Estonia for the Crypto Investor: A Comprehensive Relocation Guide

Estonia, a Baltic nation renowned for its digital prowess, has emerged as a point of interest for individuals within the cryptocurrency sphere. Its advanced e-governance systems, innovative business environment, and unique tax policies present a potentially attractive package. However, navigating the immigration landscape, understanding the specific regulations surrounding digital assets, and assessing the practicalities of daily life are crucial steps for any crypto investor or holder considering relocation. This report provides a detailed overview of Estonia from this perspective, covering key decision-making factors from immigration and taxation to lifestyle and integration.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

1. Navigating Immigration: Your Pathway to Estonian Residency

Understanding the various routes to living and working in Estonia is fundamental, particularly for non-EU/EEA citizens. Estonia offers several distinct pathways, each with specific requirements and implications.

1.1. Temporary Residence Permits (TRP)

Non-EU citizens typically require a Temporary Residence Permit (TRP) for stays longer than 90 days or for employment/business purposes. TRPs are generally issued for up to 5 years and can be renewed.

A TRP for enterprise can be obtained by registering as a sole proprietor or participating in a company. This usually requires a minimum investment under the applicant’s control (€16,000 for sole proprietors, €65,000 for company participation), a solid business plan, sufficient personal funds, housing, and health insurance. Start-ups may have exemptions from the capital requirement. Changes in business circumstances must be reported.

For employment, permits like the EU Blue Card are available for highly qualified workers meeting specific salary thresholds (e.g., €30,336 gross annual salary in 2023, or a lower threshold of €25,072 for certain specialist roles). These permits are typically valid for the duration of the contract plus three months (up to 27 months initially) and can be renewed. A Labour Market Test may apply.

TRPs are also available for other grounds such as studying, research, or family reunification. Specific conditions apply to each category, such as proof of enrollment for students or proof of relationship for family members.

An annual immigration quota (0.1% of the permanent population) applies to many TRP applications, but notable exceptions exist for citizens of the US and Japan, ICT workers, start-up entrepreneurs/employees, major investors, top specialists, students, researchers, and family members.

1.2. Long-Term (Permanent) Residence Permit

After residing in Estonia continuously for five years on a temporary residence permit, non-EU citizens can apply for a long-term residence permit. Key requirements include holding a valid TRP, registered accommodation, health insurance, permanent legal income, and demonstrating Estonian language proficiency at the B1 level.

1.3. e-Residency: A Digital Gateway, Not Physical Residency

e-Residency provides a government-issued digital identity (e-ID card) allowing global entrepreneurs access to Estonia’s secure e-services. It enables individuals to establish and manage an Estonian company entirely online, digitally sign documents, declare Estonian taxes online, and access EU business services. Key benefits include low start-up/maintenance costs for businesses, 0% corporate tax on reinvested profits, minimal bureaucracy, a transparent business environment, and access to international payment providers.

It is crucial to understand that e-Residency does NOT grant physical residency rights, citizenship, or the right to travel to Estonia or the EU without a separate visa/permit. It is purely a digital tool for business administration.

1.4. Digital Nomad Visa (DNV)

The DNV allows location-independent workers (employees of foreign companies, owners of foreign companies, or freelancers serving foreign clients) to reside temporarily in Estonia for up to one year. It can be a short-stay (Type C, up to 90 days) or long-stay (Type D, up to 365 days). US citizens can stay visa-free for up to 90 days within 180 days.

Applicants must provide proof of remote work capability, existing foreign employment/business/client contracts, and a minimum gross monthly income of €4,500 during the six months preceding the application. Standard visa documentation (passport, photos, insurance, accommodation proof) is also needed.

The application is processed via Estonian embassies/consulates or VFS Global centers abroad, or the Police and Border Guard Board if legally already in Estonia. Fees apply (€100-€120 for Type D), and processing takes approximately 30 days.

