The Bahamas Beckons: A Crypto Investor’s Guide to Island Residency, Regulation, and Reality

The Commonwealth of The Bahamas, an archipelago nation renowned for its turquoise waters and idyllic beaches, has long held appeal for international investors and high-net-worth individuals. In recent years, its allure has extended significantly into the digital asset space. Driven by a tax-neutral environment and a proactive approach to financial services, the islands present a potentially attractive proposition for cryptocurrency investors and holders seeking regulatory clarity, financial optimization, and a distinct lifestyle change.

As the global crypto landscape continues to evolve, individuals managing substantial digital asset portfolios are increasingly exploring jurisdictions that offer stability, favourable tax treatment, and a clear legal framework for their activities. The Bahamas, with its established financial sector and specific legislation targeting digital assets, emerges as a prominent contender.

This report serves as a comprehensive and practical guide for the crypto investor considering emigration to The Bahamas. It aims to provide a balanced overview, navigating the intricacies of investment-based immigration pathways, dissecting the specific regulations governing cryptocurrencies, analyzing the tax implications, detailing the practical costs of island living, assessing the quality of essential services, and evaluating the overall quality of life. By examining these crucial decision-making factors holistically, this guide intends to equip potential movers with the necessary information to make an informed decision.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

1. Securing Your Slice of Paradise: Residency Through Investment

For foreign nationals seeking long-term settlement in The Bahamas, particularly investors, the primary mechanism is achieving Permanent Residence (PR). This status grants the holder the right to live and, importantly for some investment routes, work indefinitely within the country, offering stability and freedom of movement.

1.1. The Economic Permanent Residence (EPR) Program Explained

The cornerstone for investors is the Economic Permanent Residence (EPR) program. This pathway is specifically designed for individuals making a substantial financial commitment to the country. Obtaining EPR status confers immediate permanent residency upon approval, a significant advantage compared to routes requiring lengthy temporary stays first.

Key benefits associated with EPR include:

- Indefinite Stay: PR is granted for the duration of the applicant’s life, providing long-term security, although the associated electronic travel card requires renewal every ten years.

- Minimal Physical Presence: To maintain the PR status, investors are typically required to spend at least 90 days per year in The Bahamas. This flexibility allows for significant time spent elsewhere if needed.

- Family Inclusion: The primary applicant can include their spouse and dependent children under 18 in the application at minimal additional cost.

- Pathway to Citizenship: While not guaranteed, holding PR for ten years (with at least six years of actual residency) makes an individual eligible to apply for Bahamian citizenship. However, it is crucial to understand that the granting of citizenship is discretionary and requires renouncing previous nationalities.

- Financial Independence Requirement: Applicants must demonstrate they possess sufficient independent financial means to support themselves and their dependents without needing to seek employment in The Bahamas.

1.2. Investment Options and Thresholds

To qualify for EPR, applicants must choose one of the designated investment routes:

- Real Estate: The most common pathway involves the purchase of residential property. This demonstrates a tangible commitment to the country.

- Business Investment: Investing in a qualifying “growth-category” business that demonstrably creates employment for Bahamians is another option. Priority sectors often include tourism, information technology, maritime construction, medical services, infrastructure development, agriculture, and education technology. Proposals for business investments are typically reviewed by the Bahamas Investment Authority (BIA), which often sets a practical minimum consideration threshold (e.g., $500,000), although this is separate from the EPR minimum.

- Government Bonds: Investment in Zero Coupon Bonds issued by the Central Bank of The Bahamas is also a qualifying option, though less frequently utilized than real estate.

Investment Amount: Understanding the required investment level is critical.

- The current official minimum investment threshold for EPR eligibility is BSD/USD $750,000.

- Crucially, this minimum is set to increase. Effective January 1, 2025, the required minimum investment for new EPR applicants will rise to BSD/USD $1,000,000. This represents a significant change and imposes a time-sensitive consideration for prospective investors aiming for the current threshold. Acting before this date allows securing residency at the lower capital outlay.

- While some sources mention lower figures (e.g., $500,000) or suggest investments of $1.5 million or more receive “speedy consideration,” the $750,000 (rising to $1,000,000) figure represents the official qualifying threshold for the EPR program itself. The higher $1.5 million figure likely pertains to eligibility for accelerated processing of the application, not a different category of residency.

Investment Holding Period: A significant requirement, particularly emphasized under recent regulations, is the mandatory 10-year holding period for the qualifying investment (whether real estate, business, or bonds). This means the investment is not merely an entry requirement but a decade-long commitment. Failure to maintain the investment for this duration can result in the revocation of permanent residence status. Investors must factor in the market risks associated with holding the asset for this extended period and understand the long-term nature of this obligation.

1.3. Application Essentials: Process, Documents, and Timelines

The application process for EPR is managed by the Bahamas Department of Immigration. It generally involves:

- Submission of the completed application package.

- Thorough due diligence checks conducted by the government on the applicant and source of funds.

- A potential interview with an immigration officer for the applicant and spouse.

Key Documentation: A comprehensive set of documents is required, and ensuring accuracy and proper certification is vital. Common requirements include:

- Completed Application Form (Form IV) with a Bahamian $10 postage stamp affixed, duly notarized.

- Passport: Certified copies of biographical data pages for the applicant, spouse, and any dependent children (must be valid).

- Birth Certificates: Original or certified copies for applicant, spouse, and children. Documents not in English require certified translations. Foreign documents must be properly verified (apostilled or legalized) and authenticated by the relevant Ministry of Foreign Affairs.

- Marriage Certificate: Certified copy if applicable (translated/apostilled if necessary).

- Police Certificate: Original certificate issued within the last six months, covering the previous five years of residence (required for applicants 14+).

- Medical Certificate: Original certificate dated within 30 days of application submission.

- Photographs: Two current passport-sized photographs (meeting specific requirements).

- Character References: Two original references from reputable individuals known to the applicant for at least five years (with contact details).

- Financial Documentation: Financial references from banks or similar institutions verifying economic worth (citing a figure range) and demonstrating sufficient means to reside without employment.

- Proof of Investment: Documentation proving the qualifying property purchase (e.g., conveyance) or business investment details.

- Real Property Tax Status: Proof of payment if applicable.

- Fingerprints: A complete set may be required, potentially obtainable in Nassau.

Fees:

- Application Processing Fee: A non-refundable fee, typically around $100.

- Government Fee: Payable upon approval of the application. Sources suggest this is a one-time fee of $15,000 for the main applicant.

- Dependent Fees: Small additional fees (e.g., $100) for endorsing each dependent (spouse, children) on the certificate.

Processing Times: The government aims to process EPR applications within three months of complete submission. However, actual timelines can vary depending on the complexity of the case and workload. As noted, investments significantly exceeding the minimum (e.g., $1.5M+) may qualify for expedited processing, potentially reducing the wait time considerably (perhaps to around 21 days), though this is subject to confirmation and departmental capacity. Given the potential inconsistencies in information found online regarding minimums and processing, prospective applicants should always verify current requirements and timelines directly with the Department of Immigration or through reputable Bahamian legal counsel.

1.4. Maintaining Status and the Long Road to Citizenship

Securing EPR is the first step; maintaining it involves ongoing compliance:

- Physical Presence: Adhering to the 90-day minimum annual presence requirement is necessary to retain PR status.

- Decennial Declaration: Every ten years, PR holders must file a declaration confirming that the information relied upon for their initial application remains materially unchanged, or provide an affidavit detailing any changes and confirming continued eligibility.

- Investment Hold: Maintaining the qualifying investment for the full 10-year period is critical.

Citizenship Application: After holding Permanent Residence for ten years, with a minimum of six years spent physically residing in The Bahamas, an individual becomes eligible to apply for naturalization as a Bahamian citizen.

However, several crucial points must be understood:

- Discretionary Grant: Citizenship is not an automatic right upon meeting the time criteria. The Bahamian government retains full discretion in granting citizenship.

- Renunciation Required: The Bahamas does not recognize dual citizenship. Successful applicants must renounce their previous nationality to become Bahamian citizens.

This makes the Bahamas primarily attractive for its residency and tax benefits, rather than as a fast track to a second passport, especially for those wishing to retain their original citizenship. The long timeline and uncertain outcome mean citizenship should be viewed as a potential long-term possibility rather than a guaranteed benefit of the EPR program.

2. Decoding the Digital Dollar: Crypto Regulation in The Bahamas

The Bahamas has actively sought to position itself as a forward-thinking jurisdiction for digital assets, establishing itself as one of the first countries globally to introduce comprehensive legislation specifically for the sector back in 2020. Recognizing the rapid evolution of the market, this initial framework has recently undergone a significant overhaul.

