Portugal Crypto Tax 2025 Guide: Gains, Staking, Mining & Strategies

🌟 Introduction

Updated July 2025

The tax landscape for crypto in Portugal has shifted significantly as of 2025. The Portugal crypto tax 2025 regime introduces a 28% flat tax on short-term capital gains (coins held for less than 365 days), while long-term holdings remain generally tax-exempt. Staking and lending income also fall under this 28% bracket, and gains from mining or professional crypto activities are classified as self-employment income, subject to progressive rates up to 53%.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

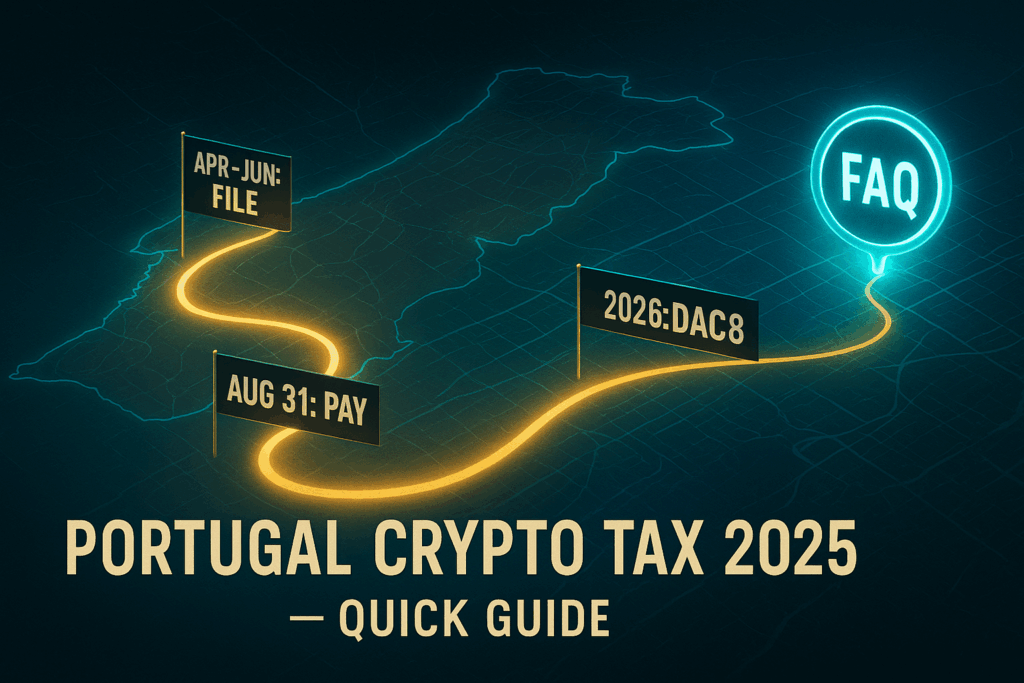

In this guide, designed for individuals, digital nomads, and professionals, we’ll unpack everything you need to know about Portugal crypto tax 2025, from the key filing deadlines (Modelo 3 deadline, April 1–June 30, payment due August 31) to smart strategies that can help reduce your tax burden legally. Ready to get compliant, optimized, and ahead of the curve? Let’s dive in.

🧠 Quick FAQ

Q: What is the short-term crypto tax in Portugal for 2025?

A: It’s a 28% flat rate on gains from assets held less than 365 days, including staking and lending income.Q: Are long-term crypto gains taxed?

A: No—long-term holdings (held > 365 days) are typically tax-exempt.Q: How is mining taxed in 2025?

A: Mining or professional crypto activity is taxed as self-employment income, with progressive rates up to 53%.

1. Overview of Portugal Crypto Tax 2025

🧾 1.1 Short‑Term vs Long‑Term Gains

Portugal officially ended its full crypto tax exemption in 2023. Now:

- Short-term gains (< 365 days) are taxed at a flat 28% under Category G, includes staking, lending, and sales/swaps within 1 year.

