Singapore Beckons: A Crypto Investor’s Guide to the Lion City

Singapore, a global economic powerhouse renowned for its stability, innovation, and world-class infrastructure, is increasingly capturing the attention of international investors, including those navigating the dynamic world of cryptocurrencies. Its blend of a sophisticated financial ecosystem, clear regulatory frameworks, and attractive tax policies presents a compelling case. However, relocating to this vibrant city-state requires careful consideration, particularly regarding immigration pathways, the cost of living, and the specific nuances of its digital asset landscape. This report provides a comprehensive overview for crypto investors contemplating a move to Singapore.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

1.1. Charting the Course: Immigration Pathways

For high-net-worth individuals and entrepreneurs, Singapore offers several routes to residency, though their direct applicability for those whose wealth is primarily in crypto assets requires scrutiny.

1.1.1. The Global Investor Programme (GIP)

The GIP stands as Singapore’s premier residency-by-investment scheme, offering Permanent Residence (PR) status to eligible global investors aiming to drive business and investment growth from Singapore. Administered by the Economic Development Board (EDB), it specifically targets experienced entrepreneurs, business owners, and family office principals.

The GIP caters to several distinct eligibility profiles. Established Business Owners must demonstrate at least three years of entrepreneurial track record and run a company with an annual turnover of S$200 million or more. Next-Generation Business Owners qualify if their family controls a company with an annual turnover of at least S$500 million. Founders of Fast-Growth Companies are eligible if they founded a company valued at S$500 million or more, backed by reputable VC/PE firms. Lastly, Family Office Principals need a minimum of five years of relevant experience (entrepreneurial, investment, or management) and possess Net Investible Assets (NIA) of at least S$200 million.

Applicants must select one of three investment options. Option A involves investing at least S$10 million in a new or existing Singapore business operation, requiring a detailed 5-year business plan and holding a minimum 30% shareholding. Option B requires an investment of S$25 million into a GIP-select fund that invests in Singapore-based companies. Option C entails establishing a Singapore-based Single-Family Office (SFO) with at least S$200 million in Assets Under Management (AUM), deploying a minimum of S$50 million locally into specific, EDB-approved investments.

A critical point regarding crypto asset considerations is how digital assets align with the GIP framework. For Family Office Principals under Option C, the official definition of Net Investible Assets (NIA) includes traditional financial assets like bank deposits and capital market products but explicitly excludes real estate. Notably, cryptocurrencies are not explicitly mentioned as included NIA. While Singapore has reportedly accepted crypto as proof of assets for residency in some instances, the GIP factsheet’s definition seems focused on traditional finance. Furthermore, the qualifying investments specified by the EDB for Option C (Family Office) encompass listed equities, qualifying debt securities, specific funds, and private equity into non-listed Singapore companies. Direct cryptocurrency investments or crypto funds are absent from this list. This apparent exclusion poses a significant hurdle for investors whose wealth is predominantly in digital assets, particularly for the Family Office option. Seeking direct clarification from the EDB is highly recommended.

Several other key GIP factors warrant attention. Dependants, specifically spouses and unmarried children under 21, can apply for PR alongside the main applicant, while parents and older children may apply for a Long Term Visit Pass (LTVP). A major consideration for families is National Service (NS); male children granted PR under GIP are liable for NS, a mandatory two-year military service. Non-compliance can lead to severe consequences, including potential bans from Singapore. It’s important to note that meeting the criteria does not guarantee approval, as the process is discretionary. The typical timeline for processing is 9-12 months. PR status requires renewal via a Re-Entry Permit (REP) every 3-5 years, subject to meeting specific conditions. Citizenship is a possibility after approximately two years of PR, but Singapore does not permit dual citizenship, requiring renunciation of the original nationality.

1.1.2. The EntrePass Scheme

The EntrePass scheme provides a pathway for entrepreneurs aiming to establish an innovative, venture-backed, or technology-focused business in Singapore, potentially leading to PR.

Regarding eligibility, applicants must intend to start, or have recently started (within the last 6 or 12 months), a private limited company registered in Singapore, holding at least 30% of the shares. The business itself must satisfy at least one innovative criterion. These criteria include receiving at least S$100,000 in funding from accredited VCs, angel investors, or government partners; being an incubatee at a recognised incubator or accelerator; possessing qualifying Intellectual Property (IP); having a research collaboration with a Singaporean Institute of Higher Learning (IHL) or Research Institute (RI); or the applicant having a strong entrepreneurial or investment track record relevant to the proposed business. Certain traditional businesses, such as food and beverage outlets or massage parlours, are ineligible for the EntrePass.

In terms of crypto relevance, while not designed for passive crypto investors, an entrepreneur establishing a business within the crypto or blockchain sector (like a platform, technology provider, or consultancy) could potentially qualify if the venture meets the innovation criteria. The scheme emphasizes active business operation and contribution rather than passive investment.