2.1. The DARE Act 2024: Embracing Digital Assets

The Digital Assets and Registered Exchanges (DARE) Act, 2024, recently passed into law, repeals and replaces the 2020 legislation. This updated Act represents a comprehensive effort to regulate the issuance, sale, trade, and management of digital assets both within The Bahamas and by entities operating from the jurisdiction. Its core aim is to create a clear, robust, and modern regulatory structure that fosters responsible innovation while ensuring market integrity and investor protection. The government and regulators have emphasized the Act’s alignment with current international best practices and standards, such as those set by the International Organization of Securities Commissions (IOSCO).

The Securities Commission of The Bahamas (SCB) serves as the primary regulatory authority under the DARE Act. The SCB is responsible for:

- Registering and licensing Digital Asset Businesses (DABs) and Digital Asset Service Providers (DASPs).

- Ongoing supervision and monitoring of registrants.

- Establishing rules and guidelines for conduct, including AML/CFT (Anti-Money Laundering and Counter-Financing of Terrorism) compliance.

- Overseeing digital asset offerings (including Initial Coin Offerings – ICOs) and stablecoin issuance.

- Protecting investors and consumers by promoting transparency and preventing market abuse (fraud, manipulation).

- Enforcing the Act, with powers to impose penalties including fines, suspension, or revocation of registration for breaches. The specific monetary values of fines are typically determined by the SCB based on the severity of the violation.

2.2. Key Rules for Crypto Holders and Businesses

The DARE Act 2024 casts a wide net, applying to a broad spectrum of activities involving digital assets. This includes, but is not limited to:

- Operating digital asset exchanges.

- Facilitating digital asset payments.

- Providing digital asset custody or wallet services.

- Trading digital assets (as a business).

- Providing advisory or management services related to digital assets.

- Dealing in digital asset derivatives.

- Offering staking services or operating staking pools as a business.

- Issuing digital assets.

The Act regulates various types of digital assets, including:

- Asset Tokens: Representing claims against an issuer, often backed by real-world assets.

- Utility Tokens: Intended for use within a specific platform or service (potentially exempt from securities classification if meeting certain criteria).

- Non-Fungible Tokens (NFTs): Categorized under the Act as either financial or consumer assets, depending on their characteristics and use.

- Stablecoins: Digital assets designed to maintain a stable value relative to another asset (e.g., fiat currency).

- Digital Currencies: Such as government-backed digital money (distinct from CBDCs like the Sand Dollar which have separate regulations).

For crypto investors and businesses, several key provisions within DARE 2024 are particularly relevant:

- Enhanced Investor Protection: Stricter requirements are imposed on digital asset exchanges regarding systems, controls, and consumer protection measures to enhance transaction security and integrity.

- Robust Custody Framework: New rules govern the custody of digital assets and custodial wallet services, emphasizing the protection and accessibility of client assets.

- Staking Disclosure Regime: A specific framework mandates disclosures for businesses staking client assets or operating staking pools.

- Comprehensive Stablecoin Rules: The Act provides a clear definition, requires registration of existing stablecoins, specifies acceptable reserve assets (e.g., fiat currency, highly liquid assets), and establishes rules for custody, management, reporting, and redemption. Crucially, the issuance of algorithmic stablecoins is expressly prohibited. This reflects a cautious approach favouring asset-backed stability.

- Issuer Requirements: Digital asset issuers face “fit and proper” standards, along with new disclosure and financial reporting obligations to enhance investor protection.

- Privacy Token Ban: The issuance of privacy tokens, which obscure transaction details, is prohibited, aligning with regulatory trends favouring transparency.

- AML/CFT Compliance: All registered digital asset businesses must adhere to anti-money laundering and counter-financing of terrorism rules and regulations.

- Sufficient Decentralization: The Act incorporates concepts related to assessing whether a digital asset is “sufficiently decentralized.” This test helps determine if an asset might function independently of its creators, potentially reducing fraud risk and influencing whether it’s regulated as a security.

This sophisticated framework signals that while The Bahamas is open to crypto innovation, it demands adherence to strict operational and compliance standards. This structured environment may increase the compliance burden, potentially favouring larger, well-resourced entities over smaller startups or individual operators. The “crypto-friendly” label should be interpreted as “clearly regulated,” not “unregulated.”

2.3. Banking Your Bits: Navigating Financial Institutions with Crypto

While the SCB and the DARE Act govern the digital asset industry itself, interaction with the traditional banking system falls under the purview of the Central Bank of The Bahamas (CBOB), particularly concerning its Supervised Financial Institutions (SFIs) – the banks and trust companies. Here, the picture becomes more complex for crypto investors.

The CBOB adopts a more cautious stance, guided by principles of financial stability and existing Exchange Control (EC) regulations. Key points include:

- SFI Restrictions: SFIs face constraints on the types of crypto assets and related activities they can engage in, either directly on their balance sheets or through associations. The CBOB applies a “same risk, same activity, same treatment” philosophy, meaning crypto-asset exposures are evaluated based on their underlying risks, similar to traditional assets.

- Prohibition on Direct B$/Crypto Convertibility: A critical restriction is the prohibition on direct conversion between the Bahamian Dollar (B$) (or officially sanctioned B$ instruments like the Sand Dollar CBDC) and foreign currency-denominated crypto assets or instruments sponsored by non-residents. This rule, rooted in Exchange Control requirements, creates a significant friction point for moving funds between local fiat and the global crypto market.

- Crypto as Foreign Assets: For Bahamian residents, crypto assets are generally treated as foreign assets under Exchange Controls. This implies that investments in such assets may need to be funded with foreign exchange purchased through the official Investment Currency Market (ICM), adding complexity and potential cost. Using credit cards for crypto purchases is still viewed as a foreign currency transaction subject to these underlying principles.

- Sand Dollar Limitations: The Bahamas’ own CBDC, the Sand Dollar, operates under separate regulations and is distinct from private cryptocurrencies. Its notoriously low adoption rates, despite government efforts and potential moves to force bank distribution, underscore the public’s hesitancy. Importantly, its limited direct convertibility with foreign crypto reinforces the CBOB’s controlled approach to digital currency interactions.

This disconnect between the DARE Act’s framework for crypto businesses and the CBOB’s restrictions on crypto interactions with traditional banking presents a major practical challenge. While a company might obtain a DARE license to operate a crypto exchange or custody service, it could face significant hurdles establishing robust local banking relationships, managing fiat on/off ramps (especially for B$), and handling operational funds within The Bahamas. Investors seeking seamless integration between their crypto holdings and the local Bahamian financial system should anticipate potential difficulties and may need to rely on international banking relationships or fintech platforms outside the Bahamian regulatory sphere for smooth crypto-fiat conversions and transactions.

The following table summarizes key features of the DARE Act 2024 relevant to investors:

| Feature | Description | Relevance for Crypto Investors |

|---|---|---|

| Expanded Scope | Covers advisory, management, derivatives, staking services alongside exchanges, custody, payments. | Broadens regulatory oversight to more complex crypto activities investors might engage in or utilize. |

| Enhanced Exchange Rules | Increased investor/consumer protection, stringent system & control requirements for exchanges. | Aims to provide a safer trading environment but may increase operational costs for exchanges. |

| Robust Custody Framework | Specific rules for digital asset custody providers emphasizing client asset protection and accessibility. | Offers greater security for investors using licensed Bahamian custodians, but requires providers meet high standards. |

| Stablecoin Framework | Clear definition, registration, reserve/reporting requirements. Algorithmic stablecoins prohibited. | Provides clarity and reduces risk for regulated stablecoins, but bans a specific (higher-risk) category. |

| NFT Categorization | Non-Fungible Tokens classified as either financial or consumer assets based on characteristics. | Regulatory treatment depends on the specific NFT, impacting how they can be issued, traded, or managed. |

| Privacy Token Ban | Issuance of privacy-enhancing tokens is prohibited. | Limits options for investors prioritizing transaction anonymity within the regulated Bahamian framework. |

| AML/CFT Compliance | Standard anti-money laundering and counter-terrorist financing rules apply to all registered businesses. | Ensures alignment with global standards but requires robust compliance procedures, impacting operational ease/cost. |

