Switzerland Calling: A Comprehensive Guide for Crypto Investors Seeking Residency

Switzerland, a nation synonymous with financial prowess, innovation, and an unparalleled quality of life, has steadily carved out a reputation as a forward-thinking hub for the burgeoning world of cryptocurrencies. Its blend of political and economic stability, a strong currency, a tradition of privacy, and a sophisticated financial infrastructure naturally appeals to global investors. For those holding or actively trading digital assets, Switzerland presents an additional layer of allure: perceived regulatory clarity, potential tax advantages, particularly regarding capital gains, and a welcoming environment exemplified by initiatives in cantons like Zug and Ticino.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

The emergence of “Crypto Valley” in Zug and Lugano’s ambitious “Plan B” project are tangible signals of this commitment, fostering an ecosystem complete with specialized crypto banks and service providers. Switzerland frequently appears high on lists ranking the world’s most crypto-friendly nations.

But does the reality on the ground fully align with this reputation? Relocating involves navigating a complex web of immigration laws, tax regulations, and practical living considerations. This report aims to provide a holistic guide for cryptocurrency investors and holders contemplating a move to Switzerland, delving into the critical details of immigration pathways, the nuances of crypto regulation and taxation, the cost and practicalities of daily life, and the overall quality of living, enabling informed decision-making.

1. Switzerland: A Premier Destination for Global Crypto Investors?

Switzerland’s longstanding appeal rests on solid foundations: unwavering political and economic stability, a globally respected strong currency (CHF), and a deep-rooted culture of privacy that extends into its financial sector. The country boasts a highly developed financial infrastructure, home to global banking institutions and wealth managers. These traditional strengths create a secure and reliable environment attractive to high-net-worth individuals (HNWIs) and investors worldwide.

In recent years, Switzerland has actively cultivated an environment conducive to blockchain technology and digital assets. This proactive stance has led to its recognition as a leading global crypto hub. The development of “Crypto Valley” in the canton of Zug stands as a prime example. Zug pioneered accepting Bitcoin for certain fees and facilitated its use as in-kind capital contributions for companies, becoming a magnet for crypto and blockchain enterprises. Similarly, the city of Lugano in the canton of Ticino launched its “Plan B” initiative in partnership with Tether, aiming to transform the city’s financial infrastructure using Bitcoin technology and accepting cryptocurrencies for municipal payments.

The presence of licensed crypto banks like AMINA Bank and Sygnum Bank, alongside crucial crypto financial service providers such as Bitcoin Suisse (which facilitates crypto tax payments in several municipalities), further solidifies Switzerland’s position. These institutions offer specialized services tailored to the needs of crypto investors, ranging from trading and custody to staking and asset management. This combination of traditional stability and modern crypto-infrastructure underpins Switzerland’s high ranking among crypto-friendly nations.

However, prospective residents must look beyond the headlines. While the environment is supportive, navigating the legal, financial, and practical aspects of relocation requires careful consideration. This report examines the specific requirements and implications for crypto investors seeking to make Switzerland their home.

2. Your Gateway to Switzerland: Navigating Immigration and Residency

Securing the right to live in Switzerland is the essential first step for any potential immigrant. The Swiss immigration system is highly structured, with processes and requirements varying significantly based on the applicant’s nationality and the specific canton they intend to reside in. All foreign nationals planning to stay for more than three months must obtain a permit.

2.1. Understanding the Basics: EU/EFTA vs. Third-Country Nationals

A fundamental distinction exists between citizens of European Union (EU) or European Free Trade Association (EFTA) countries (Iceland, Liechtenstein, Norway, Switzerland) and nationals from all other countries (third-country nationals).

EU/EFTA Nationals: Benefit considerably from the Agreement on the Free Movement of Persons (AFMP) between Switzerland and the EU. They can enter Switzerland visa-free with a valid passport or identity card. For stays exceeding three months (or for taking up employment), they must register with their local commune of residence within 14 days of arrival and apply for a residence permit. This process is generally straightforward, provided they are employed, self-employed, or can demonstrate sufficient financial means to support themselves without relying on social assistance.

Third-Country Nationals (Non-EU/EFTA): Face a more complex and restrictive process. They often require a visa approved before entering Switzerland, depending on their nationality and the purpose of their stay. Applications are typically made at the Swiss representation in their country of residence and can take several weeks or months to process.

For work purposes, entry is generally limited to highly qualified individuals – managers, specialists, university graduates with significant professional experience. The prospective Swiss employer must usually prove that no suitable candidate could be found within Switzerland or the EU/EFTA labor market. Annual quotas limit the number of permits available for third-country workers.

All third-country nationals applying for residency must typically provide:

- Proof of sufficient financial resources to cover living expenses (a reference figure of CHF 100 per day is mentioned for short stays, but requirements for residency are substantially higher).

- Proof of suitable accommodation.

- Valid health insurance covering risks in Switzerland.

- A clean criminal record (often requiring a police clearance certificate).

- A valid passport.

UK Nationals: Following Brexit, UK citizens are generally treated as third-country nationals. However, specific agreements protect the rights of those resident in Switzerland before 2021, and arrangements exist for short-term service providers until the end of 2025.

This clear difference in requirements underscores a crucial point: while EU/EFTA citizens enjoy relative ease of access, third-country nationals face higher barriers. For third-country crypto investors, pathways based on financial independence or specific investment programs often become more relevant than standard employment routes, unless they possess highly sought-after professional qualifications.