Several key EntrePass factors are crucial. A comprehensive business plan (maximum 10 pages) is essential, detailing the innovative concept, market analysis, operations, and financial projections. The initial pass is granted for one year, with renewals contingent upon meeting specific business spending and local hiring milestones. Dependants (family members) can join later through Dependant’s Passes or LTVPs, provided the business meets higher spending and hiring thresholds. The EntrePass offers a path to PR; holders can apply after establishing their business and demonstrating economic contribution, typically requiring several years and meeting standard PR criteria. As with GIP, NS liability applies to male PRs obtained via this route.

1.2. Navigating the Crypto Landscape: Regulation and Taxation

Singapore has cultivated a reputation as a crypto-friendly jurisdiction, underpinned by a proactive regulatory approach and an advantageous tax regime for individuals.

1.2.1. Regulatory Framework: The MAS Approach

The Monetary Authority of Singapore (MAS), serving as both the central bank and financial regulator, oversees the digital asset space. Its regulatory stance aims to foster innovation while diligently managing risks, particularly those related to money laundering, terrorism financing (ML/TF), and consumer protection.

The Payment Services Act (PS Act) 2019 is the cornerstone legislation governing “Digital Payment Token” (DPT) services. Activities such as operating crypto exchanges, providing brokerage services, and offering custody solutions require licensing as either a Standard Payment Institution (SPI) or a Major Payment Institution (MPI), depending on transaction volumes. Recent amendments, effective from April 2024, have expanded the regulatory scope to include custodial services, the facilitation of DPT transmissions or exchanges (even without possession of the assets), and certain cross-border money transfers.

Obtaining a DPT license is a rigorous process involving stringent requirements related to capital adequacy (e.g., S$250k base capital for MPI), governance structures, compliance capabilities, security measures, and technology risk management. MAS expects DPT firms to maintain robust in-house compliance functions, often including a locally based compliance officer. Although the licensing process is demanding, its pace reportedly accelerated in 2024.

AML/CFT compliance is strictly enforced for DPT service providers under Notice PSN02, aligning with Financial Action Task Force (FATF) standards. This includes mandatory customer due diligence (CDD), ongoing transaction monitoring, meticulous record-keeping (for 5 years), reporting suspicious transactions (STR) to the Suspicious Transaction Reporting Office (STRO), and adherence to the “Travel Rule” for value transfers exceeding S$1,500, which requires expanded information sharing. Non-compliance can result in significant penalties.

Regarding consumer protection, MAS has consistently issued warnings about the high risks associated with crypto trading, deeming it unsuitable for retail investors. Regulations prohibit DPT firms from marketing their services to the general public in Singapore, offering credit or leverage facilities to retail customers, or accepting local credit card payments for cryptocurrency purchases. Upcoming rules, set to be phased in from October 2024, will mandate the segregation of customer assets (often in trust accounts, with 90% held in cold storage), effective management of conflicts of interest, and potentially require knowledge tests for retail users before they can trade.

Furthermore, cross-border regulation under the Financial Services and Markets Act (FSM Act) extends MAS oversight to entities based in Singapore that provide digital token services outside the country. This measure aims to prevent regulatory arbitrage and ensure consistent standards.

While this regulatory clarity provides legitimacy and security attractive to many in the crypto space , the strong emphasis on AML/CFT and consumer protection introduces operational friction and restricts certain activities.

1.2.2. Taxation: A Key Advantage for Individuals

Singapore’s tax treatment of cryptocurrency represents a significant draw, especially for individual investors.

A major advantage is the absence of capital gains tax. For individuals holding cryptocurrencies as a long-term investment, profits realized from their disposal are generally considered capital gains and are therefore not taxable. This contrasts favorably with the tax policies of many other nations.

However, income tax may apply under certain circumstances. If an individual trades cryptocurrencies frequently and systematically with the primary intention of generating profit, these gains might be classified as business income. Such income would then be subject to Singapore’s progressive personal income tax rates, which range from 0% to 24% for residents, depending on the income level. Factors determining whether trading constitutes a business include the holding period of the assets and the frequency of transactions. Income received in the form of cryptocurrency in exchange for goods or services is also considered taxable income.

The tax treatment of specific activities varies. For individuals engaged in mining as a hobby, earnings are typically treated as tax-exempt capital gains. However, if mining is conducted on a commercial scale for profit, it is likely considered business income. Income earned from staking or lending cryptocurrency (exceeding S$300) is generally regarded as taxable income. Tokens received from airdrops (without providing services in return) or hard forks are usually not taxable upon receipt. However, if these tokens are later sold for profit as part of a trading business, the gains may be taxed as business income.

Regarding Goods and Services Tax (GST), a significant change occurred in January 2020. Designated Digital Payment Tokens (DPTs), such as Bitcoin and Ether, became exempt from GST when used as payment for goods or services. This exemption simplifies transactions involving these cryptocurrencies. GST, currently at 8%, may still apply to tokens not classified as DPTs.