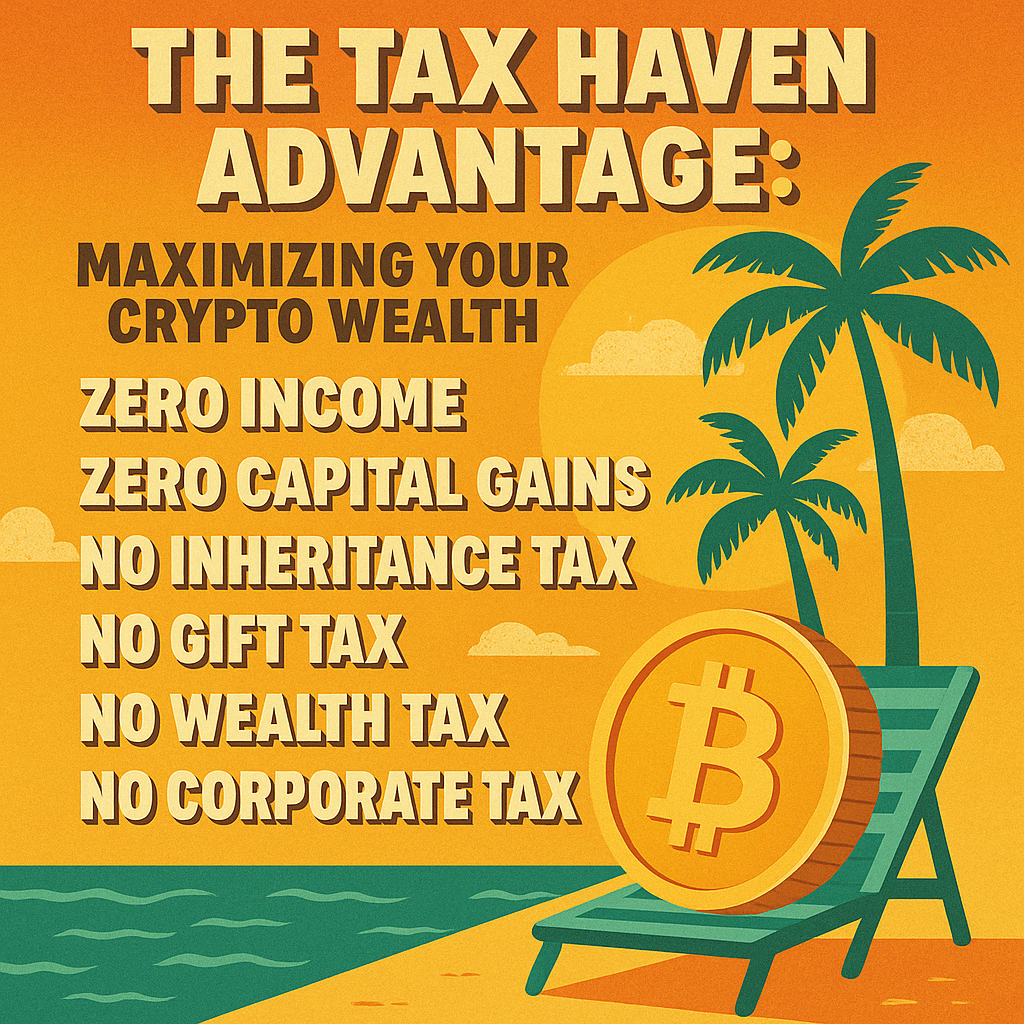

3. The Tax Haven Advantage: Maximizing Your Crypto Wealth

Perhaps the most compelling draw for many individuals and businesses relocating to The Bahamas is its highly favourable tax regime. Widely recognized as a tax haven, the country levies no direct taxes on income or wealth, offering significant potential benefits for crypto investors.

3.1. Zero Income, Zero Capital Gains: The Core Benefit

The cornerstone of the Bahamian tax advantage lies in what it doesn’t tax:

- No Personal Income Tax: Residents of The Bahamas are not subject to any tax on their personal income, regardless of where it is earned globally.

- No Capital Gains Tax: This is particularly crucial for crypto investors. Any profits realized from the sale or exchange of cryptocurrencies or other capital assets are completely tax-free at the personal level for Bahamian residents. This allows investors to retain the full value of their gains without incurring tax liabilities within The Bahamas.

- No Inheritance or Estate Tax: Transferring wealth to heirs upon death is not subject to Bahamian tax.

- No Gift Tax: Gifts made during one’s lifetime are not taxed.

- No Wealth Tax: There is no annual tax levied on an individual’s net worth.

- No Corporate Income Tax (Generally): While businesses require licenses, entities like International Business Companies (IBCs) typically pay no corporate income tax on revenue generated outside The Bahamas. Local revenue may be subject to Business License Fees, which function somewhat like a turnover tax.

This absence of direct taxation on income and capital gains represents the single most significant financial advantage for a successful crypto investor relocating to the Bahamas. Compared to jurisdictions with high income and capital gains tax rates, the potential savings can be substantial, directly increasing the net return on investment activities.

3.2. Beyond Income Tax: Understanding VAT, Property, and Stamp Duties

While free from direct taxes, the Bahamian government generates revenue through a system of indirect taxes and fees. Understanding these is essential for a realistic financial picture:

Value Added Tax (VAT):

- VAT is a broad-based consumption tax applied to the import and supply of most goods and services within The Bahamas.

- The standard rate of VAT is 10%, having been reduced from 12% in January 2022.

- A zero rate (0%) applies to exports and certain specific supplies. Some essential items are exempt, including basic groceries (though the definition can be specific), healthcare services, educational services, and residential property insurance.

- Important Update: Recognizing the impact on living costs, the government has legislated a reduction in the VAT rate on unprepared food items sold in food stores from 10% to 5%, effective April 1, 2025. This measure aims to provide relief on grocery bills but will not apply to prepared foods, restaurant meals, or deli items. This highlights the significant contribution of VAT to everyday expenses.

- VAT applies to digital products and services supplied to Bahamian customers, even by non-resident businesses, starting from the very first sale.

- VAT is also levied on many professional services, including real estate commissions, legal fees, and appraisal fees, typically at the standard 10% rate.

Real Property Tax (RPT):

- RPT is an annual tax levied on the market value of real estate owned in The Bahamas. The rates and exemptions vary significantly based on the property’s classification, value, and the owner’s status. Accurate assessment requires understanding these complex categories:

- Owner-Occupied Property: This applies to properties occupied by the owner for at least six months of the year (recent definitions suggest 183 days).

- The first $300,000 of market value is exempt from tax. (Note: Some older sources may cite $250,000, but $300,000 appears to be the current threshold based on more recent official guidance).

- The value between $300,001 and $500,000 is taxed at 0.625%.

- The value exceeding $500,000 is taxed at 1%.

- There is an annual tax cap for high-value owner-occupied properties, often cited around $120,000 (though figures vary in different sources, this seems the most plausible current cap for very high-end homes).

- Residential Property (Non-Owner Occupied, ≤ 4 units): Properties used solely as dwellings but not meeting the owner-occupier criteria, with four or fewer units.

- The first $75,000 of value incurs a flat fee of $300.

- The value exceeding $75,000 is taxed at 0.625%.

- Commercial Property: Includes properties with more than four units (even if residential), foreign-owned rental properties, and properties used for business purposes. Rates here show some inconsistency across sources, potentially due to recent changes. The following reflects more detailed/recent guidance:

- The first $500,000 of value is taxed at 0.75%.

- The value between $500,001 and $1,500,000 is taxed at 1.0%.

- The value exceeding $1,500,000 is taxed at 1.5%. (Older/less detailed sources might cite a simpler 1% up to $500k and 2% above).

- Unimproved Property (Vacant Land) – Non-Bahamian Owned:

- The first $7,000 of value incurs a flat fee of $100.

- The value exceeding $7,000 is taxed at 2%.

- Exemptions/Concessions: Property owned by Bahamians located on the “Family Islands” (islands other than New Providence and Grand Bahama) is generally exempt. Bahamian-owned vacant land is also exempt. Other exemptions exist for approved commercial farmland, certain historical buildings, and properties owned by foreign governments or charitable organizations. Bahamian pensioners (65+ or receiving NIB benefits) may receive a 50% discount on the tax applicable to their owner-occupied home (up to $1M value), after the initial exemption. A special “Condo-Hotel Tax” rate applies to units in government-approved rental programs.

- Payment: RPT is billed annually. A 10% discount is typically offered if the full year’s tax is paid by March 31st. The deadline for payment is December 31st, after which interest penalties (e.g., 5% per annum) apply to outstanding amounts. Unpaid property taxes constitute a charge against the property title.

- The complexity and varying rates necessitate careful assessment and potentially professional advice to accurately estimate annual RPT liability, which can be a significant ongoing cost for property owners, especially for commercial or high-value residential properties not qualifying for owner-occupier status.