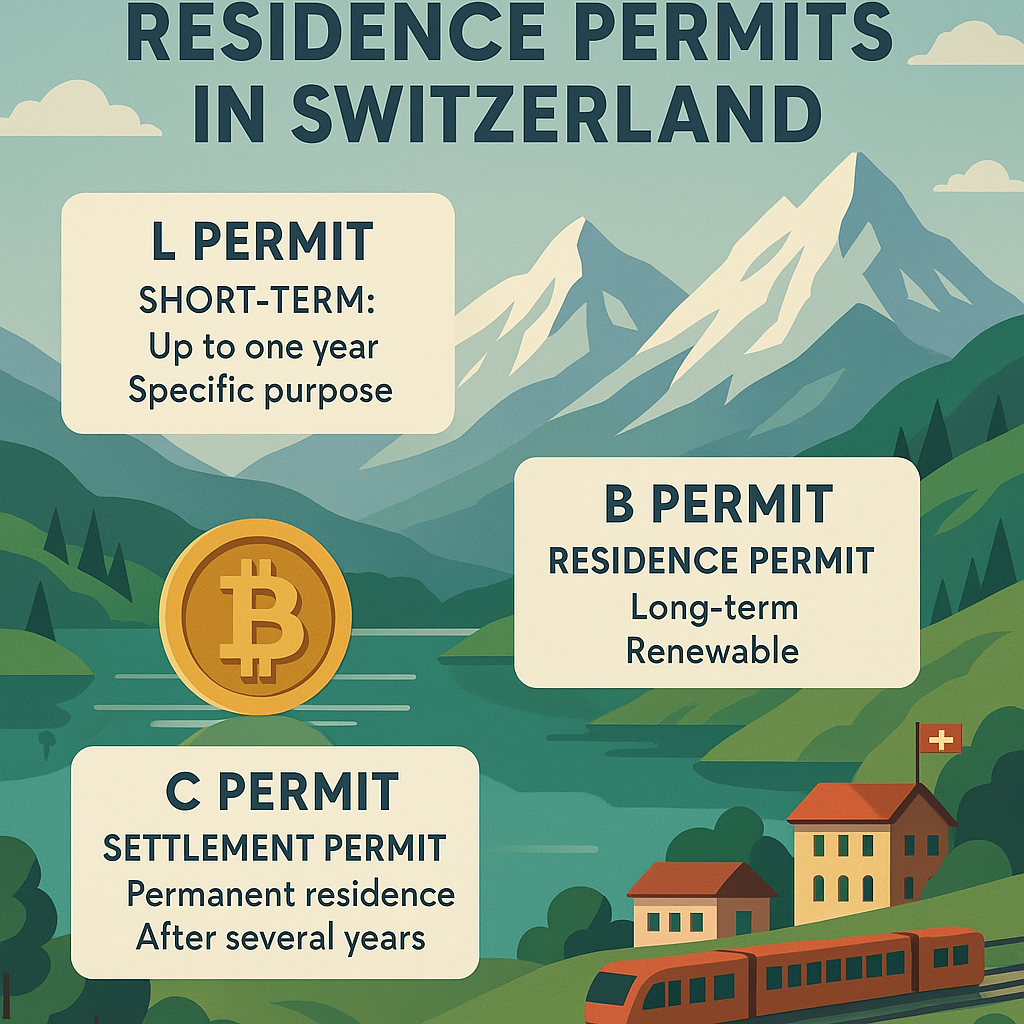

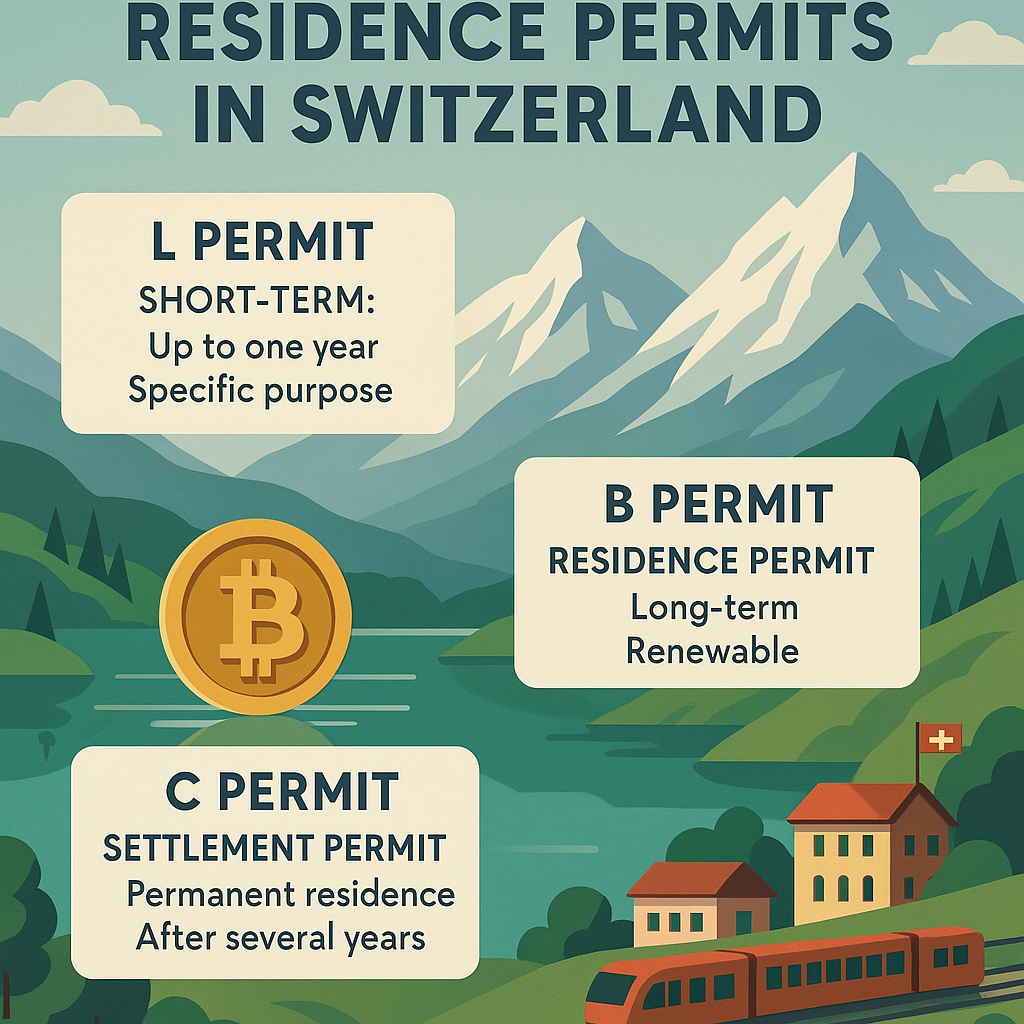

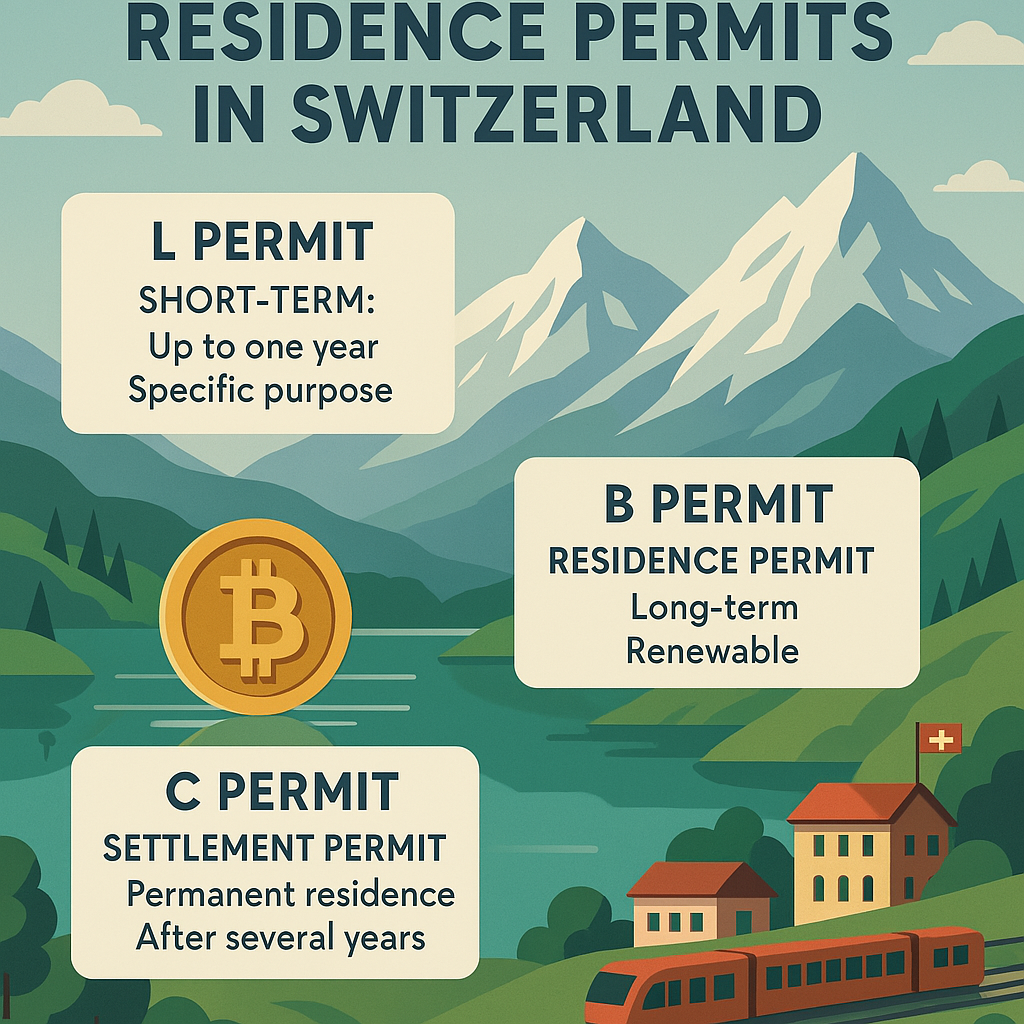

2.2. Key Residence Permits Explained: L, B, and C Permits

Switzerland issues various permits for different stay durations and purposes. For long-term residents, the B and C permits are most relevant.

