The Crypto Expat Dilemma in 2025: Navigating Global Tax, Regulation, and Residency in the Digital Age

1. Introduction: The Shifting Sands of Crypto Expatriation

The migration of cryptocurrency wealth holders seeking more favorable financial and regulatory environments is a well-established phenomenon. Historically driven by the pursuit of tax optimization, regulatory arbitrage, and desirable lifestyle changes, this trend has entered a new phase of complexity in 2025. The landscape for crypto investors considering expatriation is now characterized by intensifying global regulatory coordination, increased tax enforcement, and a more nuanced understanding of what constitutes a truly “crypto-friendly” jurisdiction.

Several potent forces are compelling crypto investors to evaluate relocation options in the current environment. Firstly, regulatory frameworks in traditional financial centers, notably the United States and the European Union, are solidifying, bringing digital assets firmly within the scope of existing financial oversight and introducing new, often stringent, reporting requirements. Secondly, the potential for substantial tax liabilities on cryptocurrency capital gains and income continues to drive the search for jurisdictions offering lower or zero tax rates. Thirdly, investors increasingly seek jurisdictions that provide not just low taxes but also clear, predictable, and supportive legal frameworks that foster stability for their digital asset activities. Finally, the maturation of certain locations into recognized “crypto hubs” – offering integrated ecosystems with supportive infrastructure, banking solutions, and vibrant communities – acts as a significant draw.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

However, navigating this landscape requires more than identifying low tax rates. The stakes are higher, the regulatory nets are wider, and the definition of a sustainable haven is evolving. This report provides an expert analysis of the current global environment for crypto expatriation. It dissects pivotal regulatory trends shaping decisions, evaluates the attractiveness and drawbacks of leading jurisdictions, outlines the critical factors beyond taxation that investors must weigh, and offers strategic considerations for those contemplating such a move in 2025 and the years ahead.

2. The Global Regulatory Net Tightens: Key Trends Shaping Expatriation Decisions

The era of operating largely outside the purview of traditional financial regulation and tax reporting is definitively drawing to a close for the crypto-asset sector. Governments worldwide, coordinated through international bodies like the OECD and G20, are systematically working to integrate digital assets into established frameworks, significantly impacting the strategic calculus for crypto expatriates.

2.1. The US Tax & Reporting Landscape: Increased Scrutiny and New Requirements

For US persons holding or transacting in cryptocurrency, the domestic regulatory and tax environment continues to evolve towards greater transparency and enforcement, regardless of their physical location.

Enhanced Broker Reporting (Form 1099-DA): A cornerstone of this shift is the implementation of new reporting requirements for “brokers,” primarily centralized cryptocurrency exchanges, under Section 6045 of the Internal Revenue Code. This rollout is phased:

- Starting January 1, 2025: Brokers are mandated to track and report the gross proceeds from customer sales and exchanges of digital assets. This information will be reported to both the taxpayer and the IRS on the new Form 1099-DA, with the first forms covering the 2025 tax year expected in early 2026.

- Starting January 1, 2026: Reporting requirements expand to include the cost basis of the assets sold or exchanged, alongside gross proceeds. While initially allowing taxpayers to rely on their own records for basis in tax year 2025, the onus will shift towards brokers reporting this information based on customer instructions or default methods (like FIFO) from 2026 onwards.

The implementation of Form 1099-DA, requiring detailed reporting of gross proceeds and eventually cost basis , directly feeds into the IRS’s stated objective of enhancing scrutiny on high-income earners and complex transactions like those involving digital assets. Consequently, the compliance burden for US crypto investors, including expatriates, intensifies, and the risk associated with inaccurate or incomplete reporting significantly increases. This detailed, third-party reporting provides the IRS with unprecedented visibility into taxpayer activities, making audits more targeted and effective.

DeFi Broker Rule Repeal – A Limited Reprieve: In March 2025, Congress voted to repeal a specific Treasury Department rule finalized in December 2024 that would have classified certain Decentralized Finance (DeFi) participants as “brokers” subject to reporting requirements starting in 2027. The repeal (H.J. Res. 25) was supported by arguments that the decentralized nature of many DeFi platforms made it unworkable for them to collect the necessary user information.

However, this repeal offers only limited relief. Crucially, it does not alter the fundamental obligation of individual US taxpayers to report their own gains and losses realized from DeFi transactions. The IRS maintains its position that cryptocurrencies are property for tax purposes. Therefore, gains or losses from DeFi activities (e.g., trading on decentralized exchanges, liquidity provision, yield farming) must still be calculated and reported on the individual’s income tax return, typically using Form 8949 and Schedule D. The repeal creates a divergence: centralized exchanges face mandatory reporting, while DeFi platforms do not, yet individual tax liability for DeFi activities remains unchanged. This bifurcation could inadvertently create a false sense of security for less informed participants in the DeFi space, potentially leading to underreporting, even as the IRS generally increases its focus on crypto compliance.

Continued IRS Enforcement Focus: The IRS’s strategic operating plan explicitly targets increased audit rates for high-income individuals (over $10 million income) and large corporations by 2026. While committing not to increase audits for those earning under $400,000, the focus clearly remains on complex financial situations, including cryptocurrency transactions and unreported offshore income. Compliance with Foreign Account Tax Compliance Act (FATCA) and Foreign Bank Account Report (FBAR) regulations remains absolutely critical for US expatriates holding foreign financial accounts, including those used for crypto activities.

Political Climate: While the second Trump administration has expressed a more supportive attitude towards digital assets, declaring crypto a national priority and potentially easing the path for stablecoin legislation , fundamental changes to tax reporting seem unlikely. The administration has directed Treasury and Commerce to develop strategies for managing digital assets , and the repeal of the DeFi broker rule occurred under this administration. However, the core 1099-DA reporting for centralized exchanges remains on track, and alignment with global initiatives like CARF appears probable regardless of the administration, given the international consensus on tax transparency.