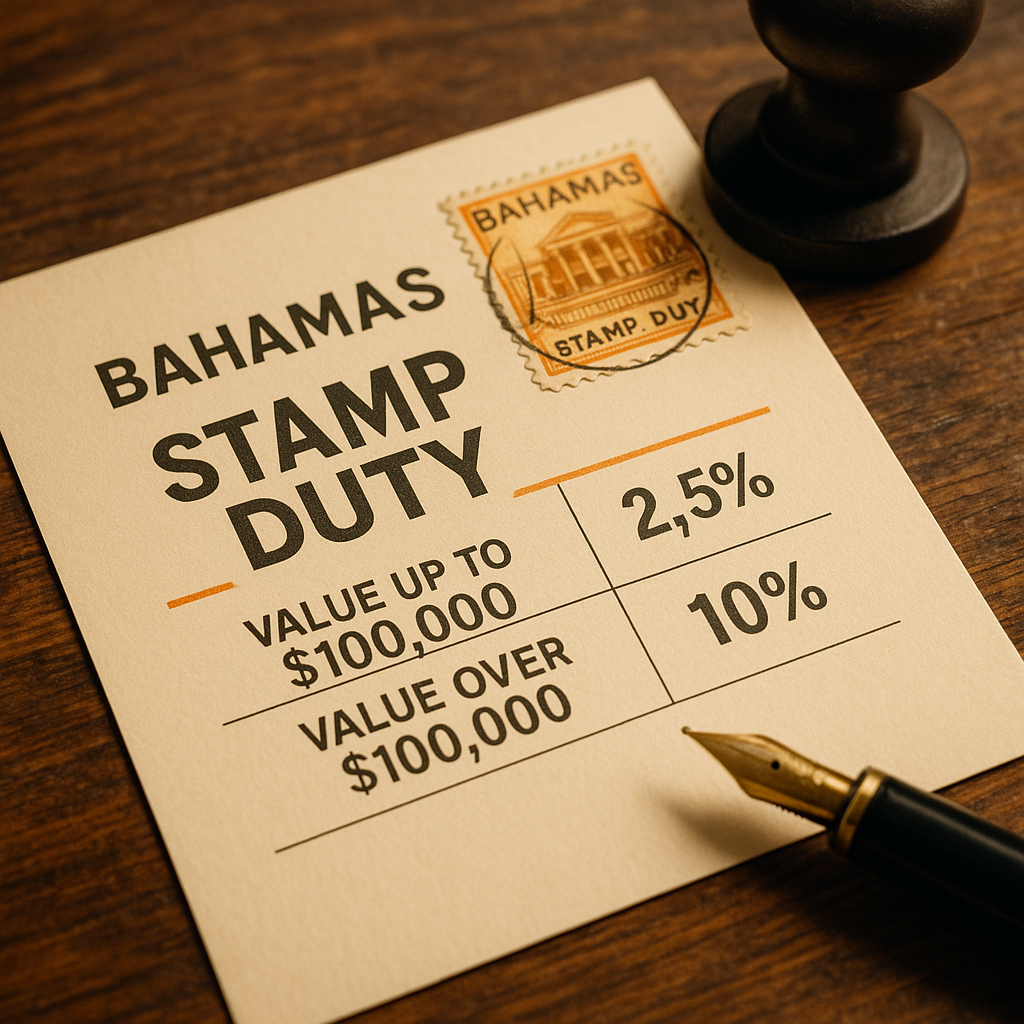

Stamp Duty:

- Stamp Duty is a tax levied on certain legal documents and transactions.

- Real Estate Conveyances: A significant Stamp Duty applies to the transfer of real property. The rate is graduated based on the property’s value:

- Value up to $100,000: 2.5%

- Value over $100,000: 10% (Note: One source mentioned a 10% VAT replacing stamp duty on conveyances, shared by buyer/seller. However, multiple other sources, including recent ones, explicitly state the 2.5%/10% Stamp Duty structure for property transfers. It’s likely Stamp Duty still applies to the transfer value itself, while VAT applies to associated services like legal fees and commissions. Verification on the exact current structure is recommended.)

- Mortgages: Stamp Duty is also payable on mortgages, typically around 1% of the loan amount.

- Other financial transactions may also attract Stamp Duty.

Import Duties:

- Customs duties are levied on a wide range of goods imported into The Bahamas. Rates vary significantly depending on the item, ranging from 0% to over 75% of the item’s value. These duties are a major contributor to the high cost of imported goods and overall living expenses. Some exemptions may apply within the Freeport Free Trade Zone on Grand Bahama Island.

Other Taxes and Contributions:

- Business License Fees: Required for operating a business, often calculated based on turnover.

- National Insurance Contributions (NIC): Mandatory social security contributions payable by employees (e.g., 3.9%) and employers (e.g., 5.9%), or self-employed individuals (e.g., 9.8%), up to a certain earnings ceiling.

The following table provides a snapshot of the Bahamian tax landscape for residents:

| Tax Type | Rate/Details | Relevance for Crypto Investor |

|---|---|---|

| Personal Income Tax | 0% | Major Benefit: No tax on salary, investment income, or other personal earnings. |

| Capital Gains Tax | 0% | Major Benefit: No tax on profits from selling crypto assets, stocks, real estate, etc. |

| Inheritance/Gift/Wealth Tax | 0% | Facilitates tax-free wealth transfer and holding. |

| Corporate Income Tax (IBCs) | 0% (on non-local revenue) | Beneficial for structuring international business activities, potentially including crypto trading/holding entities. |

| VAT (Value Added Tax) | Standard Rate: 10%. Applies to most goods/services. Foodstuffs (unprepared): 5% from April 2025. 0% on exports. Exemptions for basics (health, education). Applies to digital services & professional fees. | Significant Cost: Increases the cost of living and business operations substantially. Impacts daily spending and service fees (legal, real estate). |

| Real Property Tax (Annual) | Varies by type/value: Owner-Occupied: $0-$300k exempt, then 0.625%/1% (capped). Residential: $300 flat + 0.625%. Commercial: 0.75%/1.0%/1.5% tiers. Vacant (Non-Bahamian): $100 flat + 2%. Bahamian vacant/Family Island exempt. | Significant Cost: Can be a major annual expense depending on property type and value. Requires careful budgeting, especially for non-owner-occupied or commercial properties. Must be factored into ROI calculations for property investments. |

| Stamp Duty (Transaction) | Property Transfer: 2.5% (up to $100k), 10% (> $100k). Mortgages: ~1%. | Significant Upfront Cost: Adds considerably to the cost of acquiring real estate. |

| Import Duties | Varies widely by item (0% to 75%+). | Significant Cost: Major contributor to high prices for imported goods (cars, electronics, furniture, some foods), increasing overall cost of living. |

| National Insurance (Social Security) | Employee/Employer/Self-Employed contributions based on earnings (up to a ceiling). | Mandatory contribution for residents engaged in employment or self-employment. |

In summary, while the “tax-free” label accurately describes the absence of direct taxes on income and capital gains – a huge draw for crypto investors – it’s crucial to recognize that the government’s reliance on indirect taxes like VAT, RPT, and import duties translates into a significantly higher cost structure for living and owning property in The Bahamas compared to many other countries. The net financial benefit depends heavily on the scale of income/gains being shielded versus the increased burden of these indirect costs.

4. Paradise Pricing: The Real Cost of Living

While the tax advantages are clear, prospective residents must realistically assess the day-to-day expenses of living in The Bahamas. Generally considered one of the most expensive countries in the Caribbean and globally, the cost of living significantly exceeds that of the United States and many European nations, largely due to its reliance on imports for food and consumer goods, coupled with substantial indirect taxes and utility costs.

4.1. Finding a Home: Rental Market vs. Property Purchase Insights

Accommodation typically represents the largest single expense for residents. Both renting and buying involve substantial costs, with significant variation depending on the island and specific location.

Rental Costs: The rental market caters to a range of budgets, from basic apartments to ultra-luxury villas. Nassau, the capital on New Providence island, and neighbouring Paradise Island generally command the highest rents.

- Nassau/New Providence:

- A one-bedroom apartment in the city center might average around $1,160 – $1,320 per month, while a similar unit outside the center could range from $1,140 – $1,500 per month.

- A three-bedroom apartment in the city center typically costs $2,660 – $3,590 per month, with outside-center options potentially ranging from $3,060 – $3,400 per month.

- However, recent listings show a very wide spectrum: one-bedroom units can range from $1,200 to over $3,500, two-bedrooms from $1,600 to $4,200+, and three-bedrooms from $3,300 well into the $9,000+ range, depending heavily on location (e.g., Cable Beach, Lyford Cay), amenities, and quality.