The DNV is temporary and does not automatically lead to permanent residency or count towards the five years required for it. It cannot be extended, but a new one can be applied for after expiry.

1.5. Investor Visas / Residence Permits

A general investment TRP (for Business) requires investing €65,000 into an Estonian company or €16,000 if operating as a sole proprietor. Standard TRP requirements (business plan, funds, etc.) apply. This leads to a 5-year renewable TRP.

A Major Investor TRP requires a direct investment of at least €1,000,000 into an Estonian company registered in the commercial register that primarily invests in the Estonian economy, or into a qualifying investment fund. This grants a TRP and exempts the holder from the immigration quota. Proof of investment is required; contacting authorities is advised for specific documentation needs.

The application process is similar to other TRPs, submitted at Estonian missions abroad or the Police and Border Guard Board in Estonia. In-person application is usually required for biometrics.

Summary Table: Key Immigration Options

| Pathway | Primary Purpose | Duration | Key Requirement(s) | Leads to PR? | Crypto Relevance |

|---|---|---|---|---|---|

| e-Residency | Online company management | N/A (Digital ID) | Online application, fee (€100-€150) | No | Easy setup for holding company (tax benefits), VASP licensing (but requires more than just e-Residency) |

| Digital Nomad Visa | Temporary stay for remote work | Up to 1 year | Foreign income (€4,500/month), remote work proof | No | Suitable for remote traders/workers paid in crypto (if income proof met), not for establishing local VASP |

| TRP (Business/General) | Operate a local business/self-employment | Up to 5 years (renew) | Investment (€16k/€65k), business plan, funds | Yes (after 5y) | Path for establishing a smaller crypto-related service (non-VASP) or consultancy; potential VASP route (heavy reqs) |

| TRP (Major Investor) | Significant capital investment | Up to 5 years (renew) | €1M investment | Yes (after 5y) | High net worth individuals seeking residency via investment, potentially including crypto-related ventures |

| TRP (Employment/Blue Card) | Highly skilled employment | Contract + 3mo (renew) | Job offer, salary threshold (€25k-€30k+) | Yes (after 5y) | Working for an established crypto/tech firm in Estonia |

| Long-Term Residence | Permanent stay | Indefinite | 5 years on TRP, B1 Estonian language, income, insurance | N/A | The goal after 5 years on a TRP (Business, Investor, Employment) |

2. Estonia’s Crypto Climate: Regulation and Taxation

Estonia was an early mover in regulating cryptocurrencies but has significantly tightened its approach in recent years. Understanding the current legal and tax framework is vital for crypto investors and businesses.

2.1. Legal Status of Cryptocurrencies

Cryptocurrencies do not possess the legal status of currency or money in Estonia. However, they are recognized as digital representations of value (“virtual currency” or “virtual asset”) that can be accepted as a means of exchange or payment by natural or legal persons. Legally, crypto-assets are generally treated as property under the Law of Obligations Act.

2.2. Taxation for Individuals (Residents)

Income derived from the sale or exchange of cryptocurrency (crypto-to-fiat, crypto-to-crypto, or using crypto to pay for goods/services) is considered gains from the transfer of property. These gains are subject to a flat income tax rate of 20% (rate applicable as of 2024 data; note: general income tax rate changes may occur, e.g., rising to 22% in 2025). Gains are calculated as the selling price (or market value of goods/services received) minus the acquisition cost (purchase price plus documented transaction fees). The Estonian Tax and Customs Board (EMTA) allows using either the FIFO (First-in, First-out) or Average Cost Method to determine the acquisition cost.

Taxable events include selling crypto for fiat, exchanging one crypto for another, and using crypto to buy goods or services. Non-taxable events generally include buying crypto with fiat, holding crypto, transferring crypto between personal wallets, and gifting/donating crypto (though receiving gifts may have implications). All profitable transactions, regardless of size, must be declared annually on the income tax return (typically due by April 30th for the previous calendar year), reported in tables 6.3 or 8.3. Losses from crypto transactions under the standard system generally cannot be offset against other income but might be deductible under specific circumstances related to securities (check EMTA guidelines).