L Permit (Short-term): Granted for stays up to one year, typically for a specific purpose like a short-term work contract or project. While potentially extendable, it’s generally not intended for permanent relocation.

B Permit (Residence Permit): This is the standard initial permit for foreign nationals intending to reside in Switzerland for longer than one year.

- For EU/EFTA Nationals: Typically issued with a validity of five years and is renewable, provided conditions (like employment or financial independence) continue to be met. Can be granted to those working, self-employed, or demonstrating financial self-sufficiency.

- For Third-Country Nationals: Usually issued for one year initially and requires annual renewal. Renewal is contingent upon factors such as continued employment (if applicable), financial stability, and integration into Swiss society (which can include language proficiency). A B permit can also be granted to non-employed third-country nationals if they prove substantial financial independence.

C Permit (Settlement Permit): This permit grants permanent residence status, offering near-equal rights to Swiss citizens regarding employment and social benefits, with fewer restrictions than the B permit.

- For EU/EFTA Nationals: Generally eligible after five years of continuous and uninterrupted residence in Switzerland on a B permit.

- For Third-Country Nationals: Typically eligible only after ten years of continuous residence on a B permit. In some cases (based on specific integration agreements or nationality, though details vary), eligibility after five years might be possible. Strong integration, including language skills and respect for the legal order, is usually a prerequisite. Children under 12 may sometimes receive a C permit directly if their parents meet the criteria.

The B permit is the primary objective for crypto investors seeking initial relocation. The significantly longer pathway to the permanent C permit for third-country nationals highlights the importance of consistently meeting the B permit renewal criteria year after year, particularly regarding financial standing and integration efforts.

Table 1: Key Residence Permit Comparison (B vs. C)

| Feature | B Permit (EU/EFTA) | B Permit (Third Country) | C Permit (Settlement) |

|---|---|---|---|

| Typical Initial Validity | 5 years | 1 year | Indefinite (control check every 5 years) |

| Renewal Frequency | Every 5 years | Annually | N/A (control check only) |

| Typical Path to C Permit | 5 years continuous residence | 10 years continuous residence (exceptions possible) | N/A |

| Key Eligibility Basis | Employment, Self-employment, Financial Independence | Employment (qualified), Financial Independence | Met requirements for B permit over duration |

| Integration Requirements Emphasis | Less emphasis initially | Assessed at renewal, crucial for C permit | Demonstrated strong integration required |

Exporter vers Sheets

2.3. Pathways for Investors and High-Net-Worth Individuals (HNWIs)

Beyond standard employment routes, Switzerland offers specific pathways attractive to individuals with significant financial means, including crypto investors.

2.3.1. Residency Through Financial Independence (Non-Gainful Employment)

Both EU/EFTA and third-country nationals can potentially secure a B permit without undertaking employment in Switzerland, provided they can demonstrate sufficient financial resources to support themselves and any dependents indefinitely.

This requires substantial proof of ongoing income (e.g., from investments, pensions, foreign business activities) or significant wealth. While specific minimums vary by canton and individual circumstances, applicants must convincingly show they will not become reliant on Swiss social welfare. Some programs targeting investors mention minimum investment thresholds (e.g., CHF 1 million in one context), but this is not a universal requirement for all financially independent applicants.

Applicants must also secure suitable accommodation and mandatory Swiss health insurance, and possess a clean criminal record.

This pathway allows individuals to reside in Switzerland while managing their global assets or deriving income from sources outside Switzerland.

2.3.2. Lump-Sum Taxation (Forfait Fiscal / Pauschalbesteuerung): A Special Regime

This is a unique tax regime designed for wealthy foreign nationals taking up residence in Switzerland.

What it is: Instead of taxing actual worldwide income and wealth, tax is levied based on the individual’s annual living expenses in Switzerland. This amount is often calculated based on a multiple (typically five to seven times) of the annual rent paid for their Swiss residence or the property’s imputed rental value if owned. It provides a predictable, fixed annual tax liability.

Eligibility: This regime is strictly limited to:

- Foreign nationals (non-Swiss citizens).

- Individuals taking up Swiss tax residence for the first time or after an absence of at least 10 years.

- Individuals who do not engage in any gainful employment within Switzerland. Managing one’s own global private wealth from Switzerland is generally permitted, but active business operations or employment within the country are prohibited. Spouses living together must both meet these criteria.

Financial Thresholds: While based on expenditure, cantons typically impose minimum taxable amounts regardless of actual spending. Minimum deemed annual expenditure or notional income figures can range significantly, potentially from CHF 150,000 to over CHF 600,000 depending on the canton and the applicant’s profile. Some advisors suggest a demonstrable wealth level (e.g., CHF 10 million or more) might be expected by certain cantons, although this is not formally codified everywhere.

Cantonal Variations: This is a critical aspect – lump-sum taxation is NOT available in all 26 cantons. Several cantons, including prominent ones like Zurich, Schaffhausen, Basel-Stadt, Basel-Landschaft, and Appenzell Ausserrhoden/Innerrhoden, have abolished it. It remains available in cantons such as Geneva, Vaud, Valais, Fribourg, Ticino, Grisons, Bern, and Zug, among others. The minimum assessment bases, calculation methods (e.g., the multiplier applied to rent), and willingness to negotiate can vary considerably between the cantons that offer it. Careful canton selection is paramount.

Benefits:

- Tax Predictability: A fixed, pre-agreed annual tax amount (subject to inflation adjustments).

- Simplicity: Avoids complex declarations of worldwide income and assets.

- Confidentiality: Enhanced financial privacy as detailed global financial figures are not required by Swiss tax authorities.

- Potential Savings: Can result in significantly lower taxes compared to ordinary taxation for HNWIs with substantial foreign income or wealth.

- Recognition: Generally recognized under Switzerland’s double taxation agreements (DTAs).

Considerations:

- The “no gainful employment in Switzerland” rule is absolute and requires careful interpretation, especially for active traders or entrepreneurs. Activities that could be construed as professional trading conducted from Switzerland might jeopardize eligibility. This regime is generally better suited for individuals living off passive investments or managing global assets remotely.

- A “control calculation” applies: the lump-sum tax cannot be lower than the ordinary Swiss tax calculated on certain Swiss-source income (e.g., from Swiss real estate, Swiss securities) and Swiss-based assets.

- Renting or owning very expensive property can significantly increase the expenditure base and thus the tax liability.