- Freeport (Grand Bahama): Generally offers more affordable rental options compared to Nassau. Expect figures like $800/month for a one-bedroom or $1,600/month for a two- or three-bedroom apartment, though variations exist.

- Out Islands (e.g., Eleuthera): Tend to be the most budget-friendly for rentals, with one-bedrooms potentially around $800/month and three-bedrooms averaging $1,200 – $1,350 per month.

- Luxury Market: High-end condos and beachfront villas command premium prices, easily reaching $4,000 to $60,000+ per month.

Overall, while some sources suggest Bahamian rents are slightly lower than the US average, others indicate they are notably higher (e.g., 13% higher). The reality likely depends on the specific comparison points (city vs. national average) and the type of property. Expect rents, especially in desirable areas of Nassau, to be comparable to or higher than many major US cities.

Property Purchase Costs: Buying property involves significant capital outlay, plus substantial transaction costs. Prices vary dramatically by island, location, and property type.

- Indicative Average/Median Prices (subject to market fluctuations):

- Nassau/New Providence: Average home prices might hover around $800,000, but recent market reports show median sales prices rising to $625,000 – $732,500 and average sales prices surging to $1.2M – $1.4M, indicating strong activity in the higher end. Median land prices are much lower, around $133,000. Price per square foot averages suggest around $618/sq ft for apartments and $405/sq ft for houses.

- Exuma: Known for luxury properties, average prices can range from $1.2 million to $3.5 million. Price per square foot reflects this premium, averaging $461/sq ft for apartments and $779/sq ft for houses.

- Eleuthera: Offers a mix, with average prices potentially ranging from $600,000 to nearly $1 million. House prices average around $436/sq ft.

- Freeport/Grand Bahama: Generally the most affordable major island for purchasing, with house prices averaging around $166 – $172/sq ft.

- Luxury Market: Waterfront villas and private islands can range from $1.5 million to well over $15 million.

- Market Trends (Nassau/Paradise Island): Recent reports (early 2025) indicate a competitive market characterized by tightening supply (fewer new listings), steady demand, rapidly rising prices (especially average prices, suggesting high-end sales influence), and faster sales cycles (reduced days on market). Land values are also showing strong appreciation. Market analysts project continued annual appreciation of 4-6% in the near term.

Additional Purchase Costs: Beyond the purchase price, buyers must budget for:

- Legal Fees: Typically 1.5% to 2.5% of the purchase price for each party (buyer and seller require separate Bahamian attorneys).

- Stamp Duty: 2.5% on the value up to $100,000, and 10% on the value exceeding $100,000 (a major closing cost).

- Real Estate Commission: Usually 6% of the sale price, customarily paid by the seller, but this can be negotiated.

- VAT: 10% VAT applies to legal fees, commissions, appraisals, and other related services.

- Property Inspection: $500 to $2,500 depending on property size and complexity.

- Title Insurance: Optional but highly recommended, costing around 0.5% to 1% of the purchase price.

4.2. Daily Bread and Bandwidth: Budgeting for Groceries, Utilities, and Transport

Beyond housing, daily living expenses contribute significantly to the high cost profile of The Bahamas.

Overall Cost of Living: Numbeo data consistently places The Bahamas as significantly more expensive than the US (24-29% higher excluding rent). It ranks among the top most expensive countries globally. Estimated monthly expenses excluding rent average around $4,920 – $5,250 for a family of four and $1,390 – $1,465 for a single person. When rent is factored in, these figures increase substantially.

Groceries: This is a major expense category due to the heavy reliance on imported food items. Prices for staples are often much higher than in the US or Europe. Examples include:

- Milk (1 Litre): ~$4.30

- Loaf of Bread: ~$4.80

- Rice (1kg): ~$5.70

- Eggs (dozen): ~$7.60

- Chicken Fillets (1kg): ~$10.30

- Beef (1kg): ~$17.80 The upcoming reduction of VAT on unprepared food to 5% (from April 2025) may provide some relief, but groceries will remain a significant budget item. Monthly estimates suggest around $1,994 for a family of four and $762 for a single person.

Utilities: Known for being particularly expensive.

- Electricity, Water, Garbage: Combined basic utilities for an average apartment (e.g., 85-90 sqm) typically range from $250 to $400 per month. Electricity costs are notably high (reportedly double the world average per kWh) and can fluctuate due to fuel surcharges added to bills. Water rates are tiered, increasing with usage. Garbage collection fees depend on the type of residence and frequency of pickup.

- Internet: High-speed internet plans (60 Mbps+) average around $71 to $94 per month.

- Mobile Phone: A typical monthly plan with calls and data costs around $66.

Transportation:

- Public Transport: “Jitneys” (minibuses) are the main form in Nassau and Freeport. They are inexpensive (around $1.25-$1.50 per ride, monthly pass ~$45) but operate on fixed routes and may not run late into the evening. Service is limited or non-existent on most Out Islands.

- Taxis: Readily available, especially in tourist areas and cities. They are licensed with government-fixed rates based on distance, but can be quite expensive (e.g., starting fare ~$4.50, per km ~$3.10, 1-hour wait ~$100).

- Car Ownership: Many residents own cars for convenience. However, gasoline is costly (around $1.56/litre or $5.90/gallon). Import duties on vehicles also add significantly to the purchase price.

- Inter-Island Travel: Bahamas Ferries connects major islands. For faster travel, Bahamasair and private charter flights are options, though Bahamasair has a reputation for delays, and flights are more expensive than ferries.

Other Common Costs:

- Eating Out: More expensive than in the US. A meal at an inexpensive restaurant might cost $30, while a three-course mid-range meal for two could easily exceed $130, especially in Nassau. Fast food meals are closer to US prices (~$10.50).

- Leisure: Fitness club memberships average $95-$110/month. Cinema tickets are around $15.50.

- Education: International school tuition can range from $5,000 to $15,000+ per child per year. Private full-day kindergarten/preschool costs average $600-$640 per month.

- Salaries: It’s worth noting that average local net salaries (around $2,000/month) are significantly lower than in the US, meaning the high cost of living can be particularly challenging for those earning local wages rather than relying on foreign income or investment returns.

The table below provides an estimated monthly budget for a single person living outside the city center in Nassau, illustrating the potential scale of expenses:

| Expense Category | Estimated Low End ($) | Estimated High End ($) | Notes |

|---|---|---|---|

| Rent (1-bed outside center) | 1,140 | 1,500 | Varies greatly by location/quality. |

| Utilities (Basic + Internet + Mobile) | 387 | 560 | Electricity is a major variable. (Basic ~$250-400, Internet ~$71-94, Mobile ~$66) |

| Groceries | 600 | 900 | Highly dependent on diet and shopping habits. Estimate based on single person average ($762). |

| Transportation | 45 | 250 | $45 for monthly jitney pass. Higher end assumes partial taxi use or modest car running costs (fuel). |

| Eating Out/Entertainment | 200 | 500 | Assumes moderate frequency. Can vary significantly. |

| Health Insurance (Private) | 200 | 700+ | Essential for expats. Cost depends heavily on coverage level and provider. |

| Miscellaneous | 150 | 300 | Personal items, clothing, incidentals. |

| Estimated Total Monthly Cost | $2,722 | $4,710+ | Excludes initial moving costs, furniture, car purchase, etc. |

This illustrates that even a relatively modest lifestyle in Nassau can easily cost between $2,700 and $4,700+ per month for a single person, reinforcing the need for substantial financial resources to live comfortably, despite the tax advantages. The variation between islands is also a key factor; choosing Freeport or an Out Island like Eleuthera could reduce housing costs considerably, though potentially at the expense of convenience and access to certain amenities.

5. Essential Infrastructure: Healthcare, Banking, and Connectivity

Beyond costs, the quality and accessibility of essential services are critical factors in the decision to relocate. The Bahamas offers modern infrastructure in key areas, particularly in its main population centers, but prospective residents should be aware of certain nuances and potential limitations.

5.1. Health Matters: Navigating Public and Private Healthcare

The Bahamian healthcare system has undergone significant improvements, particularly since the introduction of National Health Insurance (NHI) in 2017. High-quality medical care is available, especially in Nassau and Freeport, with many healthcare professionals speaking English. However, the system operates on two distinct tiers, and access to specialized care can sometimes be limited, potentially necessitating costly medical evacuation to the United States (usually Miami).

Public Healthcare System (NHI Bahamas):

- Overseen by the National Health Insurance Authority (NHIA), NHI aims to provide accessible and affordable basic care to citizens and legal residents. Registration with the National Insurance Board (NIB) is required to access services.