Income from cryptocurrency mining is typically considered business income for a natural person and taxed accordingly. Income received as staking rewards would likely be treated similarly or as other income, subject to the 20% (or prevailing) income tax rate upon receipt or disposal.

A significant change is the Investment Account System, applicable from January 1, 2025. This allows crypto-assets purchased through licensed crypto-asset service providers (VASPs) or issuers in contracting states to be treated as financial assets. This system permits deferral of income tax liability until funds are withdrawn from the account, rather than taxing each transaction. Gains and losses within the account can potentially be offset. Specific rules apply regarding contributions, withdrawals, and eligible assets/providers.

2.3. Regulation of Crypto Businesses (VASPs)

Businesses providing virtual currency services (exchanges, wallet providers, transfer services, ICO platforms, etc.) must obtain a Virtual Asset Service Provider (VASP) license from the Estonian Financial Intelligence Unit (FIU). Licensed VASPs are subject to stringent Anti-Money Laundering and Counter-Terrorist Financing (AML/CTF) regulations under the Money Laundering and Terrorist Financing Prevention Act (MLTFPA), akin to financial institutions. This includes robust Know-Your-Customer (KYC) due diligence, transaction monitoring, and reporting suspicious activities.

Regulations have been significantly tightened since 2020/2022. Minimum share capital requirements were raised substantially to €100,000 for exchange services and €250,000 for transfer services. A physical presence is now mandatory, requiring a registered office and the company’s board to be located in Estonia, with actual economic activity needed. Qualified personnel are required, including management board members with higher education and professional experience, and an AML officer with relevant competence located in Estonia. Board members may face restrictions on serving on multiple VASP boards.

Furthermore, robust procedures like detailed business plans, risk assessments, internal audits, and secure IT systems are mandatory. Estonia implemented the FATF Travel Rule, requiring VASPs to collect and transmit originator information for transactions (no de minimis threshold). Increased fees apply for license application (€10,000) and annual supervision. The FIU actively scrutinizes compliance and revokes licenses for non-adherence or misuse of the jurisdiction, leading to a drastic reduction in licensed VASPs. The definition of VASP activities has also broadened to include services related to virtual currency issuance (ICOs). While not always explicitly named, DeFi/NFT platforms may fall under VASP regulations if they facilitate relevant functions, requiring assessment by the FIU.

2.4. Implications for Crypto Investors/Holders

For individual holding and trading, Estonia offers a relatively straightforward tax regime (20% flat tax on realized gains), with the potential for tax deferral via the investment account system from 2025 being a significant advantage. Reporting obligations are clear.

However, for running a crypto business, Estonia is no longer an easy jurisdiction. The high costs, capital requirements, local presence rules, and strict compliance demands make it suitable only for well-funded, serious operations committed to regulatory adherence. The environment has shifted from highly permissive to highly regulated.

3. Estonia’s Digital Heart: Infrastructure and Business Environment

Estonia’s reputation as a digital pioneer is well-earned, offering a highly advanced technological infrastructure and a streamlined business environment, particularly appealing to tech-savvy individuals and entrepreneurs.

3.1. World-Leading Digital Infrastructure & e-Government

Estonia boasts high internet penetration (89% usage) and good speeds (average 89.13 Mbps cited). The country has built a comprehensive digital society, e-Estonia, where nearly all public services (99% cited) are accessible online 24/7, including tax declarations, voting, and accessing health records. A cornerstone is the secure digital identity (e-ID) provided to all residents (ID card, Mobile-ID, Smart-ID), enabling secure authentication and legally binding digital signatures. The X-Road, a secure data exchange layer, connects public and private databases, ensuring efficiency and privacy. This digital approach saves significant time (estimated 1407 years annually) and contributes to Estonia’s high rankings in e-government surveys, aiming for “0% bureaucracy”.