- Long-term gains (> 365 days) remain generally tax-exempt, unless assets resemble securities or involve non‑EEA counterparties.

This distinction is fundamental to Portugal crypto tax 2025 and shapes holding strategies.

🔄 1.2 Categories of Crypto Income

Portuguese tax rules divide crypto-derived income into three key categories:

- Category G (Capital Gains): Short-term disposals taxed at 28%, sales or swaps of coins held less than 365 days.

- Category E (Passive Income): Covers staking and lending rewards, also taxed at 28%.

- Category B (Business/Professional Income): Applies to business-like operations such as mining farms or frequent trading; taxed progressively (14.5–53%).

📊 1.3 Why It Matters for 2025 Planning

- Holding strategy: Holding assets for > 365 days becomes a powerful exemption tool under Portugal crypto tax 2025.

- Income delineation: Proper classification avoids misfiling and electoral tax brackets.

- Business vs Hobby: The line between casual and professional activity affects enormous tax implications.

📌 1.4 Key Filing & Compliance Overview

- Tax Form: Report crypto income with IRS Modelo 3, Attachment G for short-term, E for staking/lending, B for business activities.

- Deadlines: Submit between April 1 – June 30, pay due by August 31.

- Record-Keeping: Maintain timestamps, EUR valuations, and holding-period proof for exemptions.

🔁 Chapter Takeaways

Scenario Category Tax Rate Filing Annex Notes Sell < 1 year G 28% G Includes swaps, staking, lending Hold >1 year G 0%* G Exceptions for securities/non‑EEA Staking/Lending E 28% E Mining/Pro Trading B 14.5–53% B Professional-level activity *Assuming asset doesn’t fall under security-type or other EXEMPT exceptions.

2. Detailed Tax Rules for Staking, Mining & Crypto Services

🔍 2.1 Staking & Lending (Category E)

- Staking/lending income is classified as Category E – Passive Income.

- Subject to a 28% flat tax regardless of holding period.

- This includes rewards from PoS networks, lending platforms, and yield farming.

- Unlike capital gains, these are taxed at realization, so be sure to log each reward payout with timestamp and fiat value.

⛏️ 2.2 Mining & Professional Crypto Activity (Category B)

- Category B – Business or Professional Income covers crypto mining, frequent trading treated as professional, or validating transactions.

- Taxed under progressive income tax rates ranging from 14.5% to 53%.

- There’s often a simplified regime where only 15% of gross income is taxable, capped effectively at ~8% of gross proceeds.

- 95% of mining revenues may be considered gross income, with only 5% presumed operational costs, or a similar margin method, depending on the regime opted.

- Key for SEO: Mention terms like “Category B”, “professional crypto activity”, “self-employment rates” for AI entity recognition.

🔄 2.3 Crypto-to-Crypto vs Crypto-to-Fiat

- Crypto-to-crypto trades are not taxable events if kept within the same tax year and no fiat conversions occur.

- Crypto-to-fiat conversions, purchases (e.g. buying goods), or transfers to bank accounts ARE taxable if assets held < 365 days.

- Strategically use crypto-to-crypto swaps to rebalance portfolios and defer tax under the Portugal crypto tax 2025 model.

📌 2.4 Airdrops, NFTs & Inheritance

- Airdrops & forks: taxed as passive income (Category E) when converted to fiat or used.

- NFT sales: profits on NFTs held < 365 days taxed at 28%; creation and sale as a business → Category B.

- Gifts or inheritance: subject to 10% stamp duty (Imposto do Selo), under non-commercial transfer rules.

🧾 Chapter Summary

Activity Category Tax Rate / Details Staking & lending E 28% flat Mining / Professional trading B 14.5–53% progressive (15% taxable simplified) Crypto-to-crypto trades N/A Not taxable Crypto-to-fiat / purchases G/E 28% if held < 1 year Airdrops/forks E 28% when realized NFTs (<1 year) G 28%; as business (B) if service Gifting / inheritance Stamp 10% duty

3. Portugal Crypto Tax 2025 Filing Requirements & Record-Keeping Strategy

🗂 3.1 Annual Filing Overview (Modelo 3 + Annexes)

Portuguese residents must report crypto income through the Modelo 3 personal income tax return, filed online via the Portal das Finanças, between April 1 and June 30, with payment due by August 31 .