- NHI primarily covers basic primary care and preventive services. This includes doctor visits for common illnesses, standard check-ups, vaccinations, essential screenings (e.g., for diabetes, hypertension), prenatal care, and basic childhood healthcare.

- Crucially, NHI coverage is limited. It does not extend to most secondary or tertiary care. This means services like specialist consultations, most diagnostic imaging beyond basic x-rays, emergency room visits, hospitalization, surgeries, cancer treatment, prescription medications for chronic conditions, and even childbirth are not covered by the public scheme. Patients requiring these services must pay entirely out-of-pocket unless they have private insurance.

- Public Hospitals: The main public facilities are Princess Margaret Hospital in Nassau (the largest public hospital, providing acute care, emergency services, and various specialties), Rand Memorial Hospital in Freeport (serving Grand Bahama), and Sandilands Rehabilitation Centre in Nassau (focused on psychiatric and geriatric care). A network of community clinics provides basic services on the Out Islands.

Private Healthcare System:

- The private sector offers a wider range of services, potentially more advanced equipment, and often shorter waiting times. It is the preferred choice for expats and Bahamians who can afford it.

- Private Hospitals: The primary private hospitals are Doctors Hospital in Nassau (a well-regarded, JCI-accredited facility offering numerous specialties) and Lyford Cay Hospital (also in Nassau, smaller, focused on primary care, cardiology, internal medicine, but not equipped for emergencies). Numerous private clinics and specialist practices also exist.

- Cost: Private healthcare in The Bahamas is very expensive. Providers often require payment upfront or confirmation of insurance coverage before treatment.

Health Insurance for Expats:

- Given the significant gaps in public coverage and the high cost of private care and potential medical evacuation, comprehensive private health insurance is considered essential for expatriates living in The Bahamas. Relying solely on NHI leaves individuals exposed to potentially catastrophic medical bills in case of serious illness or accident.

- Cost: International health insurance plans suitable for expats vary widely in price depending on age, health status, and coverage level (inpatient only vs. comprehensive including outpatient, dental, maternity). Expect costs ranging from $200 per month for basic coverage to $700 – $1,100+ per month for comprehensive plans from major international providers like VUMI, BUPA, Cigna Global, or GeoBlue.

- Important Note: Standard domestic health insurance from other countries (including US Medicare) does not typically provide coverage in The Bahamas. A specific international or travel health plan is necessary.

The two-tiered nature of the system makes private insurance a non-negotiable expense for most expats seeking peace of mind and access to comprehensive medical care.

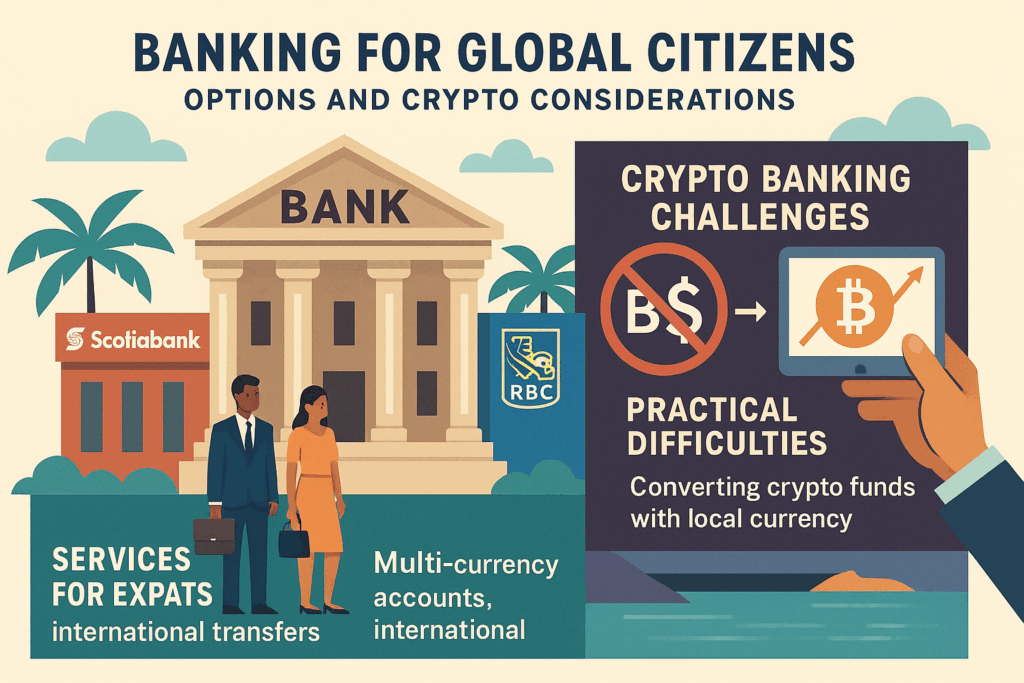

5.2. Banking for Global Citizens: Options and Crypto Considerations

The Bahamas boasts a mature and well-regulated financial services sector, functioning as a major international banking center for decades.

- Banking Landscape: Numerous domestic and international banks operate in the country. Major players include Canadian banks (Scotiabank, RBC Royal Bank, CIBC FirstCaribbean), US banks (Citibank is present), large local banks (Bank of The Bahamas, Commonwealth Bank, Fidelity Bank), and various European and private banks and trust companies. Global entities like HSBC also cater to expatriate clients.

- Services for Expats: These institutions offer a full range of retail and private banking services suitable for international clients, including multi-currency accounts and routine international wire transfers. Opening an account as a resident is generally straightforward, requiring standard identification and proof of address/residency status.

- Crypto Banking Challenges: Despite the progressive DARE Act regulating crypto businesses, integrating cryptocurrency activities with the traditional Bahamian banking system remains a significant challenge. As discussed under Regulation (Section 2.3), the Central Bank of The Bahamas imposes restrictions on its supervised banks regarding direct handling of crypto assets and, crucially, prohibits direct conversion between Bahamian dollars (B$) and foreign cryptocurrencies due to Exchange Control regulations.

- This creates practical difficulties for crypto investors or businesses needing to move funds between crypto and local fiat currency. On-ramping B$ to buy crypto or off-ramping crypto gains into a B$ bank account can be cumbersome or impossible through direct local banking channels.

- The ongoing saga of the Sand Dollar CBDC, with its low adoption and potential forced distribution, further highlights the CBOB’s cautious and controlled approach towards digital currencies, which may influence the willingness of traditional banks to engage deeply with the crypto sector, even where DARE permits certain activities.

- Implication: Crypto investors residing in The Bahamas should anticipate needing to maintain banking relationships outside the country or utilize international fintech platforms for efficient crypto-fiat conversions and management, particularly if dealing frequently between crypto and B$. The local banking system may not provide the seamless integration expected in some other jurisdictions.

5.3. Staying Online: Internet Services Overview

Reliable internet connectivity is crucial, especially for investors managing assets online or working remotely. The Bahamas offers modern internet infrastructure, particularly in its main hubs.

- Main Providers: The dominant providers are BTC (Bahamas Telecommunications Company), the incumbent operator offering fiber (FTTH) and legacy DSL, and REV (Cable Bahamas), offering services over its cable network. Starlink (satellite internet) is also available, providing an alternative, especially in areas less served by terrestrial networks.

- Services and Speeds: Both BTC and REV offer high-speed broadband plans, often bundled with TV and phone services.

- BTC: Heavily promotes its fiber network (“Unstoppable Fiber”), offering symmetrical upload and download speeds. Plans can reach up to 1 Gbps, with common tiers like 300 Mbps or 350 Mbps often advertised with free installation for around $90 – $140 per month.

- REV: Offers various speed tiers over its cable network, such as 30 Mbps (~$50/mo), 45 Mbps (~$71.50/mo), 75 Mbps (~$90.50/mo), and 105 Mbps (~$124.75/mo).

- Starlink: Provides satellite internet with plans like “Residential Lite” (deprioritized data, ~$40/mo) and “Residential” (standard unlimited data, ~$55/mo), plus a one-time hardware cost (~$389). It claims low latency suitable for streaming and video calls, making it a viable option where fiber or cable are unavailable.

- Reliability and Cost: Internet service is generally considered reliable in Nassau and Freeport. However, quality, speed, and availability can decrease significantly on the Out Islands. Costs are relatively high compared to North American or European standards, with average monthly bills for decent speeds often falling in the $70 – $100+ range.

