10 Little-Known Hacks for a Smarter Crypto Expatriation in 2025

Crypto Expatriation in 2025: The New Reality

The days of simple crypto tax evasion are over. In 2025, merely moving to a low-tax country won’t keep your digital assets hidden. The “Wild West” of crypto is being tamed by a coordinated global regulatory effort, rendering old “under the radar” strategies obsolete.

Success now hinges on mastering a complex web of global regulations, shifting from obscurity to legal optimization. This new landscape is defined by three key frameworks:

- EU’s MiCA Regulation: Fully in force, MiCA unifies digital asset rules across 27 EU states, bringing legitimacy but also strict licensing and transparency for all Crypto-Asset Service Providers (CASPs).

- EU’s DAC8 Directive: Effective January 1, 2026, DAC8 mandates automatic information exchange on crypto transactions among EU tax authorities. Crucially, it compels all Reporting Crypto-Asset Service Providers (RCASPs) worldwide to report data on their EU-resident clients, effectively ending offshore secrecy for EU taxpayers.

- OECD’s CARF (Crypto-Asset Reporting Framework): This global framework, with over 63 committed jurisdictions (including the US, UK, and Switzerland) by 2027/2028, sets a worldwide standard for tax information exchange on crypto assets, covering various transactions and even unhosted wallets.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

The combined force of MiCA, DAC8, and CARF creates a global transparency grid. Your tax authority will know about your crypto activities. This isn’t the end of tax optimization, but the beginning of a more sophisticated era. The strategic imperative has shifted from hiding to structuring.

The smartest crypto expats of 2025 will be those who build compliant, multi-jurisdictional structures. Here are 10 advanced strategies your tax advisors might not even know…

10 Hacks Most Crypto Expats Overlook (But Shouldn’t)

1. Prioritize Treaty Networks, Not Just Tax Rates

A country with a 15% tax rate and a robust network of Double Taxation Treaties (DTTs) can be profoundly more advantageous than a so-called “zero-tax” jurisdiction with a weak or non-existent treaty network. This is especially true for the modern crypto investor, whose wealth is rarely confined to a single asset class. For those with a diversified portfolio that includes foreign stocks, real estate, or business interests, focusing solely on the local tax rate for crypto is a classic rookie mistake. The real value lies in how a country’s tax system interacts with the rest of the world.

A DTT is a bilateral agreement designed to prevent the same income from being taxed by two different countries. For a crypto expat, its most powerful function is to reduce or eliminate withholding taxes at the source. For example, dividends paid from a US company to a foreign investor are typically subject to a 30% withholding tax. A strong DTT can reduce this rate to 15%, 5%, or even 0%. This saving at the source can often dwarf the benefits of a 0% local tax on a different income stream.

Let’s examine this through a comparative lens:

1.1 🇵🇹 The Portugal Trap

Portugal has long been celebrated for its tax regime, where long-term capital gains on crypto (held for over one year) are tax-free for individual investors. While attractive, this benefit is narrow. Any other income—from staking, short-term trades (taxed at 28%), or foreign sources like dividends and rent—is still taxable. The once-lauded Non-Habitual Resident (NHR) program has been replaced by the more restrictive NHR 2.0 (also known as IFICI), which offers a 20% flat tax but is now limited to a narrow list of qualified professions and specific industries like scientific research and innovation. An investor moving to Portugal solely for the crypto benefit might be unpleasantly surprised by the tax treatment of the rest of their global portfolio.

1.2 The Malta Advantage

On the surface, Malta’s 35% corporate tax rate seems prohibitive. However, this is where understanding the system becomes critical. Malta operates a full imputation system, which, when combined with its vast network of over 80 DTTs, creates an exceptionally efficient structure. For a non-resident beneficial owner of a Maltese company, the effective tax rate on distributed profits can be reduced to as low as 5%, or even 0% in some cases. For individuals, long-term crypto holdings are not subject to capital gains tax, and the territorial tax system means foreign-sourced income is only taxed if remitted to Malta. The DTT network then ensures that any remitted income is not double-taxed. This makes Malta a powerful hub for investors with complex, multi-jurisdictional income streams.

1.3 The Hungary Case

Hungary offers simplicity with a flat 15% Personal Income Tax (PIT) on most capital gains, including crypto transactions, with no additional social tax liability. While not zero, this predictable rate combined with its DTT network can be effective. The recent cancellation of the US-Hungary double tax treaty serves as a stark warning about the importance of the treaty itself. Before its termination, the treaty offered significant benefits. Now, US-source dividends paid to a Hungarian resident are subject to the full 30% US withholding tax on top of any applicable Hungarian tax, dramatically increasing the overall tax burden. This perfectly illustrates the point: the treaty network is a dynamic and critical asset, just as important as the domestic tax rate.

The optimal jurisdiction is therefore a function of the investor’s entire wealth profile. A sophisticated expat must conduct a holistic wealth audit before choosing a country. This involves mapping every income source, crypto gains, staking rewards, DeFi yields, stock dividends, rental income, royalties, against the DTTs of potential residency countries with the source countries of that income. The goal is to find the jurisdiction that minimizes the total global tax liability, not just the tax on Bitcoin.

| Feature | Portugal | Malta | Hungary |

| Short-Term Crypto CGT (<1yr) | 28% flat rate | Taxed as income (15-35%) if trading is regular; otherwise may be exempt | 15% flat rate |

| Long-Term Crypto CGT (>1yr) | 0% (tax-exempt) | Generally tax-exempt for casual investors | 15% flat rate |

| Staking/Passive Crypto Income | 28% flat rate | Taxed as income (15-35%) | 15% flat rate |

| Corporate Tax (Effective) | 15-21% (standard rates) | 0-5% for non-resident owners via imputation system | 9% (standard CIT rate) |

| DTT Network Strength | Good (approx. 80 treaties) | Excellent (approx. 80+ treaties) | Good (approx. 80+ treaties) |

| Key Treaty Highlight/Risk | NHR 2.0 regime is now highly restrictive. | Full imputation system is a major advantage for corporate structuring. | Recent termination of US-Hungary treaty highlights network vulnerability. |

2. Choose a Jurisdiction with Friendly Crypto Banks

An often overlooked aspect of expatriation planning is the friendliness of a country’s financial institutions towards digital assets. The global trend of de-risking by traditional banks, where they sever ties with clients or sectors perceived as high-risk, has made crypto a prime target. Many expats have faced the nightmare of having their accounts frozen or closed after receiving a large transfer from a cryptocurrency exchange. Therefore, choosing a jurisdiction with a proven, crypto-compatible banking ecosystem is not just a convenience; it is a prerequisite for success.