Report crypto activities using:

- Annex G for short-term capital gains (< 365 days)

- Annex E for staking & lending income

- Annex B for mining or self-employment crypto earnings (Category B)

📌 3.2 Detailed Record‑Keeping Essentials

To substantiate your filings and qualify for exemptions, maintain the following documentation :

- Transaction dates & timestamps

- Crypto quantities & EUR value at transaction time

- Holding period calculation (for > 365-day rule)

- Wallet addresses & exchange logs

- Source documentation for airdrops, mining, staking

- Crypto-to-crypto swaps records (only taxed at conversion to fiat)

Tools like CoinTracking or TokenTax support record consolidation and tax reporting, streamlining this process .

🧾 3.3 Loss Offsetting & Deductions

- Losses from disposals within 365 days can offset short-term gains in the same fiscal year; no carry-forward allowed .

- Category B taxpayers may deduct mining-related expenses such as electricity or hardware depreciation, especially under simplified or organized accounting regimes .

✅ 3.4 Professional vs. Passive Classification

Tax authorities categorize activities as professional (Category B) if they resemble a business (e.g., mining farms, frequent trading). Simplified regime may apply for gross crypto business income under €200 k, with coefficient allowances ranging from 15%–95% depending on activity type .

🧹 3.5 Clean Exit & Double‑Tax Considerations

- Crypto-to-crypto swaps are non-taxable until converted to EUR .

- Non‑EU/EEA assets or non‑residents have stricter rules; long-term exemptions may not apply .

- DAC8/CARF, effective 2026, mandates automatic reporting from exchanges, increasing compliance importance .

- Exit tax may apply on unrealized crypto gains if residency is relinquished .

🔍 Chapter 3 Summary

Task Action Dates Notes File Return Modelo 3 + Annexes G/E/B Apr 1–Jun 30 Via Portal das Finanças Pay Taxes – Before Aug 31 Maintain Records All transactions, valuations, proof of holding Continuous Critical for exemptions Offset Losses Within fiscal year – No carry-forward Claim Deductions Category B expenses – Hardware, electricity, software Monitor DAC8 / Exit Tax Apply in 2026+ or on departure – Non-EU assets & moving abroad

4. Smart Tax Optimizations & Planning Strategies

💎 4.1 Hold for Long-Term Exemption

- Diamond-hand your crypto: Hold assets for 365+ days to benefit from 0% tax on capital gains, extending Portugal’s favorable long-term regime.

- Be cautious: this exemption excludes tokens considered “security-like” or held with non-EEA providers.

🔁 4.2 Use Crypto-to-Crypto Swaps to Defer Taxes

- Swapping between cryptocurrencies (e.g. ETH→SOL) does not trigger tax events in Portugal — only crypto-to-fiat conversions do.

- Strategy: convert to stablecoins like USDT/EURT, hold 365+ days, then convert to fiat to secure the long-term exemption kryptos.io.

📉 4.3 Offset Losses and Rebalance

- Losses from disposals < 365 days can offset short-term gains within the same fiscal year (but not carried forward) TokenTax.

- Tax-loss harvesting before year-end can reduce your 28% tax liability – effective ✅.

💼 4.4 Optimize Classification: Passive vs Professional

- Aim to categorize rewards (staking, lending) as Category E (passive income) for a flat 28% rate—rather than Category B (self-employment) where progressive rates apply.

- Keep profit motives low—avoid frequent trades or large-scale mining operations to minimize risk of being classified as a professional business.

🧾 4.5 Use Simplified Regime for Small-Scale Business

- If Category B activity is unavoidable (e.g., small mining or validator setup), opt for the simplified regime where only 15% of gross revenue is taxable (effectively reducing the burden) .