2.2. Europe Under MiCA: Harmonization, Headwinds, and Hub Opportunities

The European Union has taken a significant step towards regulatory harmonization with the Markets in Crypto-Assets Regulation (MiCA), which became fully applicable on December 30, 2024. MiCA aims to create a unified legal framework across all 27 member states for crypto-assets not covered by existing financial services legislation.

Harmonization Benefits: A key advantage of MiCA is the creation of a single market for licensed Crypto-Asset Service Providers (CASPs). Once authorized in one EU member state, a CASP can “passport” its services across the entire EU without needing separate licenses in each country. This standardization simplifies cross-border operations for compliant businesses and aims to foster competition and innovation within a regulated environment.

Requirements for CASPs/Issuers: MiCA imposes significant obligations on market participants. Issuers of crypto-assets (other than stablecoins) must publish a detailed white paper notified to competent authorities. CASPs – entities providing services like custody, exchange operation, trading, execution, or advice – must obtain authorization, maintain a registered office and effective management within the EU (including at least one EU-resident director), meet capital requirements, establish robust governance and security protocols (aligning with DORA – Digital Operational Resilience Act), and implement consumer protection measures like complaint handling procedures and withdrawal rights for certain token offerings.

Impact on Stablecoins (ARTs & EMTs): MiCA introduces particularly strict rules for stablecoins, categorized as Asset-Referenced Tokens (ARTs, pegged to a basket of assets) and E-Money Tokens (EMTs, pegged to a single fiat currency). Issuers of ARTs generally require specific authorization under MiCA, while EMTs can typically only be issued by licensed credit institutions or e-money institutions. Both types face stringent requirements regarding reserve assets, custody, redemption rights, and governance to ensure stability and protect holders.

A significant consequence of these strict stablecoin rules is the potential impact on the availability of popular, globally issued stablecoins within the EU. The European Securities and Markets Authority (ESMA) has issued guidance indicating that CASPs should restrict services supporting the purchase of ARTs and EMTs whose issuers are not compliant with MiCA. ESMA expected these restrictions to be largely complete by the end of January 2025, with a potential allowance for “sell-only” services until the end of Q1 2025. This regulatory pressure could lead to the de-listing of major stablecoins like Tether (USDT) or USD Coin (USDC) from EU-facing platforms if their issuers do not obtain the necessary authorization or meet MiCA’s requirements, potentially fragmenting liquidity and limiting options for EU-based traders and investors.

MiCA and Taxation: It is crucial to understand that MiCA is a regulatory framework, not a tax harmonization directive. It standardizes rules for crypto-asset issuance and services but does not dictate how individual member states tax crypto gains or income. Crypto taxation remains a national competence, leading to diverse approaches across the EU.

Overall, MiCA presents a double-edged sword. It provides much-needed regulatory clarity and facilitates cross-border business for compliant entities through passporting. However, its stringent requirements – including the need for an EU presence, comprehensive authorization processes, and strict stablecoin rules – create significant barriers to entry for some businesses and may lead to a more restricted selection of assets and services available to EU residents compared to less regulated international markets. It fosters a compliant ecosystem, but potentially at the cost of some dynamism and choice found elsewhere.

2.3. The Dawn of Global Tax Transparency: CARF, DAC8, and the End of Anonymity?

Perhaps the most impactful long-term trend affecting crypto expatriation is the coordinated global push for tax transparency, spearheaded by the OECD’s Crypto-Asset Reporting Framework (CARF).

Introduction to CARF: Developed by the OECD and G20 countries, CARF is designed to facilitate the automatic exchange of information (AEOI) on crypto-asset transactions between participating jurisdictions. It adapts the principles of the existing Common Reporting Standard (CRS) – used for traditional financial accounts – to the unique characteristics of the crypto market.

Objective: The primary goal of CARF is to combat tax evasion and ensure tax compliance by giving national tax authorities visibility into the cross-border crypto activities of their residents. It achieves this by requiring Reporting Crypto-Asset Service Providers (RCASPs) – entities like exchanges, brokers, and potentially some wallet providers or DeFi operators with sufficient control – to collect identification and transaction data from their users and report it to their local tax authority, which then exchanges it with the tax authorities of the user’s country of residence.

Implementation Status & Timeline: CARF has received strong endorsement from the G20 and, as of late 2024/early 2025, over 63 jurisdictions have publicly committed to its implementation. This includes major financial centers and crypto hubs such as the EU member states, the UK, Canada, Australia, Japan, Singapore, and others. Many have committed to begin exchanging information under CARF in 2027 (covering activities in the 2026 calendar year), with another cohort aiming for 2028. The OECD published the necessary XML schemas and technical guidance in late 2024 to facilitate these exchanges.

EU Implementation (DAC8): The European Union is implementing CARF, along with related amendments to the CRS, through the 8th amendment to the Directive on Administrative Cooperation (DAC8). This directive mandates that all 27 EU member states transpose these rules into their national laws by December 31, 2025, with the new reporting obligations taking effect from January 1, 2026. The first reporting under DAC8 by CASPs to national authorities is due by January 31, 2027, covering the 2026 calendar year, followed by automatic exchange between member states.

Scope: CARF reporting covers a broad range of transactions, including exchanges between crypto-assets and fiat currency, exchanges between different crypto-assets, reportable retail payment transactions exceeding a $50,000 threshold, and transfers of crypto-assets (including transfers to/from external wallets). The framework is designed to capture activities facilitated by intermediaries and may extend to certain DeFi arrangements where entities exert control or influence. Amendments to the CRS were also made concurrently to cover e-money products, Central Bank Digital Currencies (CBDCs), and indirect crypto investments via derivatives.

The widespread adoption and coordinated implementation of CARF represent a fundamental paradigm shift towards global crypto tax transparency. For investors utilizing regulated CASPs virtually anywhere in the participating world, the assumption must be that their transactional data will eventually be reported back to their home country’s tax authority. This significantly diminishes the effectiveness of geographic relocation alone as a strategy for tax non-compliance, making accurate self-reporting and proactive tax planning more critical than ever.