Finally, concerning reporting, even if crypto gains are not taxable (i.e., considered capital gains), individuals earning income from digital assets through activities like business trading or staking rewards must report this income on their annual tax return. Residents use Form B1, while non-residents use Form M. The typical filing deadline is April 18th.

The absence of capital gains tax for individual long-term investors makes Singapore a highly attractive destination from a personal finance perspective for those holding substantial cryptocurrency portfolios.

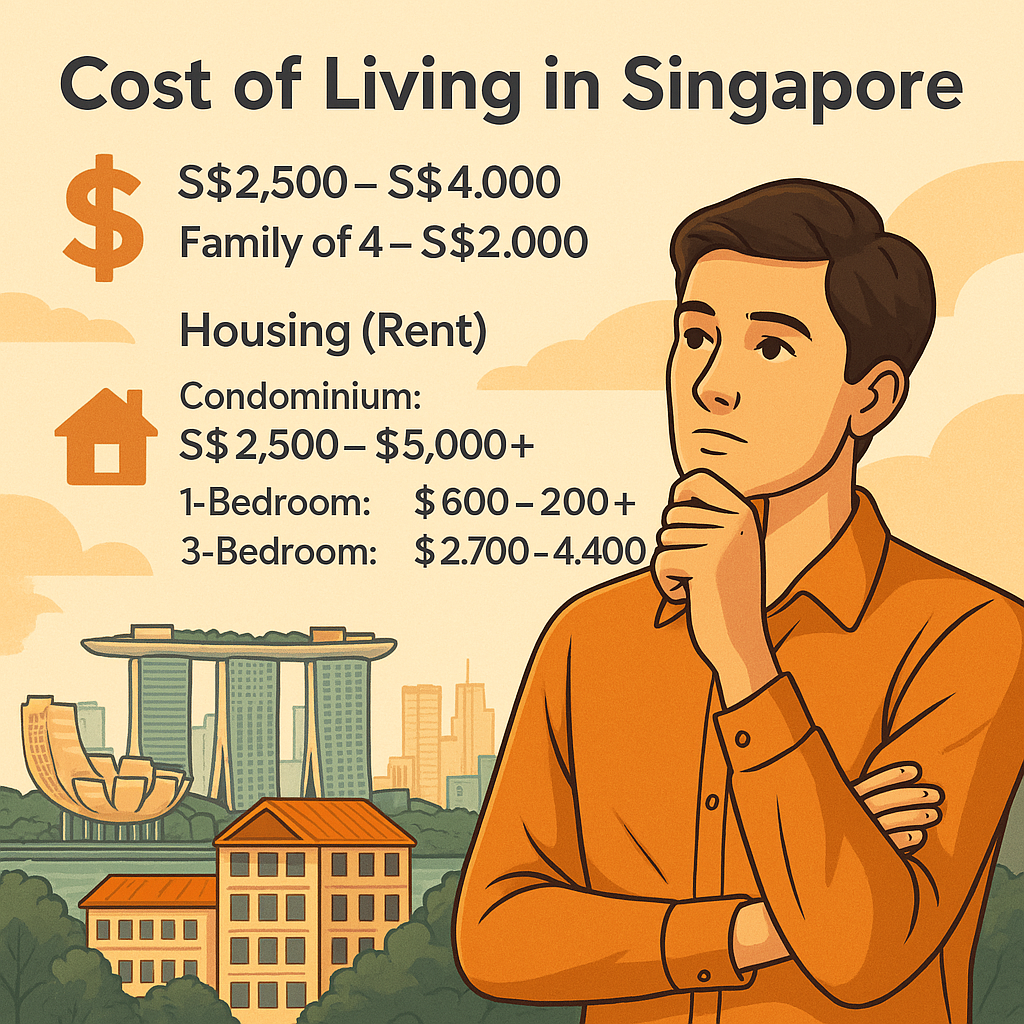

1.3. The Price of Paradise: Cost of Living

While offering numerous advantages, Singapore consistently ranks among the world’s most expensive cities. Understanding these costs is crucial for prospective residents.

Overall estimates, excluding rent for 2025, suggest a monthly budget of approximately S$1,513 for a single person and S$5,467 for a family of four. However, other estimates that include basic rent and expenses place the monthly cost for a single person between S$2,500 and S$4,000, and for a family of four between S$6,000 and S$12,000 or more.

Several key expense categories contribute significantly to the overall cost. Housing (Rent) is often the largest single expense, with prices varying considerably based on location (Central vs. Outskirts) and property type (HDB public housing vs. private Condominium). Condominiums, popular among expats for their amenities, typically range from S$2,500 to S$5,000+ monthly for a 1-bedroom unit, and S$3,000 to S$10,000+ for a 3-bedroom unit, with central regions (CCR) commanding higher prices. Renting rooms in more affordable HDB flats can cost S$600 to S$1,200+ monthly, while renting entire 3-room or 4-room flats might range from S$2,700 to S$4,400+ monthly. It’s worth noting that after previous significant increases, rental prices showed signs of slight decline or modest growth (projected 2-4%) in early 2025. Housing (Purchase) is extremely expensive due to limited land , with median condo prices around S$1.78 million and HDB resale flats around S$590,000 in 2024.