The banking landscape for crypto can be categorized into tiers:

2.1 Tier 1: Crypto-Native Banking (Switzerland & Liechtenstein)

These nations represent the gold standard. They are home to fully licensed and regulated banks built from the ground up to service the digital asset industry. Institutions like Sygnum Bank, AMINA Bank (formerly SEBA), Bank Frick, and Kaiser Partner Privatbank offer a seamless bridge between the traditional and digital financial worlds. They provide institutional-grade custody, staking, trading, and asset tokenization services, all under the robust supervision of respected regulators like Switzerland’s FINMA. These banks are designed for high-net-worth individuals, family offices, and crypto businesses that require sophisticated, compliant banking solutions.

2.2 Tier 2: Proactive & Regulated (Malta & UAE)

These jurisdictions have proactively created clear regulatory frameworks that give traditional banks the confidence to engage with the crypto sector. Malta, the original “Blockchain Island,” established the Virtual Financial Assets (VFA) Act, which provides legal certainty for crypto service providers. While direct banking can still be complex, institutions like the Bank of Valletta and Sparkasse Bank are known to be more receptive to crypto-related businesses. The United Arab Emirates, particularly Dubai and and Abu Dhabi, has launched dedicated regulatory bodies like the Virtual Assets Regulatory Authority (VARA) and crypto-focused free zones like the DMCC Crypto Centre. This has attracted major global exchanges such as Bybit, OKX, and Kraken, fostering a vibrant ecosystem where banking relationships are more accessible.

2.3 Tier 3: Mixed & Fintech-Reliant (Portugal)

Despite its favorable tax laws, Portugal’s banking sector remains inconsistent and cautious towards crypto. The central bank has been slow to fully implement MiCA, creating a climate of uncertainty for financial institutions. Anecdotal evidence from expats reveals a lottery-like experience: some users successfully transfer funds from exchanges to banks like Novobanco, Millennium, or Santander, while others have their accounts abruptly closed for the very same activity. Consequently, many crypto expats in Portugal rely heavily on international fintech solutions as a crucial intermediary.

This reliance on fintech is a key part of the modern expat’s toolkit. Global platforms like Revolut and Wirex, along with payment gateways such as Alchemy Pay, operate across Europe and provide a vital bridge between crypto exchanges and the legacy banking system, enabling smoother on-ramping and off-ramping of funds.

There is a direct correlation between a jurisdiction’s regulatory clarity and the willingness of its banks to service the crypto industry. Banks’ primary concerns are regulatory risk and AML/CFT compliance. In countries with vague or non-existent crypto rules, banks view digital asset-related funds as unacceptably high-risk, leading to widespread de-risking. However, in jurisdictions like Liechtenstein with its Blockchain Act, Malta with its VFA Act, or the UAE with VARA, the governments have created specific licensing regimes that impose strict KYC/AML standards on crypto companies themselves. This effectively pre-vets the crypto firms, giving traditional banks the legal framework and confidence needed to accept funds from these licensed entities.

The actionable strategy for any potential expat is to conduct a “banking test” as a core part of their due diligence. Before committing to a residency, one should attempt to open an account with a local bank and inquire specifically about their policy on receiving large transfers from named, regulated exchanges. A vague, hesitant, or negative answer is a major red flag that could render the entire expatriation plan unworkable. The goal should be to secure a reliable banking relationship before finalizing the move.licy on receiving large transfers from named, regulated exchanges. A vague, hesitant, or negative answer is a major red flag that could render the entire expatriation plan unworkable. The goal should be to secure a reliable banking relationship before finalizing the move.

| Tier | Jurisdiction(s) | Key Institutions / Platforms | Ideal For | Core Services |

| Tier 1: Crypto-Native | Switzerland, Liechtenstein | Sygnum Bank, AMINA Bank, Bank Frick, Kaiser Partner Privatbank | HNWIs, Family Offices, Institutional Investors | Integrated Fiat/Crypto Accounts, Custody, Staking, Tokenization, Trading |

| Tier 2: Proactive & Regulated | Malta, UAE | Bank of Valletta, Sparkasse Bank, Major Exchanges (Kraken, Bybit in UAE) | Crypto Startups, Professional Traders | Business Accounts for Licensed Crypto Entities, Exchange On/Off-Ramps |

| Tier 3: Fintech-Reliant | Portugal, etc. | Revolut, Wirex, Alchemy Pay | Individual Investors, Digital Nomads | Fiat Gateway, Multi-Currency Accounts, Crypto-Backed Debit Cards |

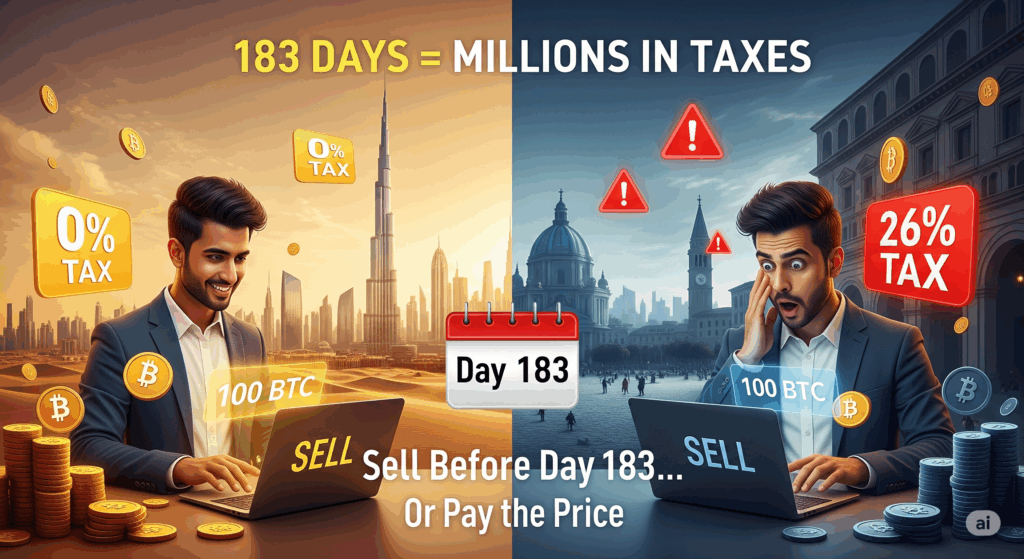

3. Exploit the “180-Day Window” Before Tax Residency Switches

The period before you officially trigger tax residency in a new country, often determined by spending 183 days there in a tax year, is a critical, one-time window of opportunity. It’s a strategic moment where actions can be taken to legally reposition assets and restructure holdings to dramatically reduce future tax liabilities. Failing to exploit this window is akin to leaving a massive amount of money on the table.

