500 – €1,600/m².

- North Region (excluding Porto): Averages around €1,900 – €2,000/m² , with some areas lower (~€1,400/m²).

- Central Region: Offers better affordability, averaging around €2,100/m² , with some areas lower (~€1,100-€1,700/m²).

- Alentejo: Traditionally lower prices, though some sources show higher averages (~€3,180/m² ) while others show much lower (~€1,000-€1,100/m² ). Requires careful local market research.

- Azores: Averages around €1,400/m².

Note discrepancies between data sources. Prices are dynamic and hyperlocal. These figures provide a general comparison.

Concrete examples from 2024/2025 estimates include: a modern 2-bedroom apartment near Lisbon center potentially costing around $500,000 USD (€465k approx.); a similar property near Porto center around $250,000 USD (€232k approx.); a larger 4-bedroom house in Caldas da Rainha (Silver Coast) around $235,000 USD (€218k approx.); and a modern 2-bedroom apartment in Tavira (Algarve) around $280,000 USD (€260k approx.).

6. Daily Life, Culture, and Getting Settled

Beyond visas and finances, understanding the practicalities and cultural nuances of daily life is crucial for a successful relocation.

6.1. Quality of Life: Climate, Culture, and Pace

Portugal consistently ranks highly for quality of life, a major draw for expats. Key contributing factors include:

- Climate: Generally mild Mediterranean climate, particularly pleasant in the south (Algarve) and coastal areas. Summers can be hot, especially inland, while winters are mild but can be wet, especially in the north. Year-round sunshine is a significant appeal.

- Culture: Portugal has a rich history reflected in its architecture, music (like the soulful Fado), cuisine, and traditions. Family values are strong. Politeness and respect are important, with formal greetings (Senhor/Senhora) sometimes used in professional or unfamiliar settings. Communication can be direct and sometimes perceived as loud, which is cultural rather than indicative of anger.

- Pace of Life: Generally considered more relaxed and laid-back compared to many North American or Northern European countries, especially outside the main business hubs of Lisbon and Porto. This contributes to a better work-life balance for many.

- Environment: Offers diverse landscapes, from extensive coastlines with beaches to rolling hills and historic cities. Opportunities for outdoor activities abound.

6.2. Safety and Security: Low Crime, High Peace of Mind?

Portugal enjoys a strong reputation as a very safe country, consistently ranking among the most peaceful nations globally.

- Low Crime Rates: Violent crime is relatively rare. Portugal compares favourably with other developed nations in terms of security indicators. The 2024 Global Peace Index ranked Portugal 7th worldwide. A high percentage of residents report feeling safe walking alone at night.

- Common Concerns: The most frequent issues reported, particularly by tourists and expats in busy areas, are petty crimes like pickpocketing (especially on public transport or in crowded tourist spots), bag snatching, and occasional scams targeting tourists. Car break-ins can also occur, especially in tourist areas or poorly lit locations.

- Other Issues: While overall crime is low, official statistics have noted increases in complaints related to domestic violence and racially motivated incidents in recent years. Some areas in Lisbon and Porto are considered less safe late at night.

- Perception vs. Recourse: While the statistical likelihood of being a victim of serious crime is low, a potential point of frustration highlighted in some expat forums is the perceived difficulty in obtaining effective police action or timely resolution through the court system if a crime does occur, particularly for non-violent offenses or complex disputes. The justice system can be slow. This suggests a possible disconnect between the country’s overall safety and the practical recourse available to victims in certain situations. Standard precautions like being aware of surroundings, securing belongings, and avoiding displaying valuables are always advisable.

6.3. Transportation Network: Navigating Portugal (Public Transport & Driving)

Getting around Portugal is generally feasible, with distinct differences between urban and rural areas.

Public Transport: Portugal has an extensive network including trains (operated by CP – Comboios de Portugal), intercity and local buses (run by various private companies like Rede Expressos, Rodonorte, EVA), metros in Lisbon and Porto, and trams (primarily in Lisbon and Porto, now largely tourist attractions).

Urban Areas (Lisbon/Porto): Public transport is generally efficient, comprehensive, and affordable, making car ownership unnecessary for many residents. Metros are fast and reliable, complemented by extensive bus networks. Parking is difficult and expensive in these cities.

Intercity Travel: Trains (Alfa Pendular – fastest, Intercidades – slightly slower) connect major cities along the main north-south axis (Braga-Porto-Coimbra-Lisbon-Faro) effectively. Express buses (Rede Expressos) offer a wider network, often reaching towns not served by rail, and can be quicker for shorter distances.