3.2. Ease of Doing Business: The e-Residency Advantage

Through the e-Residency program, entrepreneurs worldwide can establish an Estonian Private Limited Company (OÜ) entirely online, often quickly. Businesses can be managed remotely, including accessing banking (often via fintechs), declaring taxes online, and signing documents digitally. Estonia’s digital systems minimize paperwork. A major draw is the 0% corporate income tax on reinvested or retained profits, allowing businesses to grow tax-free until distribution (when tax applies). Start-up costs are relatively low (e-Residency fee ~€100-€150, company registration ~€265-€350), though annual costs include a mandatory local contact person (€200-€400/year if managed abroad) and accounting services. Requirements include e-Residency, a legal Estonian address (service providers available), and compliance with Estonian law (including AML if applicable). Opening a traditional bank account can be challenging without physical presence (see Section 7.1).

3.3. Thriving Tech and Blockchain Ecosystem

Estonia has a high density of startups per capita (10x EU average cited) and is home to numerous unicorns (Wise, Bolt, etc.). Startup Estonia fosters this ecosystem, supported by incubators, accelerators (Startup Wise Guys), VCs, and angel networks (EstBAN). Estonia has utilized blockchain in government systems since 2008 (e.g., KSI Blockchain by Guardtime for health records). Numerous blockchain companies operate in Estonia, focusing on Web3, NFTs, DeFi, cybersecurity, and integration. Guardtime, a major blockchain player, originated here. Estonia is actively engaging with Web3, leveraging its digital infrastructure for AI, ML, and dApps. The country also possesses a strong ICT talent pool.

3.4. Considerations for Crypto Investors

The digital infrastructure greatly simplifies managing personal finances and potential crypto holding companies. The 0% tax on reinvested profits in an out is highly attractive. The tech community offers valuable networking opportunities. However, the ease of starting a company via e-Residency contrasts sharply with the increasing difficulty and cost of operating a licensed VASP due to strict regulations (Section 2.3) and potential banking challenges (Section 7.1).

