Crypto Nomads 2.0: A 2025 Strategic Relocation Report for Crypto Investors and DAOs

The Paradigm Shift: From Tax Arbitrage to Sovereign Communities

Introduction: The Evolution of the Crypto Expatriate

The narrative of the crypto nomad is undergoing a profound transformation. The first wave, or “Crypto Nomad 1.0,” was largely a story of individuals driven by a singular, powerful motivation: tax optimization. As tax authorities like the U.S. Internal Revenue Service (IRS) clarified their stance, treating cryptocurrencies as property subject to capital gains tax, savvy investors began a global search for jurisdictions with more favorable fiscal policies. This initial movement was about financial arbitrage, relocating to minimize the tax burden on trading profits, staking rewards, and other crypto-related income. An expatriate, in this context, was someone who moved abroad for an extended period, often to a place with lower or zero capital gains tax, while maintaining ties to their home country.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

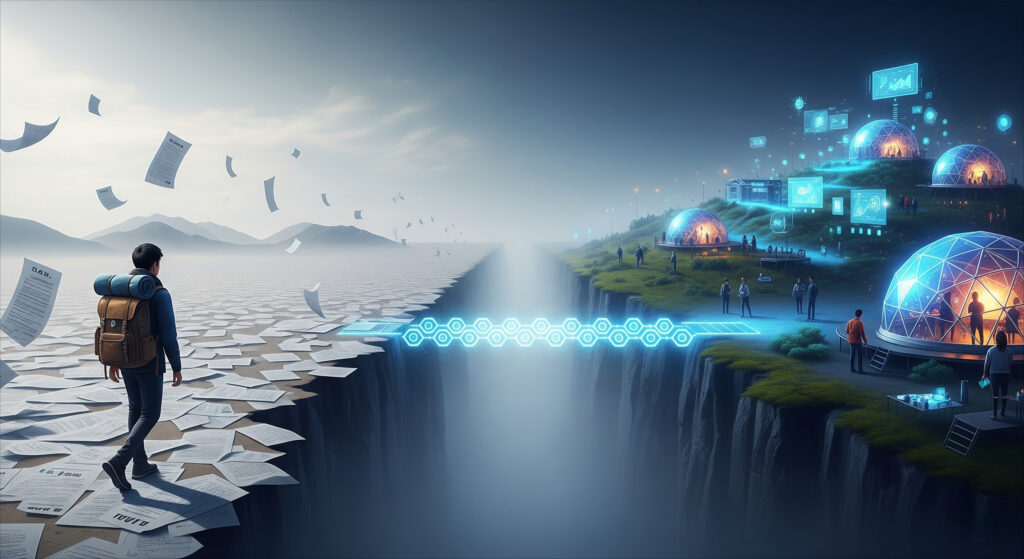

However, as the cryptocurrency ecosystem has matured from a speculative asset class into the foundation for a new, decentralized internet (Web3), the motivations for relocation have become far more complex and ambitious. We are now witnessing the rise of “Crypto Nomad 2.0.” This new cohort is not merely seeking a tax haven; they are searching for a sovereign haven. The focus has shifted from the individual to the collective, giving rise to the crypto expat community and, more significantly, the crypto micro-community.

A crypto expat community is a localized network of like-minded individuals, developers, investors, and entrepreneurs, who gather in a specific locale, drawn by shared interests in blockchain technology and a desire for financial freedom. A

crypto micro-community represents the next evolutionary step: an intentional, geographically concentrated group that actively seeks to build a holistic ecosystem based on Web3 principles. These communities are not just co-located; they are collaborating to create self-sustaining environments with their own governance structures, legal frameworks, and a shared, crypto-native identity. This evolution marks a transition from simple financial expatriation to a more profound

identity expatriation, where the goal is not just to shelter wealth but to build and inhabit new systems of governance and social organization aligned with the core tenets of decentralization. This movement is philosophically rooted in the desire for borderless money and the creation of alternative societal models outside the control of traditional nation-states, an ethos championed by pioneers of the space.

This maturation of the crypto industry itself is the primary catalyst for this shift. The rise of complex entities like Decentralized Autonomous Organizations (DAOs), Decentralized Finance (DeFi) protocols, and Decentralized Physical Infrastructure Networks (DePIN) has created a demand for more than just low taxes. These on-chain organizations require legal recognition, clear rules for treasury management, and an ecosystem of specialized talent to function effectively in the real world. Consequently, the search for a “hub” has evolved from a simple tax calculation into a quest for a complete operating system, one that is legally, socially, and technologically robust. This report analyzes the top emerging hubs through this new, more demanding lens, focusing on sovereign micro‑communities as network states.

The Four Pillars of a Crypto-Sovereign Hub

To accurately assess the viability of emerging hubs for the Crypto Nomad 2.0, a multi-faceted analytical framework is required. This report evaluates each potential destination against four critical pillars that, together, define a jurisdiction’s capacity to function as a true crypto-sovereign ecosystem.