Rural Areas: Public transport becomes less frequent and less reliable outside major towns and cities. Bus services to villages may run only a few times a day, often geared towards school or market times, with reduced or no service on weekends. Rural train lines exist but can be slow, use older stock, and stations may be located far from the actual town. Delays and cancellations on the rail network are noted as relatively common.

The usability of public transport is highly dependent on location. While excellent for city living and travel between major hubs, it presents challenges for daily life in more remote areas.

Driving: Holding a valid driving licence from most countries is sufficient (International Driving Permit usually not required). Owning a car provides significantly more flexibility, especially for exploring the countryside or living outside urban centers. Roads are generally good, but Portuguese drivers can be assertive. Police strictly enforce traffic rules, and on-the-spot fines are possible.

6.4. Bridging the Gap: Language, English Proficiency, and Integration

While Portugal boasts a relatively high level of English proficiency compared to some other European nations, language remains a key factor for integration.

Portuguese Language: The official language is Portuguese. Learning at least basic Portuguese is highly recommended for anyone planning to live in the country long-term. It is essential for navigating bureaucracy (government offices, healthcare interactions outside private clinics), understanding local culture, building meaningful relationships with locals, and avoiding isolation within an “expat bubble”. While not required for initial visa applications (D7/D8/GV), demonstrating A2 level proficiency is mandatory for applying for permanent residency or citizenship after five years.

English Proficiency: English is widely spoken, particularly among younger generations and in major cities (Lisbon, Porto), popular tourist destinations (Algarve, Madeira), and within the business and tourism sectors. Portugal often ranks highly in global English proficiency indices for non-native speaking countries.

Practical Realities: It is possible to get by with only English in heavily touristed areas like the Algarve or within international business circles in Lisbon. However, relying solely on English presents significant limitations:

- Bureaucracy: Dealing with government agencies (AIMA, Finanças, health centers) often requires Portuguese.

- Healthcare: While some doctors speak English (especially in private clinics), many nurses and administrative staff in the public SNS system may not.

- Daily Life: Outside major hubs and tourist zones, English proficiency drops significantly, making everyday interactions (local shops, services, neighbours) challenging.

- Integration: Locals generally appreciate efforts made by foreigners to speak Portuguese, even if basic. A lack of effort can sometimes be perceived negatively. True immersion in Portuguese life and culture requires understanding the language.

- Learning Resources: Free or low-cost Portuguese language courses are often available through local councils or cultural centers. Numerous online courses and apps also cater to European Portuguese.

In essence, while Portugal’s English proficiency provides a softer landing than many countries, long-term residents will find their experience significantly enriched and simplified by learning Portuguese.

6.5. Finding Your Tribe: Major Expat Hubs (Lisbon, Porto, Algarve)

Portugal hosts vibrant and growing expatriate communities, offering networks for support, socializing, and information sharing. The main hubs are :

- Lisbon: The capital city boasts the largest and most diverse expat community, attracting professionals, families, and retirees. It offers a cosmopolitan lifestyle, extensive job opportunities (especially in tech and finance), a rich cultural scene, and good international connectivity. Popular neighborhoods mentioned include Alfama, Baixa, Chiado, and Principe Real. The nearby coastal town of Cascais is also a major expat haven, particularly popular with affluent retirees.

- Porto: Portugal’s second city has a growing expat community, often described as potentially smaller and more close-knit than Lisbon’s. It offers a lower cost of living than Lisbon, historic charm, a strong local culture (including Port wine), and a more relaxed pace. It’s increasingly attracting tech professionals and younger retirees. Popular areas include the riverside Ribeira district, the upscale Foz do Douro, trendy Cedofeita, and residential Boavista.

- The Algarve: This southern coastal region has long been a magnet for expats, particularly from the UK and Northern Europe, especially retirees. It’s known for its favourable climate, beautiful beaches, golf courses, and well-established English-speaking networks and amenities. Popular towns with significant expat populations include Lagos, Albufeira, Vilamoura, Tavira, Faro, Loulé, and Portimão.

- Other Areas: Expat communities are also growing in other locations, including:

- Madeira: The island capital, Funchal, has a supportive expat community, attracted by the mild climate and natural beauty. It’s also known for its digital nomad village.

- Silver Coast: Towns like Caldas da Rainha, Nazaré, Peniche, and Óbidos, located between Lisbon and Porto, are popular for their beaches and more traditional Portuguese feel.

- Other Cities: Sintra (historic town near Lisbon), Ericeira (surfing hub), Braga (historic, affordable northern city), Aveiro (“Venice of Portugal”), and Coimbra (university city) also host expat communities.