The lump-sum taxation pathway offers unique advantages in terms of simplicity and privacy but comes with significant restrictions, particularly regarding economic activity within Switzerland. For crypto investors, its suitability hinges on their income sources and trading patterns. Passive HODLers or those managing diversified global portfolios remotely may find it appealing, while highly active traders operating from Switzerland might find the “no gainful employment” rule problematic, potentially conflicting with the criteria defining professional trading under ordinary income tax law. Obtaining a binding tax ruling from the chosen canton before relocating is highly advisable.

Table 2: Lump-Sum Taxation (Forfait Fiscal) – Key Aspects

| Feature | Description |

|---|---|

| Basis of Taxation | Annual worldwide living expenses (expenditure-based), often calculated as a multiple of rent/rental value, NOT actual global income/wealth. |

| Key Eligibility Criteria | Foreign national; First-time Swiss resident (or after 10+ year absence); No gainful employment in Switzerland. |

| Employment Restriction | Strict prohibition on any gainful activity/employment within Switzerland. Management of personal global assets generally allowed. |

| Cantonal Availability | Not available everywhere. Abolished in Zurich, Basel, Schaffhausen, Appenzell. Available in Geneva, Vaud, Valais, Ticino, Zug, Bern, Fribourg, Grisons etc. (Check specific canton). |

| Potential Minimum Thresholds | Cantons impose minimum taxable expenditure/income levels (e.g., potentially CHF 150k-600k+), varying significantly. Wealth expectations may apply unofficially. |

| Main Benefits | Tax predictability, simplified reporting, financial privacy, potential significant tax savings for HNWIs with high foreign income/wealth. |

| Key Considerations/Risks | Strict employment restriction (potential conflict for active traders); Cantonal variations are crucial; Control calculation based on Swiss income/assets; High property costs increase tax base. |

Exporter vers Sheets

3. Crypto in the Confederation: Regulation and Tax Deep Dive

Switzerland’s reputation as a crypto-friendly nation stems largely from its early engagement with blockchain technology and a regulatory approach perceived as clear and pragmatic, spearheaded by the Swiss Financial Market Supervisory Authority (FINMA) and the Swiss Federal Tax Administration (SFTA).

3.1. The Regulatory Environment: FINMA’s Stance and Key Guidelines

Rather than creating bespoke laws for cryptocurrencies, Switzerland applies its existing, robust financial market legislation in a technology-neutral way. FINMA oversees this application, aiming to foster innovation while mitigating risks associated with the financial sector.

FINMA’s Approach: Existing laws like the Banking Act, the Anti-Money Laundering Act (AMLA), the Financial Institutions Act (FinIA), and the Financial Market Infrastructure Act (FinMIA) form the regulatory bedrock. FINMA interprets these laws in the context of new digital asset business models.

Token Classification: To determine applicable regulations, FINMA categorizes tokens based on their underlying economic function:

- Payment Tokens: Cryptocurrencies intended as means of payment or value transfer (e.g., Bitcoin, Ether). Subject to AML regulations if handled commercially.

- Utility Tokens: Provide digital access to a specific application or service on a blockchain. May fall outside financial regulation if the platform is fully functional at the time of token issuance.

- Asset Tokens: Represent assets such as debt or equity claims, or participation rights. Functionally similar to traditional securities (stocks, bonds) and subject to securities laws, including prospectus requirements if offered publicly. Hybrid tokens combining features (e.g., payment and utility) are also possible and assessed accordingly.

Licensing Requirements: There is no single “crypto license.” The need for a FINMA license depends on the specific activity:

- Activities like accepting deposits from the public on a commercial basis (which can include custody solutions where a provider holds crypto for multiple clients in pooled wallets) typically require a Banking license or, under certain conditions, a FinTech license (which has lower capital and organizational requirements).

- Operating organized trading facilities for asset tokens (securities) may require a license as a stock exchange or multilateral trading facility under FinMIA.

- Providing investment advice or portfolio management involving crypto-assets may require a license under FinIA.

- Simply issuing utility tokens for an already operational platform generally does not require FINMA authorization.

Anti-Money Laundering (AML) / Travel Rule: Switzerland applies its stringent AMLA regulations rigorously to Virtual Asset Service Providers (VASPs). This includes exchanges, wallet providers offering custody, crypto ATMs, and brokers. Key obligations include:

- Customer Due Diligence: Verifying customer identity (KYC) and establishing the identity of beneficial owners (KYBO).

- Risk-Based Monitoring: Ongoing monitoring of transactions and business relationships.

- Reporting: Filing suspicious activity reports (SARs) with the Money Laundering Reporting Office Switzerland (MROS).

Travel Rule Implementation: Switzerland enforces the Financial Action Task Force (FATF) Travel Rule strictly:

- Threshold: Information must be transmitted for all VASP-to-VASP transfers, regardless of amount (CHF 0 threshold).

- Information Required: Originator’s name, account number (or unique transaction ID), and address/ID details; Beneficiary’s name and account number.

- Self-Hosted Wallet Transactions: FINMA imposes requirements stricter than the FATF standard. When a Swiss VASP sends funds to, or receives funds from, an external (unhosted) wallet, it must verify the identity of the external wallet owner and confirm their control over that wallet using appropriate “technical means” (e.g., cryptographic signature methods like the Satoshi Test or Address Ownership Proof Protocol – AOPP).

- Stablecoins: FINMA has issued specific guidance acknowledging their growing importance. It notes that many Swiss stablecoin issuers currently operate using default guarantees from licensed banks to avoid needing a banking license themselves. While permissible, FINMA highlights the associated risks for both the issuer, the guaranteeing bank, and the stablecoin holders. It sets minimum standards for these guarantees to protect depositors (e.g., ensuring holders have a direct claim against the bank in case of issuer bankruptcy). FINMA also emphasizes the heightened AML and reputational risks associated with stablecoins.

While often labelled “friendly,” Switzerland’s regulatory approach is better described as clear, principles-based, but demanding. It is not a light-touch jurisdiction. The rigorous application of AML laws, particularly the zero-threshold Travel Rule and the unique requirements for verifying self-hosted wallets, imposes significant operational and compliance burdens on VASPs operating in or transacting with Switzerland. This can translate to more stringent onboarding processes and potentially more friction for users interacting with Swiss-based crypto services compared to jurisdictions with less prescriptive rules.

3.2. Demystifying Crypto Taxes: How Your Assets Are Treated

Switzerland lacks specific legislation solely dedicated to cryptocurrency taxation. Instead, the SFTA applies existing tax principles, generally treating cryptocurrencies as intangible movable assets, akin to foreign currencies or securities. Taxation occurs at three levels: federal, cantonal, and communal, meaning rates and specific rules can vary depending on residency.

3.2.1. Wealth Tax: An Annual Obligation

Cryptocurrencies held by individuals resident in Switzerland are considered part of their total taxable wealth.

This tax is levied annually based on the market value of all taxable assets (including crypto) in Swiss Francs (CHF) as of December 31st.

The SFTA publishes an official year-end price list for the most common cryptocurrencies (e.g., Bitcoin, Ether, Ripple, Litecoin, Bitcoin Cash) which taxpayers must use for their declaration. If a specific token is not listed, its value should be declared based on the price from the trading platform where it is held, or ultimately, its purchase price if no reliable market value is available.