- Consideration for Out Islands: Those considering living outside the main population centers must carefully investigate internet availability and quality. Fiber or high-speed cable may not reach all areas, making satellite (Starlink) or potentially slower fixed wireless or DSL the only options. This could impact activities requiring very high bandwidth or ultra-low latency, such as intensive day trading or high-definition video conferencing.

6. The Bahamian Experience: Quality of Life Factors

Beyond the practicalities of residency, finance, and infrastructure, the overall quality of life is a paramount consideration. The Bahamas offers a unique blend of tropical allure and modern amenities, but prospective residents must also be aware of certain societal challenges.

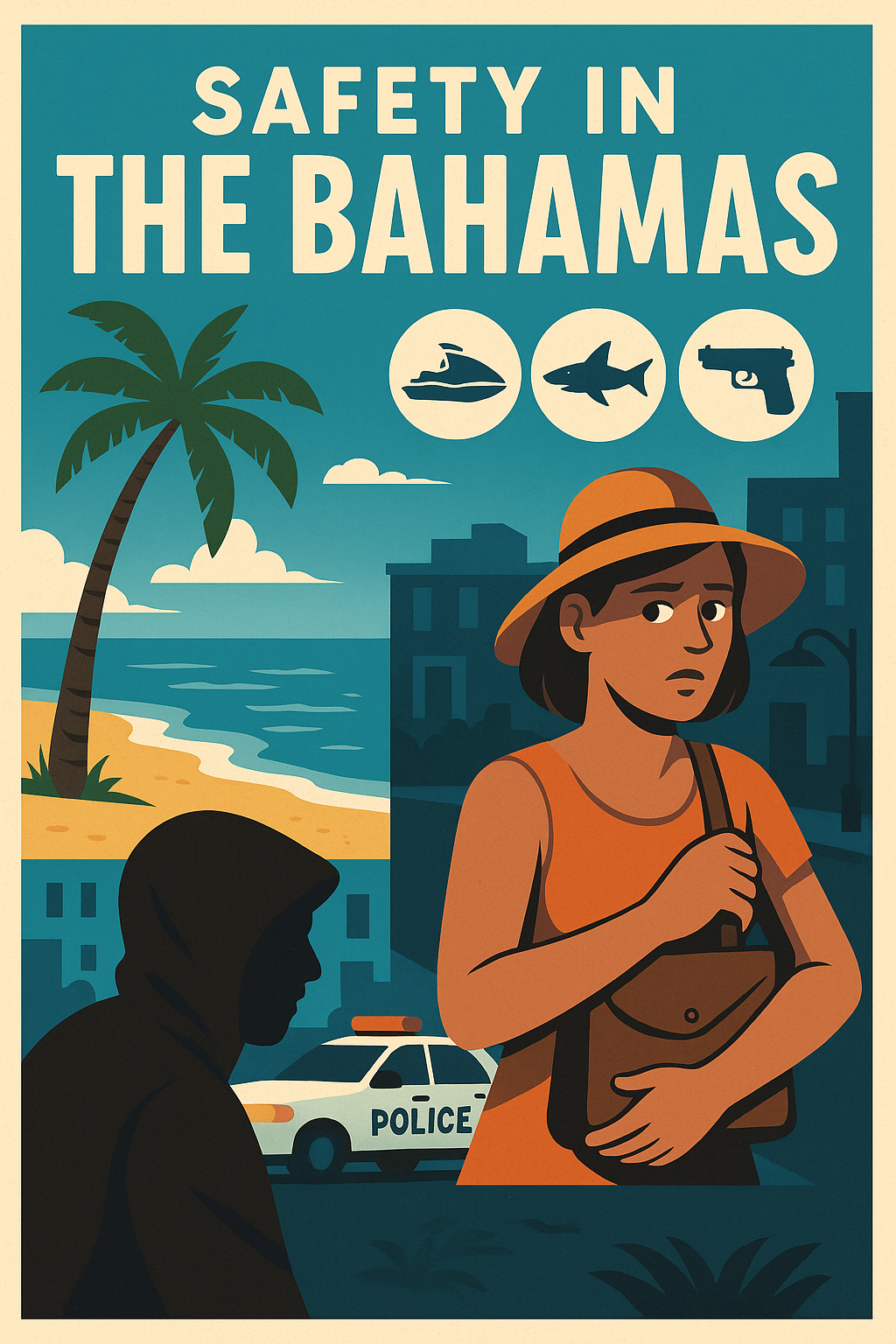

6.1. Safety First: Understanding Crime and Security Realities

While often perceived as a tranquil paradise, The Bahamas faces significant challenges with crime, particularly in its urban centers. It is crucial for potential residents to have a realistic understanding of the security situation.

- High Crime Rates: Official travel advisories (e.g., from the U.S. Department of State) consistently warn of high rates of crime, including violent crime such as armed robberies, burglaries, and sexual assaults.

- Geographic Concentration: Most crime occurs on the most populated islands, New Providence (Nassau) and Grand Bahama (Freeport). Specific areas in Nassau, notably the “Over the Hill” neighborhoods (generally south of Shirley Street), are known for gang activity and violence affecting residents. Caution is also advised in vacation rental properties lacking private security.

Specific Risks: Authorities highlight particular concerns:

- Watercraft Safety: The operation of rental jet skis and boats is poorly regulated, leading to accidents, injuries, and fatalities. There have also been reports of sexual assaults perpetrated by jet ski operators. U.S. government personnel are restricted from using independently rented jet skis on New Providence/Paradise Island due to these risks. Watercraft may be unsafe or uninsured, and operators may disregard weather warnings.

- Beach Safety: Caution is advised, particularly on and near downtown Nassau beaches where sexual assaults have occurred. Basic water safety (never swimming alone, awareness of watercraft, knowing personal limits, understanding snorkeling risks) is vital. Shark encounters, while rare, have resulted in serious injury and death.

- Firearms: Bahamian law strictly prohibits the importation and possession of firearms and ammunition without specific authorization. This is rigorously enforced, even for small quantities accidentally left in luggage. Travelers, including U.S. citizens, have faced arrest, significant jail time, and hefty fines, even when attempting to depart the country with undeclared ammunition. Extreme diligence in checking luggage before traveling is essential.

- Personal Security Measures: Standard precautions are strongly advised: be aware of your surroundings at all times, avoid displaying signs of wealth, secure lodging (doors, windows, balconies), do not open doors to strangers, and do not physically resist robbery attempts.

- Police Response: While the Royal Bahamian Police Force takes crimes against residents and tourists seriously, response times can sometimes be slow, particularly on islands with limited resources or challenging infrastructure.

This reality stands in contrast to the nation’s image as a peaceful and politically stable democracy. Potential residents must weigh the attractive lifestyle against the need for heightened security awareness and proactive safety measures, particularly if living in or frequenting Nassau or Freeport. Choosing accommodation in secure, gated communities is a common strategy employed by expats.

6.2. Island Rhythms: Culture, Lifestyle, and the Expat Scene

Life in The Bahamas offers a distinct rhythm, heavily influenced by its island geography and cultural blend.

- Lifestyle: Generally characterized as relaxed and outdoor-oriented. The climate encourages activities centered around the water – beaches, boating, fishing, diving, and snorkeling are integral parts of life for many. The pace is often slower than in major metropolitan centers. English is the official language, easing communication for many expats.

- Culture: Bahamian culture is a vibrant mix of African (due to historical slave trade), British (colonial history), and American (proximity and tourism) influences. This is reflected in music (Junkanoo), food, and social customs. Locals are often described as friendly and welcoming. The economy’s heavy reliance on tourism shapes many interactions and services.

- Expat Community: The Bahamas hosts a substantial and well-established expatriate community, concentrated in areas like Nassau, Paradise Island, Lyford Cay (an exclusive gated community), and parts of Grand Bahama. Various social clubs and organizations (like InterNations) exist, providing networks for newcomers to connect, share experiences, and receive practical advice. This can significantly ease the transition process.

- Climate: The tropical marine climate delivers generally sunny and warm weather year-round. However, The Bahamas lies within the Atlantic hurricane belt, making hurricane season (June 1st to November 30th) a period requiring preparedness and awareness. Tropical storms can cause significant disruption and damage.