Connecting with these communities is often done through online platforms like Internations (chapters in Lisbon, Porto), dedicated Facebook groups (e.g., “Americans and Friends in PT”, “Porto Expats”), and Meetup.com for shared interest groups.

7. Portugal’s Crypto Scene: Ecosystem Overview

For crypto investors and holders, understanding the local environment for digital assets – from banking attitudes to available services and community activity – is essential. Portugal presents a mixed but evolving picture.

7.1. Banking Landscape: Navigating Crypto Transactions & Account Opening

Dealing with traditional banks as a crypto holder in Portugal can present challenges, despite the country’s generally crypto-friendly reputation in other aspects.

Regulatory Oversight: The Banco de Portugal (BdP), the central bank, acts as the supervisory authority for Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) compliance for Virtual Asset Service Providers (VASPs) operating in the country. While BdP registers VASPs for AML purposes, it has consistently issued public warnings about the risks associated with crypto assets (volatility, lack of legal tender status, potential for illicit use). Portugal is also in the process of transposing the EU’s comprehensive Markets in Crypto-Assets (MiCA) regulation into national law. As of early 2025, the specific national authority responsible for licensing and supervising Crypto-Asset Service Providers (CASPs) under MiCA had not yet been formally designated, creating some regulatory uncertainty.

Bank Attitudes & Policies: The stance of individual Portuguese banks towards customers dealing with cryptocurrencies appears inconsistent and is tightening. While Portugal was previously seen as lenient, increasing regulatory pressure from European bodies (ECB, EBA) and the implementation of MiCA seem to be influencing banks to adopt more cautious approaches.

- Reports emerged in early 2025 of at least one major bank, Banco de Investimentos Globais (BiG), blocking fiat transfers to cryptocurrency platforms, explicitly citing compliance with European regulations and AML/CFT concerns.

- Conversely, at the same time, users reported that other large banks, like the state-owned Caixa Geral de Depósitos (CGD), were still permitting such transfers.

- Bison Bank is notable as its subsidiary, Bison Digital Assets, is a registered VASP, suggesting a more crypto-positive institutional stance.

- Account Opening & Transactions: While opening a standard Portuguese bank account is generally straightforward for residents (requiring NIF, ID, proof of address) , depositing funds derived directly from cryptocurrency activities or making large transfers related to crypto may trigger enhanced scrutiny from banks due to AML regulations. Banks are obligated to assess the origin of funds. Providing clear documentation of the source of crypto wealth and using regulated exchanges is advisable to mitigate potential issues or account restrictions. The inconsistent policies mean crypto holders might need to inquire with multiple banks to find one amenable to their activities. The situation is fluid, and policies could become more restrictive across the board as MiCA implementation progresses.

7.2. Accessing Crypto: Exchanges and Service Providers

Despite potential banking hurdles, accessing cryptocurrency services in Portugal is generally possible through various platforms:

- International Exchanges: Major global cryptocurrency exchanges like Coinbase , Binance , Kraken, and others are typically accessible to users in Portugal for buying, selling, and trading a wide range of crypto assets.

- Local Registered VASPs: Several entities are registered with the Banco de Portugal for AML purposes and offer crypto services locally. These include Criptoloja, Luso Digital Assets, Mind the Coin, and Bison Digital Assets. The Spanish platform Bit2Me also operates in Portugal. These local options may offer services tailored to the Portuguese market.

- Brokerages: Some online brokers offering CFDs (Contracts for Difference) also provide access to cryptocurrency trading, though this differs from direct ownership. Examples include eToro, Plus500, FP Markets, Pepperstone. Users should understand the distinction between trading CFDs and owning the underlying crypto asset.

- Bitcoin ATMs: Physical Bitcoin ATMs for buying or selling crypto with cash exist in Portugal, although their density is lower than in some other countries. Locations can be found using online maps like CoinATMRadar. Providers operating ATMs globally, some with a presence in Portugal, include CoinFlip , General Bytes , and Lamassu.

7.3. The Local Ecosystem: Startups, Events, and Community

Beyond individual trading and investment, Portugal, particularly Lisbon, has cultivated a reputation as a growing European hub for blockchain and cryptocurrency innovation.

- Government & Regulatory Interest: The Portuguese government has expressed interest in fostering the sector, launching initiatives like the Technological Free Zones (TFZs) – regulatory sandboxes for testing blockchain innovations – and developing a National Blockchain Strategy as part of its digital transition plan. Regulatory bodies like BdP and the securities market commission (CMVM) have shown engagement by creating dedicated crypto information resources.