This strategy is about temporal arbitrage: the same action, such as selling 100 BTC, can have vastly different tax outcomes depending on whether it’s executed the day before or the day after crossing a residency threshold. For an investor moving from a zero-tax jurisdiction like the UAE to a country with a 26% capital gains tax like Italy, this isn’t a minor detail; it’s the entire game. Selling the BTC while still a UAE tax resident results in zero tax. Selling it one day after becoming an Italian tax resident could trigger a seven-figure tax bill.

The goal of pre-expatriation planning is to arrive in the new country with a “clean slate” from a tax perspective. This involves several key maneuvers:

Strategic Realization of Gains and Losses: Before moving to a country that taxes capital gains, it’s often wise to realize gains while still a resident of your low or no-tax jurisdiction. This allows you to lock in profits tax-free and move to the new country with cash or a re-based asset. Conversely, if moving from a high-tax country that permits tax-loss harvesting (like the US), you should consider realizing losses to offset other gains before you depart. Your new country of residence is unlikely to allow you to carry forward losses that were incurred before you became a resident there.

3.1 The “Step-Up in Basis” on Arrival

This is a powerful but often misunderstood concept. Many countries, when a new resident arrives, will treat their assets as if they were acquired at their Fair Market Value (FMV) on the date of arrival. This is analogous to the “step-up in basis” that occurs upon death in many tax systems. Any appreciation that occurred before the move is effectively wiped clean for the new country’s tax purposes. For example, if you bought Bitcoin at $1,000 and it’s worth $70,000 on the day you become a tax resident of Spain, your cost basis for Spanish tax purposes becomes $70,000. If you sell it a year later for $75,000, you only pay Spanish tax on the $5,000 gain. The hack is to meticulously document this FMV with exchange statements or third-party valuations and declare it correctly to the new tax authority, much like the IRS step-up basis rule for expatriates.

3.2 Proactive Gifting and Estate Planning

The pre-move window is the ideal time to reduce the size of your future taxable estate. For US citizens, this means utilizing the annual gift tax exclusion, which allows for tax-free gifts up to a certain threshold per person per year ($18,000 in 2024, rising to $19,000 in 2025). By gifting assets to children or other family members before moving to a country with a wealth tax or a high inheritance tax, you can legally move those assets out of your name and shield them from future levies.

3.3 Restructuring into Tax-Deferred Vehicles

Before relocating, consider transferring assets into tax-advantaged retirement accounts that will be recognized by your new jurisdiction. For a US expat, this could involve maximizing contributions to a Self-Directed IRA (SDIRA). For a UK expat, it might mean transferring a UK pension into a Qualifying Recognised Overseas Pension Scheme (QROPS) before establishing residency elsewhere, which can offer significant tax and succession planning benefits.

To execute this effectively, a detailed checklist is essential:

Pre-Expatriation Checklist

- Final Tax Return Preparation: Prepare to file all required final or partial-year tax returns in both your old and new countries of residence. For US citizens renouncing their citizenship, this includes the complex IRS Form 8854.

- Tax Residency Audit: Pinpoint the exact date you will cease to be a resident in Country A and become a resident in Country B. Meticulously track and document your physical presence days in all relevant jurisdictions.

- Portfolio-Wide Asset Review: Conduct a full audit of every asset (crypto, stocks, real estate) to identify all unrealized capital gains and losses.

- “Step-Up” Basis Confirmation: Research and confirm whether your target country of residence provides for a step-up in basis for new residents. Determine the specific documentation required (e.g., time-stamped exchange statements, professional appraisals) to prove the Fair Market Value on your date of arrival, akin to the step-up in basis exemption

- Gifting Strategy Execution: Identify potential recipients (family members, trusts) and execute gifts below the annual exclusion threshold to avoid gift tax filings. If you exceed the threshold, ensure you file the necessary forms, such as US Form 709.

- Retirement Account Optimization: Contribute the maximum allowable amount to all available tax-deferred accounts (e.g., IRAs, 401(k)s, SIPPs) before your income status changes.

- Exit Tax Analysis: Critically assess whether your home country imposes an exit tax. Countries like Canada have a “departure tax“ that triggers a deemed disposition of assets, including crypto, upon leaving. Plan for the liquidity needed to pay this tax or explore options for deferral.

4. Use Nomad-Friendly Structures to Retain Optionality

Another advanced expatriation strategy involves separating your crypto portfolio from your personal residency. This is achieved by establishing a legal entity in a premier asset protection jurisdiction to hold your digital assets, while you personally live in a country chosen for its lifestyle benefits and favorable personal tax regime. This layered structure creates a vital firewall, offering flexibility and security unmatched by a single-jurisdiction approach.

The core of this strategy involves a two-part structure:

- The Asset Holding Entity: A legal structure established in a jurisdiction renowned for its robust asset protection laws, financial privacy, and beneficial corporate tax environment—such as the Cook Islands, Nevis, or Cayman Islands, where offshore companies or trusts can legally hold cryptocurrency under strong AML/CFT standards.

- The Personal Residency: The country where the individual and their family physically reside, selected for quality of life, strong schools, healthcare, and a low or zero personal income tax on foreign-sourced income.

Escape the trap. Own your freedom. Start Expatriating today.

Several powerful options exist for the asset holding entity:

4.1 The Wyoming LLC (for Non-US Residents)

Wyoming has deliberately positioned itself as a haven for digital asset holders. For non-US persons, a Wyoming LLC offers a formidable combination of benefits. It provides exceptional privacy, as member or manager names are not publicly disclosed. It boasts some of the strongest charging order protection in the US, meaning a personal creditor of a member cannot seize the LLC’s assets (including its crypto); they can only obtain a lien on distributions, which the LLC cannot be forced to make. Furthermore, Wyoming levies no state income or franchise tax and has passed legislation that legally recognizes cryptocurrencies as property, providing clear legal status for digital assets. An investor can form a Wyoming LLC to hold their crypto portfolio, creating a distinct legal separation between their personal and “business” assets.

4.2 The Panama Private Interest Foundation (PPIF)

A Panama Foundation is an even more robust structure for asset protection because it is legally “ownerless.” When assets are transferred to the foundation, they no longer belong to the founder; they belong to the foundation itself, managed by a Foundation Council according to the founder’s wishes detailed in the charter. This creates an almost impenetrable shield against personal creditors. Panama offers strict confidentiality (founder and beneficiaries are not named in public records), a territorial tax system (income generated outside Panama is not taxed), and a swift, non-bureaucratic setup process that does not require a specific crypto license. This makes it an ideal “legal wrapper” for a large private crypto treasury or a Decentralized Autonomous Organization (DAO).