Furthermore, the comprehensive due diligence (Know Your Customer – KYC), transaction monitoring, and reporting requirements mandated by CARF and DAC8 will inevitably impose substantial operational and technological costs on CASPs. This compliance burden, coupled with potentially stricter penalty regimes compared to CRS , may disproportionately affect smaller service providers. This could favor larger, well-capitalized players with established compliance infrastructures, potentially leading to consolidation within the crypto service industry as the implementation deadlines approach.

3. Mapping the Crypto Havens: 2025’s Most Attractive Jurisdictions

The term “crypto-friendly” is often used loosely, but a rigorous assessment in 2025 requires looking beyond headline tax rates. True attractiveness lies in a combination of favorable and stable tax policies, clear and supportive regulations, accessible banking infrastructure, a reasonable cost of living relative to the benefits, and viable residency pathways. No single jurisdiction excels on all fronts; the optimal choice is highly personalized, depending on the investor’s specific activities (long-term holding vs. active trading vs. operating a business), risk tolerance, capital, and lifestyle preferences.

3.1. Comparative Overview Table

To facilitate comparison, the following table provides a snapshot of key metrics for frequently discussed crypto expatriation destinations as of early 2025. Regulatory and banking ease scores are qualitative assessments based on the available information. Cost of living indices are indicative and relative to New York City (NYC = 100).

Table 1: Key Crypto Expatriation Jurisdictions: 2025 Snapshot

| Jurisdiction | Individual CGT (Short/Long Term) | Tax on Staking/Mining (Individual) | Wealth Tax on Crypto? | Corp Tax (Crypto Biz) | Regulatory Clarity | Banking Ease | Typical Residency Route(s) | Est. Cost of Living Index (vs NYC=100) | Key Snippets |

|---|---|---|---|---|---|---|---|---|---|

| UAE (Dubai/ADGM) | 0% / 0% | 0% (Individual) | No | 9% (>AED 375k profit); Free Zone exemptions possible | High (VARA/ADGM/SCA) | Improving (Moderate) | Golden Visa (Investment), Remote Work Visa, Employment | High (~80-85) | |

| Portugal | 28% / 0% (>1yr) | Likely Income Tax | No | Standard Corporate Tax | Moderate (MiCA/National) | Moderate | D7 (Passive Income), D8 (Nomad), Golden Visa (Investment) | Moderate (~50-60, lower outside Lisbon) | |

| Switzerland | 0% (non-professional) / 0% | Income Tax | Yes (Cantonal) | Standard Corporate Tax | High (FINMA/DLT Act) | High (esp. Private Banks) | Investment, Lump-sum Taxation (Financially Independent) | Very High (~115-125) | |

| Germany | Income Tax Rate / 0% (>1yr) | Income Tax | No | Standard Corporate Tax | Moderate (BMF/MiCA) | Moderate | Standard EU Residency | Moderate (~70-75) | |

| Malta | Income Tax Rate (if trading) / 0% (long hold) | Income Tax (if trading) | No | 35% (Effective ~5% possible) | High (MFSA/MiCA) | Moderate | Investment (PR/Citizenship), Nomad Permit | Moderate (~65-70) | |

| El Salvador | 0% / 0% | 0% | No | 0% (Tech Innovation Law) | Developing (BTC focus) | Developing | Investment (Citizenship), Standard Residency | Low (~40-50) | |

| Panama | 0% (Territorial) / 0% | 0% (Territorial) | No | Territorial | Low (Non-interference) | Challenging | Investment (Friendly Nations Visa – status varies), Pensionado | Low (~50-55) | |

| Cayman Islands | 0% / 0% | 0% | No | 0% | Moderate (VASP Act) | Moderate-High (HNW focus) | Investment (Residency) | Very High (~110+) | |

| Singapore | 0% / 0% | 0% (Individual) | No | Standard Corporate Tax | High (MAS) | High (but high barrier for non-residents) | Investment (GIP), Employment | Very High (~85-90) | |

| Georgia | 0% (Non-Georgian Source) / 0% | 0% (Individual) | No | 15% (Distributed Profit) | Moderate (Liberal but less formalized) | Moderate-High (Tolerant) | Visa-Free (1yr+), Investment, Business | Low (~35-45) | |

| Puerto Rico | 0% (Post-move assets) / 0% (Act 60) | 0% (Act 60) | No | 4% (Act 60) | Uncertain (US Law pending) | US System | Bona Fide Residency (Act 60) | Moderate (~70-75) |

Note: Tax rules can be complex and depend on specific circumstances (e.g., professional trading definitions, residency status). Corporate tax details, especially free zone benefits, require specific structuring advice. Cost of Living indices are approximate and based on available data relative to NYC=100.

This table provides a vital starting point for comparing jurisdictions across key dimensions relevant to crypto investors, highlighting the inherent trade-offs involved in selecting a potential destination.

3.2. The Zero-Tax Allure: Reality Check on Traditional Havens

Certain jurisdictions are renowned for their lack of direct taxation, making them perennial points of interest for wealth preservation.

UAE (Dubai/Abu Dhabi): The United Arab Emirates, particularly Dubai and Abu Dhabi, has aggressively positioned itself as a premier global crypto hub. Its primary appeal lies in the 0% personal income tax and 0% capital gains tax for individuals, covering profits from crypto trading, staking, mining, and holding. This is complemented by increasingly clear regulatory frameworks established by authorities like Dubai’s Virtual Assets Regulatory Authority (VARA), the Abu Dhabi Global Market’s (ADGM) Financial Services Regulatory Authority (FSRA), and the federal Securities and Commodities Authority (SCA). The government actively supports the sector through initiatives like crypto-focused free zones (e.g., DMCC, RAK DAO) offering tailored licensing , and attractive residency options like the Golden Visa for investors and professionals. Furthermore, VAT on crypto transactions was eliminated in late 2024 , and banking access for crypto holders appears to be improving, with major local banks like Emirates NBD launching crypto trading services.