Wealth tax rates are progressive and vary significantly by canton and municipality. Combined rates typically range from around 0.1% to 1.0% of net taxable wealth. Some cantons known for lower overall tax burdens (like Schwyz or Obwalden) may have very low marginal rates at high wealth levels. Tax-free allowances also apply, differing from canton to canton, meaning individuals with modest wealth may pay little or no wealth tax.

3.2.2. Income Tax: Taxable Events

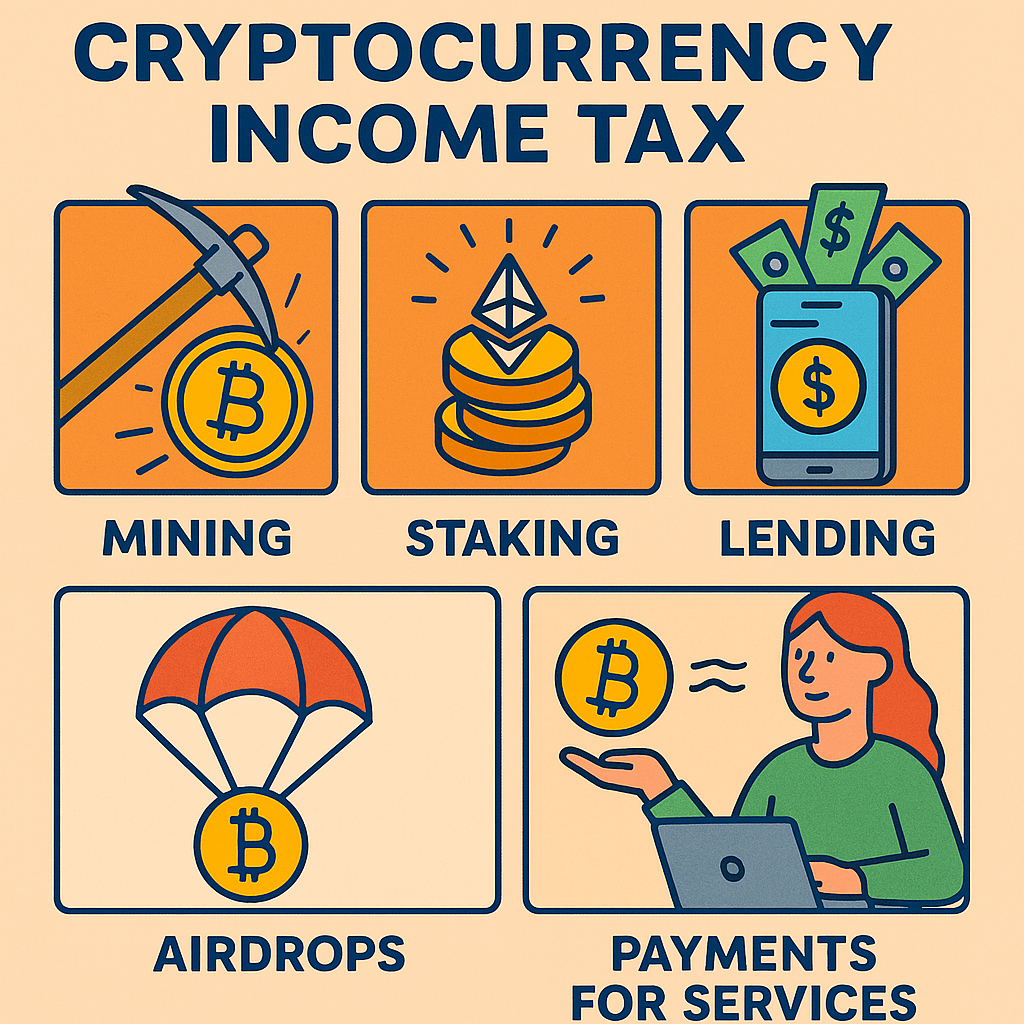

Income tax is triggered when cryptocurrencies are received as income, not typically when their value appreciates while being held (see Capital Gains below). Taxable events include:

Mining Rewards: Income generated from cryptocurrency mining is generally considered taxable income. If the mining activity meets the criteria for self-employment (systematic, profit-oriented, independent activity with capital/labour input), it’s taxed as self-employment income, allowing for the deduction of related expenses (e.g., electricity, hardware depreciation). Otherwise, it may be taxed as other income.

Staking Rewards: Rewards received for staking cryptocurrencies (locking them up to help validate blockchain transactions) are considered taxable income at the time of receipt. The SFTA generally views rewards received by individuals simply delegating their tokens to a staking pool (delegator staking) as taxable investment income (similar to interest). Rewards earned by operating a validator node (validator staking) might qualify as self-employment income depending on the scale and professionalism of the activity.

Lending Interest: Interest earned from lending cryptocurrencies is taxable income.

Airdrops and Hard Forks: Cryptocurrencies received through airdrops (free distributions) or resulting from hard forks are generally considered taxable income at their market value upon receipt. If a token has no ascertainable market value when received, it might initially be valued at zero for income tax purposes, with tax implications arising upon later sale. (Note: Some tax experts debate the universal application of income tax to all airdrop types).

Salary/Payments for Services: When cryptocurrencies are received as salary, bonuses, or payment for freelance work, their market value in CHF at the time of receipt constitutes taxable employment or self-employment income. This value should be documented (e.g., on payslips).

For income tax purposes, crypto received is valued at its CHF market value at the time of inflow. Taxpayers can typically use official SFTA exchange rates or daily bank rates for conversion.

3.2.3. Capital Gains: The Private vs. Professional Trader Distinction

This is arguably the most attractive feature of the Swiss tax system for many crypto investors.

Private Investors: For individuals holding cryptocurrencies as part of their private assets, capital gains realized from selling or exchanging them are generally TAX-FREE. This applies whether selling for fiat currency (CHF, EUR, USD, etc.) or trading one cryptocurrency for another. This tax exemption is a cornerstone of Switzerland’s appeal. The flip side is that capital losses incurred on private crypto assets are NOT tax-deductible.

Professional Traders: If an individual’s crypto trading activities are deemed to constitute professional or commercial self-employment, the situation changes drastically. In this case, capital gains ARE fully taxable as income. These gains are added to the individual’s other income and subject to progressive federal, cantonal, and communal income tax rates. Furthermore, these profits are also subject to mandatory social security contributions (AHV/OASI/AVS), adding a significant additional cost layer (around 10%). Conversely, losses incurred by professional traders ARE tax-deductible against other income.

Criteria for Professional Trading: There is no single definitive test; tax authorities assess the overall circumstances based on established criteria (often derived from securities trading practices). Factors indicating professional trading include:

- Short Holding Periods: Systematically holding assets for less than six months.

- High Transaction Volume/Frequency: A large number of trades, or a total transaction volume significantly exceeding the initial portfolio value (e.g., more than five times) within a tax year.

- Use of Debt/Leverage: Employing substantial borrowed funds to finance trading activities.

- Systematic Approach: Using professional methods, specific knowledge, or complex strategies (including derivatives for speculation rather than just hedging existing positions).

- Income Dependence: Realized capital gains constituting a significant portion (e.g., over 50%) of the individual’s net income or being necessary to cover living expenses.

The classification is crucial. Most casual investors and long-term holders (“HODLers”) typically qualify as private investors, benefiting from tax-free capital gains. However, very active traders, particularly those using leverage or relying on trading for income, risk being classified as professional traders, facing substantial tax and social security liabilities on their profits. Obtaining clarity, potentially through a tax ruling if activity levels are high, is advisable.