6.3. Environment, Education, and Getting Around

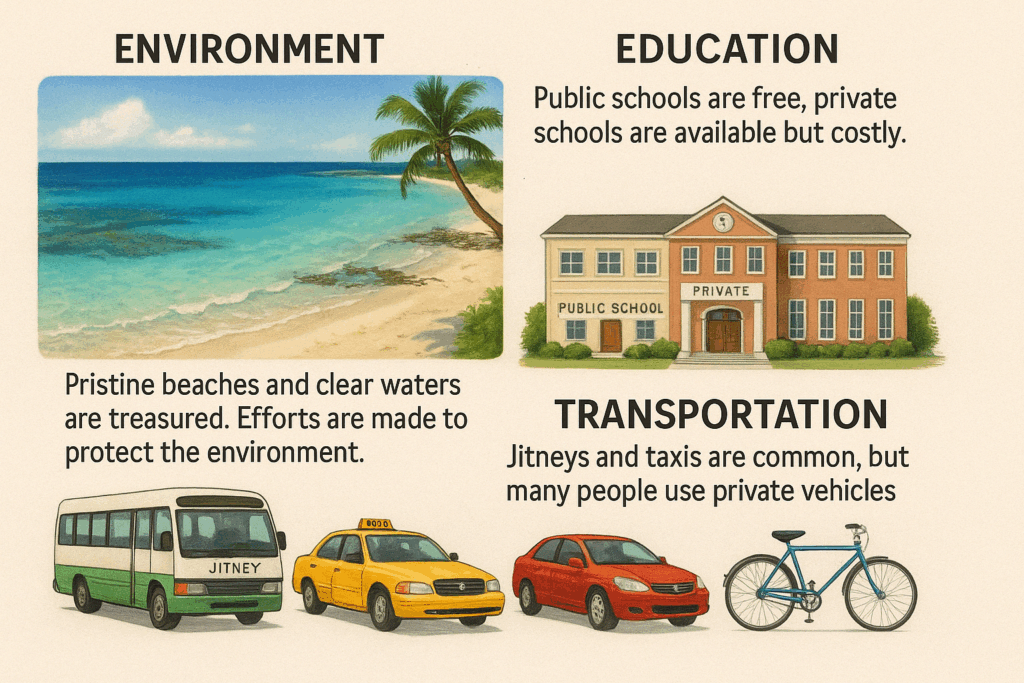

- Environment: The stunning natural environment – pristine beaches, clear waters, coral reefs – is arguably the country’s greatest asset and a primary draw for residents and tourists alike. Environmental protection is increasingly recognized, with environmental levies applied to certain imports to fund conservation efforts. Awareness of coastal ecosystems and responsible enjoyment are encouraged.

- Education: The Bahamas offers both public and private schooling options.

- Public Schools: Available and free for residents. The government cites high literacy (93%) and school attendance (92%) rates, indicating a commitment to basic education.

- Private Schools: Numerous private and international schools exist, particularly in Nassau, offering various curricula (e.g., British, American, IB). These provide alternatives often preferred by expats but come at a significant cost, with annual tuition fees potentially ranging from $5,000 to $15,000 or even higher for secondary levels. Quality and focus can vary between institutions.

- Transportation (Recap): Daily commuting relies on jitneys in Nassau/Freeport (cheap but limited routes/hours), taxis (available but costly), or private vehicles (convenient but with high fuel costs and import duties). Inter-island travel involves ferries (slower, cheaper) or flights (faster, more expensive, potentially less reliable). Bicycles are usable in some areas, but road conditions and safety can be concerns. Infrastructure limitations can make getting around more time-consuming or expensive than in more developed countries, especially outside the main islands.

Adapting to the Bahamian lifestyle involves embracing the natural beauty and relaxed pace while navigating the practicalities of safety, cost, and infrastructure, which may differ significantly from an investor’s home country.

7. The Final Tally: Weighing the Pros and Cons

Relocating to The Bahamas as a crypto investor presents a compelling mix of significant advantages and notable drawbacks. The decision requires a careful balancing act, weighing the financial incentives against the practical realities of island life.

7.1. Key Advantages Summarized

- Unmatched Tax Benefits: The absolute absence of personal income tax, capital gains tax, inheritance tax, and wealth tax is the paramount advantage. For crypto investors realizing substantial gains or holding significant wealth, this tax-neutral environment offers unparalleled potential for wealth preservation and growth.

- Progressive Crypto Regulation: The DARE Act 2024 provides a dedicated and evolving legal framework for digital asset businesses. This offers a degree of regulatory certainty and positions The Bahamas as a jurisdiction actively engaging with the crypto industry, aiming for legitimacy and investor protection.

- Established Residency Pathway: The Economic Permanent Residence (EPR) program offers a clear, albeit substantial, investment route to secure long-term residency rights for investors and their families.

- Desirable Lifestyle: The tropical climate, stunning natural beauty (beaches, ocean), outdoor recreational opportunities (boating, diving), and generally relaxed pace of life are major draws. The prevalence of English simplifies daily life for many expats.

- Geographic Proximity: The Bahamas’ close proximity to the United States, particularly Florida, allows for relatively easy travel and access.

- Political Stability: The country benefits from a long history as a stable parliamentary democracy.

7.2. Potential Drawbacks to Consider

- Extremely High Cost of Living: Daily expenses, driven by reliance on imports, VAT, high utility costs, and expensive housing (both rental and purchase), are significantly higher than in many developed nations. This can erode a substantial portion of the savings gained from the tax advantages.

- Serious Safety and Security Concerns: High crime rates, particularly violent crime in Nassau and Freeport, necessitate constant vigilance, security consciousness, and potentially lifestyle adjustments (e.g., living in gated communities). Specific risks related to watercraft and strict firearm laws require careful attention.

- Healthcare System Limitations: While basic care is available, the public system (NHI) offers limited coverage. Accessing comprehensive care requires expensive private healthcare and mandatory private health insurance. Specialized treatments may necessitate costly medical evacuation.

- Crypto-Banking Friction: Despite the DARE Act for crypto businesses, integrating crypto activities with the local Bahamian dollar banking system is difficult due to Central Bank restrictions and Exchange Controls. Seamless fiat on/off ramping locally can be a major hurdle.

- Substantial Residency Investment: The EPR program requires a large and increasing minimum investment ($750,000 currently, rising to $1,000,000 in 2025) coupled with a mandatory 10-year holding period, representing a significant, long-term financial commitment.

- Difficult Path to Citizenship: Acquiring Bahamian citizenship is a lengthy process (10+ years), entirely discretionary, and requires renouncing one’s previous nationality, making it unsuitable for those seeking a quick second passport or wishing to retain dual nationality.

- Infrastructure and Service Variability: While improving, infrastructure (transportation, internet reliability outside major hubs) and public service efficiency may not meet the standards expected by those from highly developed countries. Hurricane risk requires preparedness.

Conclusion: Is The Bahamas the Right Move for You?

The Bahamas presents a compelling, yet complex, proposition for the cryptocurrency investor. It undeniably offers one of the world’s most advantageous tax environments – a true haven from income and capital gains taxes, which can translate into massive savings for those with significant crypto wealth. This, combined with a structured regulatory approach via the DARE Act 2024 and an undeniably attractive tropical lifestyle, forms the core of its appeal.

However, this paradise comes at a price, and not just the substantial investment required for residency. The extremely high cost of living can significantly offset tax savings, particularly for those whose gains are not substantial enough to dwarf the increased daily expenditures. Furthermore, the real and officially acknowledged safety concerns, especially in urban areas, demand a level of vigilance and security investment that may be unfamiliar or uncomfortable for some. The healthcare system necessitates expensive private insurance for adequate coverage, and the friction between crypto activities and the local banking system remains a practical hurdle for seamless financial integration.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

Ultimately, The Bahamas can be an excellent choice for a specific type of crypto investor: one for whom the tax savings are the overriding priority, who possesses the substantial financial resources to comfortably afford the high living costs, property investments, and comprehensive insurance, and who is prepared to adapt to the lifestyle nuances, potential infrastructure limitations, and necessary security precautions. The investor must also understand and accept the limitations regarding local crypto banking integration and the long, uncertain, and restrictive path to potential citizenship.

The decision to relocate is deeply personal and requires exhaustive due diligence. This should include:

- Visiting the islands: Experience the environment, culture, and different locations firsthand.

- Consulting local experts: Engage reputable Bahamian legal counsel (especially regarding the EPR application, particularly before the January 2025 threshold increase) and financial/tax advisors to understand the full implications of residency, property ownership (including current RPT rates), and VAT.

- Realistic financial planning: Create a detailed budget accounting for all anticipated costs, comparing them against potential tax savings.

- Honest self-assessment: Evaluate personal tolerance for the identified drawbacks, particularly regarding safety and the cost of living.

The Bahamas offers a unique opportunity, a potential haven where financial gains can flourish under a tax-friendly sun. But realizing that opportunity requires clear eyes, careful planning, and a full understanding of both the glittering promise and the practical challenges of island life.