Healthcare in Singapore is world-class but costly for foreigners who lack access to government subsidies like MediShield Life and MediSave, which are available to citizens and PRs. Consequently, mandatory private health insurance is essential. While employers must provide minimum coverage (S$15k) for Work Permit/S-Pass holders, Employment Pass (EP) holders and others must secure their own comprehensive plans. Premiums can be substantial, averaging around S$8,435 annually according to a 2022 report. Out-of-pocket costs for private care can include S$50-S$150+ for a GP consultation and S$1,000-S$3,000+ per day for a private hospital stay.

Transportation via the efficient public network (MRT, buses) is relatively affordable, with a monthly pass costing around S$128. However, owning a car is exceptionally expensive. This is due to the Certificate of Entitlement (COE) system, which can cost over S$100k, plus high vehicle taxes and fuel prices (around S$2.80-S$3.00 per litre).

Food costs vary widely. Affordable meals (S$5-12) are readily available at hawker centres, while mid-range restaurants might cost S$20-S$50 per person. Monthly grocery expenses can range from S$400 to S$800+ per person, depending on shopping habits. Education costs, particularly international school fees, represent a significant expense for expat families. Utilities, including electricity, water, gas, and internet, typically cost S$150-S$300+ monthly for an apartment, increasing with significant air-conditioning usage.

Cost of Living Summary Table (Monthly Estimates, 2025):

| Expense Category | Single Person (SGD) | Family of Four (SGD) | Notes |

|---|---|---|---|

| Rent (1-Bed Condo Fringe) | 2,500 – 4,000 | N/A | Varies greatly by location/type |

| Rent (3-Bed Condo/HDB) | N/A | 3,500 – 7,000+ | Varies greatly by location/type |

| Utilities | 150 – 300+ | 250 – 500+ | Incl. electricity, water, gas, internet |

| Groceries | 400 – 800 | 800 – 1,600+ | Depends on lifestyle |

| Transport (Public) | ~130 | ~300 – 500 | Monthly passes/individual rides |

| Food (Dining Out/Misc) | 400 – 800+ | 1,000 – 2,000+ | Highly variable (Hawker vs. Restaurant) |

| Healthcare (Insurance) | 300 – 700+ | 800 – 2,000+ | Private insurance essential for expats |

| Personal/Entertainment | 300 – 600+ | 600 – 1,200+ | Clothing, leisure, etc. |

| Estimated Total | ~3,500 – 6,000+ | ~6,000 – 12,000+ | Excludes car, international school fees |

The high cost of living, particularly housing and unsubsidized healthcare for foreigners, necessitates significant financial resources or a substantial income to maintain a comfortable lifestyle in Singapore.

1.4. The Financial Fabric: Banking and Compliance

Singapore boasts a world-class banking system, but accessing it as a foreigner, especially one involved with crypto, involves navigating specific requirements and stringent compliance protocols.

1.4.1. Opening Bank Accounts as a Foreigner

Foreigners can open bank accounts in Singapore, but eligibility and requirements depend on their residency status and the specific bank’s policies. Generally, applicants must be 18 years or older and hold a valid pass, such as an Employment Pass (EP), S Pass, Dependant’s Pass, Student’s Pass, or Long-Term Visit Pass (LTVP).

The required documents typically include a valid passport (and potentially a national ID for some nationalities), the valid Singapore pass (or In-Principle Approval – IPA), and proof of a residential address in Singapore. Acceptable proof of address often includes utility bills, telco bills, bank statements, letters from employers or schools, or stamp duty certificates; notably, tenancy agreements are often not accepted. Proof of tax residency (potentially for multiple jurisdictions) is also usually required, and sometimes banks may ask for a letter of introduction, employment contract, or student matriculation card.

Regarding the process, while some banks offer online components, particularly if using Singpass Myinfo for data retrieval, an in-person visit to a branch is frequently required for verification, especially for foreign applicants. For non-residents (those without a local pass or address), opening an account is significantly more challenging and usually necessitates substantial minimum deposits, often targeting wealth management tiers. Minimum deposit requirements mentioned range from S$100,000 (UOB) to S$200,000 (OCBC) and S$350,000 (DBS Treasures) for basic wealth banking access. Proof of an address in Asia might also be needed. Various account types are available, including savings, current (checking), multi-currency, and investment accounts. It’s important to consider associated fees (maintenance, transaction, cross-border) and interest rates. Opening corporate accounts as a foreigner can also be challenging due to strict requirements, potentially taking 2-6 weeks.