4.3 The Liechtenstein Foundation or Trust

This is the premier, top-tier option for ultimate security and control. Liechtenstein combines extreme confidentiality with a sophisticated legal framework. Its foundation law allows for the appointment of a “Protector,” an independent party empowered to oversee the foundation’s board, approve major transactions, and ensure the founder’s original intent is followed. This provides a crucial layer of checks and balances. Crucially, Liechtenstein was the first country to enact a comprehensive legal framework for digital assets, the Token and Trustworthy Technology Service Provider Act (TVTG), also known as the Blockchain Act. This provides unparalleled legal certainty for holding, transferring, and managing crypto assets within a regulated structure.

By combining these structures, an investor can achieve true optionality. For example, they could establish a Panama Foundation to hold their main crypto portfolio. They then establish personal residency for themselves and their family in Portugal to enjoy the lifestyle and tax benefits for long-term holdings. Their crypto assets are now governed by the laws of Panama, not Portugal. This decouples personal risk from asset risk. If Portugal’s tax laws change for the worse, or if the individual faces a personal lawsuit in Europe, the assets held within the Panamanian foundation are shielded.

This structure transforms the expat from a passive resident of a single country into an agile, multi-jurisdictional operator. It creates an optionality engine. If the country of personal residence becomes politically unstable or fiscally undesirable, the expat can relocate to another country without the monumental logistical and tax headache of moving their entire asset base. The wealth structure remains stable and protected within its jurisdictional fortress, while the individual remains nimble and mobile. This is the essence of being a true global nomad in the 21st century.

5. Find “Layer 2” Friendly Jurisdictions

In 2025, the most forward-thinking expatriation strategy extends beyond mere tax avoidance. It involves relocating to jurisdictions that are not just passively tolerant of crypto, but are actively building the future of the digital economy. These “Layer 2” friendly nations, so-called because they are building on top of the foundational blockchain layer, offer strategic advantages that can far outweigh a few percentage points saved on taxes. They provide access to project opportunities, government support, a thriving ecosystem of talent, and a seat at the table where the future of Web3 is being shaped.

This approach is about seeking positive arbitrage. While most tax planning focuses on avoiding negative outcomes like taxes and liability, this hack is about positioning oneself to capture positive opportunities: deal flow, grants, network effects, and early access to innovation.

Key indicators of a “Layer 2” friendly jurisdiction include:

5.1 Government-Backed Regulatory Sandboxes

The most innovative governments understand that outdated legal frameworks can stifle progress. They create “regulatory sandboxes,” which are controlled environments allowing innovators to test new products and services—including those based on blockchain and crypto—with temporarily relaxed regulations. Being present in a country with an active sandbox provides a unique opportunity to engage with regulators and get a first look at emerging technologies.

- European Union: In 2023, the European Commission launched the European Blockchain Regulatory Sandbox to support 20 innovative projects annually, fostering dialogue between developers and regulators.

- United Kingdom: The Financial Conduct Authority (FCA) has run multiple cohorts of its influential regulatory sandbox, accepting numerous crypto and DLT firms to test their models in a live environment.

- United States (State Level): North Carolina’s Regulatory Sandbox program, launched in 2021, explicitly targets FinTech and InsurTech innovators using emerging technologies like blockchain and smart contracts.

- Ireland: The Central Bank of Ireland’s Innovation Sandbox Programme has a thematic focus. Its first cohort centered on “Combatting Financial Crime,” opening the door for blockchain-based identity verification and transaction security solutions.

5.2 Strategic Grants and National Initiatives

Some nations are putting their money where their mouth is, offering direct financial incentives and building state-sponsored ecosystems to attract crypto talent and capital.

- Thailand: In a bold move to become a regional digital hub, the Thai government recently approved a five-year personal tax exemption on profits from digital asset sales, effective from 2025 to 2029. The stated goal is to stimulate the domestic digital asset ecosystem and attract over $30 million in investment.

- United Arab Emirates (Dubai): The Dubai Multi Commodities Centre (DMCC) Crypto Centre is a prime example of a government-backed ecosystem. It offers crypto businesses licensing, co-working spaces, networking events, and access to a talent pool, all within a tax-efficient free zone.

Choosing to relocate to a jurisdiction like Dubai, or a city within the EU with a strong sandbox program, is an offensive strategy. An investor might pay some tax, but they gain invaluable access to a network of builders, the ability to apply for government innovation grants, and the chance to get involved with new protocols at the ground floor. The potential financial and strategic upside from these ecosystem benefits can easily surpass the tax savings of isolating oneself in a passive tax haven.

This approach is also a form of future-proofing. As the digital asset industry matures, talent and capital will inevitably concentrate in these supportive regulatory hubs. Jurisdictions that are merely tax-neutral today may become hostile tomorrow, whereas those actively investing in the Web3 infrastructure are demonstrating a long-term commitment. Being physically present in one of these emerging centers provides a durable, strategic advantage that will compound over time, making it a far more resilient choice for the long-term crypto expat.

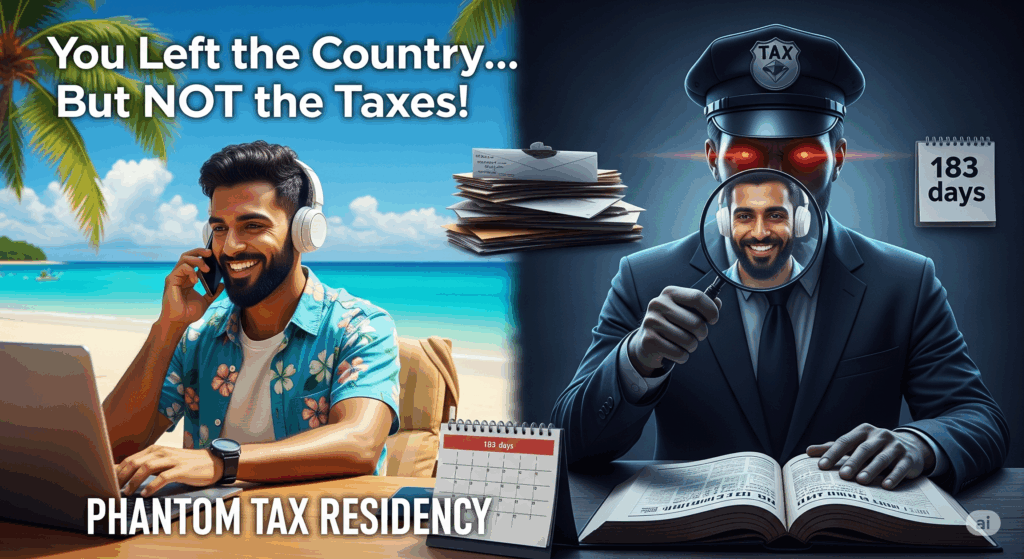

6. Watch Out for “Phantom Tax Residency”

Physically leaving a country is not the same as legally severing your tax obligations to it. One of the most perilous and expensive traps for a new crypto Physically leaving a country is not the same as legally severing your tax obligations. One of the most perilous and expensive traps for a new crypto expat is the concept of “phantom tax residency” or “trailing liability.” Many high-tax nations have designed their tax systems to be “sticky,” employing a web of rules that can allow them to continue claiming taxing rights over your worldwide income and assets long after you’ve departed. Ignoring these rules can lead to devastating financial consequences years down the line.