- Pillar 1: Fiscal & Legal Architecture: This pillar scrutinizes the clarity, stability, and favorability of a jurisdiction’s tax and legal regime. It extends beyond headline tax rates to assess the comprehensive treatment of crypto-related activities. Key metrics include the taxation of short- and long-term capital gains, corporate income, personal income, and wealth. Furthermore, it evaluates the tax treatment of specific crypto activities such as staking rewards, mining income, and airdrops. Crucially, this pillar also analyzes the legal status of digital assets, the recognition of DAOs within the Swiss legal framework, and the presence of legally binding stability guarantees that protect investors from sudden and arbitrary regulatory changes.

- Pillar 2: Web3 & Financial Infrastructure: A favorable legal environment is meaningless without the practical infrastructure to support it. This pillar assesses the on-the-ground reality for crypto investors and businesses. It evaluates the availability and quality of essential financial services, including crypto-friendly banking, reliable exchanges, over-the-counter (OTC) desks, and payment processors that can bridge the gap between the crypto and fiat worlds. It also measures the maturity of the local Web3 ecosystem, including the density of developers, venture capital, legal experts, and other specialized service providers, alongside the quality of core digital infrastructure like internet speed and reliability.

- Pillar 3: Community & Lifestyle Synthesis: This pillar examines the vital non-financial elements that determine a hub’s long-term appeal and its ability to attract and retain top talent. It assesses the vibrancy, density, and quality of the existing crypto expat community, gauging the frequency and caliber of meetups, conferences, and networking events. This pillar also includes a pragmatic evaluation of the overall lifestyle, including the cost of living, personal safety, cultural attractions, and accessibility, which are critical factors for individuals and families considering relocation.

- Pillar 4: Governance & Autonomy Models: This is the most advanced and defining pillar for the Crypto Nomad 2.0. It evaluates the degree of political and regulatory sovereignty a jurisdiction offers. This exists on a spectrum, from traditional free zones offering tax incentives within a national legal framework (like in the UAE) to radical experiments in governance like Próspera’s ZEDE model in Honduras. These ZEDEs, as seen in Honduras, aim to create entirely new, autonomous legal and regulatory systems from first principles. This pillar directly measures a hub’s alignment with the core Web3 desire for self-governance and systemic innovation.

A central challenge for any crypto relocation strategy lies in the inherent tension between the desire for decentralization and the need for the legal certainty that only a sovereign or semi-sovereign entity can provide. The core ethos of the crypto movement is to build systems free from centralized control. Yet, to function in the physical world, crypto investors, businesses, and DAOs require enforceable property rights, reliable contract adjudication, and stable regulations, all functions traditionally monopolized by the state. The hubs analyzed in this report represent different attempts to resolve this paradox. Próspera seeks to build a new, private “state-like” entity. Zug aims to integrate crypto into an existing, highly stable, and decentralized state framework. Dubai creates a tightly controlled, top-down “sandbox” within an authoritarian state. Understanding how each hub navigates this tension is the critical strategic consideration for any potential DAO migration or individual relocation.

Deep Dive Analysis of Emerging Hubs for 2025

The High-Risk, High-Reward Frontier: Próspera, Honduras (ZEDE)

Próspera represents the most ambitious and ideologically pure embodiment of the Crypto Nomad 2.0 vision. Located on the Honduran island of Roatán, it is not merely a special economic zone but a “startup city”, a privately governed charter city aiming to build a new model of governance from the ground up. Backed by a roster of prominent venture capitalists and crypto luminaries, including Peter Thiel, Balaji Srinivasan, and Coinbase CEO Brian Armstrong, Próspera is a real-world laboratory for libertarian and crypto-anarchist ideals.

- Pillar 1: Fiscal & Legal Architecture: Próspera’s legal and tax framework is its primary draw, designed to be the most favorable and innovative in the world for crypto-native individuals and businesses. The tax regime is radically simple and low: a 1% effective corporate income tax, a 5% effective personal income tax, a 2.5% sales tax, and, most importantly, a 0% tax on capital gains. What truly sets it apart is its legal treatment of Bitcoin. In a world-first move, Próspera has adopted Bitcoin not just as legal tender but as an official Unit of Account. This means businesses can conduct their accounting, file their taxes, and pay their tax liabilities entirely in BTC. This eliminates the accounting friction and taxable events associated with converting to and from fiat currencies, making it an unparalleled environment for crypto-native companies and DAOs. The entire legal system is based on English common law principles and offers regulatory choice and 50‑year stability guarantees.

- Pillar 2: Web3 & Financial Infrastructure: While the physical city is still in its early stages of construction, with landmark projects like the Duna Tower underway, the digital and financial infrastructure is being purpose-built for the Web3 economy. A key development is a partnership with Panama’s Towerbank, which provides essential international banking services for both fiat and cryptocurrency transactions, bridging the gap to the traditional financial system. On the ground, a Bitcoin ATM and a Bitcoin Center serve the growing community, facilitating education and local exchange.

- Pillar 3: Community & Lifestyle: Próspera is actively curating a high-density community of what it calls “the most interesting people in the world”. It does this through a calendar of high-profile events, such as the “Crypto Cities Summit 2025,” which brought together leaders in decentralized governance and blockchain to explore the future of self-sustaining digital cities. This intentional community-building, combined with the tropical paradise lifestyle of Roatán, creates a powerful draw. The population is growing, with over 1,700 residents from more than 40 countries, establishing it as a nascent international hub for innovators.