1.4.2. Banking Policies, Crypto, and AML/CFT

Singaporean banks operate under the strict regulatory oversight of MAS, including rigorous AML/CFT controls outlined in MAS Notice 626 for banks. This framework significantly influences how banks interact with crypto-related funds and clients.

Banks adhere to strict compliance protocols, requiring thorough Customer Due Diligence (CDD), ongoing monitoring, and screening against sanctions lists and adverse media for all customers, beneficial owners, and associated parties. This scrutiny is applied both when establishing relationships and periodically thereafter. Due to the perceived anonymity and cross-border nature of digital assets, crypto transactions and businesses often face a high-risk perception. Consequently, banks may apply enhanced due diligence (EDD) measures to clients involved in crypto activities.

Regarding fund transfers, banks are mandated to monitor and report suspicious transactions. Large cash transactions (e.g., exceeding S$20,000 for non-account holders) trigger heightened scrutiny. Wire transfers and DPT value transfers are subject to specific information requirements under the “Travel Rule”. In terms of account opening and maintenance, banks may exhibit hesitation towards individuals or businesses heavily involved in unregulated crypto activities or those unable to provide clear documentation regarding the source of their funds. Existing accounts could face closure if suspicious activity is detected or if compliance requirements are not met. While there is no explicit ban on banks serving crypto clients, the substantial compliance burden and inherent risk perception lead to a cautious approach. Banks require assurance regarding the legitimacy of funds and strict adherence to regulations.

Crypto investors should anticipate detailed inquiries about the source of their wealth and crypto activities when engaging with Singaporean banks. Maintaining transparent records and utilizing regulated exchanges can facilitate smoother interactions, although friction remains possible due to the demanding AML/CFT environment.

1.5. The Business Bedrock: Economy, Tax, and Diversification

Beyond individual benefits, Singapore offers a robust and attractive environment for business activities and broader investment diversification.