However, the picture is not entirely tax-free. A 9% federal corporate tax was introduced in 2023, applicable to businesses (including those dealing in crypto) with annual profits exceeding AED 375,000 (approx. $102,000 USD). While companies operating within designated free zones and meeting specific “qualifying income” and substance requirements may achieve a 0% rate, this requires careful structuring and adherence to complex rules. The cost of living, particularly in Dubai, is high , and while improving, traditional banks can still be cautious regarding crypto-related funds, sometimes necessitating the use of free zone corporate structures even for proprietary trading. Establishing tax residency typically requires spending significant time in the country (e.g., 183+ days) or demonstrating other substantial ties. The UAE’s attractiveness for individuals hinges significantly on the continuation of the 0% personal income tax regime, even as the country signals alignment with global transparency standards like CARF. It presents a balancing act: exceptional benefits for individuals, but growing complexity and costs for businesses.

Cayman Islands, Bermuda, British Virgin Islands (BVI): These Caribbean jurisdictions are long-established offshore financial centers offering 0% income tax, 0% capital gains tax, and 0% corporate tax. They have been developing specific regulations for digital assets, such as the Cayman Islands’ Virtual Asset (Service Providers) Act and Bermuda’s Digital Asset Business Act (DABA), aiming to provide clarity for businesses operating there. Bermuda even allows some local taxes to be paid in USD Coin.

The major drawback is the extremely high cost of living. Bermuda may also impose land taxes for longer-term property arrangements. These factors generally make these locations most suitable for institutional players, large crypto funds, or ultra-high-net-worth individuals for whom the tax savings outweigh the substantial living expenses. Banking access, while potentially available, often caters to this high-end market and requires thorough verification.

3.3. European Hotspots Reassessed: Navigating MiCA and National Rules

Europe presents a diverse picture, with some countries offering specific crypto tax advantages within the overarching framework of MiCA and the upcoming DAC8 reporting.

Portugal: Once hailed as a premier crypto tax haven, Portugal introduced significant changes in 2023. While it still offers 0% capital gains tax on crypto assets held for more than one year, gains from assets held less than one year are now subject to a flat 28% tax. Crypto-to-crypto trades and transactions involving NFTs are generally reported as remaining tax-free. Portugal continues to offer attractive residency pathways, including the D7 Passive Income Visa, the D8 Digital Nomad Visa, and the Golden Visa program (focused on fund investments, donations, or business creation since the removal of direct real estate purchase options). The cost of living remains relatively low compared to other Western European nations, particularly outside Lisbon.

The 2023 tax reform significantly dimmed Portugal’s allure, especially for active traders. It now primarily favors long-term investors (“HODLers”) who can benefit from the >1 year exemption. This shift serves as a stark reminder that even highly favorable tax policies can be subject to change, emphasizing the need for ongoing monitoring and adaptable strategies. As an EU member, Portugal is fully subject to MiCA regulations and will implement DAC8 reporting.

Switzerland: Renowned for its financial stability and mature regulatory environment, Switzerland remains a top destination, particularly its “Crypto Valley” in Zug. For individuals not classified as “professional traders,” capital gains from selling or trading crypto are generally tax-exempt. The Swiss Financial Market Supervisory Authority (FINMA) provides relatively clear guidelines, and the country boasts a sophisticated ecosystem with established crypto banks and service providers, including private banks increasingly comfortable with digital assets.

However, Switzerland imposes an annual wealth tax at the cantonal level, which includes the value of cryptocurrency holdings. Furthermore, income derived from mining, staking, or professional trading activities is subject to regular income tax. The criteria defining a “professional trader” can be nuanced and depend on factors like trading frequency, use of leverage, and systematic approach, requiring careful assessment. The cost of living is among the highest in the world. Switzerland offers quality and stability but comes at a significant financial cost, making it best suited for well-capitalized long-term holders who prioritize regulatory maturity and robust banking over minimizing every last tax liability.

Germany: Germany offers a unique tax advantage: crypto assets held for more than one year are completely exempt from capital gains tax upon disposal. Recent guidance from the Federal Ministry of Finance (BMF) in March 2025 provided further clarifications on staking, mining, airdrops, and DeFi, confirming that crypto remains treated as a private asset subject to these rules.

The downside is that short-term gains (assets held for one year or less) exceeding an annual exemption threshold (€1,000 from tax year 2024) are taxed as regular income, potentially at rates up to 45% plus solidarity surcharge. Income from staking and mining is generally treated as taxable income (either business income or other income). The BMF guidance emphasizes the need for meticulous record-keeping and documentation, especially for DeFi activities. As an EU member, Germany is subject to MiCA and DAC8 implementation.

Malta: Known as the “Blockchain Island,” Malta has a long-standing pro-crypto stance, with a comprehensive Virtual Financial Assets (VFA) framework that is being aligned with MiCA. For individuals, long-term crypto investments are generally not subject to capital gains tax. Malta offers attractive residency and citizenship by investment programs, as well as a Nomad Residence Permit. Special tax regimes may allow residents to pay low or zero tax on foreign-sourced income not remitted to Malta.

However, if crypto activities are deemed frequent trading constituting a business, profits are taxed as income at progressive rates up to 35%. The standard corporate tax rate is high at 35%, although complex structuring involving distributions and refunds can potentially lower the effective rate significantly for foreign shareholders. Malta is an EU member and thus bound by MiCA and DAC8.

3.4. Pioneers & Niche Plays: Unique Value Propositions

Beyond the established hubs, several countries offer unique approaches attracting specific types of crypto investors.

El Salvador: As the first country to adopt Bitcoin as legal tender, El Salvador offers a unique proposition. In 2023, it eliminated income, capital gains, and property taxes on “technological innovation,” explicitly including cryptocurrency activities for individuals and certain businesses. The government actively promotes Bitcoin adoption and is developing citizenship by investment pathways.