- Pillar 4: Governance & Autonomy: This is Próspera’s defining feature. As a Zone for Employment and Economic Development (ZEDE), it possesses a degree of legal, fiscal, and administrative autonomy from the Honduran national government that is unparalleled globally. It operates under its own charter and laws, administered by a private council, making it the most advanced real-world test of charter city theory. This near-sovereign status is the ultimate prize for those seeking to escape legacy governance systems.

RISK ASSESSMENT (CRITICAL): The unprecedented autonomy Próspera offers comes with existential risks.

- Political Hostility: The primary threat is the overtly hostile stance of the current Honduran government under President Xiomara Castro. In 2022, her administration repealed the national ZEDE law that enabled Próspera’s creation and has publicly labeled the project an “enemy of the people,” citing concerns over national sovereignty.

- The $11 Billion Lawsuit: In response, Próspera’s U.S.-based parent company has filed an $10.775 billion arbitration claim against the Honduran state under the investor-state dispute settlement (ISDS) provisions of the CAFTA-DR international trade agreement. This is not merely a lawsuit for damages; it is a strategic, high-stakes geopolitical maneuver designed to enforce the legal stability guarantees promised to its investors through binding international law. The sum, equivalent to a substantial portion of Honduras’s annual GDP, underscores the gravity of the conflict. The project’s survival may depend less on Honduran domestic politics and more on the enforceability of international arbitration awards against a sovereign nation.

- Operational Obstruction: Beyond the high-level legal battle, the Honduran government is engaged in a campaign of direct operational harassment. As detailed in a “State of Affairs” memorandum, this includes pressuring national banks to close accounts associated with Próspera entities, removing customs personnel to disrupt imports, refusing to recognize tax exemptions, and denying permits for events. This “death by a thousand cuts” strategy poses a more immediate and practical threat to the viability of living and doing business in Próspera than the long-term lawsuit.

- Contradictory National Regulations: A stark legal conflict exists. While Próspera has made Bitcoin legal tender, the Central Bank of Honduras has prohibited cryptocurrencies from the national financial system and explicitly stated they are not legal tender in the country. This creates a precarious legal duality for any transaction that crosses the boundary between Próspera and the rest of Honduras.

For a potential investor or resident, the decision to choose Próspera is a bet on the supremacy of international law over domestic political whims and a test of their tolerance for extreme operational uncertainty.

The Established Bastion: Zug, Switzerland (Crypto Valley)

Zug, the heart of Switzerland’s “Crypto Valley,” represents the opposite approach to Próspera. It is the original, mature, and stable crypto hub, built on a model of integration rather than separation. Its value proposition is not the creation of a new legal system but the seamless incorporation of crypto into one of the world’s most respected, predictable, and decentralized federalist states.

Pillar 1: Fiscal & Legal Architecture: Switzerland’s tax system is famously attractive for crypto investors, and Zug is one of its most favorable cantons.

- Individual Taxation: The cornerstone of its appeal for individuals is the tax treatment of movable private assets. For investors classified as “private,” capital gains from selling cryptocurrencies are 100% tax-free. To maintain this status, investors must meet several criteria, including holding assets for more than six months and ensuring trading turnover does not exceed five times the portfolio’s value at the start of the year. However, income-like events are taxable. This includes rewards from staking and lending, as well as airdrops, which are all subject to standard income tax. Income from mining is also taxable, with the Canton of Zug classifying it as a professional business activity if annual earnings exceed 100,000 CHF. All residents are also subject to an annual Wealth Tax on their total net assets, including crypto holdings. While the rates are low (Zug’s cantonal rate is approximately 0.17%), this is a recurring liability that must be factored into financial planning.

- Corporate Taxation: For businesses, Zug offers one of the lowest combined effective corporate tax rates in Europe, at approximately 11.8%. Profits generated by a company from any crypto activity, trading, staking, mining, or providing services, are taxed at this highly competitive rate.

- Crypto Payments: In a nod to its identity as Crypto Valley, the Cantonal Tax Administration of Zug accepts tax payments in Bitcoin (BTC) and Ether (ETH) for amounts up to 1,500,000 CHF.

Pillar 2: Web3 & Financial Infrastructure: Zug’s ecosystem density is unparalleled. As “Crypto Valley,” it is the legal home of many of the industry’s most foundational projects, including the Ethereum Foundation, Cardano Foundation, Tezos Foundation, and the Web3 Foundation (Polkadot). It hosts a thriving ecosystem of hundreds of startups, venture capital firms, law firms, and specialized service providers. This is complemented by a robust financial infrastructure, including crypto-native banks like Amina Bank and financial intermediaries like Bitcoin Suisse, creating a deep talent pool and a true industrial cluster.

Pillar 3: Community & Lifestyle: Switzerland is renowned for its exceptional quality of life, safety, political stability, and stunning natural beauty, all of which are hallmarks of the lifestyle in Zug. The crypto community is mature, professional, and institutional, anchored by major global conferences like the CV Summit. However, this quality comes at a price. The primary drawback of Zug is its extremely high cost of living, particularly housing. A simple one-bedroom apartment in the city center can average around 2,715 CHF per month, making it one of the most expensive locations in the world. This high barrier to entry acts as a natural filter, shaping the community.