🤝 4.6 Donations, Gifting & Exit Tax Planning

- Donate crypto to family — transfers to spouses/descendants may have 0% stamp duty, while others incur only 10%.

- Exit tax: moving tax residency out of Portugal may trigger taxation on unrealized crypto gains, worth scheduling transfers over time.

🧪 4.7 Plan for DAC8/CARF Reporting in 2026

- The upcoming EU DAC8 / CARF framework (effective 1 Jan 2026) means exchanges must report all crypto transactions to tax authorities .

- Strategy tip: clean, well-audited records will be critical—especially as automatic cross-border data sharing ramps up.

🧰 4.8 Use Specialized Crypto-Tax Tools

- Tools like TokenTax, CoinTracking, and Awaken Tax automate record keeping, gain/loss calculation, and form generation (e.g. Modelo 3 Annexes G/E/B).

- Integration with Portals (Portal das Finanças) brings peace of mind and better compliance.

🧾 Chapter 4 Summary

| Strategy | Mechanism | Benefit |

|---|---|---|

| 💎 Hold crypto >365 days | Long-term exemption | 0% capital gains tax |

| 🔁 Crypto-to-crypto swaps | Defer taxable events | Delay tax until exemption possible |

| 📉 Harvest losses | Offsets with gains | Lower 28% tax bill |

| 💼 Passive classification | Category E status | Flat 28%, avoid progressive tiers |

| 🧾 Simplified B regime | 15% revenue taxable | Reduced burden on small earners |

| 🤝 Crypto donations | Zero/low stamp duty | Tax-efficient transfers |

| 🧪 DAC8/CARF compliance prep | Accurate reporting | Avoid penalties, ensure compliance |

| 🧰 Use tax software | Automate filings | Save time, minimize errors |

5. Compliance Roadmap & FAQ

✅ 5.1 Crypto Tax Compliance Checklist

Keep track of these essential steps to stay tax-compliant in Portugal:

- Hold short-term crypto gains (< 365 days): report under Category G (28%).

- Hold long-term gains (> 365 days): qualify for exemption (unless classified as a security or held via a non‑EEA provider).

- Report staking and lending income under Category E (28%).

- Treat mining or frequent trading as Category B (income tax between 14.5% and 53%).

- Use crypto-to-crypto swaps to delay taxable events.

- File Modelo 3 with Annexes G/E/B between April 1–June 30, with payment due by August 31.

- Maintain full records: transaction dates, euro values, holding periods, wallet and exchange logs.

- Harvest losses before year-end to offset gains (losses cannot be carried forward).

- Prepare for EU DAC8/CARF reporting coming 2026.

- Monitor whether your activity could be classified as “professional” (Category B) instead of passive.

📍 5.2 Milestone Timeline

July–December 2025

- Finalize records and close the tax year.

- Execute strategic swaps to defer gains.

- Consolidate staking and lending statements.

January–June 2026

- Comply with fallback DAC8/CARF obligations, exchanges will share transaction data with tax authorities.

- Review holdings and ensure long-term exemptions for non-EEA assets if needed.

Ongoing

- Reassess annually whether your crypto activity qualifies as professional (Category B).

- Reconfirm the classification of NFTs, forks, airdrops.

- Stay updated on evolving regulations like MiCA and DAC8.

❓ 5.3 Frequently Asked Questions

What is the filing deadline for Portugal crypto taxes?

Modelo 3 (with Annexes G, E, or B) must be submitted between April 1 and June 30, and any taxes owed paid by August 31, 2025.How do crypto-to-crypto swaps affect taxation?

Swapping one crypto for another does not trigger a taxable event—only conversions to fiat do, for assets held under 365 days.What is DAC8/CARF and when does it take effect?

From January 1, 2026, DAC8 (EU’s crypto-reporting amendment) aligned with the OECD’s CARF will require crypto platforms to report user transactions to tax authorities.