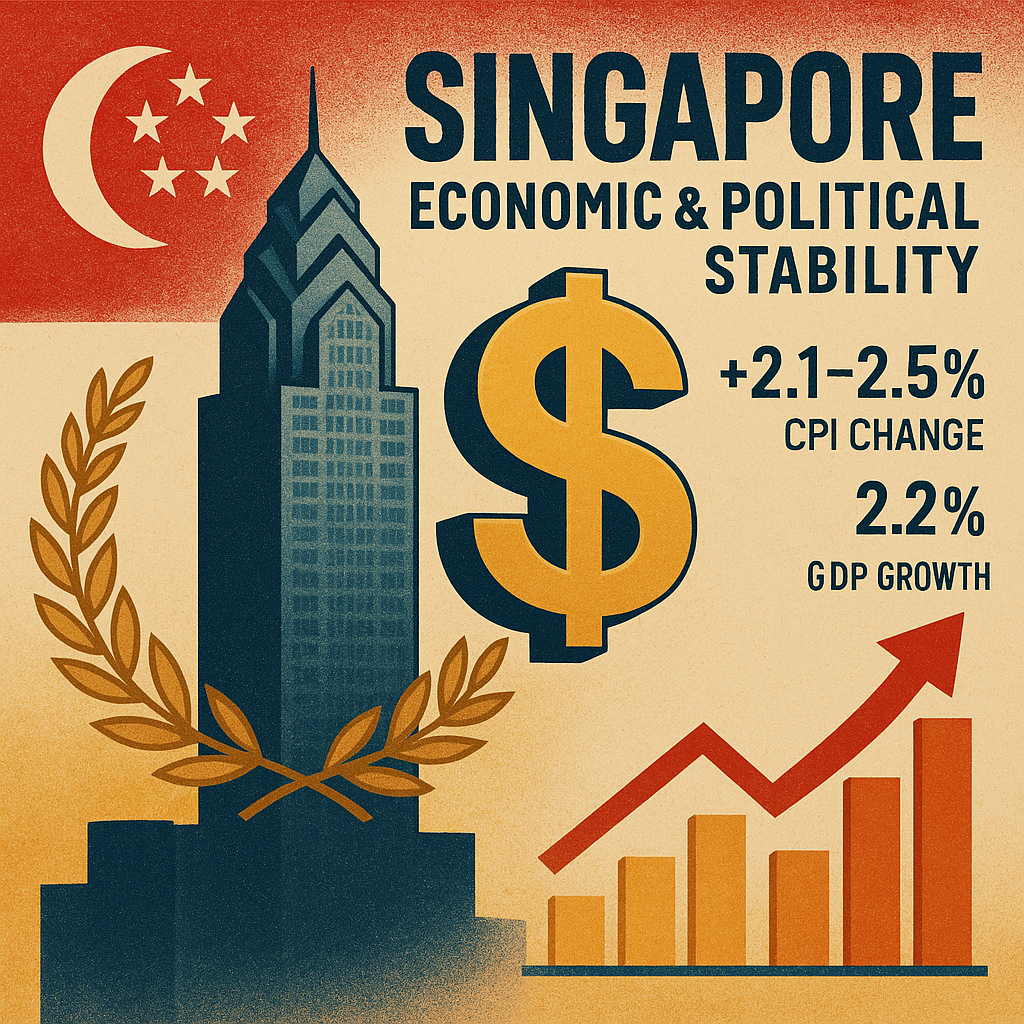

1.5.1. Economic Stability and Outlook

Singapore is characterized by exceptional economic and political stability, consistently ranking among the world’s freest and most competitive economies. It secured the #1 ranking in the 2025 Index of Economic Freedom and is known for its high standard of living and safety. The country demonstrates resilient GDP growth, projected at around 2.1% to 2.5% for 2024-2025 , following a strong recovery post-pandemic. Inflation is expected to moderate, with the IMF projecting a CPI change of 2.2% for 2025 , aligning with global trends of easing inflation after the peaks seen in 2023. Singapore maintains top-tier AAA sovereign credit ratings from major agencies, signifying very low risk. While public debt as a percentage of GDP is high, it is managed within a strong and prudent fiscal management framework. This overall stability provides a secure foundation for both personal wealth management and business operations.

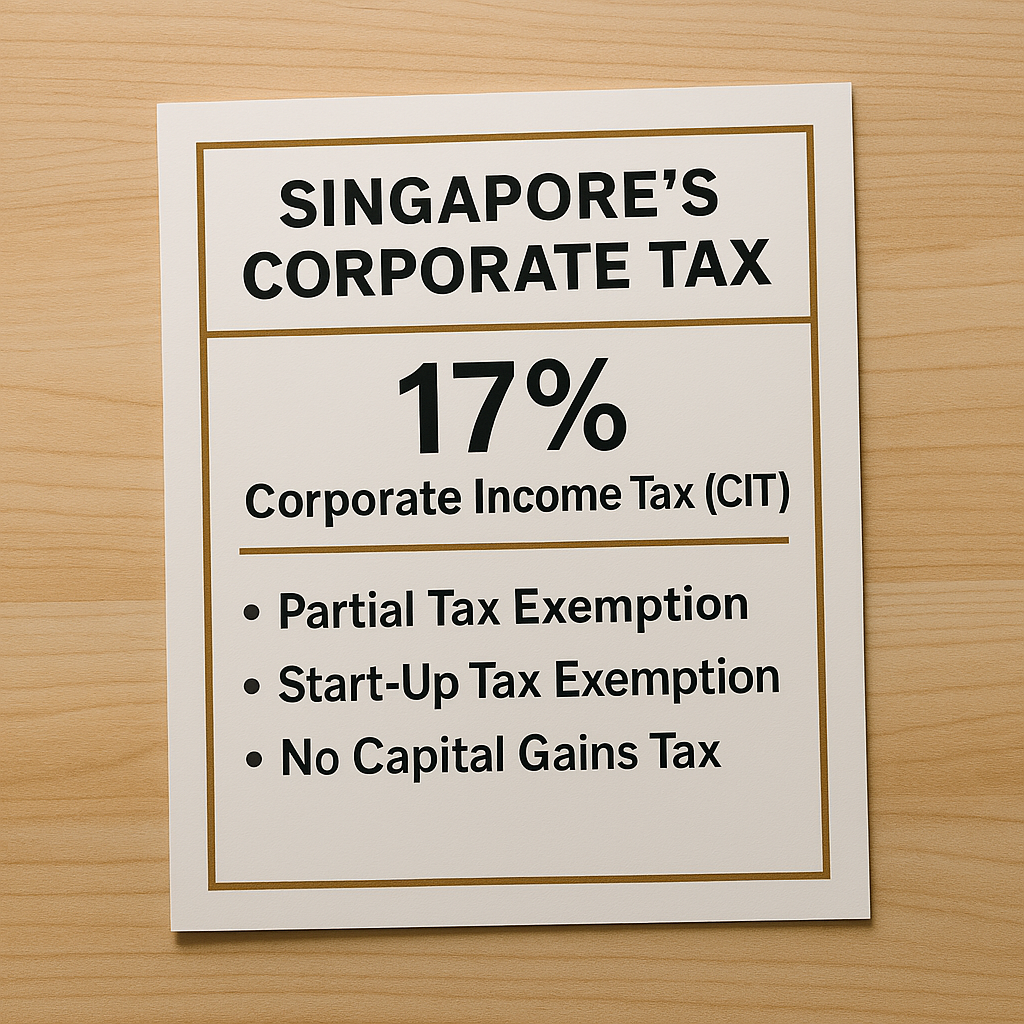

1.5.2. Corporate Tax Landscape

Singapore’s corporate tax regime is highly competitive, designed to attract and retain investment. The headline rate is a flat 17% Corporate Income Tax (CIT) applied to chargeable income for both local and foreign companies.