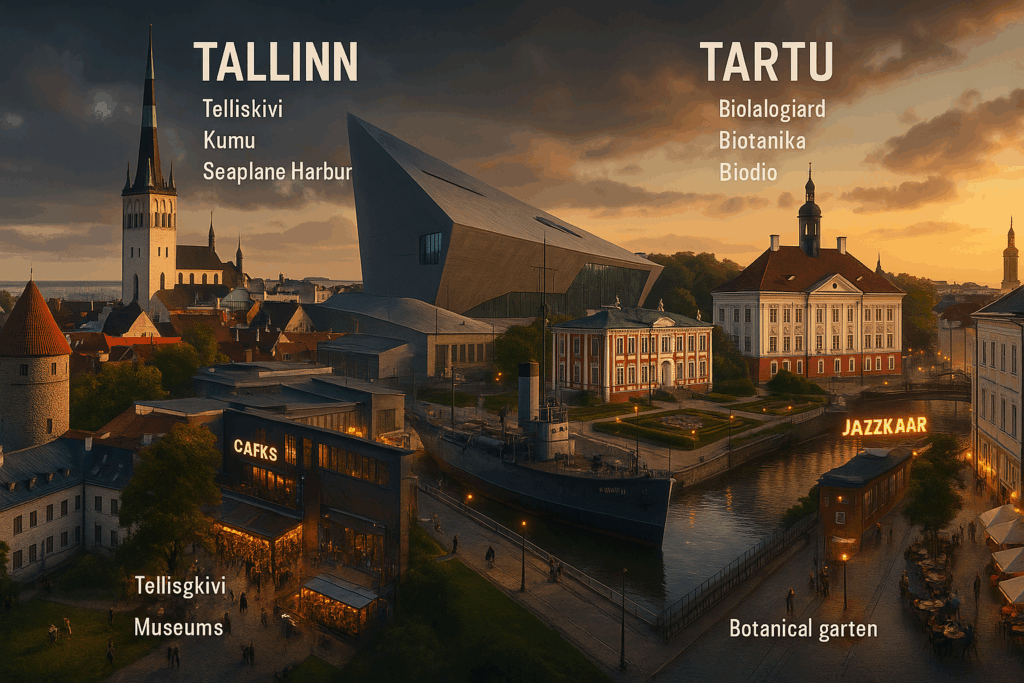

4. The Cost of Living: Tallinn vs. Tartu

Understanding the financial implications of living in Estonia is crucial. Costs vary, particularly between the capital, Tallinn, and the second-largest city, Tartu.

4.1. General Overview

Estonia’s cost of living is generally moderate compared to Western Europe but has been rising. Tallinn is significantly more expensive than Tartu and other Estonian cities, ranking relatively high (138th globally in one 2025 survey) compared to many European capitals.

4.2. Housing Costs (Monthly Averages, ~April 2025)

| Item | Tallinn | Tartu |

|---|---|---|

| Rent, 1-bed apt, City Center | ~ €704 | ~ €569 |

| Rent, 1-bed apt, Outside Center | ~ €514 | ~ €384 |

| Rent, 3-bed apt, City Center | ~ €1,250 | ~ €950 |

| Rent, 3-bed apt, Outside Center | ~ €850 | ~ €670 |

| Price per sq meter to Buy, City Center | ~ €4,500 | ~ €3,400 |

| Price per sq meter to Buy, Outside Center | ~ €3,000 | ~ €2,300 |

4.3. Utilities and Internet (Monthly Averages, ~April 2025)

Basic utilities (Electricity, Heating, Cooling, Water, Garbage for ~85sqm apt) average around €281 in Tallinn and €238 in Tartu. Internet (60+ Mbps) costs about €31 in Tallinn and €29 in Tartu. Utilities, especially winter heating, can be a significant expense, generally lower in Tartu.

4.4. Daily Expenses

Grocery prices are broadly similar, though potentially slightly higher in central Tallinn stores. Dining out is noticeably more expensive in Tallinn: an inexpensive meal might be €12-15 vs. €10-12 in Tartu; a mid-range meal for two €60-80 vs. €50-70. Public transport is affordable in both cities (See Section 7.2), with Tallinn offering free transport to registered residents.

4.5. Overall Comparison

Numbeo indices suggest consumer prices (excluding rent) are roughly 10-15% higher in Tallinn than Tartu. Rent prices are substantially higher in Tallinn (around 25-35% more). Including rent, the overall cost of living in Tallinn is significantly higher. A single person’s estimated monthly costs excluding rent might range from €600-€900 in Tallinn, likely lower in Tartu.

4.6. Context for Crypto Investors

While not the cheapest European destination, Estonia offers a lower cost of living than major crypto hubs like Switzerland or London. The choice between Tallinn (more international connections, larger business scene, higher cost) and Tartu (considerable savings, vibrant university city) depends on budget and preferences.