Pillar 4: Governance & Autonomy: Zug offers no special legal autonomy. Its strength lies in the opposite: deep integration within Switzerland’s stable and highly regarded federalist system. The cantonal government has been proactively pro-business and has played a key role in fostering the growth of Crypto Valley, providing regulatory clarity and support rather than special exemptions.

RISK ASSESSMENT

- Cost of Living: The most significant practical risk is financial. The exorbitant cost of living can quickly erode the tax benefits for anyone other than the highest-earning individuals or well-capitalized corporations, making it a challenging destination for bootstrapped startups or individual nomads.

- End of Secrecy (AEOI/CARF): The most critical regulatory risk on the horizon is Switzerland’s implementation of the OECD’s Crypto-Asset Reporting Framework (CARF). Beginning on January 1, 2026, with the first data exchanges scheduled for 2027, Switzerland will automatically exchange crypto-related financial account information with 74 partner states, including all EU members, the UK, and most G20 nations. This move fundamentally ends Switzerland’s status as a haven for financial privacy and eliminates it as an option for those seeking to avoid tax reporting obligations in their home countries.

The primary value proposition of Zug is therefore shifting. Historically, Swiss banking was synonymous with secrecy and tax avoidance. The implementation of the Automatic Exchange of Information (AEOI) for traditional finance ended that era, and the CARF will do the same for crypto. As the “privacy” advantage evaporates, a new one becomes more prominent. In a world where jurisdictions like the U.S. grapple with chaotic and politically charged crypto regulation, Switzerland’s key offering is no longer secrecy, but predictability. For a DAO foundation or a long-term Web3 project, the assurance that the legal rules will not change arbitrarily overnight is a premium asset, arguably more valuable than a zero-tax rate in an unstable jurisdiction. Zug is selling stability.

| Expense Category | Zug, Switzerland (CHF) | Dubai, UAE (AED) |

| 1-Bed Apt Rent (City Center) | ~2,715 / month | ~9,000 / month |

| Individual Income Tax (Top Bracket) | ~22.7% (varies) | 0% |

| Corporate Income Tax | ~11.8% (effective) | 9% (with free zone exemptions) |

| Cost of Business License (Crypto) | Standard GmbH setup costs | High (VARA fees) |

| Avg. Meal (Mid-Range Restaurant) | ~30 | ~40 |

| Monthly Public Transport Pass | ~85 | ~300 |

The Lifestyle Supercharger: Chiang Mai, Thailand

Chiang Mai stands as the archetypal “lifestyle” hub, a long-standing favorite within the digital nomad community. Its appeal is not rooted in sophisticated financial instruments or legal autonomy, but in an unbeatable combination of low cost of living, a vibrant community, and excellent quality of life. The critical question for 2025 is whether recent changes to its visa and crypto regulations elevate it from a temporary stopover to a viable long-term base for serious crypto investors.

Pillar 1: Fiscal & Legal Architecture Thailand’s legal framework has recently become significantly more attractive for long-term remote workers.

- The Destination Thailand Visa (DTV): The introduction of the DTV is a game-changer. It is a five-year, multiple-entry visa that allows an initial stay of 180 days, which can be extended once for another 180 days, permitting a continuous stay of nearly a full year. This eliminates the need for the inconvenient “visa runs” that characterized the past.

- DTV Requirements: The eligibility criteria are relatively accessible. Applicants must be at least 20 years old, provide proof of remote employment or freelance work, and demonstrate a bank balance of at least 500,000 THB (approximately $14,000 USD).

- Taxation: The tax implications are a key strategic consideration. An individual who stays in Thailand for fewer than 180 days in a calendar year is considered a non-resident for tax purposes and, therefore, owes no Thai tax on their foreign-sourced income. The DTV’s 180-day initial stay seems designed to align with this rule. However, if one uses the extension and stays for 180 days or more, they become a Thai tax resident, and their foreign-sourced income can become subject to Thai taxation, creating a potential trap for the unwary.

- Local Crypto Regulations: The Thai government’s stance on crypto is increasingly progressive. Owning, trading, and mining cryptocurrencies are all legal activities. The Thai Securities and Exchange Commission (SEC) actively regulates the space, licensing local exchanges like Bitkub and Orbix. Notably, Thailand has launched a pilot program permitting tourists to spend crypto via credit card platforms, and approved USDT/USDC on regulated exchanges, plus tokenized government-bond exploration.

Pillar 2: Web3 & Financial Infrastructure: The Web3 ecosystem in Chiang Mai is more focused on the user and community layers than on deep protocol development. While it is not a “Crypto Valley” in the Swiss sense, it has a burgeoning and active Web3 scene with a growing number of developers and entrepreneurs. The infrastructure for digital nomads is world-class, with ubiquitous high-speed internet and a plethora of modern coworking spaces like Alt_ChiangMai and Yellow Coworking.