Several exemptions significantly reduce the effective tax burden. The Partial Tax Exemption (PTE) scheme, available to all companies, exempts 75% of the first S$10,000 and 50% of the next S$190,000 of normal chargeable income. Additionally, the Start-Up Tax Exemption (SUTE) scheme offers enhanced relief for qualifying new companies during their first three consecutive Years of Assessment (YAs). It exempts 75% of the first S$100,000 and 50% of the next S$100,000 of normal chargeable income, up to a maximum exemption of S$125,000 per YA.

Furthermore, periodic rebates provide additional relief. A substantial 50% CIT rebate, capped at S$40,000 (potentially reduced by a cash grant component), was announced for YA 2025. Similar rebates have been offered in previous years. Singapore also imposes no capital gains tax at the corporate level, and gains from the disposal of ordinary shares held for at least 24 months may be exempt under specific conditions.

Regarding international tax, Singapore employs a territorial system. Foreign-sourced dividends, branch profits, and service income received in Singapore by resident companies may be exempt if the foreign headline tax rate is 15% or higher and the income was subject to tax in the source jurisdiction. In line with global standards, Singapore is implementing BEPS 2.0 / Global Minimum Tax rules (Pillar Two), including an Income Inclusion Rule (via MTT) and a Domestic Top-up Tax (DTT), effective from YA 2025. This ensures large Multinational Enterprises (MNEs with global revenue exceeding €750 million) pay an effective tax rate of at least 15% on profits generated in Singapore or by their Singapore-based entities globally, primarily impacting very large groups. Finally, various targeted incentives exist, such as the Development and Expansion Incentive (DEI) offering concessionary tax rates (e.g., 5%, 10%, 15%) for high-value projects, and enhanced deductions for internationalisation (DTDi).

This combination of a low headline rate, generous exemptions, periodic rebates, and targeted incentives creates an exceptionally attractive tax environment for businesses, complementing the favourable individual tax regime for crypto investors who might establish corporate structures.

1.5.3. Business Infrastructure and Diversification

Singapore provides world-class business infrastructure, encompassing state-of-the-art facilities, excellent global connectivity, a skilled and multilingual workforce where English is widely spoken, and a strong legal framework founded on the rule of law. Beyond its strengths in crypto and finance, the economy is highly diversified. Key sectors include technology (both hardware and software), logistics, biomedical sciences, advanced manufacturing, and professional services. This economic diversity presents ample opportunities for investors looking to diversify their portfolios beyond digital assets into various established and growing industries.

1.6. Weighing the Move: Pros and Cons for the Crypto Investor

Relocating to Singapore involves balancing significant advantages against considerable drawbacks.

| Advantages | Disadvantages |

|---|---|

| Favourable Individual Crypto Tax: 0% capital gains tax is a major draw. GST exemption on DPT payments. | Extremely High Cost of Living: Especially housing, cars, international schools. |

| Regulatory Clarity & Pro-Innovation Stance: Established PSA framework provides rules; MAS supports digital asset innovation. | Expensive Expat Healthcare: Lack of subsidies necessitates costly private insurance. |

| Economic & Political Stability: Safe, secure, strong rule of law, AAA rating. | Stringent AML/CFT Compliance: Creates friction in banking & crypto transactions; high scrutiny. |

| World-Class Financial Hub: Sophisticated banking, diverse investment opportunities. | GIP Hurdles for Crypto Wealth: Apparent exclusion of crypto from NIA/qualifying investments. |

| High Quality of Life: Excellent infrastructure, safety, education, transport, multicultural environment. English widely spoken. | Discretionary Visa/PR Approval: Meeting criteria doesn’t guarantee success for GIP or EntrePass. |

| Attractive Business Environment: Low 17% CIT, exemptions, rebates, ease of doing business. | National Service Liability: Mandatory 2-year military service for male PRs/dependants. |

| Strict Regulatory Enforcement: MAS actively enforces rules; penalties for non-compliance. Crypto marketing restricted. | |

| No Dual Citizenship: Must renounce original nationality for Singapore citizenship. |

The decision hinges on a trade-off. The allure of zero capital gains tax on crypto, coupled with Singapore’s stability and quality of life, is powerful. However, this must be weighed against the substantial financial burden of living costs and healthcare, the operational complexities arising from strict financial regulations, potential difficulties leveraging crypto wealth for the primary high-net-worth immigration route (GIP), and the significant personal commitment of National Service for families with sons. Suitability depends heavily on an investor’s financial capacity, risk tolerance for regulatory scrutiny, family circumstances, and long-term goals.

1.7. Making the Move: Practical Application Steps

Applying for residency via GIP or EntrePass requires meticulous preparation and adherence to specific procedures.

1.7.1. Global Investor Programme (GIP) Application Process

The GIP application process begins with eligibility confirmation and preparation. Applicants must verify they meet the criteria for one of the four profiles (Established Owner, Next-Gen Owner, Founder, Family Office Principal) and select their Investment Option (A, B, or C). A detailed 5-year business or investment plan (Form B) must be prepared, along with extensive supporting documents covering personal identification, family records, business financials, proof of assets, and CVs (detailed in Annex A of and listed in ). Considering a pre-assessment consultation with the EDB may be beneficial.