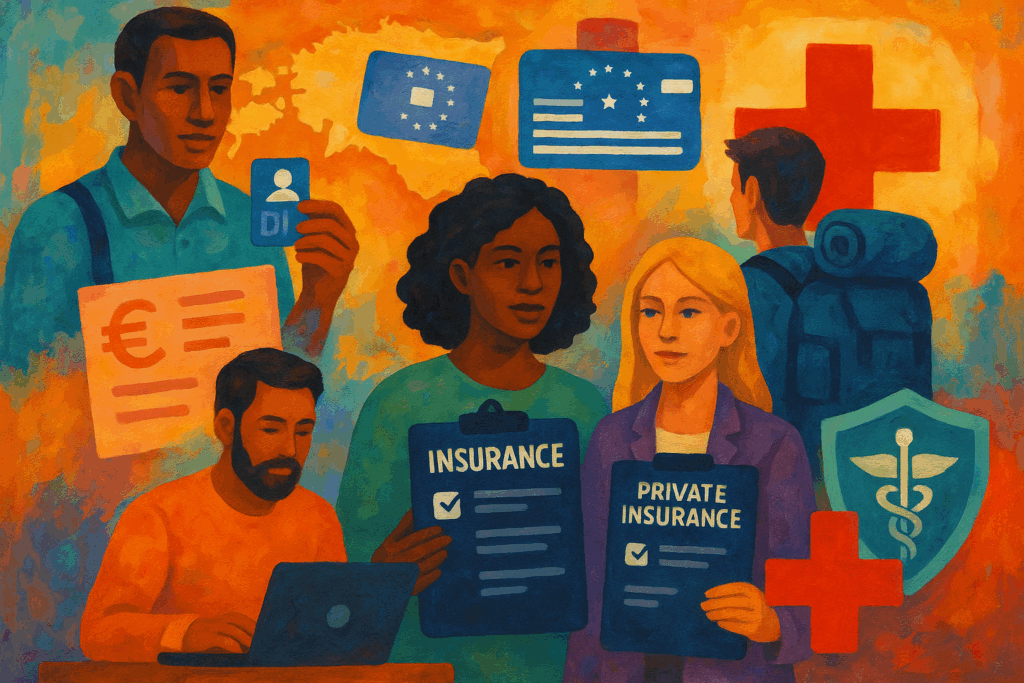

5. The Estonian Healthcare System (Tervisekassa)

Estonia provides a universal, solidarity-based healthcare system funded primarily through social tax contributions. Access and quality are generally good, but understanding how it works for expatriates is important.

5.1. Funding and Structure

The system is mainly funded by the Estonian Health Insurance Fund (EHIF), now Tervisekassa, through a 13% health insurance contribution automatically deducted from the social tax paid on salaries (total social tax is 33%). Tervisekassa contracts with healthcare providers (GPs, specialists, hospitals) who operate autonomously. The system aims for equal access to quality services for all insured individuals.

5.2. Access for Expatriates and Residents

Employed individuals paying social tax are automatically covered (coverage starts ~1-2 months after first payment, requires residence permit/ID code). Self-employed individuals must pay social tax themselves (minimum monthly obligation applies) for coverage. EU/EEA citizens (short stay) use their EHIC for necessary care.

Non-EU citizens with TRP, if not covered by employment, have options: a Voluntary Insurance Contract with Tervisekassa (requires prior insurance/income levels, premium based on average salary, e.g., ~€2858 annually for 2025, waiting period applies) or Private Health Insurance (costs vary, €30-€150+/month, offers faster access/broader coverage). Digital Nomads typically need private insurance as they usually don’t pay Estonian social tax. Uninsured persons have access limited to emergency care and specific treatments (TB, HIV, COVID, cancer screening).

5.3. Quality and Services

General Practitioners (GPs) act as gatekeepers; registration is required. Covered services include primary care, specialist care (referral needed), hospital treatment, emergency services, maternity care, and partial prescription drug costs. Estonia features a highly advanced e-Health system with national electronic health records and widespread e-Prescriptions (97% usage). Quality standards are generally good, though outcomes sometimes lag top EU countries, and access to newest medicines can be slower. English-speaking doctors are available, especially in Tallinn and Tartu.

5.4. Costs and Co-payments

While employer-funded coverage has no direct cost to the employee, the voluntary contribution is significant (~€2858/year). Even when insured, co-payments apply: GP visits are free, but home visits may cost up to €5. Specialist visits/Emergency Department visits incur fees (up to €5, potentially rising to €20 in 2025). Hospital stays have daily fees (up to €2.50-€5, potentially rising, capped at 10 days/€50 max per case), with exemptions. Adult dental care is largely paid out-of-pocket, though some reimbursement exists. Pharmaceutical co-payments can be significant. Out-of-pocket spending is relatively high (~22-24% of total health spending), mainly due to dental and pharma costs.