Pillar 3: Community & Lifestyle: This is Chiang Mai’s undisputed strength. It is home to one of the world’s largest, most established, and most welcoming communities of digital nomads and crypto expats. The social infrastructure is dense, with regular crypto-specific events like the “Weekly Bitcoin Mixer” and major annual gatherings like the “Block Mountain” blockchain conference and the “Bitcoin Thailand Half Marathon,” which includes a digital finance expo. This vibrant community is set against a backdrop of an exceptionally low cost of living, rich cultural heritage, and a relaxed pace of life, offering an unparalleled quality of life for a fraction of the cost of other global hubs.

Pillar 4: Governance & Autonomy: Chiang Mai offers zero special governance or legal autonomy. All individuals and businesses operate fully under the laws of the Kingdom of Thailand and the regulations of the Thai SEC. The value proposition here is not sovereignty, but a currently favorable and increasingly clear regulatory stance from the government.

RISK ASSESSMENT

- Regulatory Volatility: While the current trend is positive, Thailand’s regulatory and political landscape can be volatile. The pro-crypto policies are not enshrined in a long-term, stable legal framework and could be subject to change with shifts in government priorities.

- Bureaucratic Hurdles: Navigating Thai bureaucracy, particularly for visa extensions and other administrative requirements, can be a complex and often unpredictable process for foreigners.

- Tax Residency Ambiguity: The DTV’s structure, which allows for a stay of nearly 360 days, pushes individuals directly into Thai tax residency. The precise tax implications for foreign-sourced crypto income for a tax resident are complex and may require specialized professional advice to navigate correctly.

Chiang Mai is an ideal “on-ramp” for the crypto nomad lifestyle. The low barriers to entry, both financial and administrative, make it a perfect base for individual developers, freelancers, and early-stage founders to bootstrap their projects, connect with a global community, and enjoy a high quality of life. However, it is not an “endgame” destination for a large-scale fund or a DAO. As a project scales and requires institutional-grade banking, clear corporate law for on-chain entities, and absolute legal certainty, it would likely need to establish a legal and financial anchor in a more institutionally robust jurisdiction like Zug or Dubai.

The Fading Haven?: Madeira, Portugal

Portugal, with the island of Madeira as one of its jewels, was once the undisputed king of crypto tax havens. Its simple and absolute exemption on crypto gains attracted a flood of investors and nomads, creating vibrant communities in Lisbon and Madeira. However, significant and sudden changes to its tax laws have dramatically altered its value proposition, leaving many to question what remains of its appeal in 2025.

Pillar 1: Fiscal & Legal Architecture: The legal landscape in Portugal has undergone a seismic shift.

- The Old Regime (Pre-2023): The previous boom was driven by a simple ruling from the Portuguese Tax Authority that gains from the sale of cryptocurrencies were not taxable for individuals.

- The New Crypto Tax Law (2023 Onward): This has been completely overhauled. Gains from crypto assets held for less than 365 days are now subject to a flat 28% capital gains tax. While gains on assets held for more than 365 days remain tax-free, this is a far cry from the previous blanket exemption. Furthermore, income from professional crypto trading is now taxed at progressive rates up to 53%, and income from staking or lending is taxed at a 28% flat rate.

- The NHR Program Overhaul: Compounding this change was the termination of the widely popular Non-Habitual Resident (NHR) program at the end of 2023. The old NHR regime offered a 20% flat tax rate on certain Portuguese-sourced income and a tax exemption on most foreign-sourced income, making it a cornerstone of the expat value proposition.

- The New NHR 2.0 (IFICI): The replacement program, known as the “Tax Incentive for Scientific Research and Innovation” (IFICI), is a pale imitation of its predecessor. It is a highly restrictive regime that offers a 20% flat tax rate but is targeted only at a narrow list of “high-value-added” professions, such as those in scientific research, technology, and certified startups. It is no longer a broad-based program for most digital nomads, remote workers, or passive investors. The specific application of IFICI to various forms of crypto income remains unclear and subject to further regulatory clarification.

Pillar 2 & 3: Web3 Infrastructure, Community & Lifestyle: Despite the tax changes, the communities built during the boom years remain. Madeira is famous for its “Digital Nomad Village” in Ponta do Sol, which offers free coworking spaces and a strong calendar of community events, fostering a collaborative environment. The island’s lifestyle, with its stunning natural beauty, pleasant climate, and high quality of life, continues to be a major draw. The local Web3 ecosystem is active, with communities like “FREE Madeira” focused on Bitcoin adoption.

Pillar 4: Governance & Autonomy: Madeira is an autonomous region of Portugal and benefits from certain special tax regimes, such as the Madeira International Business Center (CINM), which offers a low 5% corporate tax rate to licensed companies. However, this is a corporate incentive and does not create a distinct legal or regulatory framework for crypto. For individuals, the laws of Portugal apply fully.

RISK ASSESSMENT

- Regulatory Whiplash: The abrupt and sweeping changes to both its crypto tax policy and its flagship NHR program have shattered Portugal’s reputation as a stable and predictable haven. This demonstrates a high degree of regulatory volatility.

- NHR 2.0 Uncertainty and Limited Scope: The new IFICI program is too narrow and its rules too ill-defined to be a reliable planning tool for the vast majority of crypto professionals who do not fit into its specific “scientific research” or “certified startup” categories.