Tax residency isn’t determined solely by a simple day count. While the “183-day rule” is a common benchmark, it’s often just one of several tests tax authorities use. They also look at qualitative factors like your “center of vital interests” (foyer fiscal in France), your “habitual abode,” and the location of your significant economic and personal ties. If you retain strong connections to your former country, it may deem you a tax resident and subject your global crypto gains to its tax regime.

Several countries are particularly aggressive in this regard:

6.1 Canada

Imposes a formidable “departure tax” upon emigration. Under the Income Tax Act, when you cease to be a Canadian resident, you are deemed to have sold most of your property, including all your cryptocurrency holdings, at its Fair Market Value on the day you leave. This forces an immediate realization of all unrealized capital gains, creating a potentially massive tax liability even though no actual sale has occurred. While you can elect to defer payment of this tax, it often requires posting adequate security with the Canada Revenue Agency (CRA).

6.2 France

The concept of the foyer fiscal (household) is paramount. If your spouse and children remain in France, the French tax authorities will almost certainly consider France to be your center of vital interests and tax you as a resident on your worldwide income, regardless of how many days you spend abroad.

6.3 Italy

If an Italian citizen relocates to a jurisdiction that Italy considers a “tax haven” (as per its blacklist), the burden of proof is reversed. The Italian tax authorities will presume you are still an Italian tax resident unless you can provide irrefutable evidence to the contrary. Furthermore, Italy imposes a 0.2% annual wealth tax (IVAFE) on foreign-held financial assets, including crypto held in foreign exchanges or self-custody wallets, for its tax residents. Simply leaving does not automatically extinguish this liability.

6.4 United Kingdom

The UK employs an “inheritance tax tail.” If you were a long-term UK resident, your entire worldwide estate can remain subject to the UK’s 40% inheritance tax for a period of up to 10 years after you have become non-resident.

6.5 United States

The US represents the most extreme case with its system of citizenship-based taxation. A US citizen is liable for US tax on their worldwide income, no matter where they live in the world. The only way to sever this lifelong tax obligation is to formally renounce US citizenship, a complex and costly process that can itself trigger a severe “exit tax” on your net worth and unrealized gains. Learn about the US expatriation exit tax.

The modern tax system is designed to prevent capital flight. It is easy to become a tax resident but can be procedurally complex and difficult to cease being one. The only effective counter-strategy is to engineer a deliberate and demonstrable “clean break.” This is not merely a physical move; it is a comprehensive legal and administrative process. It involves selling your primary residence, closing local bank accounts, terminating club memberships, surrendering your driver’s license, formally notifying the tax authorities of your departure date, and meticulously filing a final tax return that declares your change in status. It means building an unassailable case that your center of life has fundamentally and permanently shifted, leaving no ambiguity for a tax authority to exploit in the future.

| Country | Sticky rule / exit tax mechanism | Key thresholds & scope | Typical risk to crypto investors | Practical mitigation |

|---|---|---|---|---|

| Canada | Departure tax – deemed disposition of most property (including crypto) at Fair-Market Value on the day you cease residence (canada.ca, globallawexperts.com) | Immediate capital-gains liability; payment may be deferred only if adequate security posted to CRA (canada.ca) | Six-figure (or higher) paper gain taxed without cash realisation | Obtain third-party FMV valuations; elect to defer and post security or liquidate a portion of portfolio before exit |

| France | “Centre of vital interests” (foyer fiscal): if spouse / children or main home remain, France still taxes worldwide income (impots.gouv.fr, taxsummaries.pwc.com) | Qualitative ties outweigh day-count; no fixed monetary threshold | Crypto gains earned abroad taxed as if you never left | Break residential ties (move family, close French bank accounts); secure tax non-residence ruling before departure |

| Italy | 1) Blacklist presumption: burden of proof on emigrant if destination is on Italian “tax-haven” list (mqrassociati.com, outboundinvestment.com) 2) IVAFE wealth tax: 0.2 % p.a. on foreign financial assets, doubled to 0.4 % for assets in black-listed states (stripe.com, taxing.it) | Applies even to self-custody wallets and exchange accounts; proof required that you are genuinely non-resident | Ongoing annual tax plus fines if residency rebuttal fails | Avoid black-listed destinations; keep < 183 days; compile contemporaneous evidence (lease, utility bills, school records) to rebut presumption; consider inbound “new-resident” flat-tax regime instead |

| United Kingdom | Inheritance-tax tail: worldwide estate remains within 40 % IHT for 3–10 years after becoming non-resident (10 yrs for long-term residents) (taxadvisermagazine.com, gov.uk) | Applies if UK-resident ≥10/20 years before departure | Unexpected 40 % hit on crypto held in hardware wallets or foreign entities at death within tail period | Move assets into non-UK discretionary trust before exit; buy life cover to fund liability; monitor residence day-count to stop the tail running afresh |

| United States | Citizenship-based taxation (lifelong) plus Exit tax on “covered expatriates”: net worth > $2 m or average tax liability >≈ $200 k (indexed) triggers mark-to-market on all property, incl. crypto (irs.gov, dimovtax.com) | Unrealised gains deemed sold; Form 8854 filing mandatory; $10 k penalty for non-filing | Seven-figure tax on paper gains; continued annual FBAR / FATCA filings if not compliant | Pre-plan to drop below $2 m threshold (gifts, trusts); crystallise gains while below threshold; file Form 8854 completely and on time |

7. Optimize for Family, Not Just Yourself

A focus solely on a tax spreadsheet can quickly unravel if it ignores crucial family-centric factors like quality of education, access to healthcare, and the legal status of dependents. Overlooking these elements can lead to a failed and costly relocation, no matter how attractive the tax benefits may seem.

The “Return on Investment” for an expatriation must be measured not just in tax savings, but in “Lifestyle ROI.” A 10% lower tax rate becomes a net negative if your family is unhappy, your children’s educational prospects are diminished, or you face anxiety over inadequate healthcare. A jurisdiction like Malta, which boasts a top-5 global healthcare system and a robust network of English-speaking international schools, might offer a far higher overall ROI than a zero-tax Caribbean island with limited infrastructure.

Sophisticated crypto expats should prioritize jurisdictions that cater to families through their investment migration programs and social infrastructure:

7.1 Family-Inclusive Residency and Citizenship Programs

Many investment migration programs are explicitly designed to accommodate entire families, providing a streamlined path to legal status for all members.