The challenges include operating within a developing economy with associated infrastructure limitations. The banking system is still adapting to widespread Bitcoin use, and the regulatory environment, while currently highly favorable, is heavily dependent on the current political leadership. Acceptance and infrastructure for cryptocurrencies other than Bitcoin are limited.

Panama: Panama’s main attraction is its territorial tax system, where income earned outside Panama is generally not taxed for residents. This can apply to crypto gains if structured correctly (e.g., generated from foreign exchanges/sources). The country uses the US dollar, has a strategic location, and the government generally adopts a non-interventionist stance towards crypto. Various residency options exist, including investment routes like the (recently modified) Friendly Nations Visa.

The lack of specific crypto regulation, however, can create uncertainty. A significant practical challenge is banking access, with many traditional Panamanian banks remaining hesitant or restrictive regarding crypto-related funds.

Georgia: This Eastern European nation offers a compelling mix of benefits. Crypto gains realized by individuals are generally exempt from income and capital gains tax, as they are not considered “Georgian sourced” income. Corporate tax is low at 15%, and only applied when profits are distributed. Business setup is straightforward, and the banking environment is noted as relatively tolerant of crypto transactions. Georgia boasts a low cost of living and offers visa-free entry for up to a year for citizens of many countries, simplifying initial relocation.

Potential downsides include its geopolitical location and a less developed financial infrastructure compared to major global hubs. The regulatory environment, while currently liberal, is less formalized than in places like Switzerland or the UAE and could potentially evolve.

3.5. Jurisdictions in Transition: The Case of Puerto Rico

Puerto Rico has attracted significant attention from US crypto investors due to its unique tax relationship with the mainland US.

Current Status (Act 60): Under Act 60 (which consolidated previous incentive acts like 20 and 22), bona fide residents of Puerto Rico can benefit from significant tax exemptions. Key benefits include 0% Puerto Rican tax on passive income sources (like dividends and interest) and, crucially for crypto investors, 0% capital gains tax on assets acquired after establishing residency. Gains on assets held before moving are subject to specific rules involving US and PR taxes. This structure made it highly attractive for US citizens willing to relocate permanently.

Proposed Changes: The tax haven status of Puerto Rico is currently under threat. In April 2025, US lawmaker Nydia Velázquez introduced the “Fair Taxation of Digital Assets in Puerto Rico Act”. This bill aims to amend the US Internal Revenue Code to treat income derived from digital asset transactions by Puerto Rican residents as US-source income, effectively subjecting it to federal capital gains tax and eliminating the core benefit of Act 60 for crypto investors. The stated rationale includes recouping lost US tax revenue and addressing concerns about the incentives driving up local housing costs and displacing residents. Puerto Rico’s Governor has proposed extending Act 60 but introducing a local 4% capital gains tax, a move potentially aimed at preempting harsher federal action but still representing a significant change from the current 0%.

The introduction of this US federal legislation casts a long shadow over Puerto Rico’s viability as a long-term crypto tax haven. The outcome remains uncertain, but the direct challenge from US lawmakers highlights the precarious nature of the island’s tax incentives, which rely on specific interpretations of US law that are now being contested. For crypto investors considering relocation in 2025, Puerto Rico represents a significantly higher-risk option due to this political and legislative uncertainty.

4. Beyond the Tax Rate: Critical Factors for Crypto Investors

While tax optimization is often the primary motivator for expatriation, focusing solely on tax rates is a critical mistake. Several practical, non-tax factors significantly influence the feasibility, sustainability, and overall success of relocating as a crypto investor.

4.1. Residency Pathways: Strategic Choices for Establishing Tax Status

Accessing the favorable tax treatment offered by a chosen jurisdiction typically requires establishing legitimate tax residency. This is distinct from merely having a visa or owning property; it involves meeting specific legal criteria set by the host country, which often include physical presence requirements (the “183-day rule” is common but not universal) and demonstrating other ties like a primary home, center of economic interests, or family location. Failing to properly establish tax residency in the new location, or failing to demonstrably sever tax residency in the original home country (especially relevant for US citizens who are taxed based on citizenship, not residency), can negate the intended tax benefits or even lead to double taxation.

Several pathways exist for establishing residency, each with different requirements, benefits, and limitations:

- Digital Nomad Visas (DNVs): Increasingly popular, DNVs are offered by countries like Portugal (D8 Visa), Estonia, Malta (Nomad Residence Permit), and the UAE (Dubai Virtual Work Permit) to attract remote workers. These visas typically require proof of stable remote income (e.g., €3,480/month for Portugal D8, $3,500/month for Dubai) and allow stays ranging from one year (often renewable). However, DNVs are generally temporary in nature and do not automatically lead to permanent residency or citizenship. Furthermore, spending more than 183 days in the host country on a DNV can trigger local tax residency (as in Estonia), potentially subjecting worldwide income (including crypto gains) to local taxes if not carefully managed alongside tax obligations in the home country. DNVs offer flexibility but require careful planning to avoid unintended tax consequences.

- Residency/Citizenship by Investment (Golden Visas/CBI): Many crypto-friendly jurisdictions offer routes to residency, and sometimes citizenship, in exchange for significant financial contributions. Examples include Portugal’s Golden Visa (requiring investments from €250,000 in funds, donations, or business), Malta’s Permanent Residence Programme or Citizenship by Naturalisation for Exceptional Services by Direct Investment (requiring substantial contributions and investments), the UAE’s Golden Visa (often linked to real estate purchase or significant business investment), and Antigua & Barbuda’s Citizenship by Investment program (which accepts crypto payments). These programs typically have much higher capital requirements than DNVs but offer clearer pathways to long-term or permanent residency, and eventually citizenship (often after 5 or more years of residency). For investors seeking permanent relocation and maximum stability regarding their residency and tax status, investment migration programs often provide a more robust, albeit more expensive, solution compared to temporary nomad visas.