- Declining Competitiveness: Having lost its primary competitive advantages, Portugal now struggles to compete with jurisdictions that offer either greater stability and institutional depth (Zug), more radical autonomy (Próspera), or a clearer zero-tax regime (Dubai).

The story of Portugal serves as a critical cautionary tale for the crypto nomad. It illustrates the immense risk of building a long-term strategy on a single, fragile pillar, in this case, a favorable tax ruling that was not deeply embedded in a stable, constitutional, or treaty-protected legal framework. When political and fiscal pressures mounted, the government was able to reverse the policy with relative ease. This experience underscores the importance of the “Governance & Autonomy” pillar; a truly resilient hub requires structural, legal, and political buy-in that transcends temporary tax incentives.

The Corporate Fortress: Dubai, UAE (Free Zones)

Dubai has strategically positioned itself as the premier global destination for serious, well-capitalized, and compliance-oriented crypto businesses. It eschews the libertarian ethos of decentralization in favor of a highly structured, top-down regulatory environment. The value proposition is simple and powerful: a 0% tax environment in exchange for adherence to a comprehensive and prescriptive set of rules administered by the Virtual Assets Regulatory Authority (VARA).

Pillar 1: Fiscal & Legal Architecture

- Taxation: The fiscal appeal of Dubai is unambiguous. For individuals, there is a 0% tax on personal income, 0% on capital gains, and 0% on wealth. This simplicity is a major advantage. While a 9% corporate tax was introduced in the UAE, companies operating within designated free zones that meet specific criteria can still benefit from a 0% rate.

- The VARA Framework: The entire crypto industry in Dubai (excluding the separate DIFC financial center) is governed by VARA. In 2023, VARA rolled out a comprehensive suite of rulebooks that create a detailed and mandatory legal framework for all virtual asset activities. To operate legally, any entity must obtain a specific license from VARA corresponding to its business activities (e.g., Exchange Services, Custody Services, Broker-Dealer Services, Advisory Services) and establish a physical presence in an approved free zone, such as the Dubai Multi Commodities Centre (DMCC) or the Dubai World Trade Centre (DWTC).

Pillar 2: Web3 & Financial Infrastructure: Dubai is investing heavily in building institutional-grade infrastructure for the Web3 industry. The DMCC Crypto Centre, for example, is more than just a licensing body; it is an ecosystem hub that offers accelerator programs in partnership with global players like Brinc, TDeFi, and CV Labs (the venture arm of Switzerland’s Crypto Valley). This ecosystem is explicitly designed to support corporate growth, providing access to capital, mentorship, and a network of other licensed entities.

Pillar 3: Community & Lifestyle: The crypto community in Dubai is heavily skewed towards business, professional networking, and institutional players. It is a hub for conferences, C-level summits, and corporate deal-making, rather than the grassroots, developer-focused meetups found in Chiang Mai or Berlin. The lifestyle is characterized by modernity, luxury, and a high degree of safety and convenience. While the cost of living is high, many expats find it offers better value compared to other major global financial centers.

Pillar 4: Governance & Autonomy: Dubai represents a model of centralized, top-down governance. There is no autonomy in the libertarian sense sought by projects like Próspera. Instead, VARA provides “clarity through prescription.” Every aspect of operation is dictated by the detailed rulebooks. For large, compliance-conscious businesses, this high degree of regulatory certainty can be more valuable than the ambiguity of a less regulated environment.

RISK ASSESSMENT

- Compliance Complexity and Cost: The primary challenge of operating in Dubai is the cost and complexity of navigating the extensive VARA rulebooks. The framework consists of multiple compulsory rulebooks (Company, Compliance & Risk Management, Market Conduct, Technology) and numerous activity-specific rulebooks. Achieving and maintaining compliance requires significant and ongoing investment in legal and compliance resources, making it a prohibitive environment for small startups or individual operators.

- Regulatory Rigidity: The prescriptive nature of VARA’s licensing regime leaves little room for innovative business models that do not fit neatly into one of the predefined categories. All innovation must occur within the “walled garden” that VARA has constructed.

- Enforcement Uncertainty: As a relatively new regulatory body, the practical application and enforcement of VARA’s rules are still being tested. How the authority will interpret gray areas or handle novel situations remains a source of uncertainty for licensed firms.

Context & Validation:

A recent Barron’s feature notes that Dubai now hosts the world’s first dedicated crypto regulator and issues licenses to major players like Binance, highlighting confidence in VARA’s framework and Dubai’s evolving crypto ecosystem

Dubai is not building a “crypto hub” in the organic, permissionless sense. It is strategically constructing a regulated “virtual asset industry.” Its goal is not to foster a decentralized ecosystem but to attract, license, and supervise a lucrative new sector of the global financial economy. This makes it the antithesis of Próspera. Dubai is the ideal jurisdiction for a major exchange, a global VC fund, or an institutional custody provider that craves clear rules and is willing to pay the high cost of compliance in exchange for access to a 0% tax environment and a global business hub. It is, however, a poor fit for a cypherpunk collective or a DAO that prioritizes sovereignty and permissionless innovation above all else.