- European Golden Visas: Programs in Portugal, Malta, and Greece typically allow the main applicant to include their spouse, minor children, and financially dependent adult children (often up to age 26 if they are unmarried and enrolled in full-time education), as well as dependent parents. Italy’s program is known for being particularly flexible, often allowing the inclusion of a spouse and dependents without requiring additional financial contributions.

- Caribbean Citizenship by Investment (CBI): The CBI programs in countries like Antigua & Barbuda, St. Kitts & Nevis, Grenada, and Dominica are among the most accommodating in the world. They frequently permit the inclusion of spouses, dependent children up to age 30, dependent parents over a certain age (e.g., 55 or 65), and in some cases, even unmarried siblings of the main applicant.

7.2 Education as a Key Criterion

For families with children, the availability and quality of international schools is a non-negotiable factor. Jurisdictions with a strong offering in this area are highly desirable.

- European Hubs: Portugal, Malta, and Spain are home to numerous well-regarded international schools offering International Baccalaureate (IB), British, or American curricula. Malta’s English-based national education system is an additional advantage.

- Premier Destinations: Switzerland and the UAE offer world-class international schooling options, albeit expensive, making them top choices for ultra-high-net-worth families.

7.3 Crypto-Compatible Healthcare Strategy

Standard travel insurance is insufficient for long-term residency. Expats require comprehensive international health insurance plans from global providers like GeoBlue or Mondialcare. The “hack” here is not that insurers will accept premium payments in Bitcoin. Rather, a crypto-compatible healthcare strategy involves choosing a country with both excellent medical facilities and a crypto-friendly banking system (as per Hack #2). This ensures that you can reliably and efficiently convert crypto to fiat to pay for insurance premiums and any out-of-pocket medical expenses, creating a seamless link between your digital wealth and your family’s physical well-being.

7.4 Advanced Hack: The Dependent-Led Investment

A lesser-known strategy involves having a dependent, such as an adult child or a spouse, act as the main applicant for a residency or citizenship by investment program. This can secure residency for the entire family, including the primary crypto wealth holder. This approach can offer strategic advantages, for instance, if the main investor wishes to maintain a different personal tax residency for a period while ensuring the family is comfortably and legally settled in a desirable long-term location.

For the ultra-wealthy, this leads to the “Anchor Strategy,” where multiple residency anchors are established. The family’s primary home base and lifestyle anchor might be in a country like Portugal for its schools and quality of life. The main crypto investor could maintain a separate tax residency in a zero-tax jurisdiction like the UAE, traveling between locations. Meanwhile, the core assets are held in a third jurisdiction within a protective foundation or trust structure (Hack #4). This multi-polar approach allows a family to optimize for every critical variable simultaneously: lifestyle, personal taxation, and asset protection.

8. Use Crypto-Focused Citizenship by Investment (CBI) Programs

While direct payment of government contributions in crypto remains rare, the formal acceptance of crypto assets as a valid source of funds for due diligence purposes opens the door for crypto-millionaires to access these elite programs.

This represents a powerful legitimacy signal for the entire asset class. When a sovereign state, with its rigorous national security and financial crime vetting processes, formally creates a pathway to vet and accept wealth derived from digital assets, it provides a “stamp of approval” that can be invaluable. An investor who successfully passes this government-level crypto due diligence now possesses a powerful testament to the legitimacy of their funds, which can be used to placate skeptical banks or other counterparties in the future.

Three Caribbean nations stand at the forefront of this trend:

- Vanuatu: This Pacific nation offers the most direct crypto-CBI option available today. The Vanuatu Citizenship by Investment Program explicitly accepts direct payments in major cryptocurrencies, including Bitcoin (BTC), Tether (USDT), Ethereum (ETH), and Bitcoin Cash (BCH), for its donation-based route to citizenship. This eliminates the need for a traditional banking intermediary for the investment itself. The investment amount is fixed in USD (starting at $130,000 for a single applicant), so the required crypto amount fluctuates with the market. Vanuatu conducts enhanced due diligence on crypto applicants to ensure compliance.

- Antigua and Barbuda: A pioneer in this space, Antigua and Barbuda was one of the first CBI jurisdictions to formally acknowledge cryptocurrency as a legitimate source of funds. Applicants cannot pay the government donation or real estate investment directly in crypto; they must first convert their digital assets to fiat currency. However, the Citizenship by Investment Unit (CIU) has established procedures to verify the origin of crypto-derived wealth. Applicants should be prepared for detailed documentation requests regarding their trading history and wallet addresses, and may face an additional processing fee for using crypto-sourced funds.

- St. Kitts and Nevis: In a significant policy update in March 2025, the St. Kitts and Nevis CIU announced that it now accepts cryptocurrency as a partial source of wealth for its CBI applicants. This move aligns the program with modern financial realities. Similar to Antigua, it requires conversion to fiat before the investment is made and involves higher due diligence fees and extensive documentation to prove the origin, value, and ownership of the digital assets.

8.1 The Stablecoin Advantage Hack

For programs that require conversion to fiat (Antigua, St. Kitts) or even for direct payment (Vanuatu), using stablecoins like USDT or USDC is a savvy move. Paying a large, fixed-USD investment with a volatile asset like Bitcoin introduces significant market risk; a price drop between initiating the transfer and its confirmation could require the applicant to send more funds. Using stablecoins eliminates this volatility, locking in the value and removing a major variable from the already complex and high-stakes CBI application process.

This new frontier of crypto-focused CBI programs carries a critical implication: for the crypto investor, their on-chain history is their new financial statement. A clean, transparent, and well-documented history of transactions conducted on reputable, non-sanctioned platforms and DeFi protocols is now a prerequisite for accessing these elite mobility tools. Any history involving mixers, privacy coins, or transactions linked to sanctioned entities will almost certainly result in a swift rejection. On-chain hygiene is no longer just a security best practice; it is a vital component of international wealth mobility.

| Country | Minimum Investment (Donation) | Cryptocurrency Policy | Key Family Inclusion | Processing Time | Visa-Free Access (Approx.) |

| Vanuatu | $130,000 (single) | Direct payment in BTC, ETH, USDT, BCH accepted | Spouse, children <25, parents >65 | 1-2 Months | 94+ Countries |

| Antigua & Barbuda | $100,000 (single) | Accepted as source of funds; must convert to fiat for investment | Spouse, children <30, parents >55, siblings | 8-10 Months | 150+ Countries |

| St. Kitts & Nevis | $250,000 (single) | Accepted as partial source of wealth; must convert to fiat | Spouse, children <25, parents >65 | 3-6 Months | 150+ Countries |

9. Don’t Forget Regulatory Reputation in 2025

Choosing an expatriation destination based on low taxes or secrecy without scrutinizing its international regulatory reputation is a critical and potentially catastrophic error. In the interconnected financial world of 2025, a country’s standing with global watchdogs like the Financial Action Task Force (FATF) and the OECD is paramount. A jurisdiction that is “grey-listed” or “blacklisted” can quickly become a financial prison, making it nearly impossible for its residents to move money, open bank accounts, or conduct business internationally.