4.2. The Crypto Banking Conundrum: Finding On/Off Ramps

One of the most significant practical hurdles faced by crypto expatriates, even in jurisdictions with favorable regulations, is accessing reliable banking services for fiat on-ramps and off-ramps. Many traditional banks remain wary of cryptocurrency due to concerns about Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance risks, regulatory ambiguity, price volatility, and the perceived association with illicit activities. This can lead to difficulties opening accounts, sudden account freezes, or restrictions on transactions involving known crypto exchanges.

Identifying banks or financial institutions that are genuinely “crypto-friendly” is crucial. While the landscape is constantly evolving, some institutions have shown greater openness:

- UAE: Emirates NBD (via its Liv digital arm) has launched direct crypto trading. Other large banks like RAKBANK, FAB, and HSBC are sometimes mentioned as potentially supportive, but require significant due diligence and may still be cautious, especially for corporate accounts linked to foreign entities.

- Switzerland: Known for its crypto-supportive environment, Switzerland hosts specialized crypto banks like AMINA Bank (formerly SEBA) and Sygnum. Established private banks are also increasingly offering digital asset services to their clients , and institutions like Arab Bank Switzerland explicitly market digital asset custody and trading. Fintechs like Revolut also operate in Switzerland.

- Europe (ex-Switzerland): Fintechs like Revolut , specialized institutions like Bank Frick (Liechtenstein) , SolarisBank (Germany) , LHV Bank (Estonia) , and potentially FinecoBank (Italy) are often cited as more crypto-receptive than traditional incumbents.

- Global Fintechs: Platforms like Juno and Wirex offer integrated fiat and crypto services globally.

Strategies for navigating banking challenges include:

- Utilizing fintech platforms as intermediaries between traditional bank accounts and crypto exchanges.

- Building relationships with private banks in jurisdictions like Switzerland, which often cater to HNW individuals with complex assets.

- Establishing corporate structures within crypto-friendly free zones (like ADGM or DMCC in the UAE) which may facilitate opening business bank accounts specifically for crypto activities.

- Being prepared for extensive enhanced due diligence (EDD) processes when dealing with large crypto-related sums.

Ultimately, the practical ease (or difficulty) of moving funds between the fiat and crypto worlds can be a more decisive factor in choosing a jurisdiction than minor differences in tax rates. Countries where the banking sector is actively engaging with and providing regulated services for digital assets offer a significant practical advantage for crypto investors needing liquidity and operational efficiency.

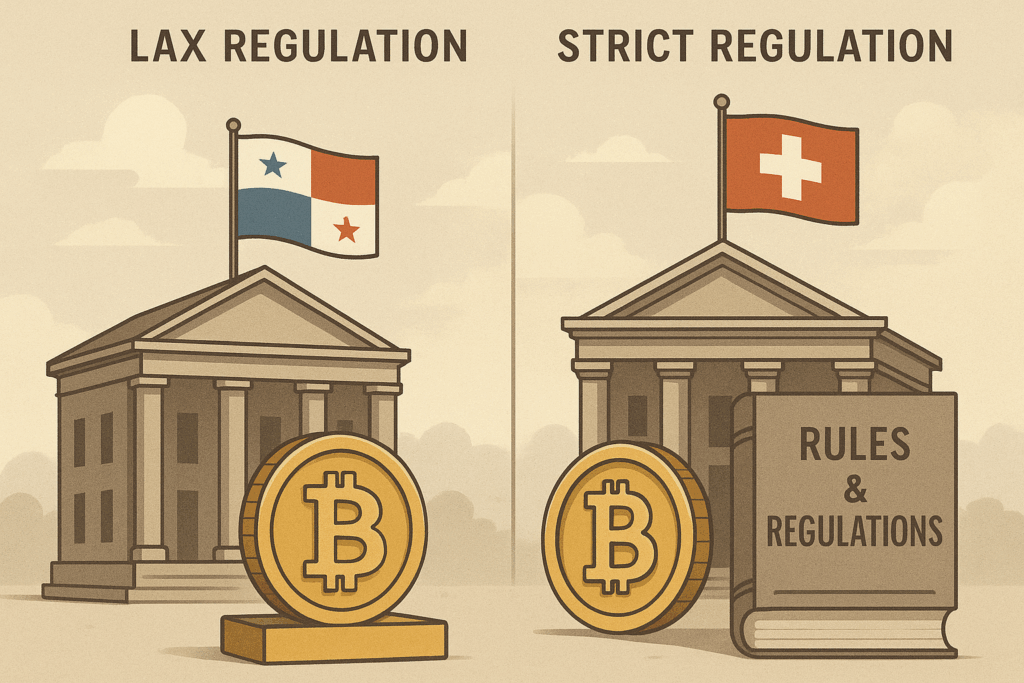

4.3. Weighing Regulatory Stability vs. Favorable Rules

Investors often face a trade-off between jurisdictions offering minimal, non-interfering regulation (which might seem attractive for its freedom but carries inherent uncertainty) and those with comprehensive, clearly defined regulatory frameworks (which provide stability and predictability but may impose more restrictions and compliance burdens).

For example, Panama and Paraguay rely on their territorial tax systems and a generally hands-off approach to crypto, which can be beneficial but lacks specific legal certainty. Conversely, the UAE (through VARA, ADGM, SCA) and Switzerland (through FINMA and the DLT Act) have invested heavily in creating detailed rules and licensing regimes for crypto activities.

The risk of regulatory and tax policy changes is ever-present, as demonstrated by Portugal’s introduction of short-term capital gains tax , the proposed changes threatening Puerto Rico’s incentives , and the ongoing evolution of BMF guidance in Germany. Therefore, jurisdictions with a track record of regulatory stability, clear processes for policy development, and strong legal institutions may be preferable for long-term planning, even if their rules are not initially the most lenient. Predictability can be as valuable as favorability.