How to Join or Build Your Own Micro-Community

The Legal & Logistical Playbook for Crypto Expatriation

Successfully relocating as a crypto investor or business requires a meticulous, multi-step strategic plan that addresses legal, corporate, and compliance dimensions.

- Step 1: Residency and Visa Strategy: The first logistical hurdle is securing the legal right to reside in the chosen hub. Each destination has a distinct pathway. In Thailand, the new Destination Thailand Visa (DTV) offers a five-year, multiple-entry permit specifically for remote workers. For Dubai, residency is typically tied to company formation in a free zone or property investment, granting renewable residency visas. Switzerland’s process is more traditional, often requiring an employment contract or significant investment through programs like the Swiss Investor Visa. Próspera offers a streamlined “eResidency” program, which is a prerequisite for forming an entity within its jurisdiction, with physical residency being a subsequent step.

- Step 2: Corporate Structuring: For any serious investor or business, operating as an individual is often suboptimal. Establishing a corporate entity in the target jurisdiction is a critical step for liability protection, asset segregation, and operational efficiency. This could involve forming a Free Zone Establishment (FZE) in the DMCC in Dubai , a limited liability company (GmbH) in Zug , or a Próspera Inc. within the ZEDE. This corporate structure becomes the legal vehicle for holding digital assets, conducting business, hiring employees, and interfacing with the traditional financial system.

- Step 3: Navigating Global Compliance: A move abroad does not erase tax and reporting obligations to one’s home country, particularly for citizens of countries with citizenship-based taxation like the United States. U.S. persons remain subject to reporting their worldwide income and must comply with regulations like the Foreign Account Tax Compliance Act (FATCA) and FinCEN’s Report of Foreign Bank and Financial Accounts (FBAR), which applies to foreign crypto accounts. Furthermore, those who renounce citizenship may be subject to a significant crypto expatriation tax on the unrealized gains of their assets. The implementation of the global Crypto-Asset Reporting Framework (CARF) by countries like Switzerland makes robust and honest cross-border tax planning more critical than ever, as automatic information sharing will become the global standard.

Governance in the Digital Age: DAO Migration and On-Chain Management

Decentralized Autonomous Organizations (DAOs) face a unique set of challenges as they are on-chain native entities that must interface with the off-chain legal world. A DAO migration is the process of anchoring the on-chain organization to a physical jurisdiction to solve these challenges.

- Legal Wrappers: The most common strategy is to create a “legal wrapper”, a traditional legal entity established in a favorable jurisdiction that is recognized as being controlled by the DAO’s token holders. This entity can take various forms, such as a Swiss Association or Foundation (a popular choice in Zug), a Cayman Islands Foundation Company, or potentially a corporate entity in Próspera. This wrapper gives the DAO a legal personality, enabling it to act in the off-chain world.

- Compliant Treasury Management: With a legal wrapper in place, a DAO can overcome its biggest operational hurdles. The legal entity can open bank accounts, custody digital assets with regulated providers, enter into contracts with service providers, hire and pay core contributors compliantly, and manage its treasury assets within a recognized legal and tax framework.

- Dispute Resolution and Legal Certainty: While on-chain governance via token voting is the primary decision-making mechanism, smart contracts can have bugs, be ambiguous, or lead to unintended consequences. Having a legal home in a jurisdiction with a reliable and sophisticated dispute resolution system (like the private arbitration offered in Próspera or the established courts in Switzerland) provides a crucial backstop for resolving conflicts that cannot be settled on-chain.

Cultivating the Ecosystem: From Co-working to Culture

The final, and perhaps most crucial, element of building a successful crypto micro-community is the cultivation of a vibrant social and cultural fabric. Legal and financial structures provide the foundation, but the long-term success of a hub depends on its human capital.

This is achieved through the creation of physical-world touchpoints that foster trust, serendipitous collaboration, and the cross-pollination of ideas. These include dedicated coworking spaces, regular informal meetups, and high-caliber conferences and hackathons. These events are the lifeblood of a community, transforming a collection of individuals into a cohesive and innovative ecosystem. Ultimately, the most resilient and attractive micro-communities are those built not just on shared financial incentives, but on a shared set of values, a common mission, and a genuine culture of collaboration and intellectual curiosity.

Case Study Highlights

The strategic choices made by these emerging hubs are best understood through their landmark policies and the voices of their proponents.

“Bitcoin is not a currency for a government; it is a global currency for the people.” — Wences Casares

This quote encapsulates the philosophical underpinning of a jurisdiction like Próspera, which has moved beyond mere acceptance to full integration of Bitcoin into its governance.

In a landmark decision for the crypto industry, the special economic zone of Próspera has recognized Bitcoin as legal tender. The move, which follows the lead of El Salvador, allows residents and businesses to pay taxes and fees in Bitcoin. The policy is undergirded by world-class AML and KYC standards to ensure regulatory compliance.

The Canton of Zug became the first canton in Switzerland to enable the payment of taxes with cryptocurrencies in 2021. As of 2025, individuals and companies can pay tax invoices up to an amount of CHF 1,500,000 with Bitcoin or Ether, a service facilitated through a partnership with Bitcoin Suisse AG.