Other Tax Considerations:

- Gifts and Inheritance: Gifts or inheritances of crypto assets may be subject to cantonal gift or inheritance tax. Rates and exemptions vary widely. Taxes are often low or zero for transfers between spouses and direct descendants but can be higher for unrelated individuals. Some cantons (like Schwyz and Obwalden) levy no inheritance or gift tax at all.

- Donations: Donations of crypto (or fiat) exceeding CHF 100 per year to qualified Swiss charitable organizations are generally tax-deductible from taxable income.

- Value Added Tax (VAT): Transactions involving cryptocurrencies used as a means of payment are generally exempt from VAT, similar to transactions in foreign currencies.

While the tax-free capital gains for private investors is a major draw, it’s essential to understand the complete picture. The annual Wealth Tax represents an ongoing cost, and income derived from activities like staking, mining, or lending is consistently taxable. Furthermore, the risk of being classified as a professional trader poses a significant financial threat to highly active individuals. A comprehensive assessment must consider all applicable taxes within the chosen canton of residence.

Table 3: Tax Treatment of Common Crypto Activities in Switzerland

| Activity | Tax Treatment (Private Investor) | Tax Treatment (Professional Trader) | Key Considerations |

|---|---|---|---|

| Buying Crypto (with Fiat) | Tax-free event. | Tax-free event (basis for future gain/loss calculation). | Document purchase price/date for wealth tax and potential future capital gains calculation (if professional). |

| HODLing (Holding Crypto) | No income/capital gains tax. Subject to annual Wealth Tax on value at Dec 31st. | No income/capital gains tax on holding. Subject to annual Wealth Tax. Asset considered business wealth. | Wealth tax applies annually regardless of gains. |

| Selling/Trading Crypto (Fiat/Crypto) | Capital Gains are TAX-FREE. Capital Losses are NOT deductible. | Capital Gains are TAXABLE as Income (+ Social Security). Capital Losses ARE deductible. | Crucial distinction. Maintain records to support private investor status (holding periods, volume etc.). |

| Receiving Staking Rewards | Taxable Income (investment income) at market value upon receipt. | Taxable Income (business income) at market value upon receipt (+ Social Security). | Consistently taxed. Value at receipt forms basis for future capital gains calculation (if professional) or wealth tax (if held). |

| Receiving Mining Rewards | Taxable Income (potentially self-employment if criteria met) at market value upon receipt. | Taxable Income (self-employment income) at market value upon receipt (+ Social Security). Expenses deductible. | Classification (private vs. self-employed) depends on activity scale/professionalism. |

| Receiving Airdrops / Forks | Generally Taxable Income at market value upon receipt (if value exists). | Generally Taxable Income (business income) at market value upon receipt (+ Social Security). | Tax treatment can be complex, especially if no initial market value. |

| Receiving Crypto Salary/Payment | Taxable Income (employment/other) at market value upon receipt. | Taxable Income (business/employment) at market value upon receipt (+ Social Security if self-employed). | Value must be declared correctly by employer/payer. |

| Gifting Crypto | Potentially subject to Cantonal Gift Tax (recipient pays). Rates/exemptions vary widely. | Potentially subject to Cantonal Gift Tax. May also trigger income tax if considered disposal of business asset above cost basis. | Rules vary significantly by canton and relationship between donor/recipient. Often tax-free for close family. |

| Donating Crypto | Generally Tax-Deductible from income if > CHF 100 to a qualified Swiss charity. | Generally Tax-Deductible from income. | Ensure charity is qualified in Switzerland. Donation valued at market value at time of donation. |

Exporter vers Sheets

3.3. Crypto Hubs: Exploring Zug’s “Crypto Valley” and Ticino’s “Plan B”

While Switzerland as a whole offers a favourable environment, certain cantons have actively positioned themselves as leaders in the crypto space, creating vibrant ecosystems and implementing specific crypto-friendly policies.

Canton Zug: Widely known as the birthplace of “Crypto Valley,” Zug has a long-standing reputation as a global hub for blockchain and crypto companies.

- Tax Payments: Zug was a pioneer in accepting cryptocurrency for tax payments. Currently, both individuals and companies can pay cantonal and federal taxes invoiced by the Cantonal Tax Administration Zug using Bitcoin (BTC) or Ether (ETH), up to a limit of CHF 1.5 million per tax invoice. The service is facilitated via Bitcoin Suisse AG, which handles the conversion to CHF and bears the exchange rate risk, charging the taxpayer a 1% fee for the service.

- Ecosystem: Hosts a dense network of crypto startups, foundations (like Ethereum), venture capital firms, and service providers. Benefits from low corporate tax rates compared to other Swiss cantons and international locations.

- Tax Regime: Offers the lump-sum taxation regime for qualifying individuals.

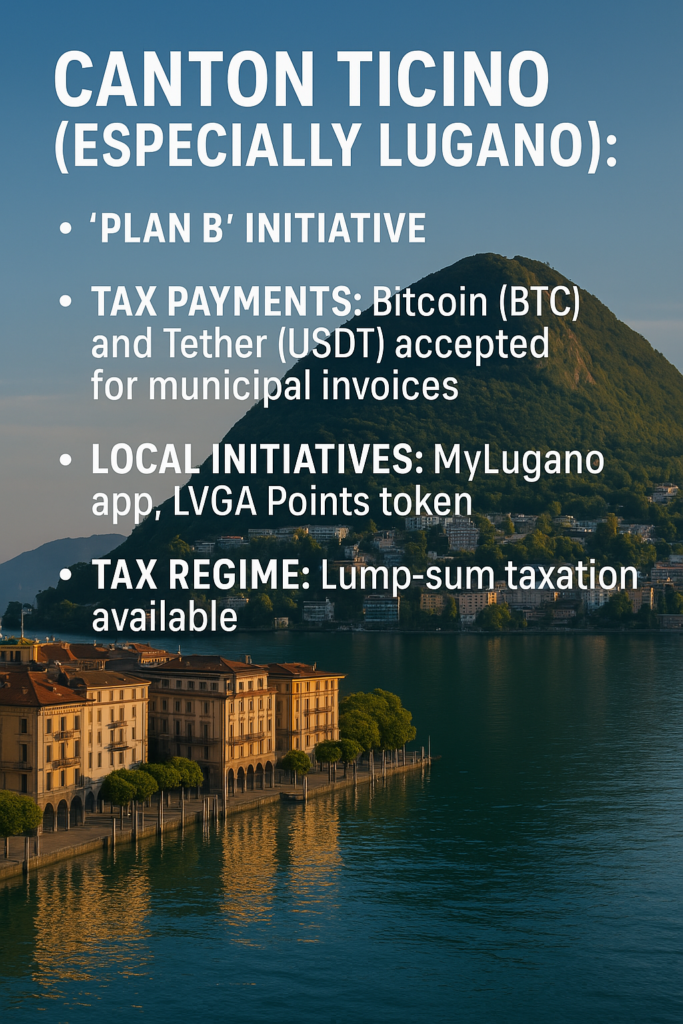

Canton Ticino (especially Lugano): This Italian-speaking canton, particularly its largest city Lugano, is making significant strides to become a leading crypto hub, directly competing with Zug.

- “Plan B” Initiative: A collaboration between the City of Lugano and Tether aims to leverage Bitcoin technology to transform the city’s financial infrastructure and integrate crypto into daily life.