5.5. Considerations for Crypto Investors

Ensuring valid health coverage upon arrival (via employment, voluntary contract, or private insurance) is crucial, especially for DNV holders. Budgeting for potential co-payments and non-covered services (like adult dental) is necessary. The advanced digital health infrastructure is a notable convenience.

6. Quality of Life in Estonia

Beyond the technical and financial aspects, the overall quality of life is a major factor in relocation decisions. Estonia offers a blend of modernity, nature, and a generally stable environment.

6.1. Safety and Security

Estonia is considered relatively safe and stable, with low crime risk by international standards. While crime rates declined significantly after the 1990s, recent years (2023-2024) saw an uptick in registered crimes (~4% increase), including property crime/theft (shoplifting, home theft) and fraud, though 2024 showed some stabilization. Bike theft is common seasonally. Violent crime, particularly homicide rates, has decreased significantly from historical highs, reaching record lows in 2022. Estonia performs well in corruption perception indices, indicating relative transparency.

6.2. Political Stability and Social Environment

Estonia is a stable parliamentary democracy and a member of the EU, NATO, OECD, and the Eurozone, ensuring political and economic stability. The social environment is generally calm and orderly, becoming increasingly diverse, especially in Tallinn. Integration policies aim to foster cohesion.

6.3. Environment and Nature

Estonia boasts abundant nature, with forests covering over 51% of the land. Access to green spaces, bogs, and the coastline is easy. The country is perceived as clean with good air quality and ranks well on environmental performance, with a growing focus on sustainability.

6.4. Culture, Leisure, and Entertainment

Tallinn offers a mix of medieval Old Town charm and modern amenities, including vibrant nightlife (Telliskivi), museums (Kumu, Seaplane Harbour), historical sites (Kadriorg), shopping, diverse dining, and major cultural festivals (Jazzkaar, Tallinn Music Week). Tartu, the intellectual hub, features museums (Estonian National Museum), neoclassical architecture, a botanical garden, theatres (Vanemuine), cafes, and a lively student atmosphere along the Emajõgi river. Both cities provide good sports facilities, cinemas, and outdoor recreation opportunities, blending traditional Estonian culture with modern European influences.

6.5. English Proficiency

Estonia ranks highly in English proficiency (#20 globally in 2024 EF EPI). English is widely spoken, especially among younger generations and in urban business/tech sectors, significantly easing initial settlement, service navigation, and professional communication. Finding English-speaking doctors and social circles is relatively straightforward. However, relying solely on English hinders deep cultural integration and is insufficient for permanent residency (requires B1 Estonian) or citizenship.

6.6. Considerations for Crypto Investors

The high safety levels, political stability, and digital convenience contribute positively to the living environment. Good English proficiency removes a major barrier. Access to nature and culture provides a balanced lifestyle. The need to learn Estonian for long-term residency remains a significant commitment.

7. Settling In: Essential Practical Steps

Moving beyond the legal and financial frameworks, successfully settling into Estonia involves navigating practical day-to-day necessities.

7.1. Opening an Estonian Bank Account: Process and Challenges (Non-Residents, Crypto Focus)

Opening an Estonian bank account (e.g., LHV, Swedbank, SEB, Luminor) is crucial for daily finances but presents challenges, especially for non-residents and those in crypto. Banks require valid ID and documented proof of a legitimate connection to Estonia (residence, employment, studies, rental agreement, local business activity). While applications may start online, mandatory in-person identity verification at a branch in Estonia is required for non-residents; e-Residency alone is insufficient.

Due to strict AML/KYC rules, banks can be risk-averse towards crypto-related funds or businesses. Expect potential extra scrutiny, source of funds requests, or refusal. Fintech companies in the EEA (like Wise or Revolut) are often suggested alternatives, potentially easier to open online and more crypto-friendly, but operate differently from traditional banks. LHV is sometimes seen as more tech-progressive. Securing traditional banking remains a key planning point, especially for remote e-residents or crypto-focused individuals/businesses.