Next is the application submission. This involves paying a non-refundable S$10,000 application fee to the EDB and submitting all completed forms (Forms A, B, C, Form 4, Statutory Declaration, Undertaking) and supporting documents, potentially via both the online GIP portal and hardcopy.

Following submission, applicants undergo assessment and interview, awaiting an invitation for an interview with the EDB. The application and plan are thoroughly reviewed. Successful candidates receive an Approval-in-Principle (AIP) letter from the Immigration & Checkpoints Authority (ICA), valid for 6 months, and must pay a S$100 PR processing fee per applicant to ICA.

Within the 6-month AIP validity period, the applicant must execute the required investment (S$10M for A, S$25M for B, or establish the SFO for C) using personal funds from a Singapore-registered bank account held in their name.

After making the investment, verification and final approval follow. Documentary evidence of the investment (e.g., share certificates, bank statements, Investment Undertaking) must be submitted to the EDB. Once the EDB verifies the investment, ICA issues the Final Approval letter.

Finally, the applicant must formalise their PR status in Singapore within 12 months from the date of the Final Approval letter to receive their PR status and Re-Entry Permit (REP).

1.7.2. EntrePass Application Process

The EntrePass application process starts with an eligibility check and preparation. Applicants must confirm they meet the criteria: aged 21 or above, intending to start or owning at least 30% of an innovative Singapore company (less than 6-12 months old), and meeting at least one innovation criterion. A compelling business plan (maximum 10 pages) is crucial, along with documents like a passport copy, CV/testimonials, and ACRA profile if the company is already registered.

The application submission is done online via the Ministry of Manpower’s (MOM) EP eService portal, accompanied by a non-refundable S$105 application fee.

MOM then conducts an assessment, reviewing the business plan and the applicant’s background, which typically takes about 8 weeks. Applicants receive either an In-Principle Approval (IPA) letter (valid for 6 months) or a rejection letter via EP Online. If outside Singapore, they must prepare for entry, adhering to travel requirements.

Pass issuance must occur within 6 months of the IPA and while the applicant is in Singapore. This can be done online via EP eService or by appointment at the Employment Pass Services Centre (EPSC). Issuance fees (S$225 per pass plus S$30 visa fee if applicable) are payable. Required details include passport information and a local address. A Notification Letter is issued upon successful issuance.

Registration (fingerprints and photo) may be required, as indicated in the Notification Letter, especially for new candidates or those whose last registration was over 5 years ago. If needed, an appointment must be made at EPSC within 2 weeks of pass issuance, bringing necessary documents like the passport, appointment letter, and notification letter.

Finally, the EntrePass card is received via delivery to the nominated Singapore address within 5 working days after issuance (or after registration, if applicable).

General Advice: Both the GIP and EntrePass pathways are complex and require extensive documentation. The business plan is particularly critical for the EntrePass. Given the high stakes involved and the discretionary nature of approvals, seeking professional guidance from immigration consultants or corporate service providers is often recommended. This can help enhance the application’s quality and ensure a smoother navigation of the process. Applicants should allow ample time for processing and stay informed about the latest requirements.

1.8. Conclusion: Singapore for the Crypto Investor – A Calculated Move

Singapore presents a compelling, yet complex, proposition for the crypto investor. Its undeniable strengths – economic and political stability, a world-class financial infrastructure, a pro-innovation stance on digital assets, and crucially, a 0% capital gains tax regime for individual investors – create a highly attractive environment. The increasing regulatory clarity under the Payment Services Act further adds to its appeal for legitimate players in the crypto space.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

However, these advantages must be carefully weighed against significant challenges. The exceptionally high cost of living, particularly for housing, car ownership, and international education, demands substantial financial resources. Furthermore, healthcare for foreigners lacks subsidies, necessitating expensive private insurance. The stringent AML/CFT regulations, while ensuring integrity, permeate the financial system, potentially creating hurdles for banking and crypto-related transactions. Critically, the premier immigration route for high-net-worth individuals, the GIP, appears difficult to access using primarily crypto assets based on current guidelines. Finally, the mandatory National Service obligation for male permanent residents is a profound personal and family consideration.

Ultimately, relocating to Singapore as a crypto investor is a viable but calculated decision. It offers a unique blend of financial benefits and high quality of life but requires significant capital, adaptability to a high-cost, high-compliance environment, and careful navigation of immigration rules that may not fully align with crypto-centric wealth. Thorough due diligence on visa eligibility (especially regarding asset recognition), cost implications, and regulatory expectations, potentially with professional guidance, is essential before embracing the opportunities and challenges of the Lion City. Singapore welcomes global talent and investment, including in the digital asset sphere, but expects participants to operate within its well-defined and rigorously enforced frameworks.