The negative effects of a country’s poor regulatory standing are not confined to its government or local banks; they create a “contagion effect” that directly taints every resident and business within its borders. A crypto investor residing in a grey-listed country may find their personal account at a major Swiss bank frozen, not because of their own actions, but simply because their address is in a jurisdiction now flagged as high-risk. The reputational risk of the country is transferred directly to the individual.

Two lists, in particular, must be on every crypto expat’s radar:

9.1 The FATF “Grey List”

Officially known as “Jurisdictions under Increased Monitoring,” the grey list identifies countries with strategic deficiencies in their Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) regimes. While it is not a formal sanction, it acts as a global warning to financial institutions.

- Consequences: Banks worldwide are required to apply enhanced due diligence to transactions originating from or connected to grey-listed countries. This translates into significant delays, invasive questions about the source of funds, higher transaction costs, and, most dangerously, “de-risking“—where major international banks sever correspondent banking relationships entirely to avoid compliance headaches. For a resident, this can mean being effectively cut off from the global financial system.

- As of June 2025, this list includes countries such as Bulgaria, South Africa, Vietnam, and recent additions like Bolivia and the British Virgin Islands (UK).

9.2 The EU List of Non-Cooperative Jurisdictions for Tax Purposes

Often called the “EU blacklist,” this list targets jurisdictions that fail to meet the EU’s standards on tax transparency, fair taxation, and the implementation of the OECD’s anti-Base Erosion and Profit Shifting (BEPS) measures.

- Consequences: EU member states are mandated to apply defensive tax measures against blacklisted countries. These can include denying the deductibility of payments made to entities in those jurisdictions, imposing higher withholding taxes on dividends, interest, and royalties, and applying stricter Controlled Foreign Company (CFC) rules.

- As of February 2025, this list includes jurisdictions such as Panama, the Russian Federation, and Vanuatu.

9.3 The Hack: Seek “Regulatory Neutrality,” Not Opacity

The intelligent strategy is not to seek out opaque, unregulated havens that are at high risk of being listed. Instead, the goal is to choose a jurisdiction with “regulatory neutrality“—one that is well-regulated, transparent, and has a long-standing record of cooperation with international bodies. Countries like Switzerland, Malta, and Liechtenstein, while having robust regulatory frameworks, offer long-term stability and unimpeded access to global banking. This stability is far more valuable than the fleeting benefits of an opaque jurisdiction on the brink of being blacklisted.

Sophisticated expats should engage in predictive analysis. This involves monitoring the public Mutual Evaluation Reports (MERs) published by the FATF for countries under consideration. A report that flags multiple “Non-Compliant” or “Partially Compliant” ratings is a strong leading indicator that a country is at high risk of being grey-listed in the near future. Choosing a jurisdiction with a clean bill of health from the FATF is a proactive way to de-risk your future.

| Regulatory List | Focus Area | Key Consequence for Crypto Expat | Example Jurisdictions (2025) |

| FATF Grey List | Anti-Money Laundering & Counter-Terrorist Financing (AML/CFT) | Banking & Transactional Difficulty: Frozen accounts, transaction delays, de-risking by international banks. | Bulgaria, South Africa, British Virgin Islands (UK), Vietnam |

| EU List of Non-Cooperative Jurisdictions | Tax Governance (Transparency, Fair Taxation, Anti-BEPS) | Adverse Tax Consequences: Higher withholding taxes, non-deductibility of payments, stricter CFC rules for corporate structures. | Panama, Russian Federation, Vanuatu, US Virgin Islands |

10. Combine Residency With Global Tax Deferral Vehicles

The pinnacle of crypto wealth structuring involves a multi-layered approach that goes beyond simply choosing a country of residence. It combines a favorable personal residency with powerful, legally recognized vehicles for tax deferral and asset protection. This strategy creates a financial fortress around your assets, optimized for tax-efficient growth, generational wealth transfer, and protection from unforeseen liabilities. It solves what can be seen as the “three-body problem” of the global crypto wealthy: taxation, liability, and growth.

This approach represents a fundamental mindset shift: from a model of direct ownership to a model of indirect control. Through a well-designed combination of companies, trusts, and retirement wrappers, an individual can legally relinquish direct ownership of their assets—and the associated tax and liability burdens—while retaining beneficial interest and strategic oversight.

Here is how the layers are constructed:

10.1 Layer 1: The Offshore Holding Company (Taxation Shield)

The foundation of the structure is often an offshore company, established in a jurisdiction with a zero or very low corporate tax rate, such as the British Virgin Islands (BVI), the Cayman Islands, or Cyprus. The crypto assets are held by this company, not the individual. This means that gains from trading or selling the crypto accrue within the company and are not immediately subject to personal income or capital gains tax in the individual’s country of residence. This layer effectively solves the immediate taxation problem.

10.2 Layer 2: The Irrevocable Trust (Liability Shield)

For ultimate asset protection and estate planning, the shares of the offshore holding company are then transferred into an irrevocable trust. This is a critical step. Once the shares are in the trust, they are no longer legally owned by the individual; they are owned by the trustee for the benefit of the designated beneficiaries. This move accomplishes two things:

- Asset Protection: The assets are shielded from the founder’s future personal creditors, divorces, or lawsuits. A creditor with a judgment against the individual cannot seize the assets belonging to the trust.

- Estate Planning: The assets are removed from the individual’s personal estate, bypassing probate and potentially eliminating future inheritance or estate taxes.

Top-tier jurisdictions for establishing such trusts include certain US states like Wyoming and Delaware, or renowned offshore centers like the Cook Islands, Nevis, and Belize, which have strong asset protection trust laws. It is important to note that gifting assets to an irrevocable trust is a taxable event that typically uses up a portion of one’s lifetime gift and estate tax exemption. Furthermore, the trust usually receives the assets with a “carryover basis,” meaning it inherits the original low cost basis of the crypto, forgoing a step-up in basis upon the founder’s death. This creates a trade-off between saving on estate tax versus paying higher capital gains tax upon a future sale by the trust.

10.3 Layer 3: The Retirement Wrapper (Tax-Advantaged Growth)

For a portion of their wealth, expats from certain countries can utilize specialized retirement accounts to achieve tax-deferred or entirely tax-free growth.