- Tax Payments: Lugano accepts Bitcoin (BTC) and Tether (USDT) for all municipal invoices, including taxes, fees, and services, apparently without an upper limit specified for this broader acceptance. This service is also offered via Bitcoin Suisse.

- Local Initiatives: Lugano has developed its own payment app (“MyLugano”) and a local loyalty points token (LVGA Points), promoting crypto usage within the city. It’s also fostering blockchain infrastructure development (e.g., 3Achain).

- Tax Regime: Capital gains remain tax-free for private investors. The canton is implementing tax reforms to further reduce corporate profit taxes, aiming to enhance its attractiveness for businesses. Lump-sum taxation is available.

Other Notable Cantons:

- Zurich: As Switzerland’s largest city and main financial center, Zurich hosts key infrastructure, including the licensed crypto banks AMINA Bank and Sygnum Bank. However, Zurich has abolished lump-sum taxation.

- Geneva: A major global center for finance and wealth management, offering international connectivity. Lump-sum taxation is available here. Generally perceived as having a higher cost of living.

- Valais (specifically Zermatt): The municipality of Zermatt, famous for the Matterhorn, also accepts Bitcoin (BTC) for local tax payments, facilitated by Bitcoin Suisse. The canton of Valais offers lump-sum taxation.

This landscape reveals active competition among cantons. Zug benefits from its established “Crypto Valley” brand and ecosystem density. Ticino/Lugano is aggressively innovating with broader crypto payment acceptance (including the major stablecoin USDT) and specific, highly visible initiatives like “Plan B.” Zurich and Geneva offer the advantages of major financial centers but may have higher costs or lack certain tax regimes (like lump-sum in Zurich). The choice of canton therefore involves balancing factors like ecosystem access, specific crypto policies (like tax payment options), availability of preferred tax regimes (lump-sum), general cantonal tax rates, and lifestyle preferences.

Table 4: Comparison of Key Crypto-Relevant Cantons

| Feature | Zug | Ticino (Lugano) | Zurich | Geneva | Valais (Zermatt) |

|---|---|---|---|---|---|

| “Crypto Valley” Status | Original “Crypto Valley”, Established Hub | Emerging Hub, “Plan B” Initiative | Major Financial Center, Crypto Banks HQ | Major Financial Center | Specific municipal adoption (Zermatt) |

| Tax Payment Acceptance | BTC, ETH (up to CHF 1.5M per invoice) | BTC, USDT (all municipal bills, no limit stated) | No | No | BTC (Zermatt municipal taxes) |

| Specific Initiatives | Early adoption, strong ecosystem support | Plan B, MyLugano app, LVGA Points, 3Achain | Hosting licensed crypto banks | Global wealth management focus | Municipal adoption |

| Ecosystem/Infrastructure | Dense network of startups, VCs, services | Growing ecosystem, Tether partnership | AMINA, Sygnum banks, financial services | Strong financial services infrastructure | Tourism focus, specific crypto services |

| Lump-Sum Taxation Available? | Yes | Yes | No | Yes | Yes |

| General Perception/Focus | Crypto/Blockchain Hub, Low Corp. Tax | Innovation, Crypto Integration, Tourism | Finance, Business, Tech (Higher Cost) | Finance, International Orgs (Higher Cost) | Tourism, Lifestyle, Lower Density |

Exporter vers Sheets

4. The Swiss Lifestyle: Practicalities and Costs

Relocating involves more than just financial and regulatory planning; understanding the practicalities of daily life and the associated costs is essential. While Switzerland offers an exceptionally high quality of life, it also comes with a reputation for being expensive.

4.1. Understanding the Cost of Living Across Key Cities

Switzerland is frequently cited as one of the most expensive countries globally. However, when factors like high salaries, efficient services, and overall quality are considered, the cost of doing business and living can compare favourably with other major international hubs like London, Paris, or New York.

Key Cost Drivers: The most significant expenses for residents are typically housing (rent or purchase) and mandatory health insurance premiums. Food, transportation, childcare, and leisure activities also contribute substantially to the monthly budget.

Regional Variation: Costs are not uniform across the country. Major cities like Geneva and Zurich consistently rank among the most expensive globally. Cantons like Zug may also have high costs due to demand. Cities in Ticino like Lugano, or areas outside the main urban centers, might offer comparatively lower living expenses, though still high by international standards.

Specific Costs: Providing precise figures requires consulting up-to-date external cost-of-living databases (e.g., Numbeo, official cantonal statistics). However, prospective residents should budget for significant monthly outlays, particularly for accommodation in desirable areas of major cities.

4.2. Healthcare in Switzerland: Accessing a World-Class System

Switzerland boasts a healthcare system renowned for its high quality, excellent infrastructure, and accessibility.

Mandatory Health Insurance (LAMal/KVG): Health insurance is compulsory for all residents, including foreign nationals. New arrivals must secure basic health insurance coverage from a Swiss-authorised private insurer within three months of taking up residence.

System Structure: It’s a private system where individuals choose their insurer from numerous competing companies. All insurers must offer a standardized basic coverage package defined by law. Individuals can opt for higher levels of coverage (e.g., private hospital rooms) through supplementary insurance policies at additional cost.

Costs: Premiums for the mandatory basic insurance represent a significant monthly expense. Costs vary based on:

- Canton of residence (premiums differ significantly).

- Chosen insurer.

- Age of the insured person.

- Chosen deductible level (franchise): Higher deductibles lead to lower monthly premiums but mean paying more out-of-pocket before insurance covers costs.

- Chosen insurance model (e.g., standard, HMO, Telmed).

- Access: Once insured, residents have access to a wide network of doctors, specialists, and hospitals. Quality of care is generally considered excellent throughout the country.

4.3. Finding Your Base: The Swiss Real Estate Market (Renting vs. Buying)

Securing accommodation is a prerequisite for registering residency. The Swiss real estate market, particularly in popular areas, can be competitive.

Renting: Renting is very common in Switzerland, especially in cities. The process typically involves submitting an application dossier (including proof of income/financial standing, permit status, potentially references), paying a deposit (usually equivalent to 1-3 months’ rent), and signing a formal lease agreement. Demand can be high, particularly for well-located apartments in Zurich, Geneva, or Zug.

Buying: Acquiring property is possible for foreigners, but subject to certain restrictions, primarily governed by the “Lex Koller” legislation.

- EU/EFTA nationals with a Swiss residence permit generally face few restrictions when buying a primary residence.

- Third-country nationals with a C permit also generally face few restrictions for a primary residence.

- Third-country nationals with a B permit may be allowed to purchase a primary residence, often subject to cantonal authorization and demonstrating intent to live there permanently.

- Purchasing holiday homes or investment properties (not used as a primary residence) is heavily restricted for foreigners, especially non-residents and often requires specific cantonal quotas and authorizations, primarily in designated tourist zones.

- The buying process involves engaging a notary, registering the property transfer in the land registry, and paying associated taxes and fees. Ownership of property impacts the calculation basis for lump-sum taxation (using imputed rental value).

- Prices: Real estate prices, both for rent and purchase, are high and vary significantly by location. Prime areas in Zurich and Geneva command premium prices. Cantons like Zug are also expensive due to high demand. Researching specific cantonal and municipal markets is essential.

4.4. Banking and Finance: Crypto-Friendly Options

Switzerland’s sophisticated banking sector offers a range of options, including institutions specifically catering to the needs of crypto investors.