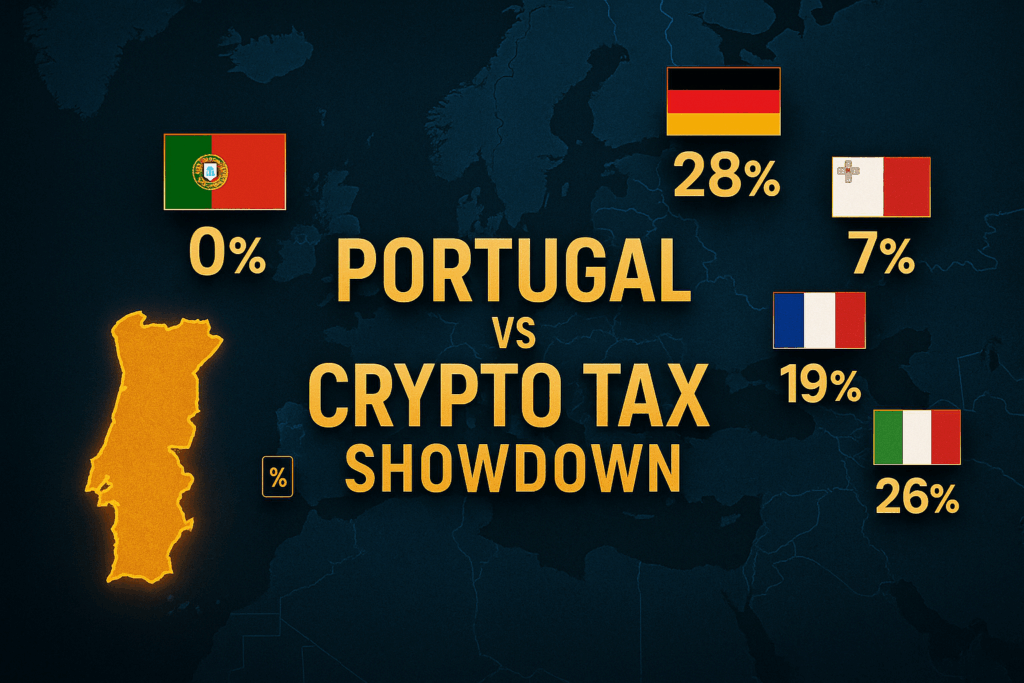

6. Portugal vs. Other EU Crypto Tax Regimes

🇵🇹 Portugal – Crypto-Friendly with Strategic Advantages

- Short-term gains (< 365 days): taxed at a 28% flat rate under Category G.

- Long-term gains (> 365 days): generally tax-exempt, except when tokens are security-like or held through non-EEA providers.

- Staking/lending (Category E): taxed at 28%.

- Mining / professional trading (Category B): taxed progressively between 14.5% and 53%.

- Strengths: strong advantages for long-term holders and those using crypto-to-crypto swaps.

🇩🇪 Germany – Clear One-Year Holding Rule + Exemptions

- Gains on crypto held less than one year are taxed at marginal income rates (up to 45%) plus a 5.5% solidarity surcharge.

- Crypto held more than one year is entirely tax-exempt, regardless of quantity.

- Staking/mining income is treated as normal income but may benefit from small annual exemptions.

🇮🇹 Italy – Rising Taxation in 2025, Still Under Debate

- Pre-2025: capital gains taxed at 26% above a €2,000 profit threshold.

- Proposed 2025 changes may raise this to 42%, but lawmakers are pushing to cap it at 28%.

- Staking and mining likely taxed as ordinary income under the same framework.

🇲🇹 Malta – Crypto-Friendly Haven

- No specific capital gains tax on crypto gains, but business-related crypto profits may be taxed as corporate income.

- High EEA compliance and license regimes ensure regulatory safety and clarity.

🇪🇸 Spain – Moderate Capital Gains Tax

- Crypto treated like other assets with capital gains taxed at 19%–26% depending on the amount.