- Self-Directed IRA (SDIRA) for US Expats: An SDIRA is a type of Individual Retirement Account that permits investment in alternative assets, including physical cryptocurrency. In a Traditional SDIRA, gains grow tax-deferred and are taxed as income upon withdrawal in retirement. In a Roth SDIRA, contributions are made with post-tax dollars, but all future growth and qualified withdrawals are completely tax-free. The IRS imposes strict rules, including annual contribution limits ($7,000 for 2025), and prohibitions against self-dealing.

- QROPS for UK Expats: A Qualifying Recognised Overseas Pension Scheme (QROPS) allows individuals who have left the UK to transfer their UK-based pensions to an overseas scheme, often in a more favorable jurisdiction like Malta or Gibraltar. This can provide greater investment flexibility, choice of currency, and more advantageous inheritance tax treatment compared to leaving the pension in the UK. The rules are complex, and recent changes effective April 2025 have tightened regulations, generally requiring the QROPS to be located in the expat’s new country of residence to avoid a 25% overseas transfer charge.

By strategically combining these layers, the sophisticated crypto expat builds a comprehensive structure that addresses every key challenge simultaneously, achieving a level of security and efficiency that a single-jurisdiction strategy cannot replicate.

Final Tips: How to Build Your Own Crypto Expat Plan

Navigating the complexities of global crypto expatriation requires more than just good ideas; it demands a concrete, actionable plan. The strategies outlined above provide a framework for sophisticated planning, but turning them into reality requires personalized execution. Here are the final steps to begin building your own bespoke plan.

First, recognize that this is not a DIY project. The stakes are too high, and the interplay between international tax law, corporate structuring, and financial regulation is too complex for a generalized approach. The first step is a professional assessment of your unique situation.

To help you get started, we have compiled a practical checklist that summarizes the key action points from the 10 hacks discussed in this report. This toolkit is designed to help you organize your thoughts and prepare for a productive discussion with a qualified advisor.

➡️ Download your free “Crypto Expat Toolkit 2025” here.

Once you have reviewed the toolkit, the next step is to get personalized feedback. A brief strategic consultation can help identify the most critical risks and opportunities in your profile, pointing you toward the most effective structures and jurisdictions for your specific goals.

Your journey to financial sovereignty and a truly global lifestyle begins with a single, informed step. The landscape has changed, but for those who are prepared, the opportunities are greater than ever.

FAQ

Can I be taxed even after I leave my country?

Yes, absolutely. Physically leaving a country does not guarantee the end of your tax obligations. Many jurisdictions implement “exit taxes” or “trailing liability” rules to prevent tax base erosion:

- Canada imposes a “departure tax”: residents are deemed to have sold most assets, including cryptocurrency, at fair-market value upon departure—triggering capital gains tax on unrealised appreciation

- The United Kingdom enforces an “inheritance tax tail”, keeping worldwide assets liable to UK inheritance tax for up to 10 years after non-residency.

- The United States taxes its citizens on worldwide income regardless of residence. Terminating that obligation generally requires formal renunciation, which can itself trigger a significant exit tax.

In short, ceasing to be a tax resident requires official legal and administrative actions, you must demonstrably sever ties with your former country.

Are stablecoins safer than BTC when expatriating?

This question has a nuanced answer that depends on whether you are assessing market risk or regulatory risk.

From a market risk perspective, yes. When making a large, time-sensitive payment for a Citizenship by Investment program or a real estate purchase, using a stablecoin like USDC or USDT eliminates the price volatility risk associated with Bitcoin or Ethereum. This prevents a scenario where the market value of your payment drops between initiation and settlement, forcing you to top up the funds.

From a regulatory risk perspective, not necessarily. Under the EU’s MiCA regulation, stablecoins (classified as Asset-Referenced Tokens or E-Money Tokens) are subject to more stringent and specific regulations than other crypto-assets. These rules include strict requirements for reserves, governance, and licensing for issuers. In response to these heightened compliance demands, some major exchanges have proactively delisted certain stablecoins for their European users to avoid falling foul of the new regulations. Therefore, while stablecoins offer price stability, they carry a unique and evolving regulatory risk that investors must monitor closely.

What countries accept crypto as investment for residency?

Several countries have started to formally integrate cryptocurrency into their residency and citizenship by investment programs, though the methods of acceptance vary.

Vanuatu is the most direct, as its Citizenship by Investment program explicitly accepts payments made in cryptocurrencies like Bitcoin (BTC) and Tether (USDT) for its government donation option.

Antigua and Barbuda and St. Kitts and Nevis both officially accept cryptocurrency as a valid source of funds for their CBI programs. This means you can use your crypto wealth to qualify, but you must convert the assets to a fiat currency (like USD) before making the final investment contribution. These applications typically involve enhanced due diligence and additional fees.

El Salvador stands in a unique category, as it has adopted Bitcoin as legal tender. While this doesn’t constitute a traditional investment migration program, it creates a highly crypto-friendly environment for those looking to establish residency.

Conclusion – The Crypto Expat Mindset in 2025

The journey of the crypto expat has evolved from a simple sprint toward a zero-tax jurisdiction into a sophisticated, multi-stage marathon of global strategic positioning. The era of operating in the shadows is definitively over, replaced by a new landscape defined by transparency and regulation. The implementation of MiCA, DAC8, and CARF has created an interconnected global system where financial information flows freely between tax authorities. In this new world, the old tactics are not just obsolete; they are a liability.

However, this new paradigm does not signal the end of opportunity. Instead, it demands a more evolved approach—the “multi-jurisdictional mindset.” The successful crypto expat of 2025 is not a resident of a single country but a strategic operator who intelligently leverages the distinct advantages of multiple jurisdictions: one for personal residency and lifestyle, another for banking and financial access, and a third for robust asset protection. This is not about finding a single perfect country, but about building a personal, resilient ecosystem of legal and financial structures.

In this framework, mobility itself becomes the ultimate asset. The freedom to move is no longer a one-time escape from a high-tax country, but a continuous strategic lever. It provides the optionality to adapt to a constantly shifting global landscape, whether that means responding to new tax laws, seizing emerging investment opportunities in innovation hubs, or simply enhancing one’s quality of life.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

Ultimately, the most profound shift is the recognition that in a transparent world, compliance is the new alpha. The greatest and most durable returns will no longer be found by attempting to hide, but by expertly navigating the regulated system. The winning strategies will involve sophisticated legal and financial engineering—using treaties, trusts, foundations, and other compliant vehicles to optimize tax, protect assets, and ensure seamless generational wealth transfer. This requires foresight, diligence, and expert guidance.

The hacks and strategies detailed in this report are designed to illuminate this new path. They are a starting point for a deeper conversation and a more personalized plan. They are not, and cannot be, a substitute for bespoke, professional legal and tax advice tailored to your unique financial situation, family needs, and long-term ambitions.