Traditional Banks: While historically conservative, many traditional Swiss banks, including cantonal banks (like Zuger Kantonalbank, involved in processing crypto tax payments) and major institutions (UBS, Credit Suisse – now part of UBS), are gradually developing crypto-related services, often focusing initially on custody and trading for institutional or HNW clients. Direct access to comprehensive crypto services for retail investors through traditional banks can still be limited.

Specialized Crypto Banks: A key advantage of the Swiss ecosystem is the presence of fully licensed banks dedicated to digital assets. Prominent examples include AMINA Bank (formerly SEBA Bank) and Sygnum Bank, both headquartered in the Zurich/Zug area. These institutions offer a wide suite of regulated services specifically for crypto investors:

- Secure custody of digital assets.

- Trading of various cryptocurrencies and fiat pairs.

- Staking services.

- Crypto-backed loans and credit facilities.

- Tokenization services.

- Institutional-grade asset management.

Crypto Financial Service Providers: Companies like Bitcoin Suisse are regulated financial intermediaries (though not banks) that play a vital role. They offer brokerage, custody, staking, collateralized lending, and payment solutions, including facilitating the crypto tax payments in Zug, Zermatt, and Lugano.

Account Opening: Procedures vary. All institutions require robust KYC/AML checks, including valid identification, proof of residence, and often detailed information on the source of funds (Source of Wealth/Source of Funds documentation), particularly when dealing with significant crypto asset transfers. Opening accounts as a non-resident can be more challenging and may involve higher minimum balances or specific eligibility criteria.

For crypto investors seeking comprehensive banking and investment services tailored to digital assets, looking beyond traditional banks towards the specialized crypto banks and regulated financial service providers often provides the most suitable solutions within the Swiss financial landscape.

5. Beyond Business: Quality of Life in Switzerland

Switzerland consistently ranks among the world’s best places to live, offering an exceptional quality of life underpinned by safety, efficiency, and stunning natural beauty.

5.1. Safety, Stability, and Efficient Transport

- Safety and Stability: The country is renowned for its extremely low crime rates, political stability, and secure environment. This sense of security is a significant draw for individuals and families relocating from less stable regions.

- Transport Infrastructure: Switzerland possesses one of the world’s most efficient, punctual, and comprehensive public transportation networks. Integrated trains, trams, buses, and boats connect virtually every corner of the country, making car ownership unnecessary in many urban and even some rural areas. The infrastructure is modern, clean, and reliable.

5.2. Culture, Languages, and Integrating into Swiss Society

Switzerland’s identity is shaped by its cultural and linguistic diversity.

Languages: There are four official national languages: German, French, Italian, and Romansh. The predominant language varies significantly by region: Swiss German dialects dominate in Zurich, Zug, Bern, and much of the north and east; French is spoken in Geneva, Vaud, and the west; Italian prevails in Ticino and parts of Grisons. English is widely understood and spoken, particularly in business environments and major cities, facilitating initial settlement. However, proficiency in the local language (German, French, or Italian depending on the canton) is generally crucial for deeper social integration, navigating daily life outside tourist/expat bubbles, and often plays a role in obtaining the permanent C permit.

Culture: Swiss culture values punctuality, efficiency, discretion, cleanliness, and adherence to rules. Regional differences exist, reflecting linguistic and historical influences. Integration involves adapting to these norms, respecting local customs, and ideally, learning the local language.

Integration Assessment: Authorities consider integration efforts when renewing permits, especially for the transition to the C permit. This includes respect for Swiss law, economic participation (working or studying), and language skills.

While navigating professional life in English is often feasible, achieving genuine integration and fulfilling the requirements for long-term settlement typically necessitates learning the language of the chosen canton. This linguistic diversity makes the choice of canton a significant cultural decision.

5.3. Education System and Leisure Opportunities

Education: Switzerland offers a high-quality education system at all levels, from primary schools to world-class universities and research institutions. The system is largely public but also features excellent international and private schools. Educational structures and curricula can vary slightly between cantons.

Leisure: The country’s stunning natural environment – the Alps, pristine lakes, and picturesque countryside – provides unparalleled opportunities for outdoor recreation year-round, including skiing, snowboarding, hiking, mountaineering, biking, and water sports. Cities offer rich cultural scenes with museums, galleries, theaters, and festivals. The high standard of living supports a wide array of leisure activities and dining options.

6. Final Considerations: Is Switzerland the Right Move for You?

Switzerland presents a compelling proposition for cryptocurrency investors and holders, blending financial advantages with exceptional quality of life. However, the decision to relocate requires a careful weighing of the benefits against the inherent challenges and costs.

Recap of Advantages:

- Favourable Crypto Taxation: The tax exemption on capital gains for private investors is a significant financial incentive. The lump-sum taxation regime offers predictability and privacy for qualifying HNWIs. Certain cantons also boast competitive corporate tax rates.

- Regulatory Clarity: A relatively well-defined and principles-based regulatory framework provides legal certainty, with FINMA applying existing financial laws to crypto activities.

- Developed Crypto Ecosystem: The presence of licensed crypto banks, specialized service providers, and active crypto communities, particularly in hubs like Zug and Ticino, offers tailored support and infrastructure.

- Stability and Quality of Life: Unmatched political and economic stability, high levels of safety, efficient infrastructure (transport, healthcare), excellent education, and outstanding natural beauty contribute to a superior living standard.

- Tangible Crypto Adoption: Initiatives like accepting crypto for tax payments in several cantons signal a progressive attitude towards digital assets.

Recap of Challenges & Considerations:

- Immigration Hurdles: The process can be complex and demanding, particularly for non-EU/EFTA nationals, who face stricter requirements regarding qualifications or financial independence.

- Professional Trader Classification Risk: The ambiguity surrounding the criteria for professional trading creates a risk of unintended tax liabilities (income tax + social security) for very active traders. Careful management of trading activity is crucial to maintain private investor status.

- Annual Wealth Tax: An unavoidable ongoing tax levied on total worldwide assets, including all cryptocurrency holdings, above cantonal allowances.

- High Cost of Living: Switzerland is expensive, with housing and mandatory health insurance being major recurring costs, especially in prime locations.

- Lump-Sum Taxation Restrictions: The prohibition on gainful employment within Switzerland under this regime may not suit all investor profiles, particularly active traders. Its unavailability in key cantons like Zurich limits options.

- Compliance Intensity: Stringent AML regulations, including the unique self-hosted wallet verification rules, impose compliance burdens on VASPs and can affect user experience.

- Integration Requirements: Long-term settlement (C permit) necessitates integration efforts, often including learning the local language of the chosen canton.

Concluding Thought:

Switzerland offers a unique and potentially highly advantageous environment for specific types of crypto investors – particularly long-term holders (HODLers) who qualify as private investors and high-net-worth individuals eligible for and suited to the lump-sum taxation regime. The combination of tax benefits (primarily tax-free capital gains), regulatory stability, and exceptional quality of life is hard to match.

However, the move is not without significant hurdles. Navigating the immigration process, understanding the nuances of the tax system (especially the critical private vs. professional trader distinction and the ongoing wealth tax), and managing the high cost of living require meticulous planning. The choice of canton is also a critical decision, impacting taxes, cost of living, language, and access to the crypto ecosystem.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

Thorough due diligence, personalized professional advice (legal and tax), and potentially obtaining advance rulings from cantonal authorities are strongly recommended before committing to emigration. For the right profile, Switzerland can indeed be an exceptional base, but it demands a well-informed and carefully executed approach.