- No special crypto exemptions; mining and staking income may be classified as personal or business income.

🇨🇾 Cyprus & 🇸🇱 Slovenia – Long-Held Assets Exempt

- Both nations generally exempt capital gains from crypto held beyond a specified minimum period (e.g., one year).

- Crypto business income is taxed under standard income or corporate tax regimes, with Cyprus offering favorable corporate tax rates .

🇧🇪 Belgium & 🇱🇺 Luxembourg – Selective Tax Relief

- Belgium: gains on private crypto transactions are exempt unless they’re considered professional.

- Luxembourg: capital gains exempt if held beyond six months; otherwise taxed as business income .

🔍 Side‑by‑Side Comparison

Country <1 yr Gains Tax >1 yr Gains Staking/Mining Key Benefit/Note Portugal 28% flat Exempt 28% / 14–53% Best for HODLers Germany Progressive 0–45% + surcharge Exempt Income tax; small exclusion Clear one-year rule Italy 26% (maybe 42%) — Income tax Ongoing debate Malta No CGT No CGT Business tax Crypto-licensed economy Spain 19–26% Same Income tax No crypto-specific rules Cyprus/Slovenia — Exempt Income tax Long-hold friendly Belgium/Luxembourg Exempt typical Small-term taxed Income if business Selective relief

🌎 Choosing Your Crypto Tax Jurisdiction

- Long-term investors: Portugal and Germany offer the best exemptions above 1 year.

- High earning miners/traders: Be cautious in Portugal (progressive tax) and Italy (rising rates).

- Expat and business-focused crypto users: Consider Malta, Cyprus, or Luxembourg for their regulatory clarity.

- Others: Countries like Spain and Italy are emerging with less favorable or more volatile policies.

🧠 Final Take

While Portugal crypto tax 2025 remains among the most favorable regimes in Europe, especially for long-term holders, it’s essential to compare with other jurisdictions based on activity type, residency options, and upcoming rule changes (e.g., Italy’s tax hike, EU DAC8). Choosing the right country depends on your crypto strategy, timelines, and lifestyle goals.

7. Final Summary & Next Steps

✅ 7.1 Key Takeaways

- Portugal remains highly favorable for long-term crypto investors

- Short-term gains and staking/lending taxed at 28%; capital gains exempt after holding >365 days; professional mining/trading falls under progressive rates up to 53%.

- Planning and strategy can significantly reduce your tax bill

- Leveraging crypto-to-crypto swaps, harvesting losses within the same year, and opting for simplified business regimes are effective ways to optimize.

- Robust compliance is essential

- Accurate filings using Modelo 3 with Annexes G, E, or B (filed April 1–June 30, paid by August 31), comprehensive record-keeping, and monitoring upcoming DAC8/CARF changes are critical to avoid penalties.

- Comparative context

- Germany offers total capital gains exemption after one year but taxes income like staking and mining at income rates. Italy is moving toward significantly higher taxes (potentially 33–42%). Malta provides clarity for licensed businesses but taxes business-related gains.

🚀 7.2 What You Should Do Next

- Audit your holdings: separate short-term from long-term holdings; make plans for strategic swaps and loss harvesting before the year-end.

- Implement record systems: use tools like TokenTax, CoinTracking, or Awaken Tax for automated documentation, form generation, and ensuring accuracy.

- Review your tax classification: determine whether your crypto activity is passive or professional. Consider simplified regimes or change your approach accordingly.

- Stay informed: watch for January 1, 2026 updates as DAC8/CARF is implemented across the EU, and monitor fiscal policy shifts in neighboring countries (especially Italy).

- Consult a crypto-savvy fiscal advisor: personal circumstances, residency status, and activity types significantly influence your optimal strategy.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

📍 7.3 Closing Remarks

The Portugal crypto tax 2025 environment offers compelling advantages, especially for long-term investors and passive holders. With proper planning, compliance, and optimization, you can significantly enhance your tax efficiency.