4.4. Cost of Living: Benchmarking Key Hubs

A critical, often underestimated factor is the cost of living in the target jurisdiction. A 0% tax rate is less appealing if daily expenses consume a disproportionate amount of capital. Cost of living varies significantly across potential crypto havens:

- Very High Cost: Jurisdictions like Switzerland (Zurich, Zug, Geneva ranking among the world’s most expensive cities), Bermuda, and the Cayman Islands consistently top global cost-of-living indices.

- High Cost: Singapore, the UAE (especially Dubai), Hong Kong, and major financial centers in developed countries generally fall into this category.

- Moderate to Lower Cost: Locations like Portugal (particularly outside major cities like Lisbon), Georgia, Malta, El Salvador, and Panama tend to offer significantly lower living expenses compared to the major financial hubs.

While subjective and dependent on individual lifestyle choices, comparing relative cost-of-living data (such as indices provided by Numbeo or Mercer, referenced in snippets ) is essential for a realistic financial assessment of expatriation. The potential tax savings must be weighed against the ongoing costs of residing in the chosen location.

5. Strategic Considerations and Overcoming Hurdles

Successfully navigating the complexities of crypto expatriation requires a tailored strategy that aligns with the investor’s specific profile and anticipates potential challenges, particularly concerning compliance in an era of increasing global transparency.

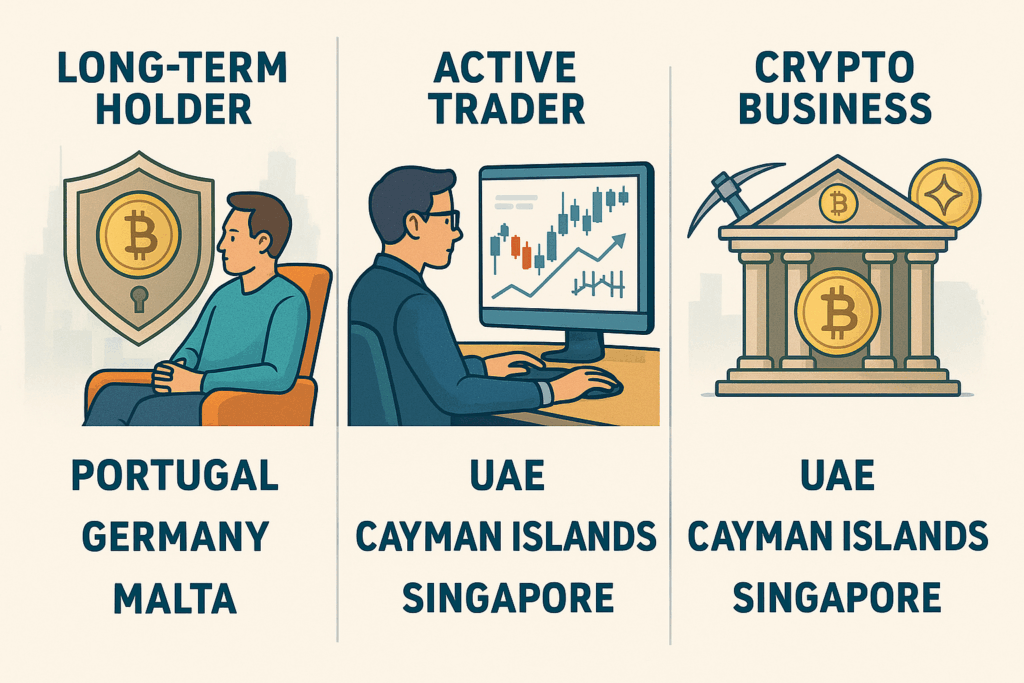

5.1. Tailoring Your Strategy: Holder vs. Trader vs. Business

The optimal jurisdiction and structuring approach differ significantly based on the nature of the crypto activity:

- Long-Term Holder (HODLer): Investors primarily focused on holding assets for the long term should prioritize jurisdictions offering exemptions or low rates on long-term capital gains. Portugal (0% >1 year), Germany (0% >1 year), and potentially Malta or Switzerland (if not deemed a professional trader) fit this profile. Key considerations include the existence and rate of any wealth tax (significant in Switzerland ), the stability of the tax regime, and the availability of secure, regulated custody solutions.

- Active Trader: Individuals frequently buying and selling crypto assets require jurisdictions with low or zero tax on all capital gains, regardless of holding period. The UAE (0%), Cayman Islands (0%), and Singapore (0%) are prime examples. Critical factors include reliable access to high-liquidity exchanges, efficient banking for fiat on/off ramps, regulatory clarity surrounding trading activities, and understanding any criteria that might classify them as a “professional trader” subject to income tax (e.g., in Switzerland ).

- Crypto Business (Mining, Staking Pool Operator, Exchange, Fund Manager, etc.): Operating a crypto-related business internationally involves a different set of considerations. Analysis must focus on corporate income tax rates, including potential benefits within special economic or free zones (e.g., UAE’s 0% qualifying income in free zones vs. 9% standard rate ). Equally important are the specific licensing requirements (e.g., MiCA for EU operations , VARA/ADGM/SCA in the UAE , FINMA in Switzerland ), the associated compliance burden (AML/KYC procedures), and the practical ability to secure robust business banking relationships.

5.2. The Compliance Gauntlet: Staying Ahead of Global Reporting

Regardless of the chosen destination, maintaining tax and regulatory compliance is non-negotiable and increasingly complex.

- US Persons: US citizens and Green Card holders remain subject to US taxation on their worldwide income and stringent reporting requirements, irrespective of their country of residence. This includes filing annual tax returns, reporting foreign financial accounts via FBAR (FinCEN Form 114) if aggregate balances exceed $10,000, and potentially filing FATCA Form 8938 for specified foreign financial assets exceeding certain thresholds. Given the IRS’s heightened focus on crypto and offshore assets, meticulous compliance is paramount.