7.2. Getting Around: Public and Intercity Transport

Tallinn and Tartu have efficient public transport (buses; Tallinn also trams/trolleybuses), payable via contactless cards or local travel cards. Fares are affordable (Tallinn: €2/hour, €30/month, free for residents; Tartu: €1.50/hour, €27.75/month).

Intercity travel, like Tallinn-Tartu (~179 km), is well-served. Buses (Lux Express, FlixBus) are frequent (hourly+), cheap (€8-€22), and take ~2h 25m. Trains (Elron) run several times daily (€10-€18), taking ~2h 25m-2h 50m. Driving is fastest (~2h 5m) but incurs fuel/vehicle costs. The efficient public transport makes car ownership often unnecessary.

7.3. Integration Resources: Language Learning and Support Networks

Estonia offers structured integration support. The “Settle in Estonia” program (via the Integration Foundation) provides free orientation modules (society, work, culture) and beginner Estonian language courses (A1, A2) for new residents (within 5 years of permit). The Integration Foundation also offers further free language courses (up to B1) and counselling.

Learning Estonian is crucial for long-term integration and mandatory (B1 level) for permanent residency. Support hubs like International House of Estonia (Tallinn) and International House Tartu offer guidance. Online communities (Meetup, Internations) and NGOs provide additional networking and support. These resources are valuable for facilitating the settlement process.

8. Conclusion: Weighing the Pros and Cons for Crypto Investors

Estonia presents a complex picture for crypto investors and holders. Its digital leadership and specific policies offer distinct advantages, but recent regulatory shifts and practical hurdles require careful consideration.

Key Advantages:

- Unparalleled Digital Environment: World-class e-governance and infrastructure.

- Business-Friendly Corporate Tax: 0% tax on reinvested corporate profits.

- Streamlined Business Setup (e-Residency): Easy, low-cost online company formation.

- Clear Individual Crypto Taxation: Flat tax (currently 20%) on realized gains, with potential tax deferral via Investment Account system (from 2025).

- Vibrant Tech Ecosystem: Strong startup scene and blockchain community.

- High Quality of Life: Safe, stable, green, good English proficiency, cultural blend.

- EU Membership: Access to EU market and regulatory stability.

Significant Disadvantages and Challenges:

- Strict and Costly VASP Regulation: Difficult and expensive to operate licensed crypto services (high capital, physical presence, compliance).

- Banking Access Hurdles: Challenging for non-residents, e-residents, and crypto-related activities due to verification and AML rules.

- e-Residency Is Not Residency: Does not grant rights to live/work physically in Estonia.

- Rising Cost of Living: Increasing costs, especially in Tallinn.

- Long-Term Integration Requirements: B1 Estonian needed for PR; citizenship requires higher proficiency and usually renouncing prior nationality (no dual citizenship for naturalized citizens).

- Small Domestic Market: Businesses often need an international focus.

Final Considerations:

Estonia remains a compelling option for individual crypto investors and holders leveraging digital tools, corporate tax benefits, and the upcoming Investment Account system.

However, for entrepreneurs aiming to run a licensed VASP, Estonia is now a demanding jurisdiction requiring significant investment and commitment to compliance.

Pay 0% Tax Legally — Start Your Tax-Free Strategy Today

Even in low-tax jurisdictions, most investors still overpay.

Our elite partner tax law firms specialize in advanced legal structures that can reduce your effective tax rate to as low as 0%, fully compliant, audit-ready, and tailored to your profile.

Crypto-friendly. International. Proven.

Prospective movers must choose the right immigration path (DNV, TRP), plan banking solutions carefully, and weigh the digital/tax advantages against regulatory hurdles and long-term integration demands (language, citizenship rules).