These actions demonstrate a fundamental difference in approach. Próspera is building a new system with crypto at its core, while Zug is pragmatically integrating crypto into its existing, highly functional system.

Conclusion

Summary of Findings: The Crypto-Sovereignty Matrix

The journey of the Crypto Nomad 2.0 is a search for an optimal balance between freedom and stability. The analysis of the top five emerging hubs reveals a diverse landscape of strategic trade-offs. No single destination is perfect for everyone; the ideal choice depends entirely on an individual’s or organization’s specific priorities, risk tolerance, and long-term vision. The following matrix summarizes the findings, scoring each hub against the four pillars of a crypto-sovereign ecosystem.

| Hub | Pillar 1: Legal/Tax | Pillar 2: Infrastructure | Pillar 3: Community/Lifestyle | Pillar 4: Autonomy | Overall Risk | Ideal Profile |

| Próspera, Honduras | Very High | Medium | High | Very High | Very High | The Ideological Pioneer, High-Risk Founder, DAO |

| Zug, Switzerland | High | Very High | High | Low | Low | The Established Institution, Fund, HNW Investor |

| Chiang Mai, Thailand | Medium | Medium | Very High | Very Low | Medium | The Lifestyle Nomad, Bootstrapped Founder, Developer |

| Madeira, Portugal | Medium | High | Very High | Low | Medium | The Lifestyle-Focused Investor (Long-Term Holdings) |

| Dubai, UAE | High | High | Medium | Very Low | Low | The Compliance-Focused Corporate, Large Exchange |

- Próspera is for the ideological pioneer with a very high-risk tolerance. It offers unparalleled legal and governance autonomy, making it the ultimate destination for those who want to build new systems from scratch.

- Zug is for the established institution, fund, or high-net-worth investor seeking stability, predictability, and access to a deep, mature ecosystem, for whom the high cost of living is a secondary concern.

- Chiang Mai is for the lifestyle-driven nomad, the bootstrapped founder, or the individual developer who prioritizes low cost of living and a vibrant community over legal sophistication and autonomy.

- Madeira remains a strong choice for lifestyle-focused investors who plan to hold assets long-term to benefit from the 0% tax, but its appeal as a broader crypto hub has diminished.

- Dubai is for the compliance-first corporation, the large exchange, or the institutional service provider that values a 0% tax environment and clear, albeit prescriptive, rules above decentralization and autonomy.

The Future of Crypto-Nomadism: Towards the Network State

The evolution from Crypto Nomad 1.0 to 2.0 is not an endpoint but a milestone on a longer journey. The trend of identity expatriation, choosing a jurisdiction based on philosophical alignment and governance models, is set to accelerate. As the digital and physical worlds continue to merge, the demand for jurisdictions that are “digitally native” in their legal and social structures will grow.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

The experiments underway in these hubs are precursors to more advanced concepts, like the “Network State”, virtual communities with a shared sense of purpose that eventually manifest in a network of physical enclaves around the globe. The practical challenges of DAO migration and the search for a true crypto micro-community are the first steps in this direction. The search for a crypto expat community is no longer just about finding a better place to live; it is about finding the right platform on which to build the future. The key takeaway for 2025 and beyond is that the most successful crypto hubs will be those that offer not just low taxes, but a robust, predictable, and innovative operating system for the citizens and organizations of the decentralized age.

Frequently Asked Questions

What is a crypto micro-community? A crypto micro-community is a geographically concentrated group of crypto investors, developers, and enthusiasts who are intentionally building a shared lifestyle and ecosystem based on Web3 principles. It goes beyond a simple crypto expat community by often involving shared governance, legal structures (like a ZEDE or free zone), and a mission to create a self-sustaining, crypto-native environment.

How to legally expatriate with crypto? Crypto expatriation involves establishing legal and tax residency in a new country. This typically requires obtaining a long-term visa (like a digital nomad visa), setting up a physical residence, and potentially forming a local corporate entity to hold assets. It is crucial to understand your home country’s exit tax rules and ongoing reporting requirements, such as the U.S. crypto expatriation tax and FBAR filings.

What tax benefits do these hubs offer? Benefits vary significantly. Próspera and Dubai offer 0% capital gains tax. Switzerland offers 0% capital gains tax for private investors but has a wealth tax. Portugal offers 0% tax on long-term (held >1 year) crypto gains. Thailand can be tax-free on foreign income if you remain a non-resident (<180 days/year).

What is the difference between a ZEDE and a standard Free Zone? A standard Free Zone (like in Dubai) typically offers tax and customs exemptions within the host country’s legal framework. A ZEDE (like Próspera in Honduras) is far more radical, allowing the creation of a completely autonomous administrative, fiscal, and legal system, effectively operating as a semi-sovereign jurisdiction within the host country.

How does DAO migration work in practice? DAO migration involves a decentralized autonomous organization establishing a legal anchor in a physical jurisdiction. This is usually done by creating a “legal wrapper”, such as a foundation or association in a DAO-friendly country like Switzerland, that can represent the DAO in the off-chain world. This legal entity can then open bank accounts, sign contracts, and manage treasury assets in a compliant manner, bridging the gap between on-chain governance and real-world legal requirements.