- CARF/DAC8 Impact: The impending implementation of global AEOI for crypto-assets means that transactions conducted through regulated CASPs in participating jurisdictions (the vast majority of developed nations and financial hubs) will likely be reported to the investor’s home country tax authority starting in 2027 (for 2026 data). This necessitates proactive planning, accurate record-keeping, and ensuring alignment between reported information and self-declared tax filings. Operating solely through non-compliant or decentralized platforms may avoid intermediary reporting under CARF, but does not absolve the individual from their personal tax obligations.

- Local Compliance: Adherence to the specific rules of the host jurisdiction is essential. This includes meeting visa requirements (e.g., minimum physical presence days), filing local tax returns if required (even if the rate is 0%), complying with local AML/KYC regulations when interacting with financial institutions or CASPs, and understanding local property or business regulations.

- Meticulous Record Keeping: The complexity of crypto transactions (especially involving DeFi, staking rewards, airdrops, NFTs) combined with varying international tax treatments necessitates rigorous record-keeping. Investors must track acquisition dates, cost basis (purchase price plus fees), disposal dates, sales proceeds, and the nature of each transaction. Using crypto tax software can help aggregate data, but outputs should be carefully reviewed for accuracy, particularly regarding transfers between own wallets (which are generally non-taxable events but sometimes misclassified by software) and complex DeFi interactions. Tax authorities (like Germany’s BMF) are increasingly emphasizing the need for taxpayers to provide detailed transaction histories and reports. The First-In, First-Out (FIFO) accounting method is often the default or required method if specific identification is not possible.

5.3. Sourcing Reliable Expertise in a Dynamic Field

The intricate interplay of international tax law, rapidly evolving crypto regulations, diverse immigration rules, and practical banking challenges makes crypto expatriation a field where professional guidance is indispensable. Relying solely on online articles or forums carries significant risk due to the complexity, jurisdiction-specific nuances, and constant changes in the legal and regulatory landscape.

Investors should seek advisors possessing a rare combination of expertise:

- International Tax Law: Deep understanding of tax residency rules, double taxation treaties, controlled foreign corporation (CFC) rules, exit taxes, and reporting obligations (FATCA, FBAR, CRS, CARF/DAC8).

- Crypto-Specific Regulation: Familiarity with frameworks like MiCA, VASP regulations, AML/KYC requirements specific to digital assets, and the tax treatment of various crypto transactions (staking, mining, DeFi, NFTs) in relevant jurisdictions.

- Immigration Law: Knowledge of visa requirements, residency pathways (DNVs, Golden Visas), and the process for obtaining and maintaining legal residency status.

- Jurisdictional Expertise: Ideally, advisors should have specific knowledge or reliable local contacts in the target expatriation countries to navigate local laws and practicalities (like banking).

Due diligence is crucial when selecting advisors. Investors should verify credentials, seek references, and specifically inquire about the advisor’s experience with high-net-worth individuals, cryptocurrency assets, and cross-border planning scenarios. A multi-disciplinary team approach, potentially involving tax lawyers, immigration specialists, and financial advisors, may be necessary to address all facets of the expatriation plan.

6. Conclusion: Charting Your Course in the New Crypto World Order

The landscape for cryptocurrency investors considering expatriation in 2025 is profoundly different from just a few years ago. The overarching narrative is one of convergence: digital assets are being drawn into the global regulatory and tax mainstream. This necessitates a more sophisticated and compliance-focused approach to international planning.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

Key trends reshaping the decision-making process include the relentless global push towards tax transparency, exemplified by the widespread commitment to CARF and its EU counterpart, DAC8. This signals the diminishing viability of geographic arbitrage as a means of tax evasion for activities conducted through regulated intermediaries. Concurrently, the EU’s implementation of MiCA creates a harmonized regulatory zone, offering clarity and passporting benefits for compliant entities but also imposing significant operational requirements and potentially restricting access to certain assets like non-compliant stablecoins. In the US, enhanced broker reporting via Form 1099-DA further tightens the net, increasing visibility for the IRS despite limited reprieves like the DeFi broker rule repeal.

Consequently, the definition of a “crypto-friendly” jurisdiction has evolved. While low or zero tax rates remain a primary attraction, true friendliness in 2025 must also encompass regulatory clarity and stability, a functional and accessible banking system willing to engage with crypto assets, a reasonable cost of living that doesn’t negate tax savings, and achievable, sustainable residency pathways. The analysis reveals a spectrum of options: established zero-tax havens like the UAE grappling with new corporate taxes and global standards; European nations like Portugal and Germany offering specific long-term holding benefits but within the stricter EU framework; pioneers like El Salvador betting heavily on Bitcoin; and stable hubs like Switzerland offering maturity at a high cost. Each presents a unique set of trade-offs.

There is no universally “best” country for crypto expatriation. The optimal choice is deeply personal, contingent on the individual’s financial situation, the nature of their crypto activities (holding vs. trading vs. business), their tolerance for risk and regulatory change, lifestyle preferences, and long-term goals. A long-term holder prioritizing stability might favor Switzerland despite the wealth tax, while an active trader might gravitate towards the UAE’s zero capital gains tax, accepting the higher cost of living and business tax complexities.

Given the high stakes and complexities involved – navigating international tax treaties, evolving crypto regulations, residency requirements, banking hurdles, and impending global reporting standards – attempting such a move without expert guidance is highly inadvisable. Proactive, meticulous planning and unwavering commitment to compliance are paramount for success in this new world order. Seeking qualified, multi-disciplinary professional advice tailored to one’s specific circumstances is not merely recommended; it is essential.

Looking ahead, the full impact of CARF implementation post-2027 will be a major factor, potentially further leveling the playing field regarding tax transparency. MiCA will continue to evolve with further guidance and interpretation, shaping the EU crypto market. New jurisdictions may emerge as crypto hubs, while existing ones will continue to adapt their policies in response to technological innovation and international pressures. The interplay between regulation striving for control and innovation pushing boundaries will continue to define the crypto landscape for years to come.