- Companies & Startups: A notable number of crypto and blockchain-focused companies, VCs, accelerators, and development firms have established a presence in Portugal. Examples include:

- Investment/VC: Lightshift Capital, Masterblox, SumCap.

- Infrastructure/Platforms: Anchorage Digital (custody, trading), Bepro Network (developer marketplace), WalletConnect, Protocol Labs (R&D), SKALE Labs (scaling solutions), Tether.

- Exchanges/Local VASPs: Criptoloja, Luso Digital Assets, Mind the Coin, Bison Digital Assets.

- NFTs/Gaming/Metaverse: RealFevr, Exclusible, Dotmoovs, QUDO, TRUE.

- Social/DAO/Web3 Professional Networks: TAIKAI (builder hub), Talent Protocol.

- Development Agencies: EvaCodes, Zfort Group, IdeaSoft, Covent IT, TripleHash Labs.

- Events & Community: Portugal, especially Lisbon, hosts numerous crypto, blockchain, and Web3 events throughout the year, ranging from large conferences to regular meetups. Notable examples include ETHLisbon, NFC Summit, and community gatherings like “Degens Hangout”. These events provide valuable networking opportunities and contribute to a sense of community for those involved in the crypto space.

This active ecosystem offers potential business opportunities, collaboration possibilities, and a supportive environment for crypto professionals and enthusiasts relocating to Portugal, extending the country’s appeal beyond just favourable tax rules or lifestyle factors.

8. Final Thoughts: Is Portugal the Right Move for You?

Portugal presents a compelling, yet increasingly complex, proposition for cryptocurrency investors and holders considering relocation in 2025. The decision requires careful weighing of the significant advantages against the notable challenges.

Key Advantages:

- Favourable Long-Term Crypto Gains Tax: The 0% tax rate on capital gains from crypto assets held for over 365 days remains a powerful incentive and a standout feature compared to many other jurisdictions.

- Untaxed Crypto-to-Crypto Swaps: The ability to trade between different cryptocurrencies without triggering an immediate taxable event offers significant flexibility for portfolio management.

- Accessible Residency Pathways: Visa options like the D7 (for passive income earners) and D8 (for remote workers) provide relatively clear routes to residency for those meeting the financial criteria. The revamped Golden Visa offers a path via non-real estate investments with minimal physical presence required.

- High Quality of Life: Portugal offers an attractive lifestyle with a pleasant climate, beautiful scenery, rich culture, high levels of safety, and generally friendly locals.

- Relative Affordability: Despite rising costs, Portugal remains more affordable than many Western European and North American counterparts, particularly outside Lisbon.

- Growing Crypto Ecosystem: An active community, regular events, and a developing infrastructure of startups and service providers offer networking and potential opportunities.

Main Challenges and Considerations:

- Evolving & Complex Tax Landscape: The introduction of taxes on short-term gains (28%), staking/lending income (28%), and professional trading/mining income (progressive up to 53%) marks a significant departure from the previous tax-free status. The termination of the NHR regime for new entrants removes broad tax benefits on foreign income, making the overall tax picture less advantageous than before for many. The exit tax on unrealized gains is a crucial long-term factor.

- Bureaucracy and Delays: Administrative processes, particularly for obtaining residence permits through AIMA, can be slow, complex, and involve significant paperwork and waiting times.

- Banking Uncertainty: Accessing banking services with crypto-derived funds can be challenging due to inconsistent bank policies and increasing AML scrutiny.

- Rising Cost of Living: While still relatively affordable, the cost of living, especially housing in desirable urban and coastal areas, has been increasing, impacting affordability.

- Integration Requires Effort: While English is widely spoken in some contexts, achieving full integration and navigating daily life smoothly (especially bureaucracy and public services) necessitates learning Portuguese.

Conclusion:

Portugal in 2025 still holds significant appeal for crypto investors and holders, primarily due to the enduring tax exemption on long-term capital gains. This, combined with accessible residency routes and a desirable lifestyle, makes it a strong contender for relocation.

However, the decision is no longer as straightforward as it once was. The evolving tax rules, the end of the NHR program for newcomers, potential banking difficulties, rising living costs, and bureaucratic hurdles require careful consideration. Potential movers must undertake a thorough assessment of their individual financial situation (including the nature and sources of their crypto income and their investment time horizons), their tolerance for administrative processes, and their commitment to integrating into Portuguese life, including language learning.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

Portugal can be an excellent choice, but it demands realistic expectations and diligent planning. Consulting with specialized legal and tax advisors in Portugal before making a commitment is strongly advised.